Galeanu Mihai

While there was a slowdown in client hiring in the third quarter of 2022, Insperity, Inc. (NYSE:NSP) still performed very well in the quarter and is expected to have the momentum continue into the fourth quarter of 2022.

It produced solid results in most metrics and should finish the year strong.

In 2022 the company has had a nice run starting on March 8, 2022, when it was trading at a little over $84.00 per share, and eventually reaching its 52-week high of $121.75 per share on November 1, 2022, before slightly pulling back. Since that time, it has traded somewhat flat, probably because of uncertainty over the coming year and the possibility investors may think much of its performance is already priced in and maybe looking to take some profits off the table.

TradingView

With the company increasing internal hiring by approximately 7 percent and about 56 percent of its clients not considering increasing staff over the balance of the year, it appears the small and medium business (SMB) market is wary about taking on too many hires in light of the recession worsening as we head toward 2023.

Even though I like management’s confidence in hiring in order to meet its growth goals of 2023, it’s quite possible they’ll meet some strong headwinds that’ll put some downward pressure on its performance and share price.

In this article we’ll look at some of its recent numbers and the risk it faces if the economy gets worse as it operating expenses increase.

Some of the numbers

Revenue in the third quarter was $1.44 billion, up 18.98 percent year-over-year, but missing by $15.76 million.

Company Presentation

Earnings per share in the reporting period was $1.23, beating by $0.27, and up 38.2 percent from $0.89 in earnings per share in the third quarter of 2021. Net income for the first nine months of 2022 was $141.2 million, or $3.66 per share.

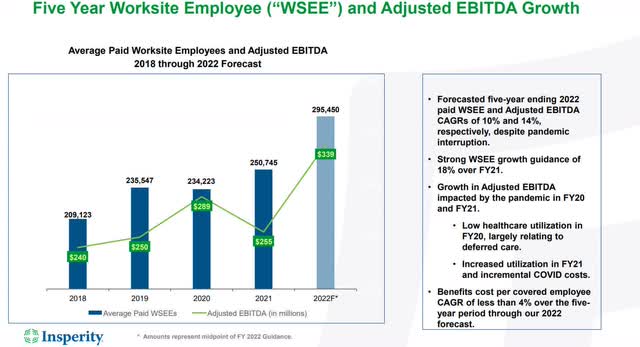

Adjusted EBITDA in the third quarter was $79.8 million, up 32.7 percent from the $60.1 million in EBITDA in the third quarter of 2021. Adjusted EBITDA in the first nine months was $273.4 million, up 22 percent year-over-year.

Gross profit in the quarter was $244.6 million, up 23.2 percent from the same reporting period last year.

Average number of paid Worksite employees (WSEE) was 303,347, up 17.8 percent from WSEEs of 257,560 in the third quarter of 2021.

Operating expenses in the quarter jumped 20.8 percent year-over-year, with a chunk of that on internal hiring and retention efforts in light of the tight labor market. This could be a headwind for the company in 2023 if the recession gets worse than expected for longer than expected.

Even so, the company probably had to hire and increase compensation for existing employees because it would be extremely difficult to hire and retain employees in a softer economy if that’s how it plays out, without pre-emptively mitigating the issue.

That suggests if the economy goes south NSP will have weaker numbers with higher costs. On the other hand, once the economy strengthens the company will be positioned to accelerate growth without scrambling to find workers to produce the desired results.

The overall numbers were solid for the company in the reporting period, but with the potential economic headwinds we’re facing in 2023, this could rapidly change. I don’t expect it to happen in the fourth quarter, but further out there simply isn’t anyway of accurately knowing what’s going to happen.

The economy and NSP

A major reason I’ve been focusing on the economy so much in this article, beyond the obvious impact a recession would have on most sectors, is that the small and medium business client base of NSP usually is the first to shed employees during a deep recession; they can’t afford to keep them on for an unknown duration.

This appears to be already showing in the decline in hiring its clients projected for the remainder of 2022, with only 44 percent saying they planned on increasing staff for the remainder of 2022, down from the 53 percent that said they planned on increasing staff in mid-2022.

In a survey of its clients, about 75 percent said they expect 2023 to be better than 2022, although 48 percent said they believe there is going to be a negative impact on their businesses in the first two quarters of 2023. Either they expect the second half to be very strong or didn’t see the disparity in their responses. Management used the survey responses to point to the “resiliency” of its client base, but I don’t share that level of optimism.

As the company mentioned in its earnings report, tough economic times will have more of a negative impact on its client base than it will are larger companies. So, while its client base asserted, they expected a stronger 2023 than 2022, I don’t think they understood the implications of their conclusions that a weaker economy would have a negative impact on their businesses.

I bring this up because I think this is how investors should look at 2023. In other words, there is a lack of clarity in how the economy is going to do in the months ahead, and even though there have been some good results in 2022, I don’t think the underlying fundamentals of the economy are as strong as many suggest, and there is a very significant chance things are going to get worse before they get better.

The point is, as far as the ability of companies to project out future performance under the current economic conditions is impossible. There are too many variables involved that could push things either way, with most of the potential negative catalysts on the downside of the economic ledger.

If that’s how it plays out, as mentioned earlier, NSP will be disproportionately affected because of the small and medium size business clientele it serves.

Conclusion

NSP has been doing well through most of 2022, outperforming in most metrics, but the majority of small and medium size businesses are already starting to think in terms of slowing down hiring, which doesn’t bode well for NSP in the quarters ahead, especially if the first half of 2023 is economically weak.

Nonetheless, if the economy does start to crack, it doesn’t matter if it’s in the first or second half, either way NSP will underperform in contrast to how it has been doing over the last year or so.

Much of this is still in the hands of the Federal Reserve and how it continues to respond to inflation by raising interest rates. It has signaled a possible slowdown in the pace of raising rates, and that has resulted in more optimism in the market, but if that’s how it plays out, interest rates in the market are still going to continue climbing even if it’s at a reduced pace.

And while inflation has shown signs of shrinking, there’s a long way to go before that will have a positive impact on the economy, in my opinion.

With the visibility we have now, it appears momentum in the market should continue, but this is prone to quickly changing, which is why it’s extremely difficult if not impossible to know which way things will go over the next twelve months.

Since NSP is exposed to the quick response of small and medium size business owners to quickly cut the size of their workforce in response to a weakening economy, it’s at more risk than some of its peers that compete for the hiring business of larger corporations – at least when looking at it from a short-term perspective.

But with the company having a strong surge in its share price from mid-June 2022, it’s getting riskier for investors thinking of taking a position in the company at this price level.

Even in the best-case scenario of the economy not falling off the cliff in 2023, the pace of growth going forward appears to be more incremental than in the recent past, and at best, I think the company doesn’t have a lot more upside left in it, even if the economy grows at a very modest pace.

Be the first to comment