Hulton Archive/Hulton Archive via Getty Images

An Investment Strategy For the Ages: Do Whatever Feels Right for You.

It sort of makes sense when you stop and think about it – after all, I do happen to live in an ancient convent in the heart of Lisbon. But the Convento dos Inglesinhos was never a “typical” convent. On the contrary, the mission here was to train Catholic priests to journey to England, infiltrate the Anglican Church and reinstitute the Catholic faith. In other words, they were an ecclesiastical, late-middle age version of the CIA.

So how fitting it is that centuries later, a self-confessed FINANCIAL heretic has come to reside in these hallowed chambers.

I have come here to you today to confess my sin: I do not particularly care whether my portfolio’s risk adjusted returns exceed or fall short of those on a low-cost stock index fund. I am not (to borrow a certain phrase) “seeking Alpha.” What is my top investment goal? Simple: collect passive dividend income, spend less than I earn, and reinvest the savings so I can grow my portfolio income at a compound rate. I prefer paying our bills with dividend income as opposed to periodic sales of assets for two reasons. First, I can’t plan my personal spending based on stock prices that I view as irrational, impossible to predict and notoriously uncooperative. Second, I don’t ever want to be a forced seller while stock prices are dropping. On the contrary, I would much rather be in a position where I can buy stocks whenever I see prices drop precipitously. A dividend growth-oriented portfolio suits both purposes, which matters more to me than outperforming any particular benchmark.

The question, of course, is whether one can practice my particular form of financial heresy without getting burned at the proverbial market stake. And it was to answer this very question that I first embarked on my mission to track each and every little investment I have made since March 2nd using the free portfolio tracking feature on Google Finance. Whenever I find that our dividend income has outgrown our monthly spending needs, I pick one or two companies from the list of stocks that we already own and I buy a few more shares. How has my approach worked so far this year?

According to Google Finance, my savings portfolio is up 7,617% since March 2nd. I’ve lost about $1,080 so far, which is a bit less than 3% of my total investment. Losing less is never as emotionally gratifying as earning more, but I can’t think of a better real-life illustration of the power of dollar cost averaging during a bear market.

Savings Portfolio (Google Finance)

Saving on Big Ticket Expenses.

If you were to ask me where I focus the majority of my limited financial attention span, I would not say “I focus on investing.” Since the day I bought my very first investment back in 1995, experience has taught me one thing: if you stick with index funds or a portfolio of blue-chip American companies with strong balance sheets and established earnings, it doesn’t make a huge difference which fund or which companies you pick. Over the very long term, you’ll probably do well enough that the question of how well isn’t going to matter much to you.

But if investment selection doesn’t typically deliver life-changing results, saving money is absolutely an area where a tiny little adjustment here and there can generate vast marginal returns over the long-term. And here is where I’d like to point to a misconception that trips up a lot of financial commentators. Retirement does not have to be a stage in life where you spend down all of your life savings. On the contrary. I know many retirees who earn more money in retirement than they ever earned while they were working, and they all have exactly one thing in common: they spend less than they earn and they regularly invest the savings.

But I’ll be perfectly honest with you. I was never all that interested in skipping restaurants meals or ordering a drip coffee instead of a latte to save a couple of bucks here and there. I enjoy traveling and when I do, I like to stay at moderately priced hotels and prefer flying business class on long-haul trips. For someone like me, saving money every time I make a spending decision wouldn’t be the most effective way to get ahead, so my choice is to focus my saving on the really big ticket items: (1) health, (2) taxes, and (3) education. For example, property taxes in the Washington, DC area used to set us back over $10,000 a year. Our current property tax bill in Lisbon is a couple hundred bucks per year. Our total medical costs – insurance, co-pays, prescriptions – come to around $4,000 per year for a family of three (we know one family in New York City that pays well over $3,000 every single month in health insurance costs alone). We save tens of thousands of dollars per year by avoiding State and local income taxes. Now that our daughter is close to college age, we’ve started to compare the cost of universities in Europe to the cost of private colleges in the USA. Total costs to attend a school like Barnard (not including room and board) amount to nearly $67,000 per year (and rising). As of last week, my wife and I are now Portuguese/US dual citizens, so our daughter can apply to the top EU universities and pay tuition in the area of $2,000 per year. So how much do we save per year by living in Portugal? I estimate the answer would come to about $120,000 per year. That’s more than enough for me to feel perfectly comfortable ordering that second glass of wine with lunch any time I want to.

Despite rampant inflation, our savings rate this year has actually been a bit higher this year than it has been in the past. The reason why is because most of our portfolio income is paid in U.S. Dollars, whereas most of our spending is in Euros. The price slide for the Euro has shaved 20% off most of our living expenses over the past year, but I fully expect that the pendulum will surely swing the other direction one day. For now, I’m locking in the savings by investing in shares that I think will pay rising dividends far into the future.

I don’t want to give the impression that saving money is the most important benefit we enjoy by living in Portugal. We’ve enjoyed our new life here for nearly seven years and now that we have Portuguese citizenship, it no longer feels like we’re “just passing through.” We have a permanent connection to this country now, and we really feel that.

Where I’m Looking to Invest Next.

At some point towards the end of this month, I’ll pay our bills and see how much is left over. Then I will go down the list of every company we own and pick the one that seems like the best value at the time. At the moment I am gravitating towards European companies that are trading lower thanks to the falling Euro. Unilever (UL) and LVMH (OTCPK:LVMUY) strike me as particularly appealing bargains but as most of us have seen this year, a lot can change over a two week period.

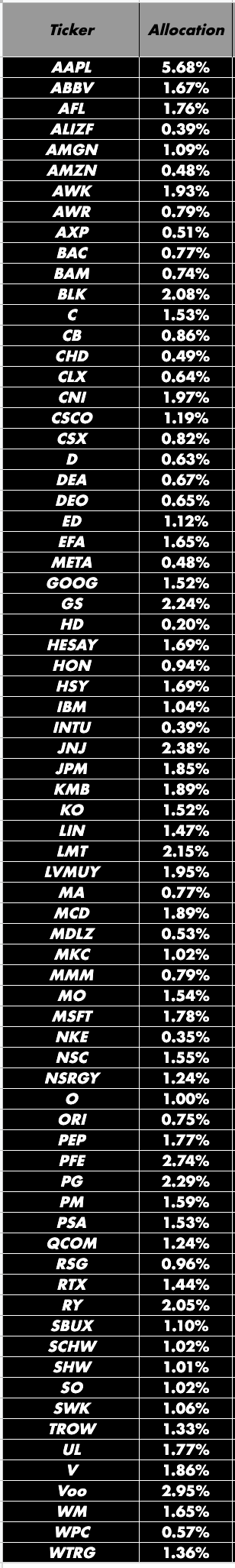

As a matter of disclosure, I like to sometimes post my entire portfolio to help shed light on any biases I might have. Since my portfolio is essentially a passive index fund of mostly dividend-paying companies with either no debt or a-rated credit, the list doesn’t change much over time.

Author’s personal Portfolio (Author’s personal spreadsheet)

Be the first to comment