Kimberly White

Introduction

Intuit Inc. (NASDAQ:INTU) reported solid fiscal Q1 2023 earnings last Tuesday, beating analyst estimates by a substantial margin. Most of the lowlights came from Credit Karma, which put a dent in fiscal year 2023 guidance. We already knew this could happen, but we were pretty impressed to see how flexible Intuit’s operating model is in managing profitability. We’ll talk about all of this in this article.

Without further ado, let’s jump directly into the numbers!

The numbers

Intuit’s numbers for the quarter were once again solid, but this is something we could’ve expected based on management’s comments on November 1st. That day, the company issued a press release claiming that Q1 numbers were expected to come in above guidance, and that’s precisely what happened.

The headline numbers

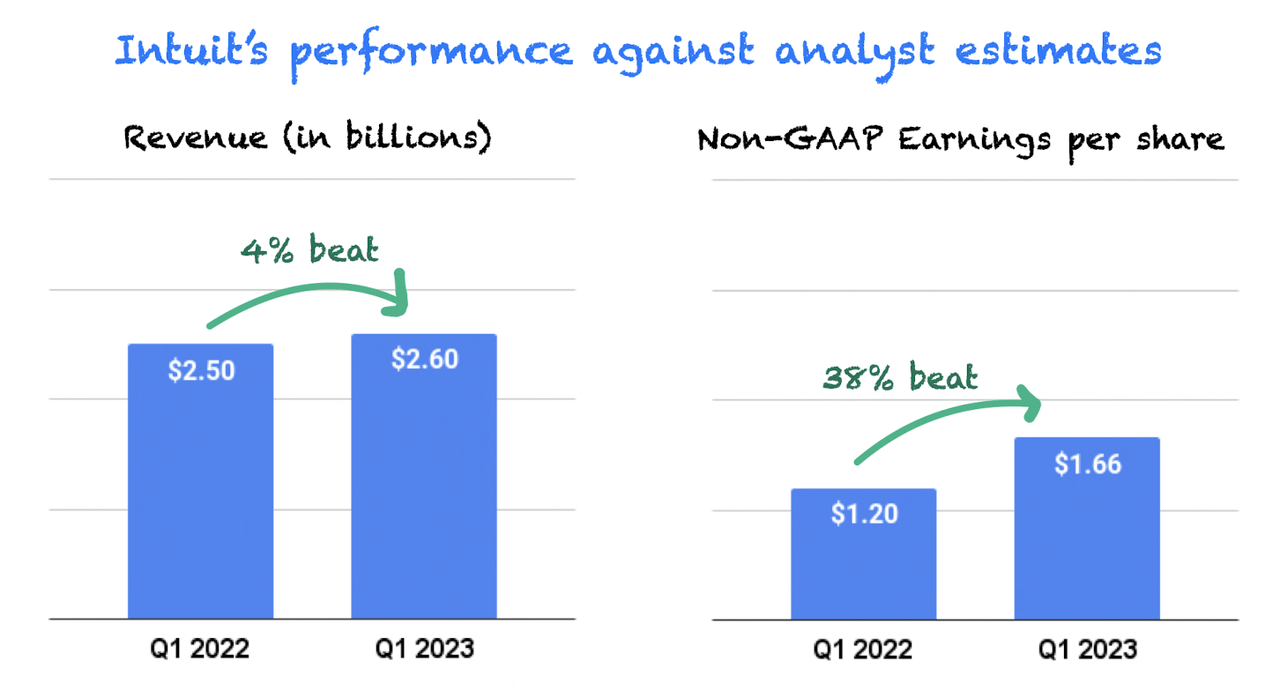

Intuit beat both top and bottom analysts’ estimates. The beat was much more pronounced in the bottom line, portraying the different levers the company can pull to protect its profitability. There was more evidence of this in the guidance, as we’ll see later on:

Made by Best Anchor Stocks

Intuit is more than used to beating estimates, even in deteriorating macro environments. As we’ll talk about later, Credit Karma was a clear weak spot, but the company’s platform diversity allowed it to make up for its low growth and come in above guidance and analysts’ expectations. If we go into recession, we think many investors will be surprised by how resilient some of the company’s segments will prove to be.

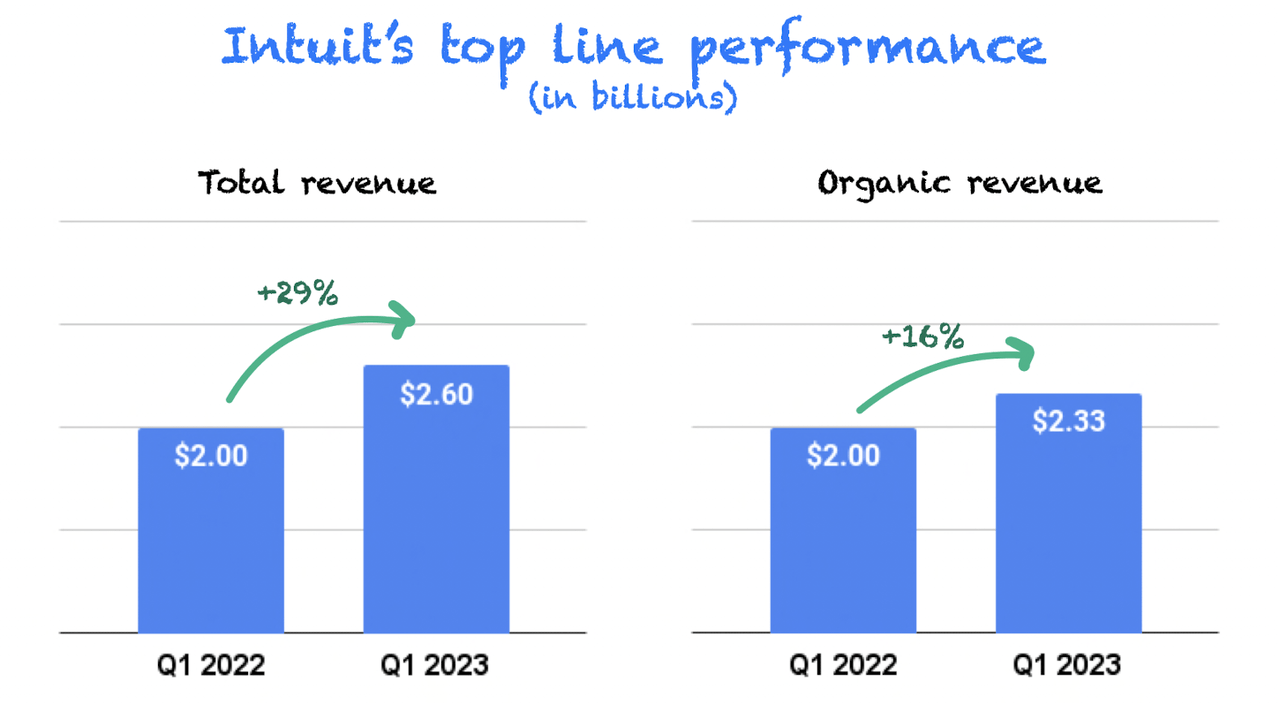

Digging into revenue

Q1 revenue came in at $2.6 billion, growing 29% year-over-year and 16% year-over-year organically (i.e., without including Mailchimp):

Made by Best Anchor Stocks

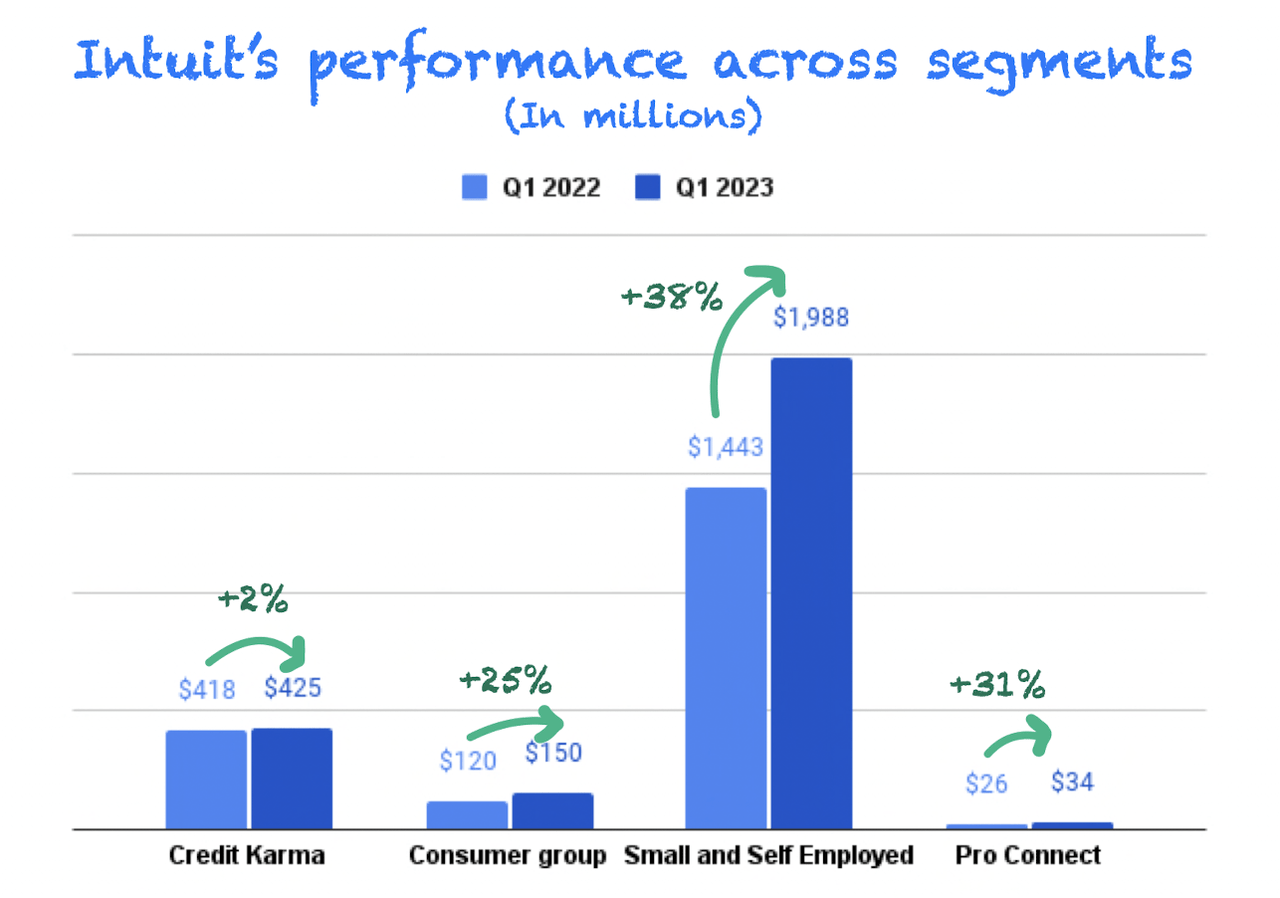

There are many drivers to Intuit’s total revenue, which exhibited widely diverse performance. The Small Business and Self Employed segment again showed excellent performance, organically growing the top line by 19%. The consumer segment also showed strong growth (+25% year over year) driven by customer growth and extension filers in October. The weak spot was clearly in Credit Karma, as previously discussed:

Made by Best Anchor Stocks

Let’s now look at each segment individually; we’ll start with the “good” news and leave the bad news (Credit Karma) for the end.

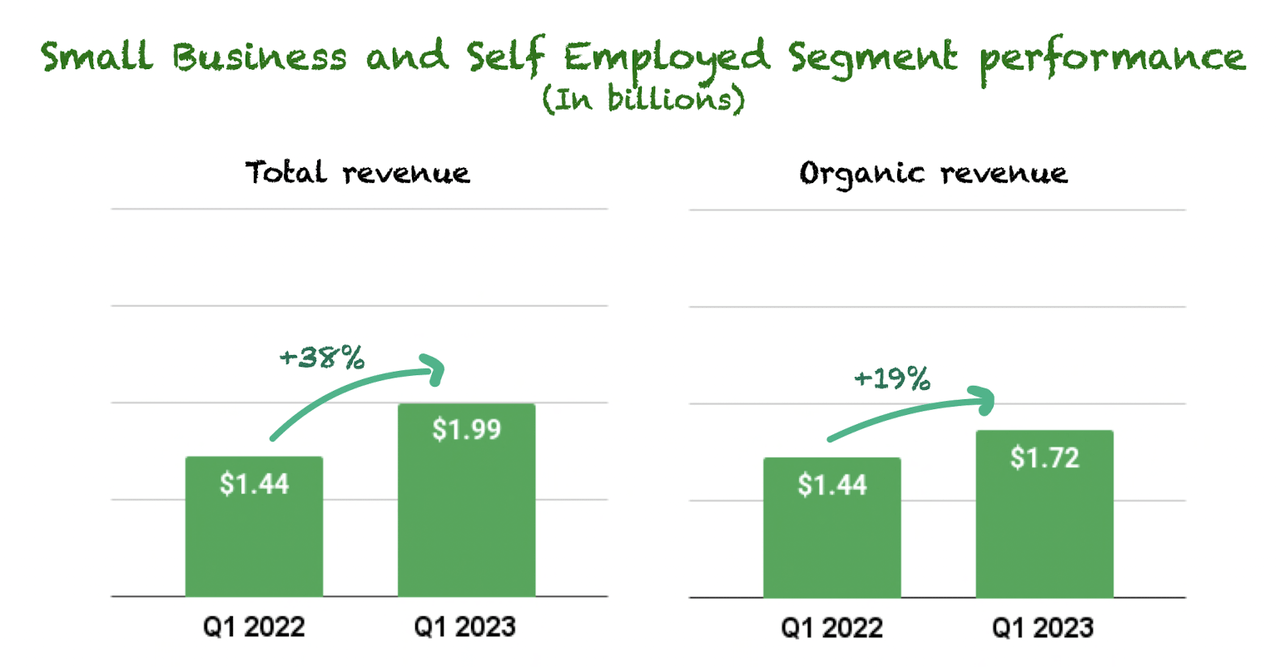

Small business and Self-Employed Group – Resilient and robust growth

The Small Business and Self-Employed group was a highlight once again. Q1 revenue grew an impressive 19% organically and 38% if we account for the acquisition of Mailchimp:

Made by Best Anchor Stocks

From a total revenue perspective, it was a sequential deceleration, as Q4 revenue grew 41% year-over-year. Still, it’s pretty impressive for two reasons. First, the slowdown is minimal despite the macro landscape being much more worrying now than it was 3 months back.

Secondly, organic growth stayed at a very similar level to Q4 (+20% year-over-year) and significantly above the organic growth the segment was experiencing before the acquisition of Mailchimp, despite being now larger and the macro landscape being more “problematic.”

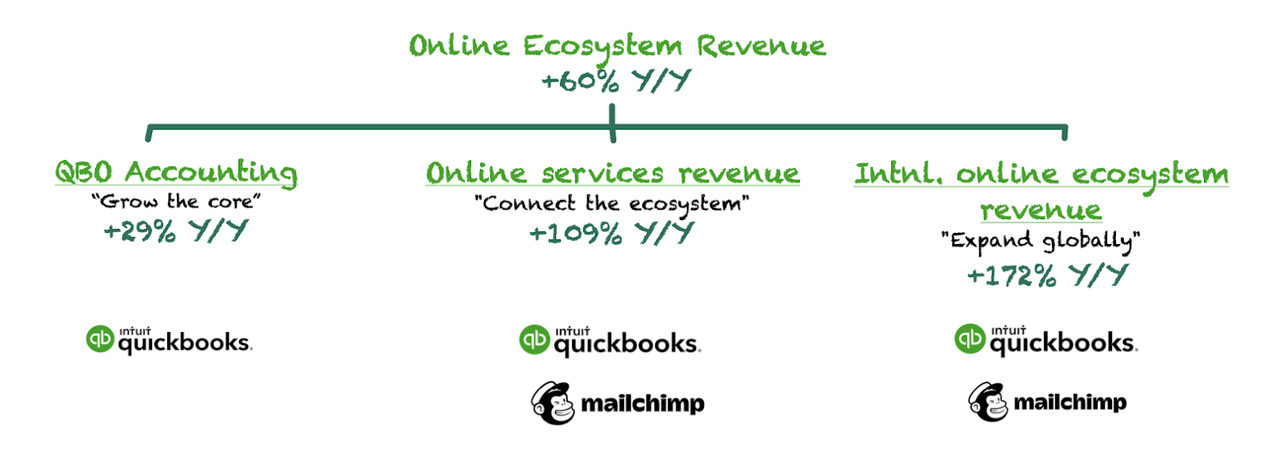

Once again, small business and self-employed revenue growth was driven by online ecosystem revenue, which grew 60% year-over-year, 28% excluding Mailchimp. This growth rate significantly differed from desktop ecosystem growth, which grew “only” 7%. Some time ago, Intuit started to shift its desktop offerings to a subscription base offering, which makes revenue more predictable. Evidently, the ultimate goal is to shift the desktop ecosystem customer to the Online Ecosystem, which management expects will be the future growth driver of the company:

We continue to expect the Online Ecosystem to be our growth catalyst going forward.

Source: Michelle Clatterbuck, Intuit’s CFO, during the Q1 2023 earnings call.

To continue growing online ecosystem revenue, management focuses on three pillars, which build some sort of funnel. Once again, the three pillars showed more than adequate growth, underscoring that growth might be far from over.

The first pillar is to grow the core, which relies on growing the accounting offering. Accounting is the sticky part of Quickbooks, and it grew 29% in Q1, driven by customer growth, higher prices, and a better mix. Quickbooks customers might pull back on some additional offerings during a downturn but can’t pull back on Accounting because it’s a legal requirement.

Once customers are locked-in accounting, the company cross-sells different offerings (capital, payments, Mailchimp…) to connect the ecosystem. These services are encompassed in online services revenue, which grew 109% in the quarter, 28% without including Mailchimp. Intuit continues to find effective ways to cross-sell its offerings to existing customers. Many customers are putting an increased focus on cash flow now that times are tougher:

What we’re seeing across the board is a continued flight to digitization. If you use our payments capability, you get paid faster, and cash flow is more critical in this environment.

Source: Sasan Goodarzi, Intuit’s CEO, during the Q1 2023 earnings call.

Growth in online services comes from existing customers digitizing a greater part of their business. Management expects this trend to remain resilient during a downturn, and so do we.

The last step is something the company expects to accelerate with the addition of Mailchimp, which is expanding globally. International online ecosystem revenue grew 172% year over year and 19% if we don’t take into account Mailchimp. We were surprised to read about the impact that localizing the language has on conversions (emphasis added):

We are right now focused on localizing the language. Where we have localized language versus not, we have more than 13 points conversion variants. And so of course, localized language is one of our largest levers internationally along with having a playbook that we’re putting in place around go-to-market to raise awareness.

Source: Sasan Goodarzi, Intuit’s CEO, during the Q1 2023 earnings call.

There are many levers to pull to expand globally, and Intuit seems to be doing just fine in this regard.

You can find below a summary of how the different online ecosystem segments grew in the quarter:

Made by Best Anchor Stocks

It was no doubt a deceleration in growth rates across the board for the Small Business and Self-Employed segment. Still, it’s impressive the company continues to maintain these high growth rates despite the macro environment.

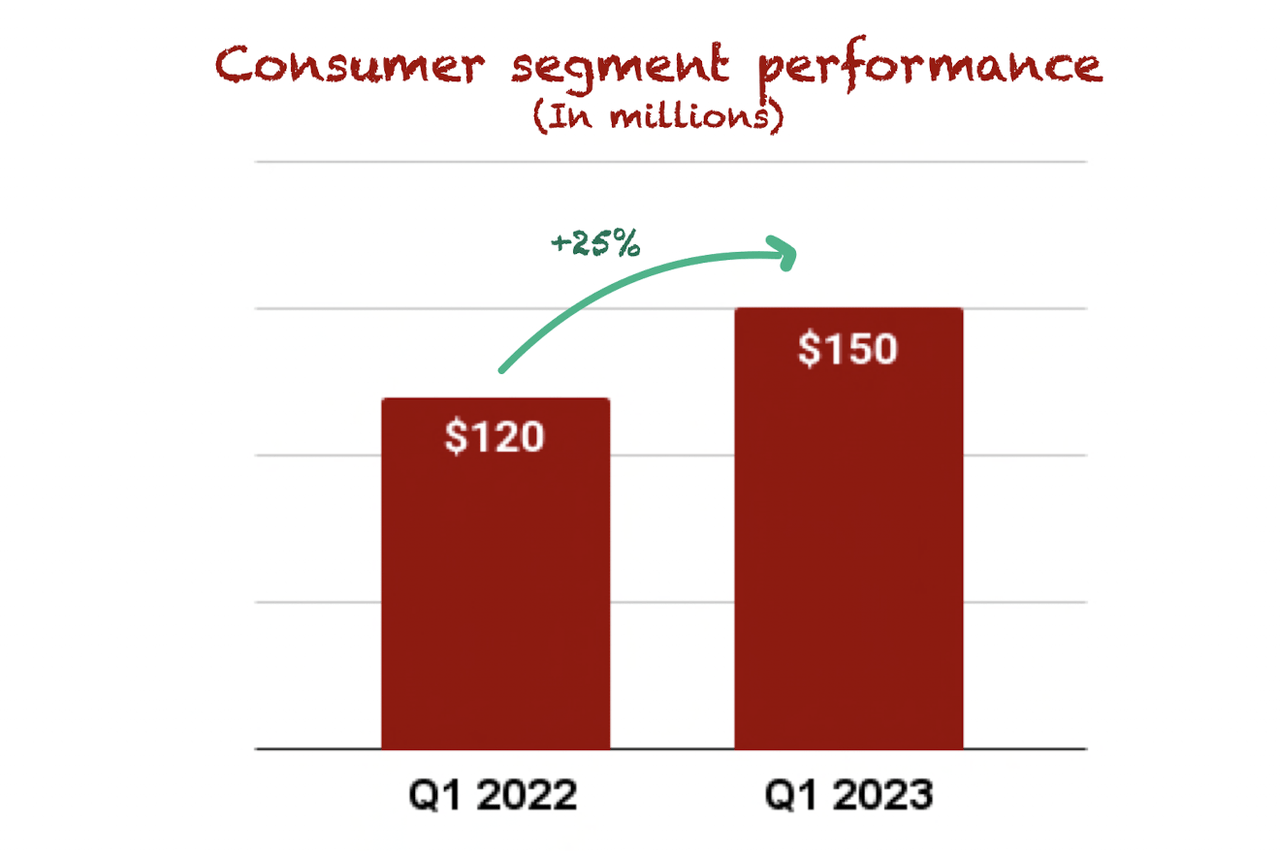

Consumer group – Not worth looking at the quarterly numbers

Consumer group revenue grew 25% year over year, significantly above management’s long-term target growth rate for the segment:

Made by Best Anchor Stocks

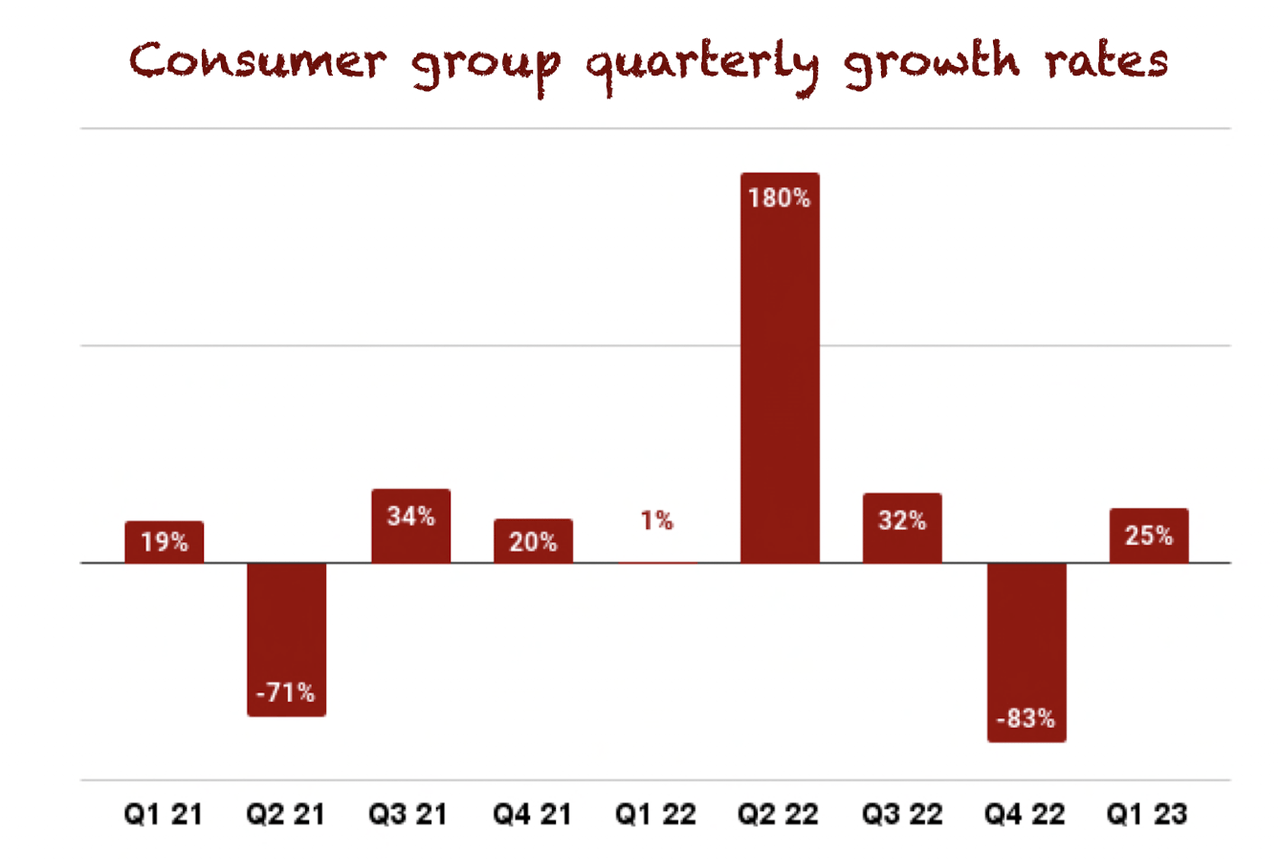

Growth was fueled by an October peak driven by new customers and extension filers. As we always say, we don’t think spending our time analyzing the quarterly performance of this segment is worth it. Quarterly results are volatile because tax filing seasons typically vary, and there’s always a significantly wide window where filers can choose to file their taxes. Both things are outside of management’s and our control, so we shouldn’t over-obsess with volatility here. Take a look at quarterly growth rates for the segment to see what we mean:

Made by Best Anchor Stocks

Of course, volatility is significantly reduced when we look at the yearly results because, eventually, all filers have to file inside the tax window. For this reason, we’ll have to wait until Q4 2023 to really see how the segment has evolved. Of course, the same reasoning can be applied to the ProConnect group, so we will not talk about it either.

By the way, volatility in consumer revenue is the main reason Intuit has a different fiscal year than the calendar year. The goal of the fiscal year was to capture the entire tax season.

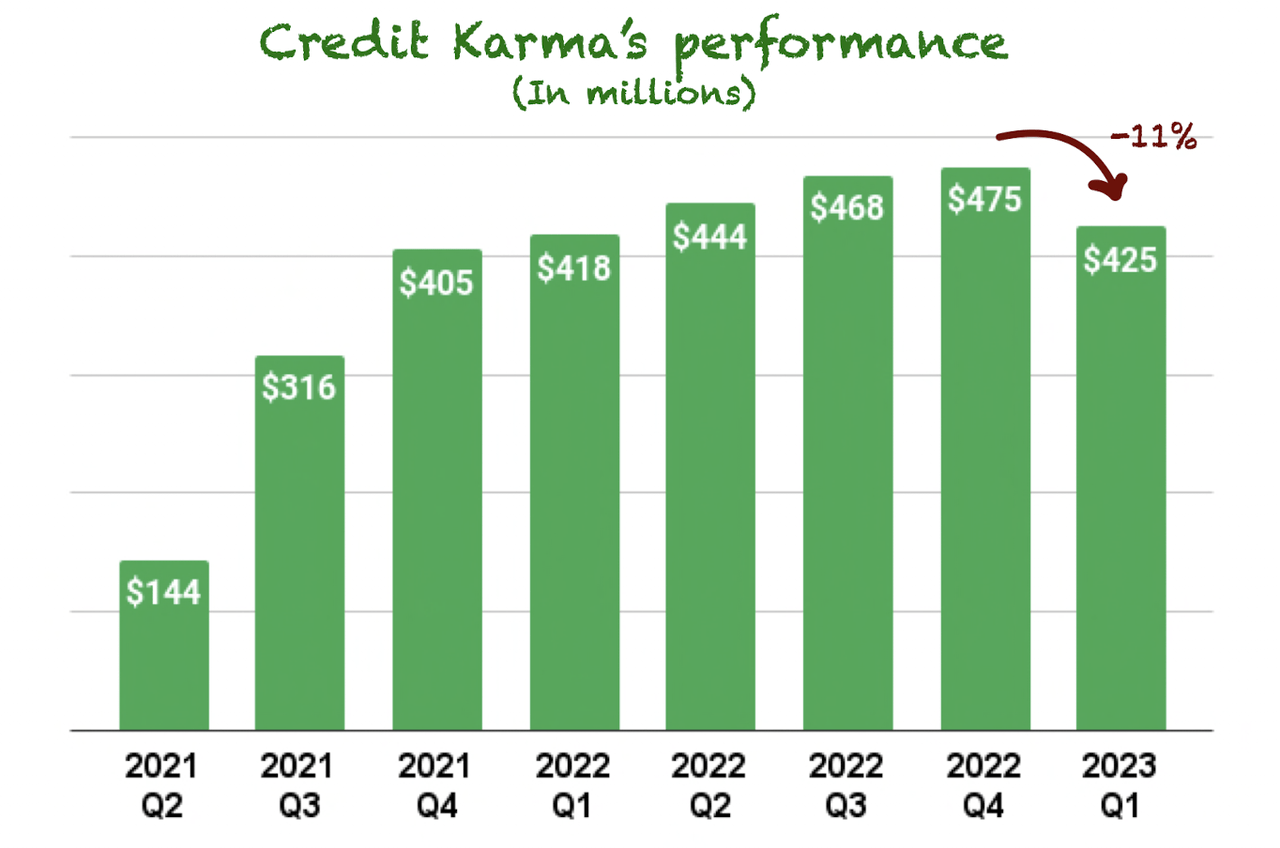

Credit Karma: Deteriorating macro and tougher comps

Credit Karma was the clear lowlight of Intuit’s results. Revenue only grew 2% year-over-year and dropped a whopping 11% sequentially:

Made by Best Anchor Stocks

If this trajectory continues, we should see negative growth rates in the coming quarters as the company faces tougher comps. For example, if the company maintains $425 million in revenue in Q2 (which seems unlikely), year-over-year growth would drop to -4%.

Almost all verticals were negatively impacted by a worsening macro, except for Credit Cards, which helped offset part of this deterioration:

On a product basis, revenue growth was driven primarily by credit cards, offset by headwinds in personal loans, home loans, auto insurance and auto loans. As the macro environment continues to remain uncertain, we’re seeing an impact across all verticals.

Source: Michelle Clatterbuck, Intuit’s CFO, during the Q1 2023 earnings call.

We already knew that Credit Karma could be exposed to the economic cycle, and we had already seen that Intuit was tightening its belt in the segment, signaling weak times ahead. However, despite the segment’s cyclicality, Intuit as a group remains well insulated from the economic cycles, as Quickbooks, Mailchimp, and the Consumer Group make up more than 85% of the company’s revenue.

It wasn’t a good quarter for Credit Karma, but as we’ll see later on, what’s about to come in the remainder of the year could be even worse.

Profitability – Contracting margins but back to margin expansion this year

GAAP EPS decreased substantially from $0.82 to $0.14, whereas non-GAAP EPS increased by 8%.

There was significant margin contraction at the GAAP level caused primarily by significantly higher SBC; we’ll talk about this later. High SBC is evident if we look at cash flow, which improved significantly with respect to the comparable quarter. Operating cash flow increased 126% year over year.

Of course, the same seasonality we discussed in the consumer segment impacts the cash flow metrics, so they were “inflated” due to the October peak in tax filings.

Qualitative highlights

The qualitative highlights are also crucial in the earnings release because they allow us to look ahead. However, this time there were not as many highlights, as most of the questions were related to guidance, which we’ll discuss in a bit.

The status of Mailchimp’s turnaround

Since its acquisition, Intuit has made some efforts to turn Mailchimp around. It’s not like the company was not performing well, but it was performing below Intuit’s expectations. The main reason for this was that Mailchimp had historically been optimized for profitability, and Intuit wanted to ensure it was optimized for growth.

Several months ago, Intuit replaced Mailchimp’s CEO, stopped investing in marketing, and started to iterate on the product. As a result, there have been quite a bit of changes over the last few months (emphasis added):

And as I mentioned a moment ago, there’s been a lot of innovation just in the last sort of three to four months in Mailchimp from an entirely new brand campaign where we communicate the benefit to how you can grow your business to SMBs, both on air and through digital assets.

We’ve redesigned our website. So when you come to us, you’re very clear about the benefits that we offer, the choices that you have and why it can help fuel the success of your business to then revamping the first-time use experience, along with what we have just implemented for, I would say, higher-value, larger Mailchimp customers and new customers that we want to pursue, which is a one-hour assisted onboarding to help you get on to the platform to help you understand the benefits of the platform.

And in context of what we’ve shared around international and Mailchimp as sort of the lead internationally, we are right now focused on localizing the language.

Source: Sasan Goodarzi, Intuit’s CEO, during the Q1 2023 earnings call.

All these changes are starting to show up in the numbers, and management believes it will be able to accelerate Mailchimp’s growth in the coming quarters (emphasis added):

This business was run for cash flow and profitability, and now we’re running it for growth. And we’re actually quite pleased with the impact that we’re starting to see, and we would expect that to accelerate in the upcoming quarters.

Source: Sasan Goodarzi, Intuit’s CEO, during the Q1 2023 earnings call.

Intuit lives up to an agile operating model, and Mailchimp’s fast transformation is a sign of this. The problem was detected and the solution was implemented very fast. Probably much faster than one would expect for such a large company.

Significant innovations in the money portfolio

Intuit sees a lot of payment volume through Quickbooks, but it doesn’t fully capture the value in these transactions. Management saw the opportunity some years ago and started innovating significantly in the payments space. Innovations are far from over (emphasis added):

This quarter, we made it even easier for more customers to access their cash quickly by removing friction and opening the funnel to more customers. We’re also rolling out a new invoicing experience with a more streamlined workflow and improved design, which is driving an increase in the percentage of companies that send payment-enabled invoices.

Looking ahead, we’re tackling another big challenge for our small business customers, B2B payments. More than $2 trillion of invoices were managed in QuickBooks in fiscal year 2022.

We’re also building our own bill pay functionality in QuickBooks and plan to launch this capability in the future.

Source: Sasan Goodarzi, Intuit’s CEO, during the Q1 2023 earnings call.

We highly doubt we will see these new features generating significant revenue over the short to medium term, but we think they will be crucial for the long term, both in terms of revenue and stickiness. Intuit sees a lot of data and business thanks to Quickbooks, allowing the company to uncover new opportunities.

Selling the platform to third parties?

There was an interesting discussion about selling some of Intuit’s proprietary platform services to third parties. The rationale is that, as Intuit has built excellent platform capabilities, it should also try to make some money by selling them for external use. Think about the Assisted Offerings, for example. Now that Intuit has built it, large corporations might be interested in using Intuit’s software to manage their customer support.

Management said they are looking into the opportunity and have even funded it. However, it remains a long-term growth opportunity more than a significant growth driver over the short to medium term:

This was actually at Investor Day one of our, what we call Horizon 3 ideas that we have invested in, which is around externalizing services. So first and foremost, we do see a big problem space out there where developers and partners and firms look to access and have a need for things like around our virtual expert platform services to connect people to experts or had to use for our identity services and have a use for our fraud and risk capabilities.

So there’s a lot of services that we have across our platform that you heard Mariana talk about of which there is a need for those services externally. Now we want to be very choiceful and intentional what we choose to externalize and what we choose not to externalize and what problems we choose to solve and which ones we intentionally choose not to solve. But we do believe it as an opportunity, it’s actually something that we funded about a little bit over 15 months ago, and we have a mission-based team that is working on it.

Source: Sasan Goodarzi, Intuit’s CEO, during the Q1 2023 earnings call.

Intuit develops scalable software in many cases because the platform approach leads the company to deploy its software solutions across all of its segments. This scalability will likely be crucial to selling it to third parties.

Share-based compensation, dilution, and buybacks

Share-based compensation (“SBC”) was again a lowlight for Intuit. SBC expense grew 51% year-over-year, driven by the Credit Karma and Mailchimp acquisitions and higher compensation costs. Despite the high SBC expense, diluted shares outstanding were “only” up 2.5%, aided by the $500 million management allocated to buybacks during the quarter.

Recall that SBC expenses can be up without too much dilution; this is caused by how the expense is calculated. A volatile stock almost always creates higher SBC, and we can argue we have seen a fair amount of volatility since October 2021. During the last earnings call, management argued they expect SBC to come down to more normal levels in the future:

Our fiscal 2023 guidance includes stock-based compensation of $1.8 billion, an increase of 39% over fiscal 2022. Approximately 25% of this total is equity granted as part of the Credit Karma and Mailchimp transactions, and approximately 75% of this total is related to our broad-based equity program designed to attract, retain and incentivize employees. Looking ahead, we expect stock-based compensation as a percentage of revenue to flatten over the next few years.

The labor market is still tight and very competitive, especially for the talent that Intuit is after. This means that compensation will most likely keep creeping up for some time until it softens.

Guidance – The lowlight driven by Credit Karma

Guidance was clearly a mixed bag on the revenue front. While the company reiterated full-year guidance for the Small Business and Self-Employed and consumer segments, it significantly reduced the guidance for Credit Karma (emphasis added):

We are lowering our fiscal year 2023 revenue guidance for Credit Karma to a decline of 15% to 10% versus our previous guidance of 10% to 15% growth. At the same time, we are reiterating our fiscal year 2023 revenue guidance for all other segments.

Source: Sasan Goodarzi, Intuit’s CEO, during the Q1 2023 earnings call.

The company was, however, quick to point out that they tried to completely “de-risk” further guidance downgrades on Credit Karma by being conservative. They basically assumed that the macro situation would get worse throughout the remainder of the year:

One of the things that we learned with Credit Karma is there are two factors that we look at but we did not take into account: one is unemployment, the other is delinquency rates. And what I mean by that, not taking it into account as we view it, we look at it, and they’re at historical lows. And the one thing that we learned from this process, what we are adjusting and have adjusted our KPIs is just looking at where they are today, but also projecting where they could be a year from now and ultimately projecting what could happen if we were sitting in the shoes of some of the partners that are on our platform.

So that is a very important shift, which actually gets at the point you made around our Credit Karma guidance. We feel that it is absolutely derisked.

Source: Sasan Goodarzi, Intuit’s CEO, during the Q1 2023 earnings call.

On the Small Business and Self-Employed side, management argued that they feel the guidance is already de-risked and they are comfortable with it. Management also said that their long-term growth targets of Credit Karma growth between 20% to 25% are unchanged as they feel this is a cycle more than anything else. Therefore, we shouldn’t care too much about the journey rather than where Credit Karma ends up.

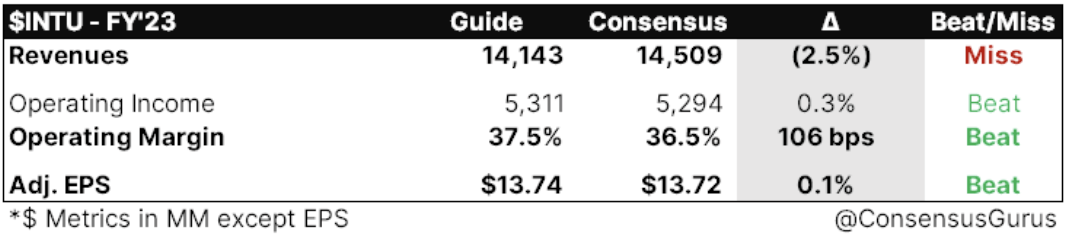

The drop in Credit Karma’s guidance made the yearly guidance come $700 million lower than what was announced at Investor Day. The company now expects $14.1 billion in revenue for the full year, which is 10 to 12% growth. However, there was a clear highlight in the company’s guidance: profitability. Intuit managed to maintain its profitability targets despite the lower revenue:

Consensus Gurus

Management already said in prior earnings calls they had the levers to pull in case the macro deteriorated further, and they will do just that. This said, it’s great to see that investments in R&D and innovation are not part of these levers. They are crucial for the long-term health of the company (emphasis added):

As I talked about on a previous call, when we were going through our planning for this year, we were really looking at making sure we had identified areas that we could take action on, the levers we could pull if we did see the macro environment get worse. Those things look like marketing expenses, things that we just don’t think are going to pay off in the near term; other areas like travel, discretionary spend. But we are protecting R&D and our innovation.

Source: Michelle Clatterbuck, Intuit’s CFO, during the Q1 2023 earnings call.

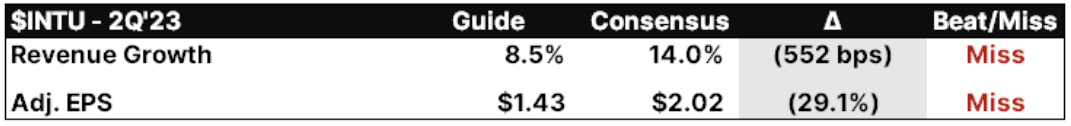

When it comes to quarterly guidance, it was a miss on all fronts:

Consensus Gurus

However, I don’t think this is worrying, to be honest. Part of the miss comes from Credit Karma, and the other part from the timing of the consumer segment. The tax season falls between Q2 and Q3, and it’s always tricky to estimate when people will file their taxes.

All in all, it wasn’t the best guidance, but it was severely impacted by Credit Karma, which we already knew could be under pressure from a deteriorating economy. Only time will tell if management was too conservative with the new guidance for the segment.

Conclusion

Intuit reported solid results for its fiscal Q1 2023 but missed guidance driven by a softer-than-expected Credit Karma. Of course, we already knew this could happen, but we also knew that the diversity of the platform would help offset it. The clear highlight was on profitability, as Intuit has maintained its profitability guidance despite the significantly lower top-line guidance for the year.

In the meantime, keep growing!

Be the first to comment