Michael Burrell/iStock via Getty Images

Introduction: Why Is Intuit Stock Down?

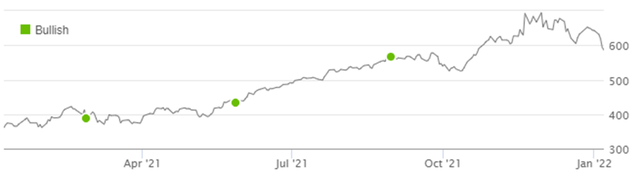

We review our investment case on Intuit Inc. (INTU) after its stock price fell below $600 for the first time since October 2021 on Wednesday (January 5). INTU shares are now down 18% since their 52-week high in November.

Intuit stock fell as sentiment has turned against “expensive” technology stocks in the last few months. The NASDAQ index has also fallen by 6.1% from its November peak, and Intuit started with comparatively high valuation multiples. Federal Reserve minutes released on Wednesday, indicating sooner and faster rate rises, added to the weakness in technology stocks.

We initiated our Buy rating on Intuit in September 2019. Even after the recent correction, Intuit shares have gained 120% (with dividends) in just under 2.5 years, including a gain of 70% during 2021:

|

Librarian Capital’s Intuit Rating History vs. Share Price (Last 1 Year) Source: Seeking Alpha (06-Jan-22). |

Key developments since our last update in August 2021 include:

- Acquisition of Mailchimp (announced on September 13)

- Intuit’s annual investor day (September 30)

- Release of Q1 FY22 results (November 18)

As we will explain, these show Intuit’s structural growth remains powerful, and double-digit EPS growth will likely continue. We believe Intuit stock is trading at just over 50x P/E on a pro forma basis. Our forecasts show a total return of 25% (8.0% annualized) by July 2025, lower than our typical requirement but still attractive in light of Intuit’s earnings resilience and strong potential.

Intuit Buy Case Recap

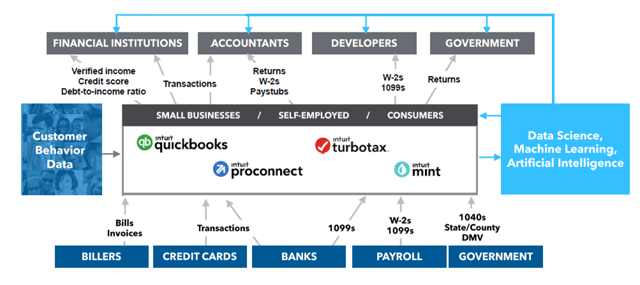

Intuit is one of the strongest businesses in our coverage, providing mission-critical software and services (with accounting and tax at the core) to small businesses and consumers in the U.S. and selected international markets, on a largely recurring revenue model (including with subscriptions).

Intuit is also a platform business, enjoying strong economies of scale, operational leverage and the ability to cross-sell. Under the “One Intuit Ecosystem” strategy since 2017, management has enabled the flow of data across its platform as well as opened it to third-party operators, creating a powerful ecosystem of apps, data analytics and referrals:

|

One Intuit Ecosystem (as of 2018) Source: Intuit investor day presentation (Sep-18). |

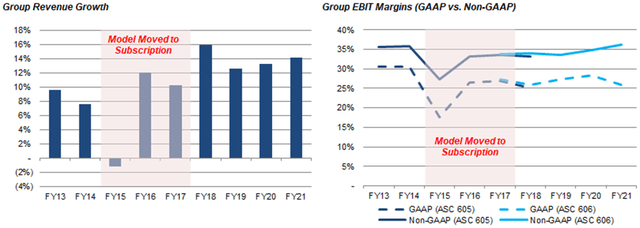

Intuit has targeted, and historically delivered, double-digit revenue growth and an expanding EBIT margin; we believe this will continue in the future:

|

Intuit Group Revenue Growth & EBIT Margin (FY13-21) NB. FY21 revenue growth excludes Credit Karma. Source: Intuit company filings. |

At the time of our initiation, relative to FY19 financials, Intuit shares were trading at a 39.2x P/E and a 2.6% Free Cash Flow (“FCF”) Yield. We have been assuming an exit P/E of 42.0x since November 2020. At its recent 52-week high of $716.86, the P/E was approx. 62x relative to FY22 guided EPS.

We believe recent developments have continued to support our Buy case.

Acquiring Mailchimp to Add Marketing Tools

Our Buy case was helped by the acquisition of Mailchimp, announced on September 13 and completed on November 1.

Mailchimp is a digital marketing platform for Small and Medium Businesses (“SMBs”) that allows them to control all aspects of their online marketing, manage their customer relationships and acquire new customers. Founded in 2001, it had 13m of global users (including 2.4m of Monthly Active Users and 0.8m of paying customers), and approx. $800m of revenues in 2020 (up 20% year-on-year, and with over 50% from outside the U.S.).

The addition of Mailchimp’s marketing tools would augment Intuit’s existing offerings in accounting, payments and human capital management:

Intuit believes Mailchimp will add more than $30bn to its Total Addressable Market, taking it to $260bn globally.

The $12bn consideration was paid 50/50 in stock and cash, with the stock component paid in new shares issued at $562.61, and the cash component partly financed by a new $4.7bn loan.

Mailchimp will continue to operate under its own brand but will become part of Intuit’s Small Business & Self-Employed (“SBSE”) segment. Management expects the acquisition to be accretive to non-GAAP EPS in FY22.

Investor Day Reaffirmed Long-Term Targets

Our Buy case is supported by the annual investor day on September 30.

Management reaffirmed the long-term expectations of growing revenues at double-digits, driven by both consumer numbers and Average Revenue Per Customer (“ARPC”), and of expanding EBIT margin over time, through a flat gross margin and various OpEx margins being flat to down over time:

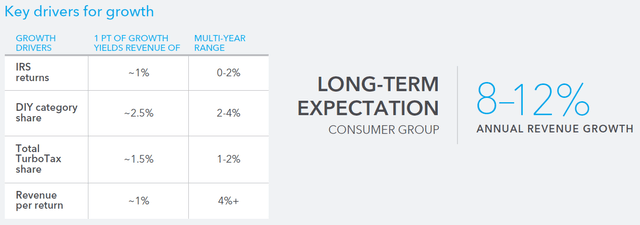

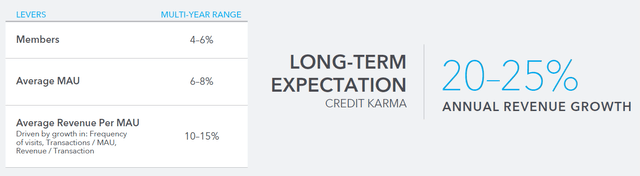

Management also provided long-term revenue growth targets by segment:

- SBSE: 10-15% annual revenue growth (no change)

- Consumer: 8-12% annual revenue growth (no change)

- Credit Karma: 20-25% annual revenue growth (new)

Key drivers for revenue growth in each segment are shown below:

|

Intuit Long-Term Revenue Growth Expectations By Segment SBSE Consumer Credit Karma Source: Intuit investor day presentation (Sep-21). |

We expect Intuit to achieve these revenue growth targets.

Rebound Continuing in Q1 FY22

Q1 FY22 results, released on November 18, also supported our Buy case.

Key P&L items from Intuit’s Q1 FY22 are below. SBSE is the only segment with a meaningful year-on-year comparison, because Consumer revenues are traditionally concentrated in Q3 (due to tax filing deadlines) and Credit Karma (acquired December 2020) was not included in the prior year:

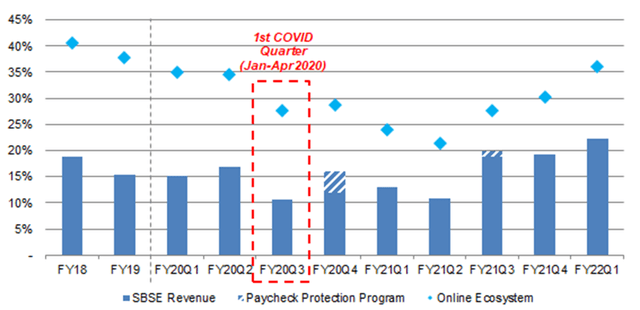

SBSE revenues grew 22.2% year-on-year, continuing the rebound from a COVID-19′ negative impact in CY2020 (roughly Q3 FY20 to Q2 FY21):

|

Intuit SBSE Revenue Growth (Since FY18) Source: Intuit company filings. |

SBSE’s total Online Ecosystem revenue growth of 36% more than met Intuit’s long-term target of 30%. International online revenues grew even faster, by 39% on a constant currency basis, despite non-U.S. markets recovering more slowly than the U.S., reflecting the still-lower penetration outside the U.S.

Credit Karma revenues reached another record in Q1 FY22, the $418m revenues achieved comparing favourably with the $1.1bn of in FY21 and $0.9bn in FY20 (on a pro forma basis). Growth was driven by a combination of macro bounceback (banks reduced their lending due to COVID-19), the integration of Credit Karma with TurboTax last season, and further product innovations that have attracted more users and financial institutions.

Higher FY22 Organic Growth and Outlook

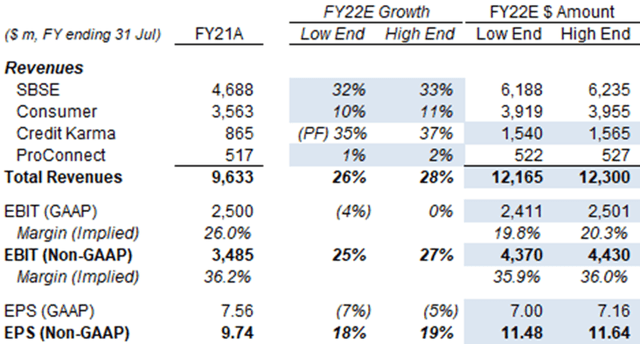

As part of Q1 results, Intuit raised its FY22 guidance, raising organic growth rates and also including Mailchimp as part of full-year expectations. FY22 non-GAAP EPS is now expected to be $11.48-11.64 (from $11.05-11.25):

|

Intuit FY22 Guidance (Updated) NB. Actual guidance highlighted in blue. Credit Karma growth rates are pro forma. Source: Intuit results release (Q1 FY22), Librarian Capital. |

Expected revenue growth rates for different segments include:

- SBSE growth now to be 32-33%, including organic growth of 16-17% (was 12-14%) and Mailchimp revenues of $760-770m (newly acquired)

- Consumer growth of 10-11% (no change)

- Credit Karma growth 35-37% (was 18-21%)

- ProConnect revenue growth of 1-2% (no change)

The expected Non-GAAP EBIT Margin includes an approx. 80 bps negative impact from the acquisition of Mailchimp, including planned “aggressive” investments. Management expects “margin expansion to continue from this new level over time”.

Valuation – Is Intuit Stock Overvalued?

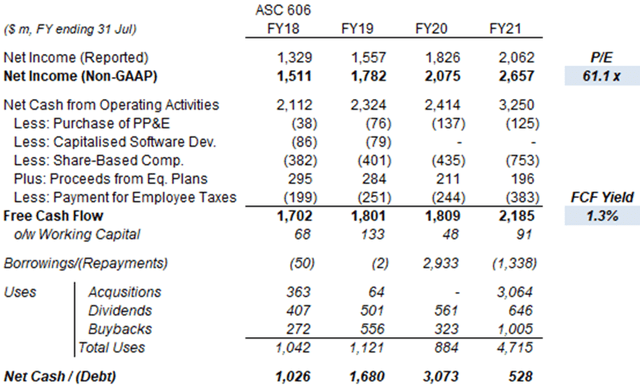

At $586.39, relative to pro forma FY22 EPS, we believe Intuit stock is trading at a P/E of slightly over 50x.

Neither reported FY21 EPS nor guided FY22 EPS fully reflects the newly acquired Credit Karma and Mailchimp businesses: FY21 included only just under 8 months of Credit Karma and no contribution from Mailchimp, while FY22 includes a full year of Credit Karma but only 3 quarters of Mailchimp.

If we were to nonetheless use the guided FY22 EPS range, the implied P/E multiple would be 50.4-51.1x; similarly, if we were to use the reported FY21 EPS, the implied P/E multiple would be 61.1x:

|

Intuit Earnings, Cashflows & Valuation (FY18-21) NB. FY21 includes just over 2 quarters of Credit Karma contribution. Source: Intuit company filings. |

These P/E multiples are significantly higher than the 42.0x we have assumed for Intuit’s exit P/E in FY25. However, we believe whether a stock is “overvalued” is not determined by its current P/E, but by the expected investor returns from its current price (more below) – from that perspective, Intuit stock is not overvalued.

Intuit has a Dividend Yield of 0.5%, from a dividend of $0.68 per quarter ($2.72 annualized), which was raised by 15% at the time of FY21 results.

Intuit repurchased another $339m of its shares during Q1 FY22, and “aims to be in the market each quarter” with more buybacks. Management aims to use buybacks to, “at a minimum”, offset dilution from share-based compensation over a 3-year period.

Intuit Stock Forecasts

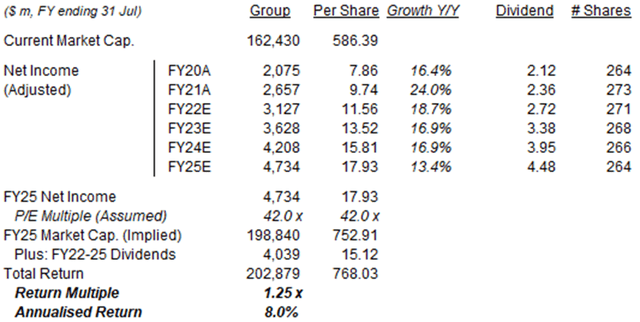

We have updated our forecasts with the raised FY22 guidance but kept other assumptions unchanged:

- FY22 EPS of $11.56 (was $11.15), midpoint of the new guidance

- In FY23 and FY24, Net Income growth of 16.0% each year

- In FY25, Net Income growth of 12.5%

- From FY22, share count reduction of 0.8% each year

- From FY23, dividend to be based on a Payout Ratio of 25%

- P/E of 42x at FY25 year-end (July 2025)

As before, the 16.0% Net Income growth in each of FY23 and FY24 is equivalent to the sum of 12.5% of organic growth and 3.5% from Credit Karma, implying a 7% benefit to EPS from Credit Karma spread over 2 years. (We have conservatively assumed no benefit from Mailchimp for now.)

The 42x P/E assumed reflects Intuit’s proven resilience during downturns and low-teens long-term future EPS CAGR, and conservatively still represents a significant de-rating from the current approx. 50x P/E.

Our new FY25 EPS forecast of $17.93 is 4% higher than before ($17.29):

|

Illustrative Intuit Return Forecasts Source: Librarian Capital estimates. |

With shares at $586.39, we expect an exit price of $753 and a total return of 25% (8.0% annualized) by July 2025, in just over 3.5 years.

While the 8.0% annualized return is lower than the 10% we typically require, we are making an exception for Intuit because of its proven resilience during the pandemic and strong long-term potential. In addition, given a P/E de-rating is a one-off, the annualized return should trend towards Intuit’s long-term low-teens EPS growth as we extend the forecast period.

Is Intuit Stock a Buy? Conclusion

Intuit stock has fallen below $600 for the first time since October 2021, and is now 18% below its 52-week high in November.

Shares are at just over 50x pro forma FY22 EPS. Even assuming a further de-rating to 42x, we believe they can be a good investment.

The $12bn acquisition of Mailchimp expands the Intuit platform into marketing tools, significantly enlarging the addressable market.

Intuit has reaffirmed long-term targets, which imply a double-digit EPS growth; Q1 FY22 results were strong and the outlook was raised.

With shares at $586.39, we expect a total return of 25% (8.0% annualized) by July 2025, still an attractive risk/reward.

We reiterate our Buy rating on Intuit Inc. stock.

Be the first to comment