MistikaS

The US dollar is the world’s reserve currency, and the euro is also a reserve currency, even though it’s one of the newest fiat foreign exchange instruments. The euro replaced a host of European currencies in January 1999. Coins and banknotes were launched on Jan. 1, 2022, in 12 European Union countries, making the introduction of the euro the most significant cash changeover in history. After dropping to the 82.30 level against the US dollar in 2000, the euro made higher lows and higher highs until 2008.

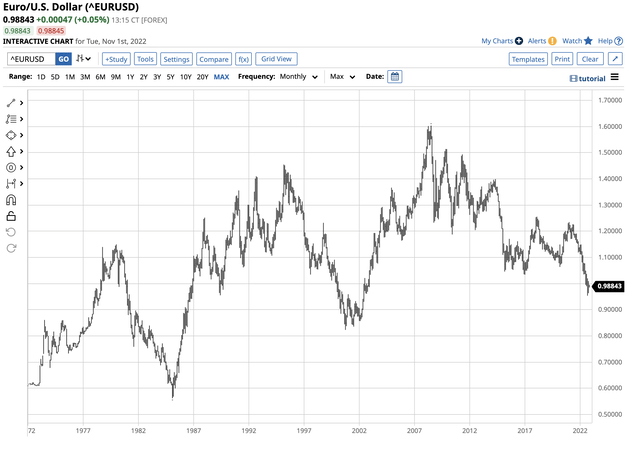

The euro peaked against the US dollar in 2008 at $1.6038. Since then, it has made lower highs and lower lows, dropping below parity against the greenback for the first time since 2002 in July 2022. The Euro Trust Currency Shares ETF (NYSEARCA:FXE) tracks the euro against the US dollar on the up and downside, and it has been in a bearish trend over the past 14 years.

The euro falls below parity

In July 2022, the euro currency fell below parity against the US dollar for the first time since 2022.

Chart of the Euro versus the US Dollar Currency Pair (Barchart)

The long-term chart highlights the euros’ bearish trend that began at the 2008 $1.6038 high. The euro has made lower highs and lower lows against the dollar over the past 14 years, and the bearish trend continues with the drop below parity to a low of $0.95364 in September. At under the $0.9900 level on Nov. 1, the euro remained cheaper than the dollar.

Consolidation with a bullish bias follows the drop

Currencies rarely experience sharp and sudden rallies or declines. Instead, price trends tend to occur over extended periods with plenty of backing and filling. Central banks and governments tend to manage currency volatility, providing stability for cross-border payments. The euro and the US dollar are the world’s leading reserve currencies, only increasing government intervention and stabilizing the world’s financial system.

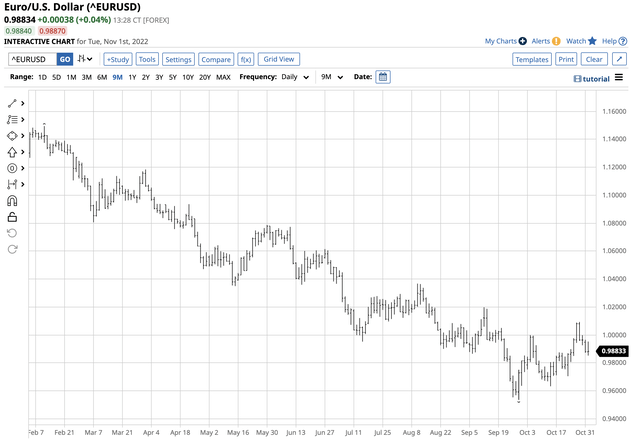

Short-term Chart of the Euro versus the US Dollar Currency Pair (Barchart)

The short-term chart shows that the euro reached its most recent low against the US dollar of $0.95364 on Sept. 28. Since then, the euro currency has made higher lows and higher highs, probing above the parity level on Oct. 26 and 27 before falling back below the critical pivot point.

The trend is still bearish for three reasons

Three compelling factors favor a continuation of the bearish path of least resistance in the euro vs. the US dollar currency relationship:

- The war in Ukraine is on Europe’s doorstep. The first major conflict since WW II impacts Europe’s economy as food and energy shortages and increased military spending weighs on its economy.

- Rising US interest rates support the US dollar versus the euro currency. In March 2022, the US Fed Funds Rate was at zero percent. If the Fed increases the short-term rate by another 75 basis points at tomorrow’s FOMC meeting, the rate will rise to 3.75% to 4.00%. Interest rate differentials are a compelling reason for the dollar’s rise versus the euro.

- The bearish trend in the euro began in 2008. Currency trends can last for many years, and the trend is always your best friend in markets.

On the long-term chart, the next downside target for the euro vs. the US dollar currency relationship stands at $0.8230, the October 2000 low.

Peace in Ukraine could ignite the euro

Sentiment in the euro remains bearish in early November 2022. The most bullish factor for the euro is the overwhelmingly bearish sentiment that has led to a significant speculative short position in the currency pair.

Meanwhile, a sudden end to the war in Ukraine, which seems unlikely in November 2022, will likely lead to a sudden and vicious short covering rally in the European currency. The lower the euro falls, the higher the chance of sudden bear market rallies, but the end of the conflict could ignite the euro and push it back to the pre-February 2022 $1.2349 high from January 2021. A move above that level would end the 14-year bearish trend in the euro currency vs. the US dollar.

Another factor that could support a rally in the euro would be a reversal of the US Fed’s hawkish monetary policy path. However, that seems as unlikely as an end to the conflict in Ukraine in early November 2022.

FXE is the ETF

The most direct route for a risk position in the US dollar vs. the euro currency pair is in the over-the-counter foreign exchange arena or the CME futures markets. The Euro Trust Currency Shares ETF (FXE) provides an alternative for market participants looking for exposure to the currency pair without venturing into the OTC or futures markets.

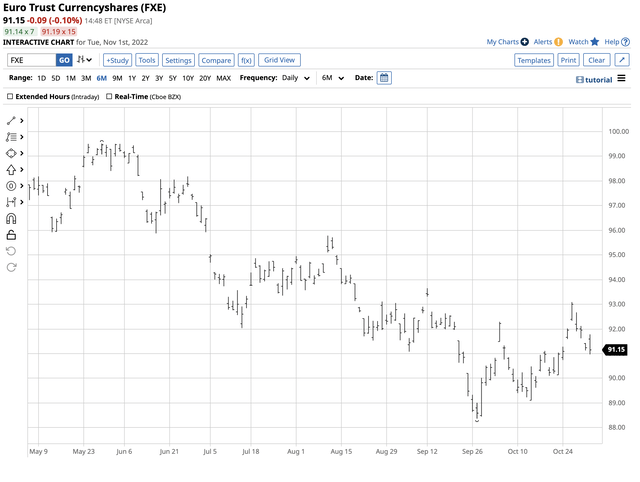

At the $91.19 level on Nov. 1, FXE had nearly $342 million in assets under management. FXE trades an average of 234,983 shares daily and charges a 0.40% management fee. The latest recovery in the euro vs. the dollar took the exchange rate from $0.95364 on Sept. 28 to $1.00935 on Oct. 27, a 5.84% rally.

Chart of the FXE Euro versus the US Dollar ETF Product (Barchart)

Over the same period, FXE rose from $88.37 to $93.09 per share or 5.34%. One of the drawbacks of the ETF is it only trades when the US stock market operates, while the foreign exchange market trades around the clock. The ETF can miss any moves to highs or lows when the US stock market is not functioning. A long position in the euro vs. the US dollar is a contrarian risk, given the compellingly bearish price action and fundamentals weighing on the euro’s value. However, the most significant moves tend to come from unexpected events, which could be the only bullish factor for the European currency these days.

Be the first to comment