claudiodivizia

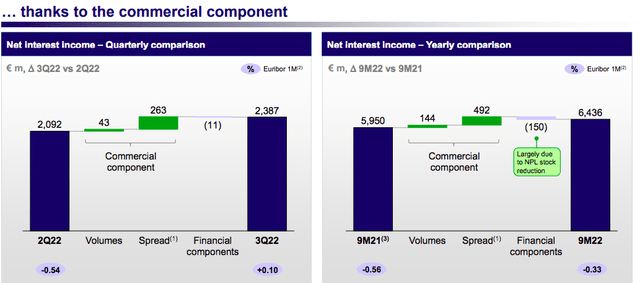

Here at the Lab, we were positive on the Italian banks. We recently upgraded with an outperforming rating UniCredit and since mid-June, we were already bullish on Intensa San Paolo (OTCPK:ISNPY) with a publication called “again a buy at this price“. After our Q3 expectation, today we are back to comment on the three months’ results. All in all, the leading Italian bank benefited from the higher rates which closed the Q3 account with a Net Interest Income of €2.39 billion, up 14.1% versus the second quarter result and up by almost 20% compared to the same period last year.

Source: Intesa San Paolo Q3 results

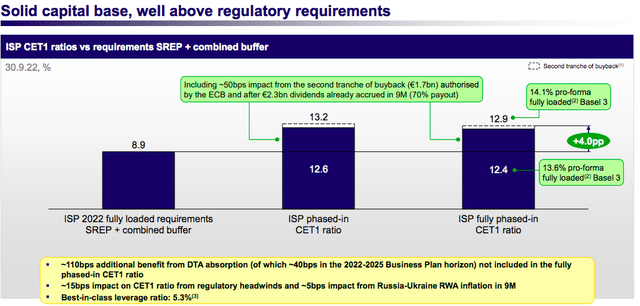

However, considering that net fees and commissions fell by 4.5% to €2.15 billion (mainly due to the decline in brokerage and consulting activities), ISP’s revenues reached €5 billion, posting a decrease of 6.4% on the company’s top-line sales. Operating costs stood at €2.64 billion, in line with the second quarter of 2022. Going down to the P&L, ISP’s net income stood at €930 million and was a clear beat versus Visible Alpha’s expectation. This was due to lower-than-expected loan loss provisions, confirming a cost of risk of 54 basis points compared to the 59 basis points in the same period in 2021. Looking at the details, net adjustments to loans amounted to €496 million (including €196 million for exposure to Russia and Ukraine), compared to the €730 million recorded in the second quarter. To sum up, Russian exposure was further reduced by approximately 65% and there was a consequent CET1 impact of 10 basis points, reaching 12.4%.

Source: Intesa San Paolo Q3 results

Here are our key takeaways:

- We appreciated that gross impaired loans were equal to 2.4% compared to about 2.3% in the previous quarter and the bank continues to show its effort on de-risking;

- We expect the launch of the second €1.7 billion buyback tranche (after the 2022 results);

- Intesa San Paolo’s sensitivity to rate hikes is much higher than market expectation, and as already anticipated, with the 1-month Euribor at 2%, the additional benefit expected on the bank’s interest margin is expected to be around €2 billion. For this reason, we expect an interest margin of over €11 billion in 2023;

- Related to point 3), Net Interest Income beats Wall Street analyst expectations by almost 10% and we believe that consensus will review upwards Intesa San Paolo’s earnings trajectory;

- Even in the event of a significant deterioration in the economic scenario, the cost of risk is expected to be below 60 basis points.

Conclusion and Valuation

Although explicit forward guidance has not been provided, management expects a significant acceleration thanks to the contribution of the interest margin. In addition, Intesa San Paolo provided an update on the financial estimates for 2022 and approved an interim dividend for 2022 of € 0.0738 per share (for a total payment consideration of €1.4 billion), expected to be paid on the 23rd of November. The bank is confirmed to be one of the best in managing costs across Europe and with the latest deleverage of Non-Performing Loan will navigate the next macroeconomic turbulences. This is why the management confirmed its €6.5 billion net profit estimates for 2025. Targets are unchanged so did our valuation, so we confirm our buy rating set at €2.4 per share. In our estimates, our CET1 ratio stood at >12% for 2023, following management indication with a payout at 70% – €2.3 billion are already accrued for the 2023 dividend with an estimated yield higher than 10% (at ISP’s today price).

Be the first to comment