Nikada/E+ via Getty Images

Summary

I recommend going long Instructure Holdings, Inc. (NYSE:INST) for a potential 62% upside over a three-year period. INST is a company that develops learning management systems to improve educational outcomes for students and increase instructors’ effectiveness. I expect the education industry to become increasingly digitized, and INST is well-positioned to capitalize on this trend.

Company overview

Learning management systems developed by Instructure Holdings aim to improve educational outcomes for students, increase instructors’ effectiveness, and motivate students and staff alike to study and grow in tandem.

Education will always be important

I believe that economic prosperity, quality of life, geopolitical competitiveness, and social progress are all directly tied to educational attainment. When asked about the best investment, Warren Buffett frequently says this.

Therefore, governments invest huge sums of money in the education market. Education is one of the highest government spending areas in the United States, costing over $1.6 trillion in total, according to CNBC. Traditional instruction, including personnel, facilities, and materials, accounts for the lion’s share of educational budgets. Even so, money allocated for technology in the classroom is a crucial element of school budgets. From now until 2028, the amount of money spent on educational technology around the world is expected to increase by 15.5% annually, reaching $283 billion. It’s a huge industry, and I think INST is just getting started with its explosive expansion.

I think it’s only natural for the education industry to become increasingly digital. Thanks to technological advancements, we are now able to democratize access to a high-quality education for all members of society. With the advent of new technologies, educators have access to innovative resources that can be used to enhance both the effectiveness and the individualization of their teaching methods, whether they prefer to remain in the classroom or transition to a fully online format. Furthermore, I believe that technology in the classroom allows for the expansion of educational opportunities to students in remote areas, the creation of supportive educational communities, and, most importantly, the dissemination of high-quality instruction to a larger number of students in a shorter amount of time.

Blended learning environments, which are made possible by technological advances, combine the best parts of traditional classroom study with the flexibility and convenience of online resources to make an ideal setting for students of all learning styles and abilities.

The Learning Management System [LMS] is the single most crucial piece of software in the realm of educational technology. It enables educators to design, implement, and assess their students’ progress through customized learning programs, while also helping students better manage their own learning resources, consolidate their access to course materials, and work together on projects. A number of ancillary technological tools, such as student evaluations, analytics, and multimedia tools, have emerged to supplement and enhance the LMS in order to better serve the needs of both educators and learners. In my opinion, these measures are essential for making significant advances in the areas of education’s availability, bandwidth, efficiency, and interaction.

Product optimized for scalability across the nation

Since INST was created from the ground up to operate in a cloud environment, I believe they have a distinct advantage over competing point solutions, whether they are being used in a single classroom or across a wide region. This gives INST a big advantage over its competitors because it suggests that the company’s unit economics will be better than those of point solutions that can’t spread the cost of R&D and S&M over a large customer base.

Technically speaking, INST offers solutions that can be implemented to manage comprehensive educational environments of any scale. With the help of INST’s solutions, educators can reach out to students in underserved communities around the world. I think that INST’s go-to-market engine can grow with this model of wide deployment, since they can make a single sale and then implement their solution on multiple systems.

In the arena of higher education, INST’s scalability is a shining star. The breadth and proven scalability of the INST solution allow them to sell to a single college or university and then deploy across many academic departments or even across multiple state systems. To give you an idea of scale, the Clark County K-12 district, which uses INST, has over 315,646 students enrolled at present.

INST has leading market position

The proof is in the pudding. In my opinion, INST’s dominant position as the leading paid LMS in North American Higher Education and K-12 reflects the platform’s unique value proposition, strong execution, and all-encompassing support for the learning lifecycle. What’s more, I think INST’s prominence in the industry creates a network effect, making standardization on its platform more alluring to ecosystem partners and setting them up to rapidly grow their customer base. In addition, I believe INST is in a prime position to win business from clients who want to implement a cutting-edge learning platform across K-20 systems because of their prominence in both the Higher Education and K-12 markets.

Efficient growth model

I think it’s smart that INST is reinvesting in the company for expansion purposes; they have a lot of potential gains to make. INST uses a single outbound sales motion, which is a smart move because it simplifies the sales process and frees up reps to concentrate on new business opportunities across all grade levels. To put it simply, the growth model is tailored to maximize growth, specifically rapid growth with minimal setbacks.

In my opinion, INST should rapidly scale up to further extend its market lead, as doing so will allow the company to reinvest a greater portion of its growing cash flow. I think Netflix, Inc. (NFLX), which has the most paid subscribers and can afford to reinvest massive sums of money in content creation, is a good company to use as a comparison for this type of expansion. Additionally, when comparing efficiency per subscriber, NFLX is superior to smaller competitors.

In any case, I concur that the current mood on the capital markets is unfavorable, and it would appear that INST is putting a premium on profits in order to maintain its viability and appease the market. Nonetheless, I think INST can restart its growth engine to boost growth once the market improves.

In countries where paid LMS and adjacent system penetration is still low, for instance, my findings suggest INST could continue investing to expand its customer base. The way I see it working out is that INST will do this through channel partners who have extensive experience with the local market and distribution infrastructure.

Valuation

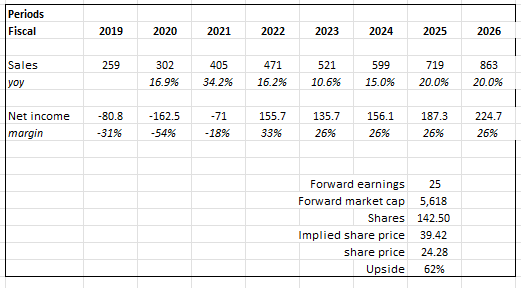

INST is undervalued, according to my model. Over a three-year period, investors can expect a 62% return at this price.

My model assumption is based on management’s FY22 revenue guidance and my belief that the company will restart its growth engine in the future to grow at a rapid pace. Given the weak macroeconomic environment, I predicted that FY23 would be a year of slower growth, which is what the consensus predicts. Beyond that, I expect INST to extend its growth runway by reinvesting in the business, so margins will begin flat.

INST is currently trading at 25 times expected earnings. If INST trades at 25 times forward earnings in FY25, it is worth $39.42 in that year.

Own calculations

Risk

Future growth opportunities internationally may not be successful

Even though I believe INST can successfully implement its business model in other markets, I recognize that this may be unrealistic due to INST’s lower brand recognition outside of its home market. Worst case, INST pours a lot of money into these projects but sees a low return on investment. This may cause cash flow to be low for a time, which may scare off potential investors.

Digitalization is not a priority for the education sector stakeholders

Adopting digital tools does not appear to be a top priority in the education sector, similar to the legal industry (about which I wrote here), which makes sense given that educators should be teaching. As a result, the adoption of LMS may be much slower than expected in schools that have not adopted or are still using legacy point solutions.

Conclusion

Instructure Holdings, Inc. has a three-year potential upside of 62%. The mission of INST, a company that specializes in creating learning management systems, is to boost both student learning outcomes and teacher efficiency. It is my belief that the education sector will become increasingly digitized, and that Instructure Holdings, Inc. will be in a prime position to profit from this shift.

Be the first to comment