gorodenkoff/iStock via Getty Images

Institutional Ownership and Market Sentiment

Investor sentiment-the propensity of individuals to trade on noise and emotions rather than facts-represents investors’ beliefs about future cash flows that the prevailing fundamentals cannot explain. Research, including the 2006 study ” Investor Sentiment and the Cross-Section of Stock Returns,” the 2012 studies ” Global, Local, and Contagious Investor Sentiment” and ” The Short of It: Investor Sentiment and Anomalies,” and the 2018 study ” Investor Sentiment: Predicting the Overvalued Stock Market,” has found that such activity can lead to mispricing, especially for hard-to-arbitrage stocks and during periods of high investor sentiment. Eventually, any mispricing would be expected to be corrected when the fundamentals are revealed, making investor sentiment a contrarian predictor of stock market returns. The research has also found that overpricing is more prevalent than underpricing because investors with the most optimistic views about a stock exert the greatest effect on the stock’s price; their views are not counterbalanced by the valuations of the relatively less optimistic investors who are inclined to take no position if they view the stock as undervalued, rather than take a short position. Thus, when the most optimistic investors are too optimistic and overvalue the stock, overpricing results. In contrast, underpricing is less likely.

Research, including the 2008 study ” Do Retail Trades Move Markets,” the 2014 study ” Industry-Based Style Investing” and the 2018 study ” Behavioral Biases in the Corporate Bond Market,” has found that retail investors tend to be the “noise traders” or “dumb money” that trade on sentiment. Examples of times when investor sentiment ran high are the 1968-69 electronics bubble, the biotech bubble of the early 1980s, and the dot-com bubble of the late 1990s. Sentiment fell sharply, however, after the 1961 crash of growth stocks, in the mid-1970s with the oil embargo, and in the crash of 2008.

Institutional Ownership

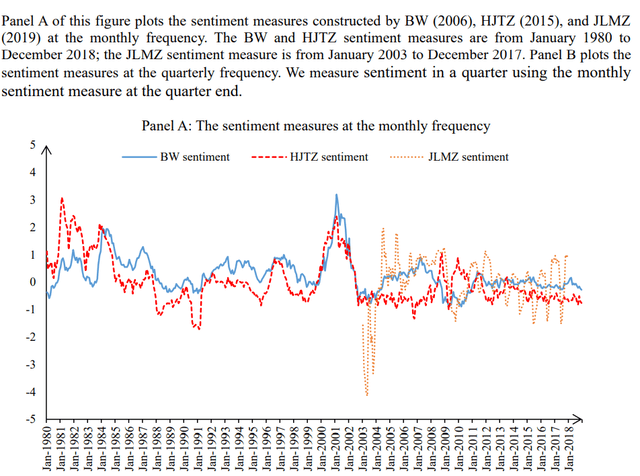

Zhenyu Gao, Jiang Luo, Haohan Ren and Bohui Zhang contribute to the literature on investor sentiment with their September 2022 paper ” Institutional Investors and Market Sentiment: A Revisit” in which they used a comprehensive data set of institutions’ long and short positions to examine their trading patterns during periods of high investor sentiment (using the Baker and Wurgler measure of investor sentiment). They constructed a sample of U.S. institutional investors’ quarterly 13-F filings and the Baker-Wurgler (BW) sentiment measure over the period from the second quarter of 1980 to the fourth quarter of 2018. The BW sentiment measure contains five metrics: the dividend premium (the difference between the average market-to-book ratio of dividend payers and nonpayers), the closed-end fund discount, number of IPOs, first-day returns on IPOs, and the equity share in new issues. (Data is available at Wurgler’s New York University webpage.) They also used two other measures of sentiment from the literature, HJTZ and JLMZ, both of which tended to move together with the BW measure.

Sentiment Measures (September 2022 study Institutional Investors and Market Sentiment: A Revisit )

Following is a summary of their findings:

- Aggregate institutional trading was significantly and negatively related to the lagged BW sentiment measure-a one-standard-deviation increase in the BW sentiment measure was associated with a 43.8 percent decrease in aggregate institutional trading.

- The average institutional demand in a quarter was negatively and significantly related to the lagged BW sentiment measure for high-volatility stocks-when market sentiment was high, institutional investors tended to sell (or buy less), especially for risky stocks (high-volatility stocks, which are more subject to limits to arbitrage and thus overvaluation), and their trading affects correcting sentiment-related mispricing.

- Short sellers, whom the research (including the 2016 study ” The Shorting Premium and Asset Pricing Anomalies,” the 2017 study ” Smart Equity Lending, Stock Loan Fees, and Private Information,” the 2020 studies ” Securities Lending and Trading by Active and Passive Funds” and ” The Loan Fee Anomaly: A Short Seller’s Best Ideas,” and the 2021 study ” Pessimistic Target Prices by Short Sellers“) has consistently found to be informed investors who are skilled at processing information, are primarily institutions, especially hedge funds.

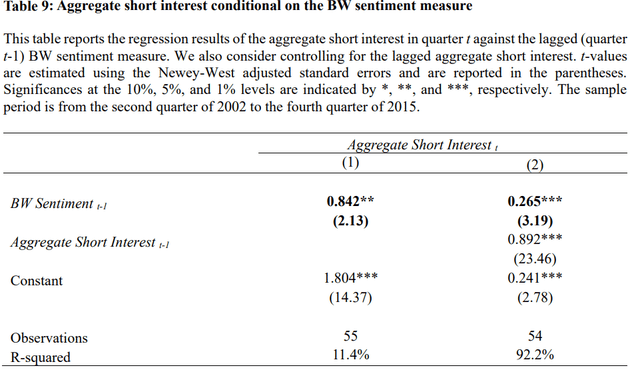

- The short sales of high-volatility stocks were positively and significantly related to the lagged BW sentiment measure-when market sentiment was high, institutional investors shorted stocks, especially high-volatility stocks, reacting to market sentiment rationally.

Aggregate Short Interest Conditional On the Baker Wurgler Sentiment Measure (Sept 2022 study Institutional Investors and Market Sentiment: A Revisit)

- When market sentiment in the previous quarter was high, institutional investors tended to sell high-volatility stocks, which caused a lower level of sentiment in the current quarter, reflecting the correcting force exerted on mispriced stocks when institutional investors bet against sentiment.

Their findings led Gao, Luo, Ren and Zhang to conclude that, on average, institutional investors bet against sentiment traders and correct mispricings (overvaluations), making the market more efficient. They added: “The evidence is consistent with the notion that institutional investors cope with market sentiment rationally; when market sentiment is at a high level, they, on average, sell (or buy less), especially for high-volatility stocks.”

Investor Takeaways

The evidence makes clear that due to limits to arbitrage, investors with the most optimistic views about a stock exert the greatest effect on the stock’s price. That is because their views are not counterbalanced by the valuations of the relatively less optimistic investors who are inclined to take no position if they view the stock as undervalued, rather than take a short position. When the most optimistic investors are too optimistic and overvalue the stock, overpricing results. In contrast, underpricing is less likely. Thus, the takeaway for investors is to avoid being a noise trader. Don’t get caught up in following the herd over the investment cliff. Stop paying attention to prognostications in the financial and social media. Most of all, have a well-developed, written investment plan. Develop the discipline to stick to it, rebalancing when needed and harvesting losses as opportunities present themselves. In other words, act more like institutional ownership.

Larry Swedroe is chief research officer for Buckingham Wealth Partners and Buckingham Strategic Wealth

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based upon third party data which may become outdated or otherwise superseded at any time without notice. Third party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. By clicking on any of the links above, you acknowledge that they are solely for your convenience, and do not necessarily imply any affiliations, sponsorships, endorsements or representations whatsoever by us regarding third-party websites. We are not responsible for the content, availability or privacy policies of these sites, and shall not be responsible or liable for any information, opinions, advice, products or services available on or through them. The opinions expressed by featured authors are their own and may not accurately reflect those of Buckingham Strategic Wealth® or Buckingham Strategic Partners®, collectively Buckingham Wealth Partners. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency have approved, determined the accuracy, confirmed the adequacy of this article. LSR-22-394

Be the first to comment