Alexey Kartsev/iStock via Getty Images

To be a successful investor, you often have to be patient with your investments. This includes being ‘wrong’ for a while before you turn out to be ‘right’. This is because, after all, Mr. Market can be rather mercurial, sending shares up and down at random while trying to recognize what their true value is. While this can be stressful for investors who are on the wrong side of a trade, it can also prove beneficial by giving them the opportunity to buy the stock at an even greater discount if they truly believe the fundamental picture has not changed. One great example of this can be seen by looking at Insteel Industries (NYSE:IIIN), an enterprise that focuses on the production of steel wire reinforcing products that are used for concrete construction applications. Recently, shares of the business have taken a beating compared to the broader market. In addition to concerns over the economy more broadly, this response seems to have been driven by a slight weakening and bottom line results year over year. But given how cheap shares are, I see very limited downside for investors, even if the financial condition of the company worsens materially moving forward. Because of this favorable risk-to-reward scenario, I do think that the company is still worthy of the ‘buy’ rating I gave it previously.

Tough times

Back in early August of this year, I wrote an article that took a bullish stance on Insteel Industries. In that article, I talked about how shares of the company had taken a beating over the prior few months, driven lower by concerns over market conditions. This came even at a time when the fundamental condition of the company remained strong and the cash flow that the firm generated could be considered significant. I did believe at that time that some return to normalcy was probable. But given how cheap shares were, I felt as though even such a reversion would leave some upside for investors moving forward. This led me to upgrade the company from a ‘hold’ to a ‘buy’, reflecting my belief that it should outperform the broader market for the foreseeable future. Unfortunately, things have not gone exactly as planned. While the S&P 500 has dropped by 8.1%, shares have fallen a further 16.5%.

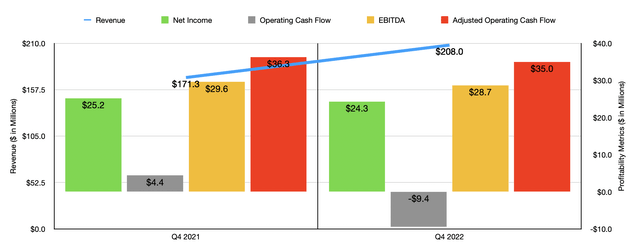

To really understand why this decline in share price developed, we should touch on how the company ended the final quarter of its 2022 fiscal year. This is the only quarter for which data was not available when I last wrote about the company, but for which is available today. During that quarter, revenue came in strong, hitting $208 million. That’s 21.4% higher than the $171.3 million the business generated in the same quarter only one year earlier. Interestingly, management did not really provide that much of a discussion on why sales rose, except to say that they benefited from higher average selling prices on their products. They did say that while the residential construction market is likely to be problematic, that represents only 15% of their sales exposure. Non-residential construction, including government projects, has been rather strong for the enterprise and management even said that they expect strength to continue into the 2023 fiscal year.

When it comes to profitability, the picture was somewhat worse year over year. Net income fell from $25.2 million in the final quarter of 2021 to $24.3 million at the same time this year. This was driven largely by a decrease in the gross margin of the company, which fell from 23.3% to 19.1%. Management attributed this to lower shipment volumes and higher plant operating costs. This makes sense when you consider that the 26.1% increase in average selling prices would have deterred spending by the company’s customers. Other profitability metrics followed suit. Operating cash flow went from $4.4 million to negative $9.4 million. If we adjust for changes in working capital, it would have fallen from $29.6 million to $28.7 million. Meanwhile, EBITDA for the company also suffered, inching down from $36.3 million to $35 million. Although it’s horrible to see bottom line results worsen, it is also impressive how sturdy they ended up being considering current market conditions. In many cases, you would expect profits and cash flows to plummet. But with most of these metrics, we saw only a modest decrease year over year.

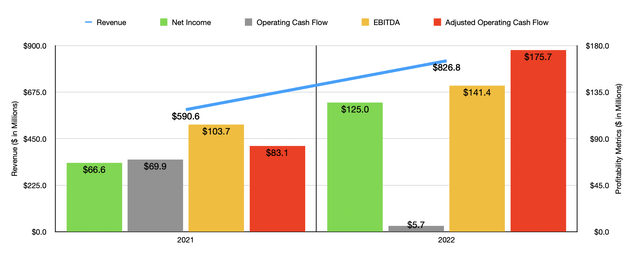

The fourth quarter performance for the company was helpful in establishing the 2022 fiscal year as a robust one from a sales perspective. Revenue of $826.8 million dwarfed the $590.6 million generated in 2021. Even though the company faced margin pressure, net income rose nicely, climbing from $66.6 million to $125 million. Operating cash flow, meanwhile, dropped from $69.9 million to $5.7 million. But on an adjusted basis, it rose from $83.1 million to $141.5 million. A similar trajectory can be seen when looking at EBITDA, with the metric increasing from $103.7 million to $175.7 million.

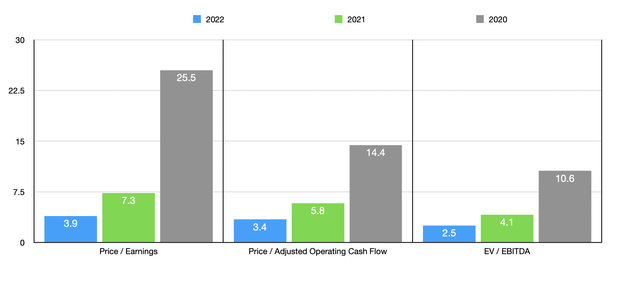

As I mentioned already, management believes that the outlook for the company is favorable when it comes to the non-residential exposure the business has. They said that backlog remains solid and third-party nonresidential construction indices point to continued expansion. Government projects should also prove helpful for the company at the end of the day. Unfortunately, though, we do not have concrete estimates from the company as to what the 2023 fiscal year might look like. Because of this, it would be best to value the firm based on 2022 fiscal year results. Using data from that year, the business should be trading at a price-to-earnings multiple of 3.9. The price to adjusted operating cash flow multiple should be 3.4, while the EV to EBITDA multiple should be 2.5. These numbers stack up favorably against the data from the 2021 fiscal year and the data from 2020. But as you can see in the chart above, even a return to 2020 levels would not necessarily indicate that shares are overpriced. If anything, the company would look more or less fairly valued.

| Company | Price/Earnings | Price/Operating Cash Flow | EV/EBITDA |

| Insteel Industries | 3.9 | 3.4 | 2.5 |

| Builders FirstSource (BLDR) | 3.9 | 3.4 | 2.9 |

| A. O. Smith (AOS) | 17.8 | 18.4 | 11.5 |

| Tecnoglass (TGLS) | 12.0 | 9.5 | 7.4 |

| Apogee Enterprises (APOG) | 18.5 | 25.0 | 10.8 |

| Owens Corning (OC) | 6.2 | 5.9 | 4.2 |

As part of my analysis, I also compared Insteel Industries to five similar businesses. On a price-to-earnings basis, these companies ranged from a low of 3.9 to a high of 18.5. And when it comes to the price to operating cash flow approach, the range was between 3.4 and 25. In both cases, our prospect was tied as the cheapest of the group. Meanwhile, using the EV to EBITDA approach, the range was between 2.9 and 11.5, with our target being the cheapest.

Takeaway

All the data we have in front of us today is, to me, pretty bullish. Yes, margins contracted in the final quarter of the year and there is some uncertainty for the enterprise. But management remains optimistic and shares are trading at incredibly cheap levels. My attitude might be different if this were a highly leveraged company. But based on the most recent data available, the firm has no debt and has cash and cash equivalents on hand of $48.3 million. That significantly reduces the risk for shareholders. Factoring all of these in, I do believe that a ‘buy’ rating for the company is appropriate at this time.

Be the first to comment