lovelyday12/iStock via Getty Images

By Jay Jacobs

Dollar menus’ and dollar pizzas’ days are numbered

We anticipate there could be significant investment in agricultural technology and food innovation in the face of continually rising food production costs. To the many consumers who still mourn the dollar menu, brace yourselves: Inflation might be coming for the whole meal – fast food menu prices were 7.4% higher this June compared to last year. And more broadly, the most recent CPI report showed domestic food prices increased at a 10.4% YoY pace, the largest jump in over forty years.2

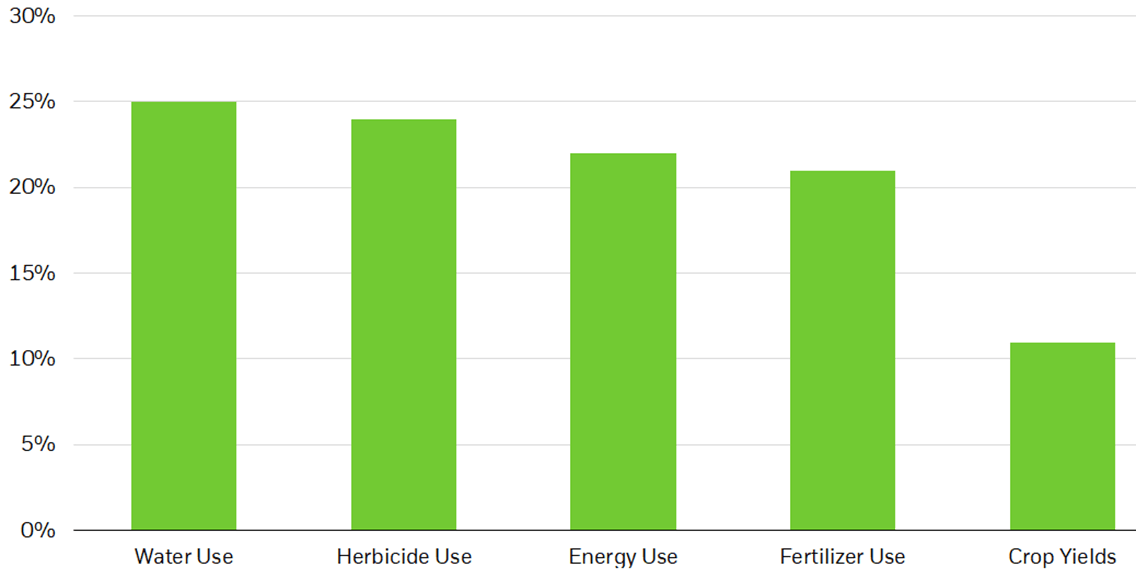

Precision agricultural and agricultural robots can produce more food on less land, with significantly less water and other inputs, allowing for substantial efficiency gains and lower food production costs. This could prove game-changing for food supply chains, which are currently under duress as geopolitical conflict hits global grain stores. Take smart-crop monitoring, for example. This solution uses real-time sensors and imagery to direct delivery of water and nutrients within a farm system to where it is most needed; deployment could drive an additional $175 billion in global GDP.3 Agricultural producers were already turning to technology to increase output and drive profitability. The global market for precision agriculture reached an estimated $7 billion in 2021.4 Now, productivity benefits from this technology could help alleviate food shortages and combat inflation, while driving immediate revenues for agricultural technology companies. By 2030, precision agriculture sales are expected to reach $21 billion, growing at a 12.8% compound annual growth rate.5

Precision agriculture can combat inflation by maximizing crop yields and reducing input requirements

Precision Agriculture Efficiency Gains Vs. Traditional Farming Methods (%) (Association of Equipment Manufacturers, “The Environmental Benefits of Precision Agriculture in the United States,” 2021)

Controlled environment agriculture (CEA) companies could similarly benefit. CEA enables efficient indoor crop cultivation, making it possible to produce food year-round in urban environments that are closer to consumers and therefore not reliant on strained supply chains. Produce grown in indoor vertical farms, for example, travels just 43 miles on average, compared to 2,000 miles for conventionally cultivated products.6 CEA companies could experience heightened near- and long-term revenue growth as the world grapples with the immediate reality of strained global food supply chains.

Within food innovation, lab-grown meat is taking an entirely different approach to rethinking food production. Raising livestock is resource-intensive, requiring significant crops, land, and water before animals reach maturity. This makes animal products, like meat, extremely susceptible to stressed supply chains and food inflation. Lab-grown, or cultivated, meat, on the other hand, can be made from just a small sample of animal cells, minimizing the impact of exogenous factors on its availability and price. While lab-grown meat is still early-stage, we expect today’s challenges to accelerate development efforts, potentially benefitting the companies involved.

Clean Energy To Combat Energy Inflation

Economically lean and environmentally clean

Amid high inflation, clean energy is enjoying a renewed focus given its stable power generation costs, relative affordability, and local footprint. Ensuring the continuity of affordable energy supplies during the energy transition will require fossil fuels like natural gas for power and heating in certain regions. But energy market shocks may also accelerate investments into renewable energy in places where energy security goals are aligned with decarbonization, since, for consumers, energy shocks are like carbon taxes that make renewable energy more competitive.

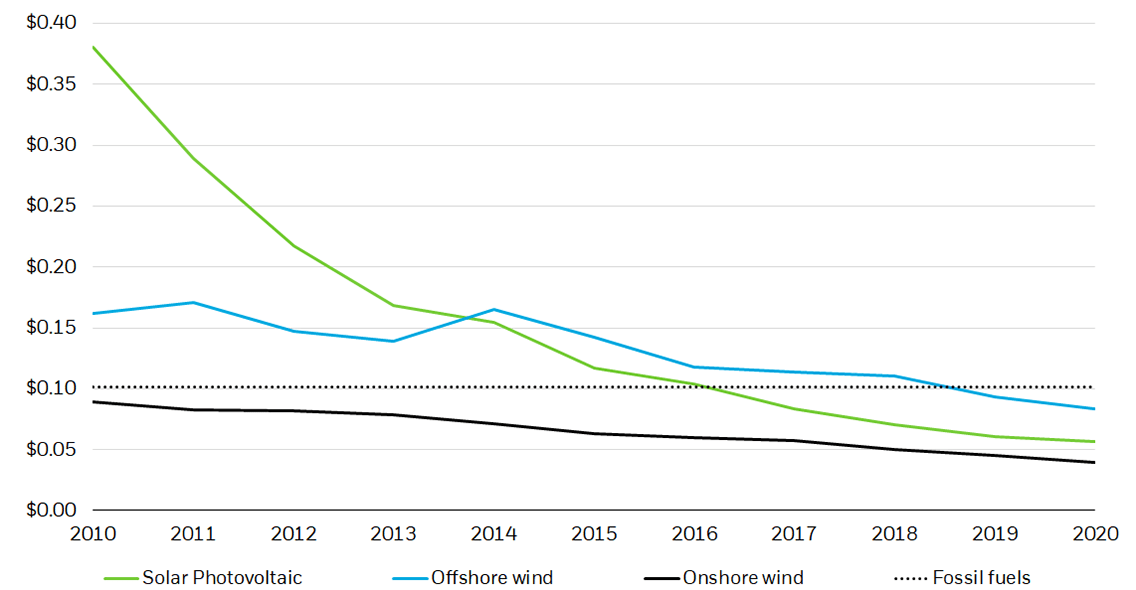

Clean energy sources like wind and solar can generate energy in a variety of natural or geopolitical environments, making reliable production more shock-resistant. Moreover, we see the price of clean power generation is currently generally stable, rather than variable, because inputs are not linked to volatile commodities like oil. While environmental factors can vary, optimized systems featuring multiple clean energy sources, and supportive infrastructure like smart grids and energy storage, can offer reliable and consistent energy. As of 2021, clean power is already significantly more affordable than fossil fuel energy – on a levelized cost of electricity basis, solar and wind power are now 1/3rd of the price of coal and a little less than 2/3rd of the price of natural gas.7 Additionally, clean power tends to be generated locally rather than imported, offering economies greater control over their energy supply amid inflation-inducing supply chain disruptions.

Clean power is more affordable than fossil fuels

Levelized Cost Of Electricity, By Source (2020 USD/kWh) (IRENA, “Renewable Power Generation Costs in 2020,” June 2021)

The energy transition will not happen overnight, but clean energy’s characteristics are accelerating the transition and can drive immediate revenues for clean energy companies. We are already seeing meaningful commitments to ramp up clean energy generation amid today’s supply shock. In late-February, Germany announced its intention to fully transition to clean power by 2035, 15 years sooner than its previous target.8 And, just a week later, the European Union announced plans to fast-track clean energy adoption and phase out Russian fossil fuels “well before 2030.”9

Infrastructure As A Potential Buffer Against Inflation

Cementing a place in portfolios

Infrastructure stocks could prove resilient amid high inflation and rising rates. They tend to hail from value-oriented sectors like utilities, industrials, and materials, where valuations are driven primarily by near-term cash flows rather than long-term growth expectations. Many infrastructure asset owners have additional lines of defense against inflation, including: (1) 10- to 20-year contracts that reset their pricing in parallel with changes in inflation; (2) long-term fixed interest rate debt that erodes in relative cost as inflation rises (i.e., their interest payments remain the same, even as the dollar depreciates); and (3) a tendency to pay large dividend payments – dividends often increase during inflationary periods.10

Public sector spending serves as an additional tailwind for infrastructure investments. In the U.S., the Infrastructure Investment and Jobs Act (IIJA) is directing $1.2 trillion in government spending to rebuild and enhance U.S. infrastructure, regardless of a changing market environment. At the same time, global infrastructure spending is accelerating as an intentional solution to many of inflation’s drivers – most specifically, supply chain pressures. In our view, this spending could mute the impact of today’s macroeconomic challenges and provide investors a compelling growth opportunity.

Conclusion

Thematic approach to inflationary challenges

Long-term structural themes are not only resilient to inflation today but could help alleviate inflationary pressures tomorrow. Investors looking to access these long-term structural themes may want to consider Megatrend ETFs to gain exposure to themes, such as emergent food and agricultural technology, clean energy, and infrastructure to seek long-term growth potential and to help hedge against rising inflation.

________

© 2022 BlackRock, Inc. All rights reserved.

1 U.S. Bureau of Labor Statistics, July 2022.

2 Ibid.

3 McKinsey & Company, “Agriculture’s connected future: How technology can yield new growth,” October 9, 2020.

4 Grand View Research, “Precision Farming Market Size, Share & Trends Analysis Report By Offering (Hardware, Software, Services), By Application (Yield Monitoring, Weather Tracking, Field Mapping, Crop Scouting), By Region, And Segment Forecasts, 2022 – 2030,” 2022.

5 Ibid.

6 EIT Food, “Is vertical farming really sustainable?”, August 2018.

7 Lazard, “Levelized Cost of Energy Analysis – Version 15.0,” October 2021.

8 Bloomberg, “Germany Brings Forward Goal of 100% Renewable Power to 2035,” February 2022.

9 European Commission, “REPowerEU: Joint European action for more affordable, secure and sustainable energy,” March 2022.10 IHS Markit, “Inflation impact on dividend distributions,” March 28, 2022.

10 IHS Markit, “Inflation impact on dividend distributions,” March 28, 2022.

Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

Technology companies may be subject to severe competition and product obsolescence.

International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. These risks often are heightened for investments in emerging/ developing markets or in concentrations of single countries.

Funds that concentrate investments in specific industries, sectors, markets or asset classes may underperform or be more volatile than other industries, sectors, markets or asset classes and than the general securities market.

This material represents an assessment of the market environment as of the date indicated; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any issuer or security in particular.

The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective.

The information presented does not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy or investment decision.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial professional before making an investment decision.

The information provided is not intended to be tax advice. Investors should be urged to consult their tax professionals or financial professionals for more information regarding their specific tax situations.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by Bloomberg, BlackRock Index Services, LLC, Cohen & Steers, European Public Real Estate Association (“EPRA®”), FTSE International Limited (“FTSE”), ICE Data Indices, LLC, NSE Indices Ltd, JPMorgan, JPX Group, London Stock Exchange Group (“LSEG”), MSCI Inc., Markit Indices Limited, Morningstar, Inc., Nasdaq, Inc., National Association of Real Estate Investment Trusts (“NAREIT”), Nikkei, Inc., Russell or S&P Dow Jones Indices LLC or STOXX Ltd. None of these companies make any representation regarding the advisability of investing in the Funds. With the exception of BlackRock Index Services, LLC, which is an affiliate, BlackRock Investments, LLC is not affiliated with the companies listed above.

Neither FTSE, LSEG, nor NAREIT makes any warranty regarding the FTSE Nareit Equity REITS Index, FTSE Nareit All Residential Capped Index or FTSE Nareit All Mortgage Capped Index. Neither FTSE, EPRA, LSEG, nor NAREIT makes any warranty regarding the FTSE EPRA Nareit Developed ex-U.S. Index or FTSE EPRA Nareit Global REITs Index. “FTSE®” is a trademark of London Stock Exchange Group companies and is used by FTSE under license.

© 2022 BlackRock, Inc. All rights reserved. BLACKROCK, BLACKROCK SOLUTIONS, BUILD ON BLACKROCK, ALADDIN, iSHARES, iBONDS, FACTORSELECT, iTHINKING, iSHARES CONNECT, FUND FRENZY, LIFEPATH, SO WHAT DO I DO WITH MY MONEY, INVESTING FOR A NEW WORLD, BUILT FOR THESE TIMES, the iShares Core Graphic, CoRI and the CoRI logo are trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

iCRMH0722U/S-2288822

This post originally appeared on the iShares Market Insights.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment