vfhnb12/iStock via Getty Images

Different companies but similar bullish thesis

In the stock market, some of the best deals are made when everyone is selling in a panic. This phenomenon occurs when the macroeconomic environment is gloomy and investors are discouraged about future economic prospects. Currently, we can say that we are in one of those situations and the stock market crash is a proof of that. However, there have been some companies that have collapsed much more than the S&P500 and their current prices have reached very interesting levels. The companies in question are Intel (INTC) and Meta (META), two companies that operate in completely different sectors but have some similar traits:

- Both have collapsed around 60% reaching an oversold level, synonymous with overly pessimistic sentiment.

- Both Intel’s fair value and Meta’s fair value are much higher than the current price.

- The market is punishing the companies because free cash flow will be greatly reduced due to increasing capex. Both Meta and Intel are investing for the long term by sacrificing short-term performance.

- Both companies have a glorious history behind them and are still leaders in the industry in which they operate. On this aspect, however, Intel presents a more complex situation than Meta.

Overall, we are talking about a negative sentiment derived from the highly uncertain condition about the future of both companies. Intel will invest hundreds of billions to create new factories around the world, and Meta will invest tens of billions to create a new virtual reality. In addition, for Intel, competition from AMD (AMD) is becoming increasingly fierce, while for Meta, the family or apps segment is struggling to grow. Impossible to say a priori how this will all evolve, but my impression is that the market is discounting the worst possible scenario for both.

Meta

Meta is in my opinion one of the most undervalued companies and its collapse has reached levels that are completely unjustified. From an all-time high of $384 per share it has slumped 65% and has been due mainly to two problems:

- The first related to heavy investment in the reality labs segment.

- The second related to stagnant growth in the family of apps.

Investment in the immersive virtual world

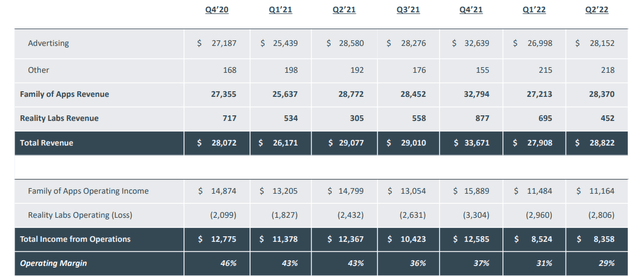

Regarding the first aspect, investors have not liked the amount of money that Meta is investing in the immersive virtual world, especially since this segment still appears to be losing money. In 2021 alone, $10 billion (about 50% of capex) was invested in the development of the metaverse, and Mark Zuckerberg expects this to continue for at least the next 3-5 years. Beyond the money invested, an additional issue that is worrying investors’ concerns Meta’s shrinking operating margins.

The reality labs segment shows revenue growth on a quarterly basis but continues to generate losses. The Q2 2022 loss of $2.8 billion was larger than the Q2 2021 loss of $2.43 billion; in addition, the operating margin deteriorated by 14%. As a result of all this, investors’ distrust of this company is understandable; however, there are 3 reasons that make me think we have reached too high a level of pessimism.

- Meta is a company that can afford large investments because of its ability to generate operating cash flow. In 2021 alone, the free cash flow generated was $39.11 billion. This value also includes expenses for the metaverse.

- Meta is a company with a strong financial situation: current net debt is -$23.81 billion. Investments in the metaverse will be partially or fully covered by capital generated by the family of apps segment.

- The market is discounting that these investments are almost a money-loser, when in fact this is not the case at all. It is still too early to tell whether they will be a success or not since we are talking about long-term investment in an industry that is still in its infancy. Meta is the undisputed world leader in social networking and developing immersive virtual reality would take the online communication experience to another level. This project is very ambitious, but the market does not feel the same way.

Family of Apps segment

The second aspect that worried investors was the diminishing revenue growth of the family of apps segment. It would seem that the market is discounting a scenario where Meta has stopped growing and users can only decline.

Looking at the latest quarterly results there was a decrease in revenue compared to Q2 2021, but several observations need to be made:

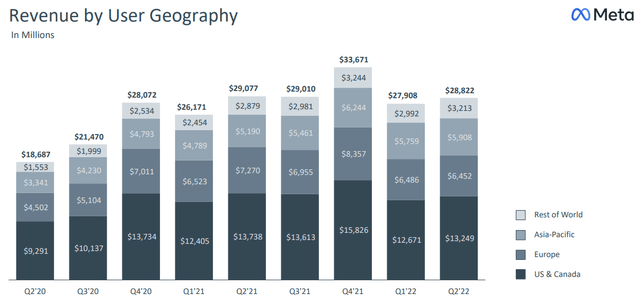

- The decrease in revenue per user compared to Q2 2021 was driven by lower spending on advertising for European, U.S., and Canadian users. Definitely not encouraging data, but it should also be noted that users in the rest of the world and Asia-Pacific spent much more than in Q2 2021. While there has been a worsening on the other hand there has been an improvement.

- The decrease in revenues in the world’s major economies is a logical consequence of the recession we are in. Spending on advertising is among the first to be cut for companies struggling to stay afloat. Once we get through this recessionary phase of the economic cycle, there is no reason to think that Meta cannot continue to grow. I think this is a temporary stall.

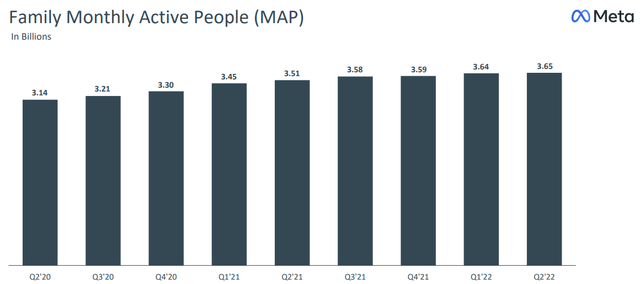

Finally, regarding the number of users, we cannot yet speak of no growth.

MAPs continue incredibly to increase albeit at a slow pace. We are talking about 3.65 billion people using one of Meta’s apps monthly, almost half the world’s population.

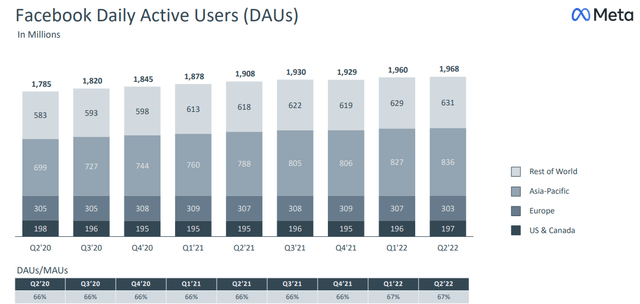

Focusing on Facebook, we can see that once again the fastest growing segments are rest of the world and Asia-Pacific. Europe, the United States, and Canada are segments that have been stagnant for years due to demographic reasons: it is difficult to get new users when virtually everyone has Facebook.

How much is Meta worth?

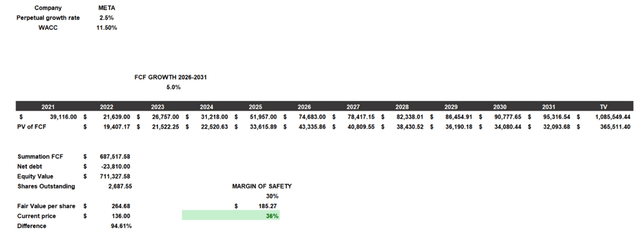

To understand what Meta is worth I will create a discounted cash flow. This model will take into consideration the following parameters:

- Cost of equity will be 11.50% and includes a beta of 1.30, a risk-free rate of 4%, an equity risk premium of 5% and additional risks of 1%. Since Meta has negative net debt the WACC will be equal to the cost of equity.

- The FCF from 2022 to 2026 represents TIKR Terminal analysts’ estimates; from 2026 to 2031 I applied a conservative growth rate of 5% instead. The perpetual growth rate will be 2.5%.

- The source of net debt and shares outstanding is TIKR Terminal.

According to these assumptions, Meta’s fair value is $264 per share, while it is currently trading at $136. Applying a 30% margin of safety, to achieve an annual return of 11.50% we would have to buy this company at $185 per share, which is well above the current price. From a fundamental point of view, Meta is significantly undervalued.

Intel

The market has also probably been too hard on Intel, down about 60%. Here, again, the potential upside is very high, but the risks may be greater. It has been about 5 years since the price per share fell below support at $42, and as of today, we can say that it has been largely pierced as we have reached $26.80 per share. The reasons that led to such a violent collapse were mainly two:

- The first related to the loss of market share against AMD.

- The second related to the tens of billions of dollars invested to expand Intel’s operations around the world.

Market Share

Intel continues to struggle against AMD, which is constantly increasing its market share. At this stage, investors have much more confidence in AMD than Intel as the latter has shown in recent years a difficulty in innovating and launching its new products. The emblem of this difficulty was the launch of Sapphire Rapids, a processor that is better in terms of performance than AMD’s alternatives but does not provide an overwhelming advantage, according to Patrick Gelsinger. Originally scheduled for 2021 after a series of delays the new launch date was moved between February 6 and March 3, 2023.

Beyond Sapphire Rapids’ continued delays, however, what I think really triggered the stock sell-off were Patrick Gelsinger’s words at the Evercore Technology Conference. The CEO admitted that the competition has done a great job and that Intel is still in a process-technology deficit. This implies that Intel still expects to lose substantial market share in favor of AMD and then only regain it from 2025-2026 onward. Objectively this is a serious problem, but I believe the market has already discounted in the current price the worst possible scenario after these statements, which is why I believe we are close to a bottom. I am confident in Patrick Gelsinger’s work, the large investments planned, and the rebirth of a company that has dominated its industry for decades. Intel still remains the giant to beat, and I believe that these years represent a temporary difficulty that inevitably affects every large company. In addition, an important aspect often overlooked is Intel’s realization that it has performed poorly in recent years, which has led it to chase the competition. The sense of revenge under the leadership of the new CEO is tangible, and the financial resources available to Intel are not comparable to its competitors, which is why more than $100 billion will be invested over the next 10 years. AMD is certainly doing a great job, but if we compare the figures of the two companies there is still a huge gap. Suffice it to say that Intel’s LTM revenues were $73 billion while AMD’s were $21.57 billion.

Capex growing strongly

The second reason investors preferred to sell their Intel shares was due to Patrick Gelsinger’s policy of investing hundreds of billions of dollars over the next 10 years. This is a choice aimed at consolidating Intel’s leadership in both America and Europe, as well as making the entire supply chain more stable. Moreover, in recent years the East has played too important a role in semiconductors for the West, and Intel through its new factories represents the hope of reducing this dependence. This plan includes the following investments:

- Up to €80 billion in the European Union over the next decade along the entire semiconductor value chain. The most ambitious plan currently is the construction of Intel’s two new processor factories in Magdeburg, Germany. The total cost is around €17 billion and work is expected to begin in the first half of 2023 and be completed by the end of 2027. In addition to Germany, however, Intel also plans large investments in other European nations. Investments of €12 billion are expected to expand manufacturing space in Leixlip, Ireland; €4.5 billion in Italy to build an operational factory between 2025-2027.

- $30 billion funding partnership agreement with Brookfield Asset Management to jointly invest in expansion of Ocotillo campus in Chandler, Arizona. In addition, an additional $20 billion has been allocated for the construction of 2 new factories in Ohio. CHIPS and Science Act funds are expected to be released in early 2023.

All these investments have worried investors as they will distort Intel financially and economically. If the new facilities perform as expected it would be the turning point for Intel as it would become the pivot of the entire West in semiconductors, but all this while incurring quite a few risks. The only certainty right now is that Intel’s capex over the next few years will be so high that it will have negative free cash flow, as well as likely increased debt. I personally agree with the choice to sacrifice Intel’s operations in the short term to possibly enjoy huge benefits in the future, but I do not blame those who disagree. When a company invests so much, it is inevitable that doubts will arise about its future.

How much is Intel worth?

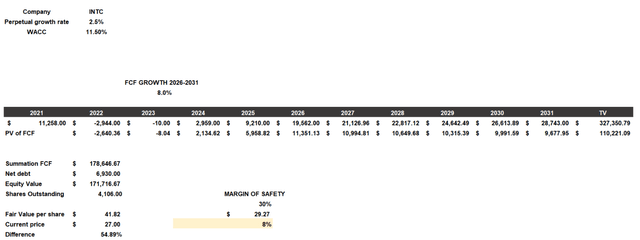

Intel’s free cash flow model will be constructed based on the following parameters.

- The cost of equity will be 12.25% and includes a beta of 0.65, a risk-free rate of 4%, an equity risk premium of 5%, and additional risks of 5% to discount any complications related to future investments. Intel remains a solid company, but the expected free cash flow for the next few years is negative due to the huge capex; therefore, shareholders need a high cost of equity to support this risk. The after-tax cost of debt will be 6.6%.

- The capital structure will be 90% equity and 10% debt, with a resulting WACC of 11.50%.

- The FCF entered from 2022 to 2026 represents TIKR Terminal analysts’ estimates; from 2026 to 2031 I considered a growth rate of 8%. I assumed that from 2026 some of the new factories may already be operational and result in steady and stable growth. The perpetual growth rate is 2.50%.

- The source of net debt and outstanding shares is TIKR Terminal.

According to these assumptions, Intel’s fair value is $41.82 per share, much more than the current $27. Moreover, even considering a 30% margin of safety, we can expect an annual return of 11.50% by buying Intel at a maximum of $29.27 per share. Just like Meta, it seems that the market has too much negative sentiment for this company. Moreover, I think the assumptions made may even be too conservative. In 2020, which is before the sharp increase in capex, Intel generated a free cash flow of $21.12 billion. In this model, I have considered a free cash flow of $28.74 billion in 2031, not that high considering that in the previous years the company spent over $100 billion to build new factories around the world.

Be the first to comment