Mediattivo/iStock via Getty Images

On April 13th 2022, we listed the Global X Green Building ETF (GRNR) on Nasdaq. GRNR is designed to provide exposure to companies that are positioned to benefit from the advancement of the global green buildings sector, including those involved in the management, development, and technologies of green buildings.

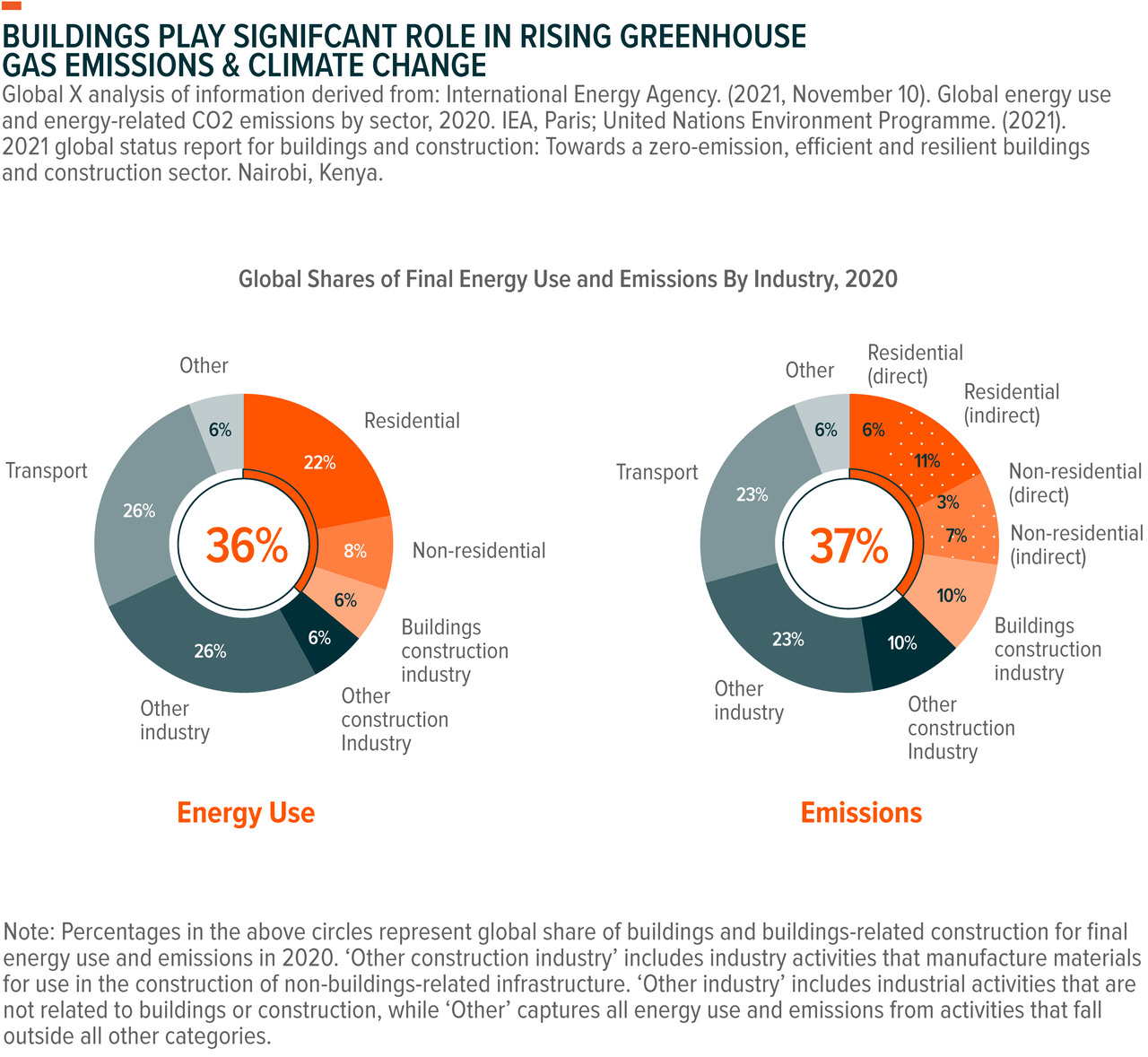

Buildings are responsible for up to 37% of energy-related carbon emissions globally and 50% of all extracted materials.1,2 By 2050, nearly 70% of the world’s population is projected to live in urban areas, which will require the building stock to double from today.3 Additionally, urban environments are increasingly vulnerable to climate change and extreme weather events.4 In our view, key to reducing building-related emissions and improving urban resiliency in the face climate change is the advancement of the green building theme.

In this piece, we explore how the world’s increasing focus on sustainability and climate change mitigation can create significant demand for the development, management, and technologies of green buildings. We also discuss how this theme can be accessed through the Global X Green Building ETF (GRNR).

Key Takeaways

- The green building sector represents a multi-trillion-dollar opportunity to meet the rapidly increasing demand for buildings while reducing greenhouse gas emissions and boosting climate resiliency.

- While green buildings require completing a certification process and can potentially have higher upfront costs, green buildings offer several potential benefits over traditional buildings. Benefits include preferential insurance and loan rates, lower operational costs, well-defined certification standards, and increased resilience to climate change and extreme weather events.

- Accelerating efforts to mitigate climate change through government policy along with developer and consumer preferences shifting toward sustainability are catalysing demand for green buildings.

Green Buildings Offer Solutions for Climate Change and Demographic Shifts

The global population is expanding at a rapid pace and becoming increasingly urban. By 2050, the world’s population is expected to reach 9.7 billion, 68% of which is projected to live in urban areas.5,6 And all these people will need places to live, work, and congregate. However, buildings account for a significant share of global greenhouse gas emissions, and urban environments and city dwellers are expected to become increasingly vulnerable to the impacts of climate change, including extreme heat events and rising sea levels.7

Author

Green buildings offer solutions to meet the increasing demand for buildings while reducing emissions and improving climate resiliency. Green buildings focus on recycling, reuse, and reduction to minimize consumption and reduce environmental and societal impacts. According to the International Finance Corporation (IFC), a green building:

- Achieves at least 20% higher energy efficiency than a comparative baseline building that does not have an energy-efficient design;

- Can quantitatively report sustainable metrics, such as energy and water savings and greenhouse gas (GHG) emissions reductions; and

- Meets international certification standards, such as the U.S. Green Building Council’s (USGBC’s) Leadership in Energy and Environmental Design (LEED) or the IFC’s Excellence in Design for Greater Efficiencies (EDGE). Also acceptable is national certification, such as China’s Three-Star System, Singapore’s Green Mark, and the Green Building Council of South Africa’s Green Star system.8,9

Companies can either design and construct new buildings or redesign and retrofit existing buildings to meet green building standards. In their design, green building projects can minimize the need for new materials and use locally harvested, sustainably grown options.10 Green buildings also use sustainable and high-efficiency technologies and services for systems like lighting, HVAC, refrigeration, and electricity.

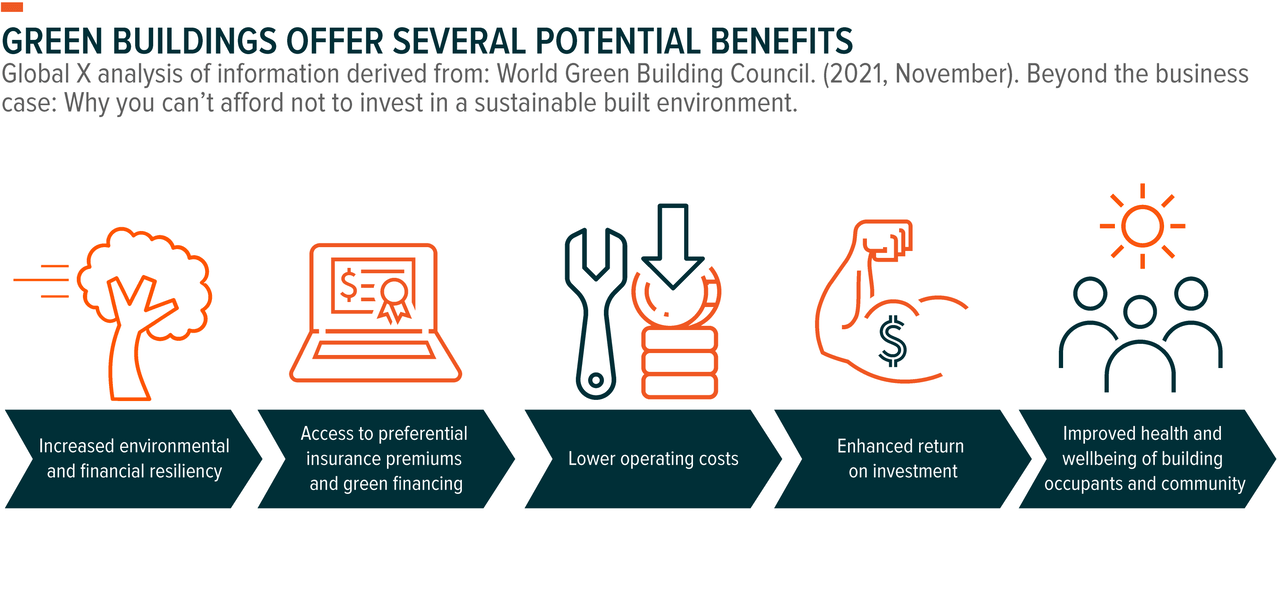

In this way, green buildings offer several potential benefits over traditional buildings. These include increased environmental resiliency, a lower risk of stranded assets, and access to preferential insurance premiums.11 Access to finance specifically allocated for green buildings is another potential benefit.12 In 2019, $66 billion in green bonds were issued globally for the development or refinancing of green buildings, accounting for 28% of all green bonds issued that year.13 A green building can also boost the health and wellbeing of its occupants and the surrounding community.14

Green buildings require completing the green certification process and can have higher upfront costs in comparison to conventional buildings, but they often have significantly lower operational costs.15,16 On average, green buildings in the U.S. use 25% less energy and have operating and maintenance costs that are 10% to 20% lower than traditional buildings, enhancing the potential long-term return on investment.17 For a best-in-class example, we highlight that U.S.-based Boston Property Group’s mixed-use green building at 888 Boylston Street in Boston, Massachusetts uses 35% less energy than a comparable baseline, saving $650,000 per year in operating expenses.18

Author

Green Buildings Present a Multi-Trillion-Dollar Opportunity

We expect green buildings will continue to gain market share due to increasing demand for sustainable solutions and new regulations. In 2021, the U.S. Green Building Council certified over 432 million square feet of LEED space in the top 10 markets alone, including the United States, China, Canada, and India.19

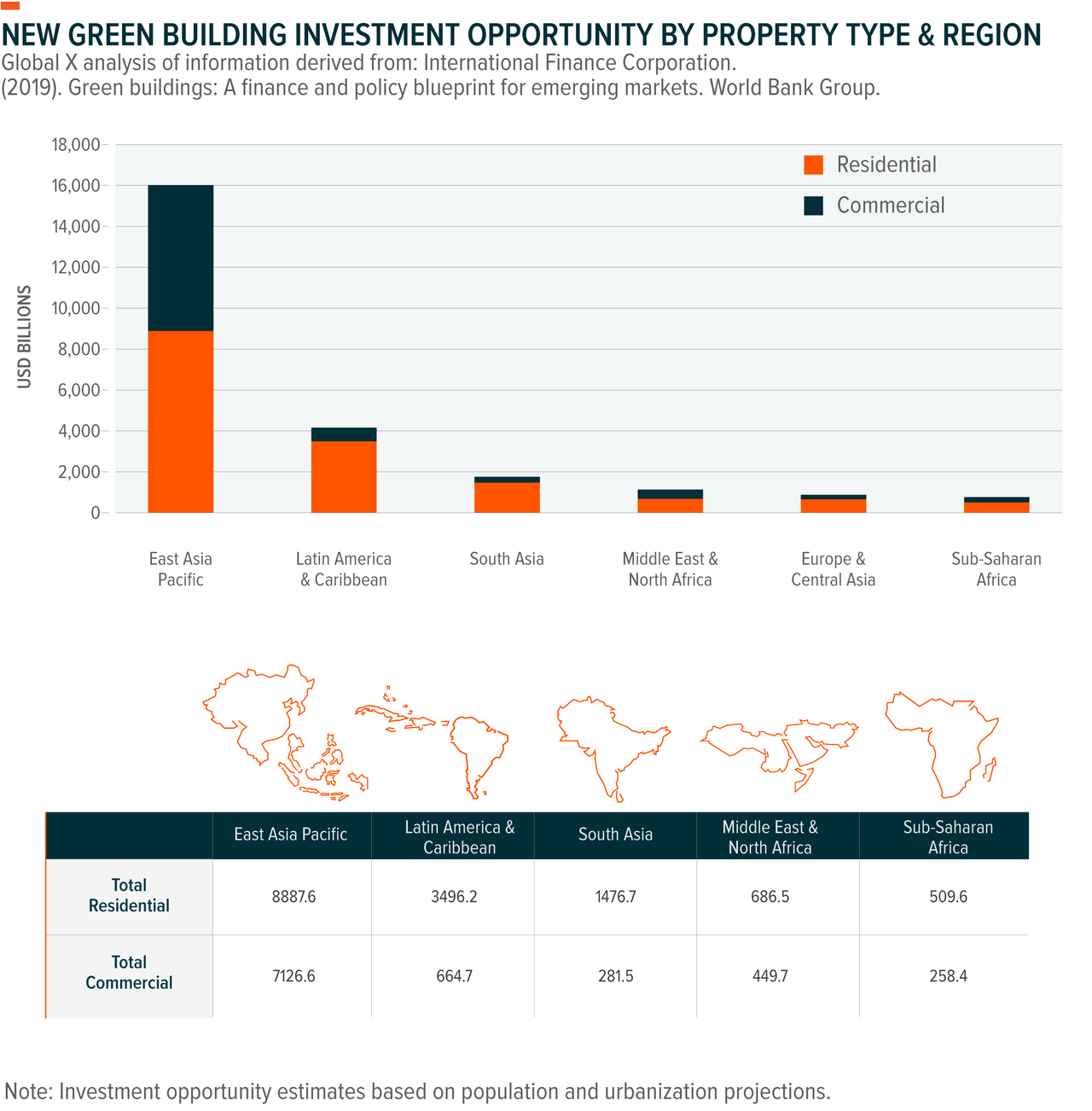

The opportunity for new green building developments is greatest in emerging markets (EMs). Overall, green buildings represent a $24.7 trillion investment opportunity by 2030 in EMs alone, driven by the EMs forecast to have the largest population growth in urban areas.20 The East Asia and Pacific region represents the largest investment opportunity at $16.0 trillion based on population and urbanization projections, followed by Latin America at $4.1 trillion.21

Author

Retrofitting already-developed buildings to meet green building standards in EMs could be an additional $1.1 trillion investment opportunity in EMs.22 Retrofitting opportunities are likely even greater in developed countries throughout North America and Europe. In Europe, more than 75% of buildings were built before green building legislation came into force.23 The European Union requires member states and city and regional authorities to renovate a small percentage of buildings annually to meet 2030 emissions reduction targets.24 These efforts are expected to lead to a 20-fold increase in green building renovation rates throughout the region over the coming decade.25

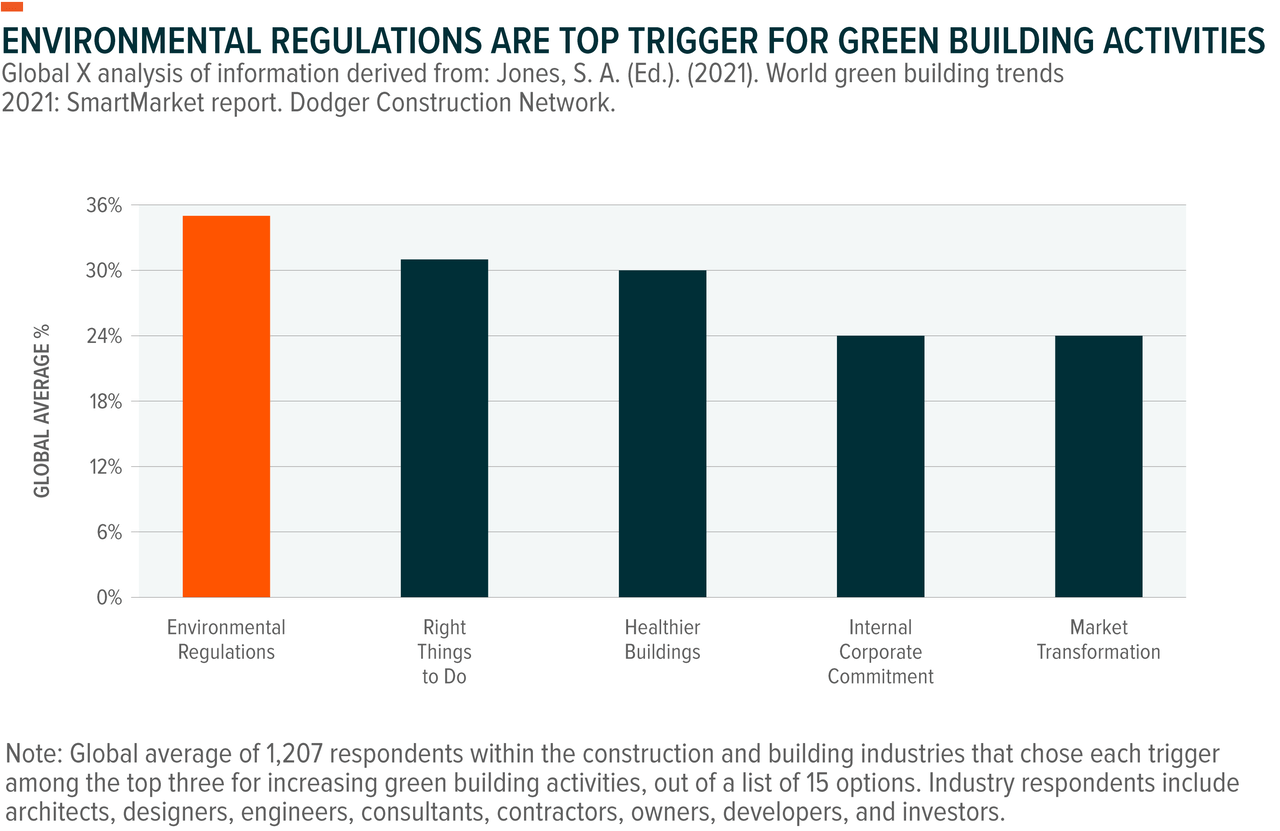

Climate Policies, Consumers, and Developers Catalysing Demand

Environmental regulations are the biggest driver of green building demand.26 Importantly, 136 countries specifically mention buildings as a focus of climate change mitigation strategies in their nationally determined contributions (NDCs) for the Paris Agreement on climate change.27 Ramping up renewable energy is the only mitigation strategy that is mentioned by a greater number of countries.28

Author

Stringent energy efficiency standards and building codes drive the development of green buildings, particularly in developed, high-income countries. For example, Japan’s Building Energy Efficiency Act that went into full effect in April 2017 requires mandatory energy efficiency compliance standards for planned non-residential buildings where the floor area is greater than 300 square meters. Clients must comply to start construction.29,30 Japan’s government aims to expand mandatory compliance with green building standards to all buildings by around 2025.31

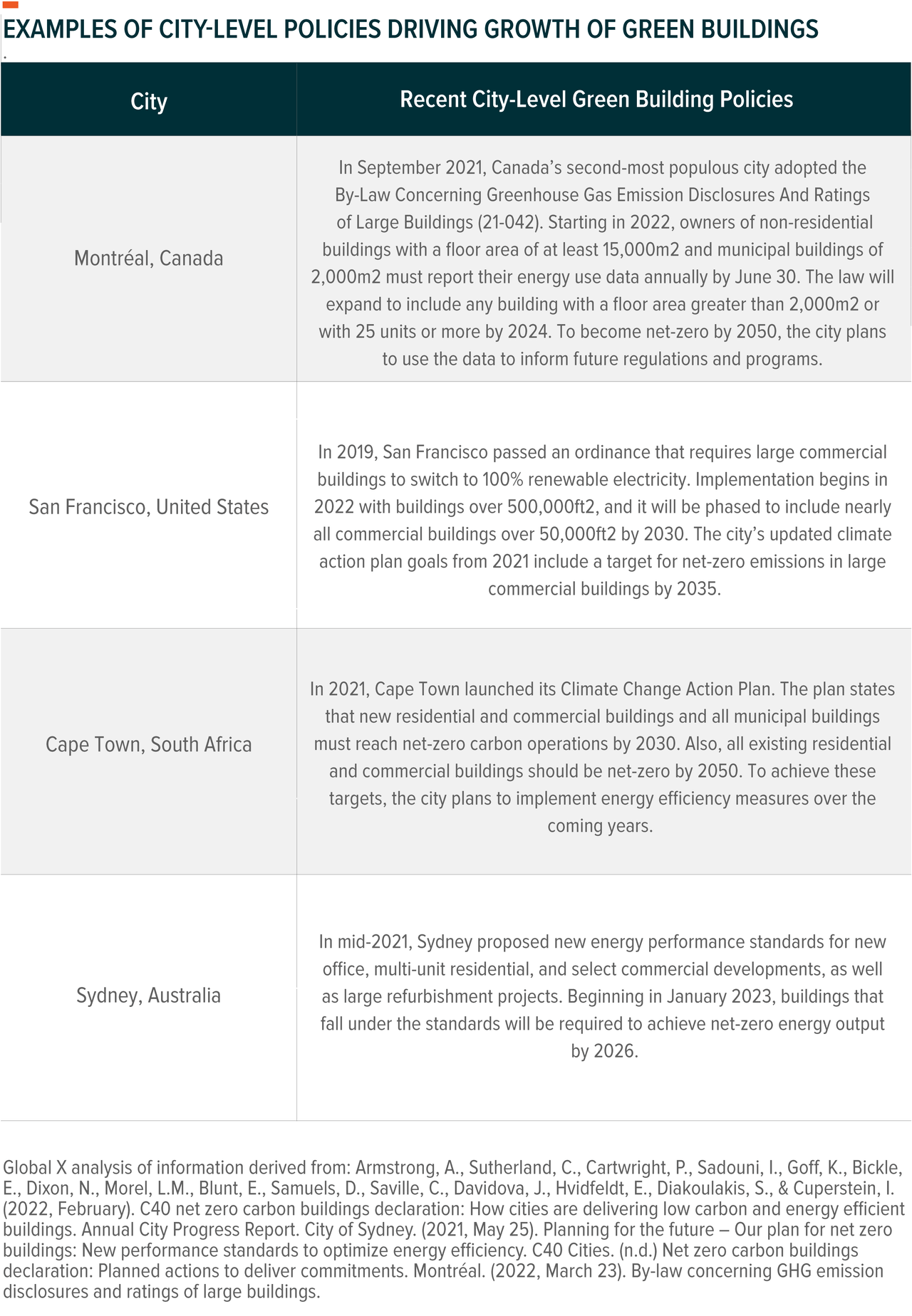

Local policy can often change at a much faster pace than national policy, increasing the likelihood for ambitious green building legislation.32 Major cities have ramped up climate change mitigation ambitions via targets and agreements that require a swift transition towards building sustainably. As of March 2022, 28 major cities, including New York, London, Johannesburg, Medellín, and Tokyo, had pledged to adhere to the World Green Building Council’s Net Zero Carbon Buildings Commitment.33 As part of the commitment, signatories agree to work towards all buildings being net zero by 2050, with an interim goal of halving emissions by 2030.34 These targets require radical and rapid transformation for sustainable practices and technologies across the entire building and construction value chain.

Also, nearly 100 mayors from cities representing a combined 20% of global GDP joined the C40 Cities initiative.35 And more than 1,000 cities have signed onto the global Cities Race to Zero campaign.36 These initiatives strive to halve emissions in member cities by 2030 to keep global warming below 1.5C.37 In our view, to reach these targets, cities will need to encourage the rapid expansion of green buildings through stricter regulations and increased access to green financing.

Outlined in the table below are examples of cities that have implemented green building-related policies in recent years as part of climate initiatives like C40.

Author

Additionally, an increasing number of developers are focusing solely on green buildings. Boston Properties (BXP) is a global leader in developing, operating, and managing certified green buildings.38 As of year-end 2020, the company had more than 25.8 million square feet of Gold or Platinum LEED certified property, representing more than 60% of the company’s total eligible floor area.39 The company continues to develop and retrofit its properties and work towards range of sustainability targets, including achieving carbon-neutral emissions by 2025.40

Architects, engineers, and contractors cite client demand as their main motivation for increasing green building activities.41 We expect that higher heating and energy prices over the past couple of years throughout the world, including across Europe, will encourage energy efficiency efforts and the use of distributed generation systems such as rooftop solar.42 The COVID-19 pandemic also accelerated the push for healthier buildings, including advanced air filtration systems.43

Also supporting this trend is that several global green building organizations have standardized definitions and processes for obtaining green building certifications. These processes provide clear pathways for developers, managers, and equipment/service providers looking to capitalize on or move into the green building space. Of these certification systems, the USGBC’s LEED is the most widely used with over 100,000 certified buildings worldwide.44

GRNR: An ETF Targeting the Green Building Theme

The Global X Green Building ETF (GRNR) is designed to provide exposure to companies that stand to benefit from the advancement of the green building theme through the development, management, and/or technologies of green buildings. GRNR strives for targeted exposure to the green building theme by investing in companies that derive at least 50% of their revenues (“pure”) from one of more of the following three main areas of the green building value chain.

- Green building development: Companies that design, construct, redevelop, or retrofit properties that meet reputable green building certification standards. Green building certification standards verify that a building has met certain environmental, energy, human health, and other standards in its design, construction, and operation.

- Green building management: Companies that manage and/or operate buildings that have obtained a green certification.

- Green building technologies and materials: Companies that provide products/services that increase the energy efficiency of residential, commercial, or public buildings. This includes products/services such as insulation and building envelopes, controls and displays for heating, cooling, lighting and home automation, HVAC, energy management services, windows, doors, elevators, etc.

Conclusion: A Theme Poised to Scale Rapidly

Accelerating climate change efforts by governments, corporations, and consumers should drive significant investment into the green building space over the coming decades. As a result, we expect investment opportunities to emerge across the green building and construction value chain, especially as potential new regulations, streamlined green building certification processes, and consumer preferences can spur increased demand for green commercial and residential space. Whether new developments to meet population growth in EMs, a potentially $24.7 trillion opportunity as soon as 2030, or retrofitting buildings in North America and Europe, we expect the green building theme’s stature will continue to grow.45

Related ETFs

GRNR: The Global X Green Building ETF (GRNR) invests in companies positioned to benefit from increasing demand for buildings that either positively impact the natural environment or reduce/eliminate negative impacts. This includes companies involved in green building development and management, as well as the technologies used to increase energy efficiency in residential, commercial and public buildings.

Click the fund name above to view current holdings. Holdings are subject to change. Current and future holdings are subject to risk.

Footnotes

1. International Energy Agency. (2021, November). Tracking buildings 2021. IEA, Paris.

2. World Green Building Council. (2021). Annual report 2021.

3. Ibid.

4. Working Group II. (2022, March). Summary for policymakers. In Climate Change 2022: Impacts, Adaptation, and Vulnerability. Contribution of Working Group II to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change [Pörtner, H.-O., Roberts, D.C., Poloczanska, E.S., Mintenbeck, K., Tignor, M., Alegría, A., Craig, M., Langsdorf, S., Löschke, S., Möller, V., & Okem, A. (Eds.)] Cambridge University Press. In Press.

5. United Nations. (n.d.) Global issues: Population. Accessed March 31, 2022.

6. United Nations Department of Economic and Social Affairs, Population Division. (2019). World urbanization prospects: The 2018 revision (ST/ESA/SER.A/420). United Nations, New York.

7. World Green Building Council. (2021). Annual report 2021.

8. International Finance Corporation. (2019). Green buildings: A finance and policy blueprint for emerging markets. World Bank Group.

9. Donnelly, J. (2019, December). IFC insights: Building green – the business case. International Finance Corporation.

10. LEED. (2014, June 4). Green building 101: Sustainable materials and resources. United States Green Building Council.

11. World Green Building Council. (2021, November). Beyond the business case: Why you can’t afford not to invest in a sustainable built environment.

12. Ibid.

13. Winkler, B. (2020, February 11). Green buildings and green bonds. Environmental finance.

14. Press Room. (n.d.) Benefits of green building. United States Green Building Council. Accessed March 28, 2022.

15. Albers, J., & Bitner, D. (2021, August). Green is good: Sustainable office outperforms in Class A urban markets. Cushman & Wakefield.

16. World Green Building Council. (2021, November). Beyond the business case: Why you can’t afford not to invest in a sustainable built environment.

17. Press Room. (n.d.) Benefits of green building. United States Green Building Council. Accessed March 28, 2022.

18. Boston Properties. (2021). Boston’s most sustainable building: BXP executes high performance design from the inside out.

19. Verdinez, D. (2022, February 9). USGBC announces top 10 countries and regions for LEED in 2021. United States Green Building Council.

20. International Finance Corporation. (2019). Green buildings: A finance and policy blueprint for emerging markets. World Bank Group.

21. Ibid.

22. International Finance Corporation. (2021, January). A green reboot for emerging markets: Key sectors for post-covid sustainable growth. World Bank Group.

23. Scott, M. (2021, September 12). Europe grapples with its retrofit challenge. Reuters.

24. Wilson, A. (2021, September). Revising the energy efficiency directive: Fit for 55 package [Briefing]. European Parliamentary Research Service, EU Legislation in Progress: European Parliament.

25. Scott, M. (2021, September 12). Europe grapples with its retrofit challenge. Reuters.

26. World Green Building Council. (2021, November). Beyond the business case: Why you can’t afford not to invest in a sustainable built environment, p. 64.

27. World Green Building Council. (2021). Annual report 2021.

28. Ibid.

29. Sawachi, T. (2021, November 3). Japanese national GHG reduction targets and its building energy codes [PowerPoint slides]. IEA EBC Building Codes Working Group Annual Symposium.

30. Ministry of Land, Infrastructure, Transport and Tourism. (2016, April). Overview of the Act on the Improvement of Energy Consumption Performance of Buildings (Building Energy Efficiency Act). Institute for Building Environment and Energy Conservation.

31. Sawachi, T. (2021, November 3). Japanese national GHG reduction targets and its building energy codes [PowerPoint slides]. IEA EBC Building Codes Working Group Annual Symposium.

32. World Green Building Council. (2021, November). Beyond the business case: Why you can’t afford not to invest in a sustainable built environment.

33. World Green Building Council. (n.d.) The net zero carbon buildings commitment. Accessed March 28, 2022.

34. Ibid.

35. C40 Cities. (2022, March). C40 annual report 2021.

36. C40 Cities. (n.d.) Cities race to zero. C40 Cities Climate Leadership Group. Accessed March 28, 2022.

37. C40 Cities. (2022, March). C40 annual report 2021.

38. Boston Properties. (2021). Boston Properties 2020 annual report.

39. Boston Properties. (2021, March). Boston Properties: 2020 environmental, social & governance report.

40. Ibid.

41. Bernstein, L., & Logan, K., Dodge Construction Network. (2021). World green building trends 2021: SmartMarket report, p. 7.

42. European Commission. (2022, March 8). REPowerEU: Joint European action for more affordable, secure and sustainable energy [Press release].

43. World Green Building Council. (2021, November). Beyond the business case: Why you can’t afford not to invest in a sustainable built environment, p.64.

44. United States Green Building Council. (2022). Mission and vision.

45. Donnelly, J. (2019, December). IFC insights: Building green – the business case. International Finance Corporation.

Investing involves risk, including possible loss of principal. The investable universe in which GRNR invests may be limited. Real estate and REITs are subject to changes in economic conditions, credit risk and interest rate fluctuations. Green building companies may be affected by unique supply and demand factors that do not apply to other real estate sections, such as changes in demand for energy efficient technology and materials. They may be significantly affected by changes in government spending, regulation or taxation. Social responsibility investment criteria limit the types of securities that can be included, which could cause the Fund to underperform other funds that do not have a social responsibility focus. International investments, including emerging markets, may involve risk of capital loss from unfavorable fluctuation in currency values, from the differences in generally accepted accounting principles or from social, economic or political instability in other nations. GRNR is non-diversified.

Carefully consider the Fund’s investment objectives, risks, and charges and expenses before investing. This and other information can be found in the Fund’s summary or full prospectuses, which may be obtained at globalxetfs.com. Please read the prospectus carefully before investing.

Global X Management Company LLC serves as an advisor to Global X Funds. The Funds are distributed by SEI Investments Distribution Co. (SIDCO), which is not affiliated with Global X Management Company LLC or Mirae Asset Global Investments. Global X Funds are not sponsored, endorsed, issued, sold or promoted by Solactive AG, nor does Solactive AG make any representations regarding the advisability of investing in the Global X Funds. Neither SIDCO, Global X nor Mirae Asset Global Investments are affiliated with Solactive AG.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment