JHVEPhoto

Introduction

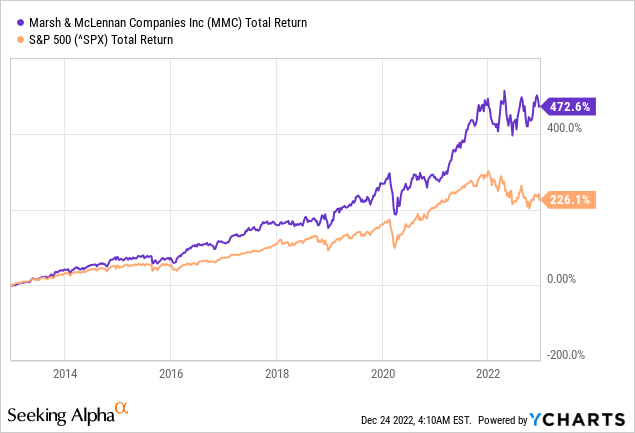

Marsh & McLennan (NYSE:MMC) has achieved strong returns over the past decade, with an average annual return of 19% compared to the S&P 500’s return of 12.5%.

In 2022, the company’s stock price reached an all-time high, reflecting the company’s strong financial performance and the overall growth of the professional services industry. Currently, the stock is moving sideways due to increased price risk as a result of the Fed’s interest rate hike.

In this article, I review the cash flow statements, as the company is a true dividend compounder. I then assess whether investing in Marsh & McLennan is more valuable than buying government bonds; from this perspective, Marsh & McLennan is worth buying.

Company Overview

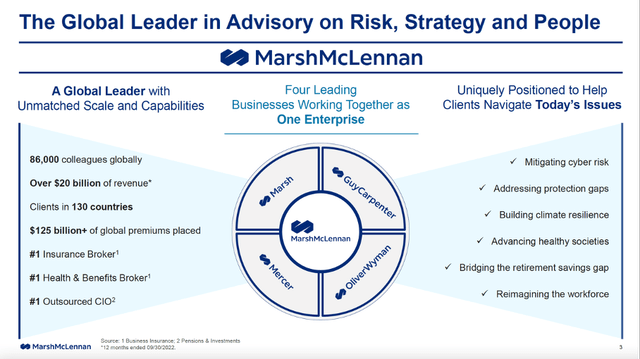

Global leader in advisory on risk, strategy and people (Marsh & McLennan 3Q22 Investor Presentation)

Marsh & McLennan is a global professional services firm that provides advice and solutions in the areas of risk, strategy, and people. The company was founded in 1905 and has since grown to become one of the largest and most well-known firms in its industry, with a presence in more than 130 countries. Marsh & McLennan provides a range of services including insurance brokerage, consulting, and risk management to a diverse client base that includes corporations, governments, and not-for-profit organizations.

Third Quarter Earnings Were Strong

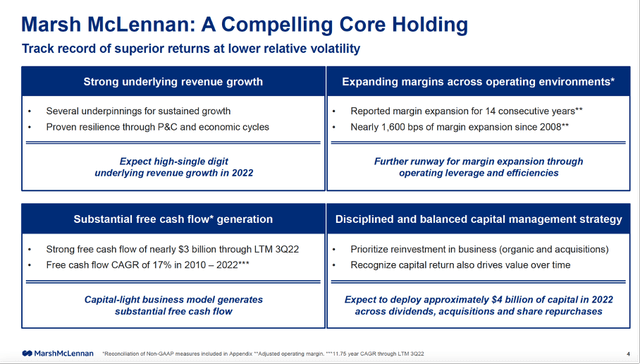

A compelling core holding (MMC 3Q22 investor presentation)

Because of the low capital required to operate the business, the company generates a large amount of free cash flow, with a free cash flow margin of 16%. Since 2010, free cash flow has increased at a 17% CAGR. The cash can be used to fund acquisitions, allowing the company to expand further, or it can be distributed to shareholders.

Marsh & McLennan’s third-quarter results showed continued growth. Underlying revenue increased 8% year on year in the quarter, and adjusted operating income of $851 million was a third-quarter record, up 12% from the third quarter of 2021. The operating income margin increased by 110 basis points, resulting in a 9% increase in adjusted EPS.

In the company’s earnings transcript, Group President and COO John Q. Doyle says:

Higher inflation offsets lower real GDP growth, rising interest rates, boost Marsh & McLennan’s fiduciary income, and the challenging insurance market drives a flight to quality. We also have a track record of success and being resilient through cycles, and I believe Marsh McLennan is well positioned to perform.

Rising interest rates facilitate the company’s continued growth by increasing fiduciary income. As the Fed raises interest rates to 5%, profits increase.

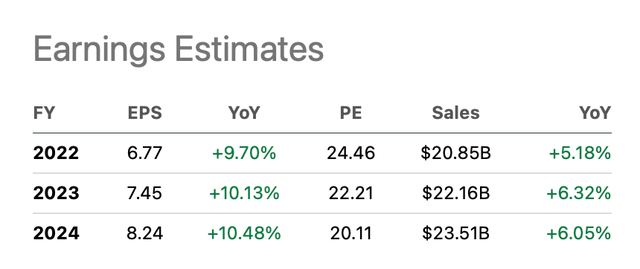

Earnings per share are expected to rise 10% annually in the coming years, according to analysts on the Seeking Alpha MMC ticker page.

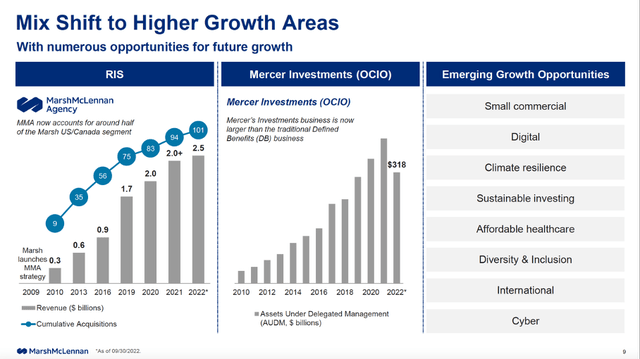

Mix shift to higher growth areas (MMC 3Q22 investor presentation)

Deeper Dive Into Its Cash Flow Statement

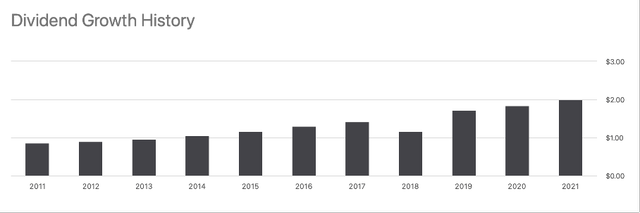

Marsh & McLennan has a long history of distributing dividends, and has consistently increased its dividend per share by an average of 8.8% per year over the past decade. The company’s dividends are typically paid on a quarterly basis, and the amount of the dividend is determined by the company’s board of directors. Currently, the dividend rate is $2.36, making the dividend yield 1.4%.

Dividend Growth History (Seeking Alpha MMC ticker page)

A closer look at the cash flow statement shows that the company has consistently increased its cash flow for dividends in recent years.

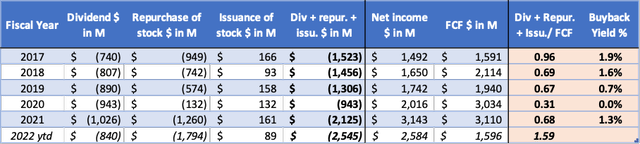

Marsh & McLennan also has a share repurchase program in place, and the company has periodically made share repurchases as part of its capital management strategy. Share repurchases are a tax-efficient way to return value to shareholders because it boosts the company’s earnings per share and dividends per share. In fiscal 2021, the company repurchased approximately $1.3 billion in shares. As a result, the buyback yield is 1.3%.

As free cash flow declined this year due to losses from Hurricane Ian, Marsh & McLennan returned more value to shareholders than it generated in free cash flow. In other years, returns to shareholders were lower than free cash flow, indicating consistent long-term returns.

Marsh & McLennan cash flow highlights (SEC and Author’s own calculations)

Investing in Marsh & McLennan, Or Investing In Govn. Bonds?

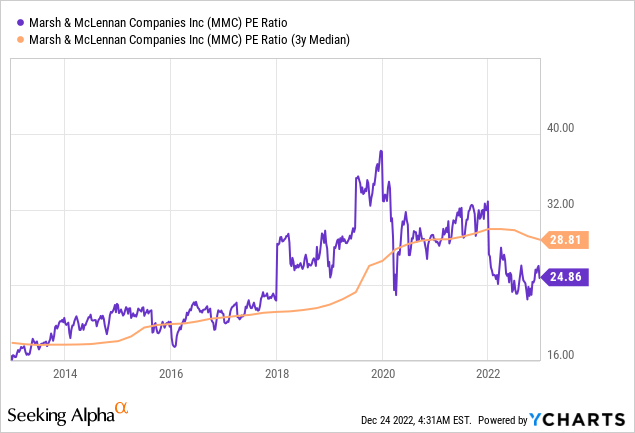

A common valuation metric is the price to earnings ratio. The price to earnings (P/E) ratio is a financial ratio that is used to evaluate the relative value of a company’s stock.

Historically low interest rates have driven up asset prices, house prices and stock prices have risen significantly. As the Fed seeks a rate hike to 5% because of the need to bring inflation down to the normal 2% level, asset prices are generally falling.

A good metric to assess if equity prices are fairly valued is the earnings yield. The earnings yield is the inverse of the PE ratio. It is calculated by dividing the company’s earnings per share by the current market price per share of its stock and is expressed as a percentage. A high earnings yield can indicate that a company’s stock is undervalued, while a low earnings yield can indicate that it is overvalued.

Marsh & McLennan’s PE ratio is currently 24.9, which is quite high considering the S&P500’s PE ratio of 20. Conversely, we arrive at an earnings yield of 4% for Marsh & McLennan and 5% for the S&P 500. Both look attractive at the moment, given that interest rates are not yet at 5%.

For the future, earnings per share are expected to increase 10% annually on average. And forward 2023 PE ratio is expected to be 22, bringing the earnings yield to 4.5%.

Investors can choose: Invest in Marsh & McLennan with an earnings yield of 4.5% (and earnings per share rising 10% annually), or buy government bonds yielding 5% in 2023? It’s a close one but given Marsh & McLennan’s strong growth outlook for the next few years, I opt for investing in Marsh & McLennan.

Marsh & McLennan earnings estimates (Seeking Alpha MMC ticker page)

Conclusion

Marsh & McLennan is a global professional services firm that provides consulting and solutions in risk, strategy, and people. Marsh & McLennan offers a variety of services to a diverse client base that includes corporations, governments, and nonprofit organizations, such as insurance brokerage, consulting, and risk management. The company has grown to become one of the largest and most well-known in its industry.

Over the last decade, the stock has delivered strong returns, with an average annual return of 19%. The company is a true dividend compounder, with dividends per share increasing by an average of 8.8% per year. In addition to dividends, the company has a robust share repurchase program.

Stock prices typically fall when the Fed raises interest rates to 5%. Earnings yield is a good indicator of whether stock prices are overpriced. Marsh & McLennan is currently valued more expensively than the S&P 500. However, with strong expected earnings growth over the next few years, the measure appears to be favorable. Investors can choose between investing in Marsh & McLennan with a 4.5% forward earnings yield in 2023 (earnings per share grow 10% annually) or investing in government bonds with a 5% yield.

Be the first to comment