sfe-co2

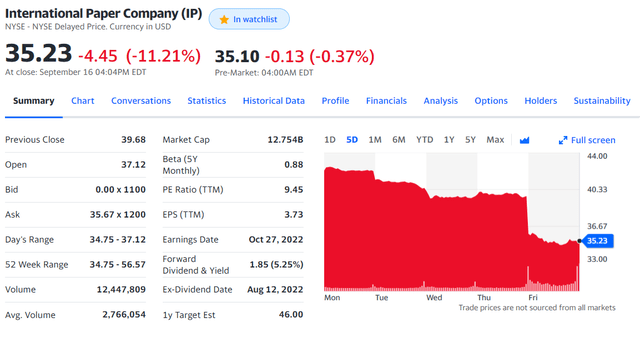

Last Friday, at the exchange’s closing bell, International Paper’s stock price declined more than 10%. Why? FedEx (FDX) reported its Q1 preliminary account results with a profit warning. The CEO also explained that “global volumes declined as macroeconomic trends significantly worsened later in the quarter, both internationally and in the U.S. FedEx is swiftly addressing these headwinds, but given the speed at which conditions shifted, first quarter results are below our expectations“. In addition, as explained here, Jefferies analyst shifted IP’s rating from neutral to sell (from $40 to $31 per share). This was due to 1) a softer containerboard demand, 2) inventory de-stocking for the inflationary pressure environment, 3) expected selling price cut and 4) not a positive outlook for 2023.

For two years, here at the Lab, we have covered International Paper (NYSE:IP) and so far, it has been a long and enjoyable ride. After analyzing IP’s Russian exposure and its Q1 performance, we upgraded (once again) the company to buy.

International Paper’s Stock Price Evolution (last 5 days) (Yahoo Finance)

Our internal team is still confident in IP’s potential capital upside, so we are benefiting from this recent price decline to double down our investment size.

Why Are We Still Positive?

Looking at the details of Jefferies’ sell rating, they claimed that “orders have fallen off starting in July and have persisted through (September) as customers and containerboard manufacturers work through excess inventory”.

- Yes, it is true that there was lower demand in July. However, according to Fastmarkets RISI, demand bounced back in August (and it is flat in September). This trend had a similar trajectory also in Europe;

- Jefferies is projecting a lower export; however, International Paper focused its activities mainly on the US market, where there isn’t an acute energy crisis and macroeconomic indices are healthier than the European ones;

- We believe that containerboard prices will go up even further (and not down) over the short/medium term – this is due to the energy price evolution and related to point 2) the US companies might benefit from the ongoing conflict between Russia/Ukraine, which would result in an increase in exports thanks to a lower cost-structure (we also emphasized this point in our recent fertilizer analysis). In addition, soft and hard pulp prices are not going down, and therefore this will support pass-through increases;

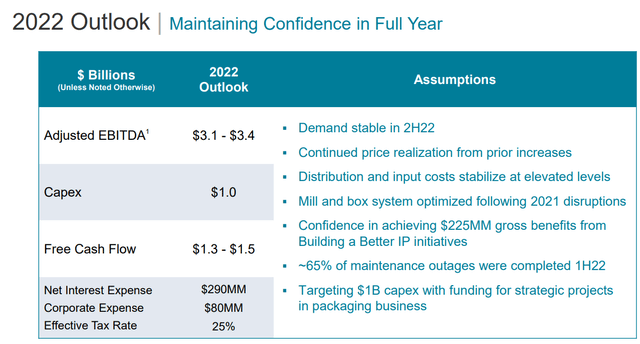

- With a lower demand in July, during the Q&A session at July’s end, IP’s management could never forecast the following guidance:

- Stable demand in H2;

- Continued price increases;

- Stable input costs.

International Paper 2022 Guidance (International Paper Q2 Results)

Conclusion and Valuation

Here at the Lab, we used to work in the Investment Banking equity research arm, and we know that analysts just follow the numbers more than providing a top-down view analysis. We believe our long-term thesis still holds, and there is no doubt about the evolution from plastic to paper thesis. In addition, we consistently rated IP with a long-term growth rate of 2% which is more in line with the population growth rather than the CAGR estimate in the packaging/e-commerce trend evolution. We are even more encouraged to buy IP thanks to the recent Mondi (OTCPK:MONDF) transaction that sold its largest plant located in Russia. Ilim JV could then follow. International Paper also has a strong balance sheet and there is no evidence of a dividend cut. To sum up, we decide to leave unchanged our target price at $55 per share, reiterating our buy rating.

Be the first to comment