KanawatTH/iStock via Getty Images

Overview

Many of us are familiar with Intuit’s (NASDAQ:INTU) industry-leading products in personal taxes (Turbo Tax) and small business accounting (QuickBooks). However, the company has expanded well beyond these two areas and assembled a portfolio of products that have improved and will continue to improve the financial lives of its customers.

Mission statement and goals

On Intuit’s website, CEO Sasan Goodarzi described their mission statement as follows:

We are a purpose-driven, values-driven company. Our mission to power prosperity around the world is why we show up to work every single day to do incredible things for our customers. Our values guide us and define what we stand for as a company.

The company emphasizes solving customer problems that matter most, customer driven innovation, design for delight, and execution excellence. Its audacious goals include putting more money into customers’ pockets, double their household savings rate, and improving the success rate of its small-medium business customers by over 10 pts compared to the industry.

Intuit’s businesses

Intuit operates through four main segments:

(1) The consumer segment serves consumers with do-it-yourself and assisted TurboTax income tax preparation products and services sold in the U.S. and Canada. Mint.com is a personal finance offering which helps customers track their finances and daily financial behaviors.

(2) The small business and self-employed segment serves small businesses and the self-employed around the world and the accounting professionals who assist and advise them. Offerings include QuickBooks accounting, financial and business management online services and desktop software, payroll solutions, time tracking, merchant payment processing solutions, and financing for small businesses.

(3) The ProConnect segment serves professional accountants in the U.S. and Canada, who assist small businesses in tax preparation and filing. Professional tax offerings include Lacerte, ProSeries, and ProConnect Tax Online in the U.S., and ProFile and ProTax Online in Canada.

(4) Credit Karma, which was acquired in 2020, serves consumers with a personal finance platform and app that provide personalized recommendations to help consumers find the most appropriate and low-cost credit card, home, auto and personal loan, and insurance products; online savings and checking accounts through FDIC-member partner, MVB Bank, Inc.; and access to credit scores and reports, credit and identity monitoring, credit report dispute, and data-driven resources.

In October 2021, Intuit reached an agreement to acquire Mailchimp, a global customer relationship management and marketing platform that helps small and mid-market businesses grow, for approximately $12 billion-the largest in the company’s history. Mailchimp will become part of the Small Business and Self-employed segment.

(Author’s note: I suspect that the purchase valuation was lower than expected because of the negative impacts of Apple’s Mail Privacy Protection (AAPL), enactment of data protection laws around the world, and web browsers’ blocking of third party cookies, all of which have impeded Mailchimp’s ability to help track the activity of email recipients.)

Positive tailwinds

The company has benefited from the growth in number of small businesses, strong digitization trend, shift of software from the desktop to the cloud, superb execution of growth strategies, and implementation of artificial intelligence technologies in its products. More interestingly, the company’s acquisitions of Credit Karma and Mailchimp and strategy to derive synergies across its ecosystem will continue to disrupt and transform the small and mid-size business landscape.

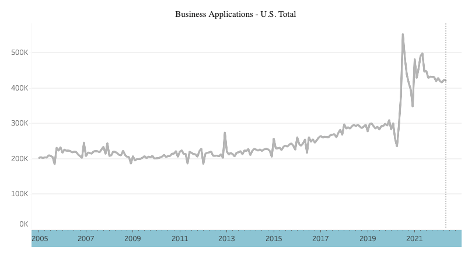

(1) Growth in the number of small businesses: the number of business applications has grown steadily over the last decade and accelerated after the outbreak of the COVID-19 pandemic (figure 1). Intuit provides a cost-effective and scalable accounting system which can be handled by the business owner or with the help of a bookkeeper.

Figure 1: New business applications

US Census Bureau, Business Formations Statistics

(2) Digitization: Intuit has benefited from a shift to digitization as consumers increasingly leverage technology (such as Intuit’s TurboTax) to simplify tax preparation and speed up the refund process to get money into their pockets sooner. Similarly, its QuickBooks software helps small or new owner-operated businesses, which often have a difficult time hiring or paying professional accounting staff, to efficiently handle their book-keeping, payroll, timesheets, invoicing/payments, or financing needs.

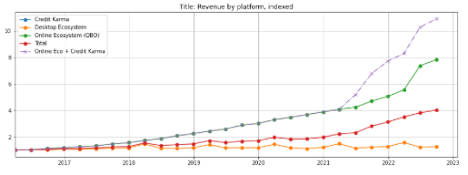

(3) Software shift from desktop to the cloud: The shift of computing from the desktop to the cloud enables Intuit to create software with more powerful capabilities (e.g., big data analytics requiring networked cloud connections) with lower distribution costs and recurring subscription revenues. Cloud-based revenues, which were about 50% before the COVID-19 outbreak, is up to ~80% after factoring the Credit Karma acquisition. Since 2016, desktop revenues have barely grown, while online revenues grew about 6x (before the acquisition of Mailchimp). If we include Credit Karma and MailChimp revenues, online revenues have grown over 10x since 2016 (figure 2).

Figure 2: Intuit’s revenues from cloud vs desktop applications

Created by author using public financial data

(4) Growth strategies

Intuit has executed well in growth strategies on multiple fronts. As examples:

- Entering adjacent spaces: QuickBooks has extended its capabilities well beyond bookkeeping software into financial, payroll solutions, time tracking, merchant payment processing solutions, and financing for small businesses.

- Expansion into underpenetrated user segments: even though the e-filing space is generally well penetrated, TurboTax is finding and targeting under-penetrated segments amongst the Latinx, investor, and self-employed customers to accelerate near-term revenue growth.

- Create new segments targeting underserved needs: Intuit customers sometimes lack the knowledge to prepare more complicated taxes and move on to professional tax accountants. In response, the company has created the artificial intelligence-driven TurboTax Live and ProConnect Tax services to match e-filers to professional accountants with the right expertise for a fee. This service enables customers to move between using Intuit’s e-filing products and professional tax accountants and keeps customers within the company’s orbit.

- Keeping customers that may be outgrowing the company’s products: DIY (do it yourself) e-filers who decide they can no longer do their own taxes “graduate” to professional help. Intuit supplies a line of tax preparation software to tax professionals, which may also keep some of these customers within the company’s orbit.

- Strategic price increases: Intuit has done tests on price increases and concluded that pricing of financial products is less of a factor than users’ confidence in the products. Management noted on the 2022 Q2 earnings call that there is “a lot of room to move up on pricing”, particularly for Turbo Tax. The hassle and high cost of switching accounting systems also creates some degree of pricing inelasticity for QuickBooks software.

(5) Application of AI: Intuit holds a rich asset base of customer accounting and tax data across its ecosystem, which positions it as the source of truth–the system used to maintain and look up accurate data–for individuals and small businesses. In its 2021 Investor Day presentation, the company articulated the goal of applying artificial intelligence to the data to generate actionable insights for customers, particularly those looking to transact with smaller businesses that lack the public reporting and transparency of larger businesses. Management noted that interactions on its platform create additional records of behaviors which Intuit’s AI can use to train its models to derive better insights and recommendations for customers.

Create synergies across businesses

In addition to growing and leveraging the data on Intuit’s platform, management has been highly focused on cross-selling opportunity across its products.

(1) Credit Karma and Turbo Tax:

Credit Karma can provide personalized financial and tax insights for its members who have filed taxes using TurboTax by using data from their previous tax returns. It has also incorporated Turbo Tax into its app, which enables its members to prepare their taxes within the app. Similarly, Intuit has offered Turbo Tax filers five-day early refund advances if they sign up to have their tax refund directly deposited into a Credit Karma Money account.

(2) Credit Karma, QuickBooks, and Mailchimp:

MailChimp has been included as a tab in QuickBooks Online, which enables users to transfer all their customer and revenue data into MailChimp’s customer relationship management system, facilitating the integration and adoption by QuickBooks users. Intuit has also integrated Credit Karma into the QuickBooks Payroll platform and is offering the 16 million employees paid by QuickBooks the option to deposit their paychecks into a Credit Karma money account.

(3) Mint.com, a free consumer finance/accounting app which Intuit acquired for $170 million in 2009, captures a wealth of valuable information on users’ personal finance, spending habits, and borrowing habits. Even though the app has not captured as many subscribers as expected and is hardly mentioned in recent management presentations, the data is highly valuable to Intuit and its partners.

Geographical expansion

Intuit’s tax products are primarily geared towards the US and Canadian populations. However, 30% of QuickBooks Online’s revenue come from outside the US. The acquisition of Mailchimp, which derives half of its revenues from overseas, is likely to help enlarge Intuit’s global footprint as both QuickBooks and Mailchimp users around the world seek to unlock the benefits of having an integrated accounting back office and customer relationship management system.

Consolidated Financials

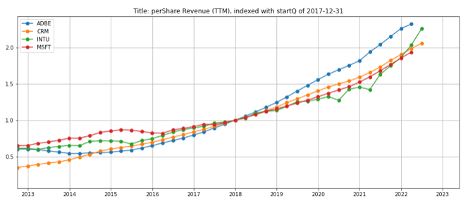

Since 2018, Intuit’s per-share revenue has grown by almost 2.3x (figure 3, green line), higher than Microsoft (MSFT) (red line), and Salesforce (CRM) (orange line) and just a little below Adobe (ADBE) (blue line).

Figure 3: Intuit and comparables: per-share revenues

Created by author using public financial data

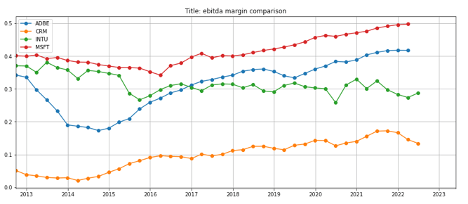

EBITDA margins:

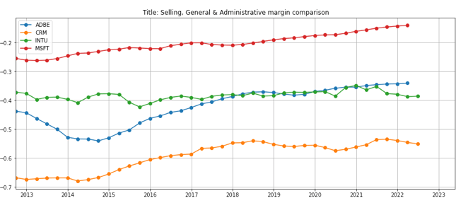

Software providers benefit from operating leverage over the long run due to lower incremental costs, which Adobe, Salesforce.com, and Microsoft have all exhibited (figure 4, blue, orange, and blue lines). Intuit’s EBITDA margins have not grown (green line) since 2016 and its SGA margins have remained flat (figure 5) even though it reduced its R&D expenses as a percentage of revenue by about 100bps.

Figure 4: Intuit and comparables: EBITDA margins

Created by author using public financial data

Figure 5: Intuit and comparables: SGA margins

Created by author using public financial data

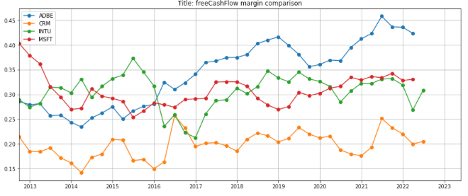

Strong cash flow generation:

Over the past five years, Intuit’s free cash flow margin (figure 6, green line) has been close to Microsoft’s (red line). It is higher the Salesforce’s (orange line) but lower than Adobe’s (blue line).

Figure 6: Intuit and comparables: free cash flow margins

Created by author using public financial data

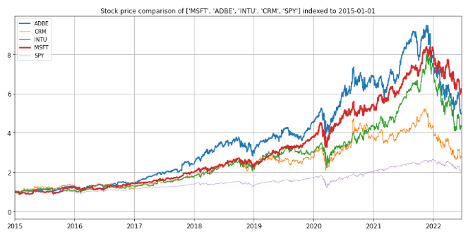

Stock price

The stock price has run up since 2015 but pulled back by almost 50% in the recent market pullback triggered by the Federal Reserve interest rate hikes and Russian invasion of Ukraine. It has outperformed Salesforce, but underperformed Adobe and Microsoft over the last seven years.

Figure 7: Intuit and comparables: stock price (indexed)

Created by author using public stock price data

However, does this sharp pullback make INTU an attractive buy?

Segment analysis

Revenues

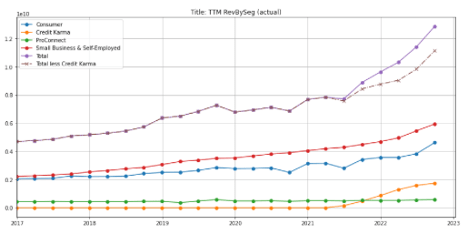

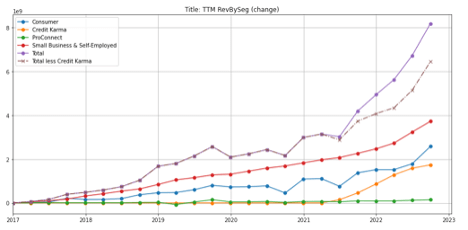

Since 2017, revenues of Intuit’s Consumer segment were up almost 2.4x or 15.7% p.a.; the Small Business and Self-Employed segment (including Mailchimp but excluding Credit Karma) was up almost 3x, or 17% p.a., and contributed almost half of the dollar growth in the period (figure 9, red line). In comparison, ProConnect was only up 35%, or 5.5% p.a.

In 2017, the Consumer (figure 8, blue line) and Small Business & Self-Employed segments (red line) were relatively similar in size. However, revenues of the Small Business and Self-Employed segment have grown faster (red line) and accelerated in the last two quarters due to the acquisition of Mailchimp. Today, it is Intuit’s largest segment with annual revenues of about $6 billion, accounting for 46% total revenues compared to 36% from the Consumer segment.

Credit Karma (orange line), which was acquired in the end-2021, contributed about $1.8 billion in additional revenues (14% of total revenues) for the twelve-months ended April 2022.

Figure 8: Actual TTM revenues by segment

Created by author using public financial data

Figure 9: Change in revenues by segment (base year 2017 = 0)

Created by author using public financial data

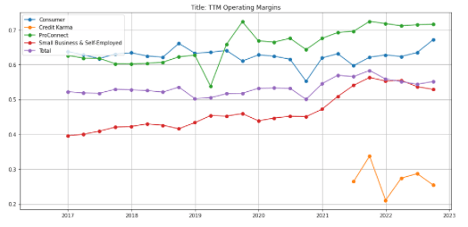

Operating Margins

Intuit’s consumer segment has high (~68%) operating margins, which remained generally stable over the last 6 years (figure 10, blue line). The Small Business & Self-Employed segment’s margins have expanded by over ~1500 basis points from 2017 through 2021 before ticking down due to Mailchimp’s lower margins (red line). Management noted that excluding Mailchimp, Intuit’s 2022 operating margin would have expanded by 60 basis points.

Credit Karma margins are half that of the Consumer Segment (orange line), and accounts for just 6% of Intuit’s total operating income. However, Credit Karma and Mailchimp’s margins are likely to expand as they are integrated into the Intuit ecosystem.

Figure 10: Operating margins by segment

Created by author using public financial data

In Q3 2022, Intuit entered into a settlement agreement with the State Attorneys General regarding their advertising practices related to free tax preparation. This resulted in a $141 million one-time charge in the quarter but removes the overhang of the potential litigation.

The ProConnect segment accounts for less than 5% of total revenues and less than 6% of operating income. Even though it has the highest margins of all segments and delivered moderate year-over-year growth, I do not expect it to move the needle in the near- to intermediate term because of its relatively small size.

Segment analysis

Intuit’s Consumer and Small Businesses segments are stable, steady growing and generate recurring revenues, but its recent acquisitions of Credit Karma and Mailchimp contribute greatly to the company’s growth potential.

Consumer segment

Nothing is certain except death and taxes (Ben Franklin, 1789)

Figure 11: The four key drivers of the consumer segment

|

Driver |

Guidance/ Projections |

Comments |

|

Number of taxes filed |

Short term: Flat to down due to (1) the reduction in population from COVID-19 deaths, and (2) many people who filed taxes for their COVID-19 stimulus checks no longer need to do so Long term: population growth of 0.5% to 1% |

Historical population growth: – 1960-2020: 1.5% to 0.57% – 2021: 0.1% |

|

DIY as percentage of total returns |

+1% |

Estimate provided by management |

|

Share of IRS returns |

Turbo Tax share: 31% +2% share of DIY |

Target Latinx, self-employed and investor segment: 13% growth Turbo Tax Live creates opportunity to: – reduce churn of Turbo Tax users who need help by matching them to experts using AI (DIY to DFM churn estimated at 10 million) – capture some of the 88 million people currently utilizing professional tax preparation help – (Turbo Tax 2022 est’d revenue of $1 billion) |

|

Average revenue per return |

+ 7-9% |

Confidence in the product is a higher priority than pricing so there is room for further increase Average revenue per return increase likely to continue with greater tax code complexity and higher utilization of TurboTax Live |

|

Historical growth Guidance |

2017-2021: 15.7% Short term: 10% Long term: 8-12% |

Long term estimate feels conservative |

Small business and self-employed segment

This segment grew 17% from 2017-2021, but management notes that the business has a “very, very large TAM (total addressable market)” with customer penetration still “well below 10%”. Intuit is expanding both upmarket with QuickBooks Advanced for mid-market businesses (revenues up +57% year-over-year) and down-market with QuickBooks for the self-employed.

Drivers for this segment include:

- Continued increase in customer adoption

- Higher digital penetration: QuickBooks Online, which generates recurring revenues, grew +26%

- Higher effective prices, in part from customers subscribing to additional products (e.g., time track, payroll, merchant payments)

- Increased share of international market, which is growing faster than the US market

- QuickBooks Live, which connects customers with a trusted bookkeeper partner who can ensure the books are done right

Management guided 2022 revenue growth to 16-17%, with longer term organic revenue growth likely to be in the 10-15% range.

Professional software segment

Management noted in the Q3 2022 earnings call that it expects 4-5% growth in this segment, which is insufficient to move the needle.

Recent acquisitions contribute greatly to the platform’s strengths

Credit Karma

Credit Karma is a personal finance platform and app that provides personalized recommendations to help match its 121 million members with its 24,000 financial institution partners.

Lenders typically have little data to underwrite loans or financial products to individuals and small businesses. Credit Karma’s LightBox technology leverages the data drawn from Turbo Tax returns (which averages 55,000 attributes per customer) and Mint.com data to assess a customer’s past payment behavior and ability to pay, which improves the probability of matching the customer with a suitable lender or provider offering the best pricing. This has resulted in the doubling of the loan approval rate, on which Credit Karma gets paid.

In the Q3 2022 earnings call, CEO Sasan Goodarzi noted:

“We are really good at leveraging what we know about you with your permission to then really match you to financial products that are right for you and find ways to save money to get you out of debt”

Credit Karma has also successfully capitalized on cross-selling opportunities:

- The integration of Turbo Tax into the Credit Karma app makes it easy to cross sell both products. For example, Turbo Tax handles $105 billion in tax refunds for 38 million customers. By offering Turbo Tax customers who agree to directly deposit their tax refunds into a Credit Karma Money account the ability to receive their refunds five days early, Turbo Tax customers has accounted for 40% of new customers since the acquisition closed.

- Integration of Credit Karma into the QuickBooks payroll platform has opened the door for eligible employees to sign up for the direct deposit of their payroll checks into a Credit Karma Money account. This has increased the money market account fees earned and creates still more valuable data assets for Intuit’s AI platform.

Since the close of the Credit Karma acquisition, its average revenue per monthly active user has been up 29%. Its Q3 2022 revenue grew 48% year-over-year, and its 2022 revenue is expected to reach $1.55 billion.

Mailchimp

Small businesses typically depend on the business owner or marketing persons to establish and maintain customer relationships. Management notes that the biggest challenge for small businesses is to get more customers, and estimates that more than three quarters of small businesses have not adopted a customer relationship management software.

Intuit’s acquisition of Mailchimp represents a major shift from its exclusive focus on back-office operational support functions to front office marketing and sales functions, providing customers with software that help small businesses find, engage, and retain customers to generate new revenue.

Mailchimp’s software is driven by more than 2 billion data points across its platform and creates insights that fuel 2.2 million daily AI-drive predictions daily, which allows small and mid-market businesses to test, track and optimize for each customer engagement. The combination with Intuit enables Mailchimp to combine its customer data with QuickBooks’ 60 billion datapoints to help small businesses generate the insight to understand, manage, determine the profitability, and identify actionable strategies and automate the process to pursue each customer. This in turn enriches Intuit’s data assets, furthers its strategy to become an AI-driven expert platform, and positions Intuit as the source of truth for businesses to operate efficiently and grow revenues.

Intuit’s acquisition of Mailchimp will create a potentially formidable competitor to existing e-commerce and digital marketing platform, especially in the historically underserved small (less than 50 employee) business segment which lack budget and training for the more expensive, feature rich offerings from Salesforce and Adobe.

Mailchimp’s game changing potential

Intuit CEO Sasan Goodarzi stated in the Mailchimp acquisition conference call on September 13, 2021:

“This is where the real magic happens bringing the two platforms together.”

Intuit’s strategy to combine a user’s Mailchimp customer data with sales data from QuickBooks to generate actionable sales and operational insights is a powerful capability. However, I believe this is just scratching the surface.

Salesforce, one of the most successful CRM software providers, discussed the use of global modeling data to allow Einstein, its AI engine, to “detect aggregate, anonymous trends across many Salesforce customers, then use a broader set of aggregated data to train and improve [when to send messages to customers]… As a result, predictions are more accurate and can cover more contacts, leading to better engagement rates.”

According to SalesforceBen.com, this means “gathering data from multiple Salesforce organizations and using AI to analyze the data for trends that can then be applied to features such as Opportunity Scoring or Lead Scoring.” It further elaborates: “Global models are important for customers who wish to use Einstein’s [Salesforce’s AI] features but do not have enough data of their own to train a custom model. This might be because they are a new company or new to CRM and have little, if any, existing data.” Salesforce assures its customers that “global models don’t reveal the underlying data, meaning [customer] data is not shared with other customers.”

Intuit certainly has the ability and is expected to do the same, but it has the added unique advantage of having access to accounting data, which Salesforce does not.

In an ideal world, Intuit could take this advantage to an extreme to become a “super-broker” that matches buyers and sellers by using both a buyer’s purchase history and anticipated needs and its potential suppliers’ production capacity and cost structure. Perhaps this could take the form of an email saying, “Dear [user], you are running low on [widget XYZ], which you currently buy from supplier A. We believe supplier B can provide you with lower prices, better service, and more timely deliver – would you like to be connected?”

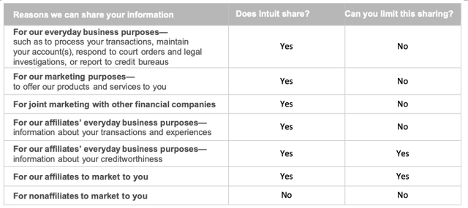

Privacy concerns

In my November 2021 article on Intuit in which I shared my understanding of the provisions in Intuit’s privacy statements (keep in mind I’m not a lawyer), I observed that nothing explicitly prevents Intuit from using customers’ data in its platform to connect buyers and sellers (figure 12). In fact, I note that this is something Credit Karma is already doing with information from Turbo Tax and Mint.com. However, if Intuit goes down this path, it must do so carefully to avoid jeopardizing the trust of customers that it has worked so hard to earn.

Figure 12: Reasons Intuit can share user information

Intuit website

Source: Intuit website “What does Intuit do with your personal information“

Mailchimp recorded unaudited revenue of approximately $800 million in calendar year 2020, growing 20 percent year-over-year. Approximately 95 percent of revenue is recurring and over 50 percent of revenue is outside the U.S. In the company’s Q3 2022 earnings call, management noted:

We are probably more excited today as we sit here than we were even when we made the announcement because now we’re into the work… we are delivering against our expectations and our belief and confidence that is the best is yet to come.

Financial outlook

Management guidance for 2022

In the Q3 2022 earnings call, management said it expects 2022 revenues of $12.6 billion or 31-32% growth, which includes organic growth (i.e., excluding Mailchimp revenues) of 23-24%.

Intermediate term outlook

|

Segment |

Historical Growth (2017-21) |

Potential Longer- Term Growth |

|

Consumer |

15.7% |

8-12% |

|

Small Business and Self Employed |

17.0% |

14-16% |

|

MailChimp |

– |

>20% |

|

Credit Karma |

– |

>20% |

I expect EBITDA margins to expand due to the operating leverage inherent in software businesses like Intuit.

Valuation

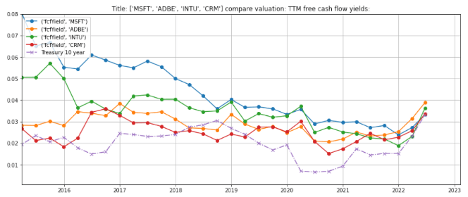

The valuation, as measured by the free cash flow yield, has risen to just below 4%–the highest in 3 years (figure 13, green line). However, this yield represents an insufficient spread over the 10-year risk-free US Treasury rate (dashed purple line).

From a value investor’s perspective, I believe Intuit stock trades at a premium to the intrinsic value of current cash flows as investors have priced in the acquisition synergies of the Credit Karma and Mailchimp acquisitions as well as the ability of the company to monetize the value of its vast data assets. As such, the stock is likely to take a hit if the synergies take longer or fail to materialize.

Figure 13: Intuit and comparables: free cash flow yield

Created by author using public financial and stock price data

Concerns

1. A near-term recession

According to market observers, the threat of recession is very real. However, as much of Intuit’s tax, small business accounting products and Mailchimp are subscription based and generate recurring revenues, the impact is likely to be less pronounced.

Management pointed out that even though most companies suffered from revenue contraction in the 2008-09 recession triggered by the Global Financial Crisis, Intuit grew revenues by 4%.

Furthermore, management believes that in a recession, QuickBooks’ cash flow management capabilities become more critical, Credit Karma’s financial product matching capabilities will likely be in greater demand as individuals and companies struggle to find ways to access cheaper financing, and more QuickBooks customers should subscribe to Mailchimp’s customer relationship management system to establish new customer relationships and generate new revenue.

2. Acquisition execution and integration risks

I believe the stock has priced in some future benefits from the Credit Karma and Mailchimp acquisition and could pull back sharply should the synergies take longer or fail to materialize.

3. Customer privacy concerns

(Already discussed above)

In conclusion

- Intuit has expanded its offerings beyond consumer tax and small business accounting software into a portfolio of products that improve the financial lives of its customers.

- The company is well run and has benefited from industry tailwinds. Its consumer and small business segments are stable, steady growing, and generate recurring revenues, but do not justify its current lofty valuation.

- The Credit Karma and Mailchimp acquisitions create significant potential synergies and opportunities to monetize Intuit’s large amounts of valuable customer data by generating actionable insights for its customers and partners.

- If these two acquisitions are successfully integrated, Intuit stock will be worth significantly more over the long run.

Be the first to comment