bjdlzx

(Note: This article appeared in the newsletter on June 17, 2022 and has been updated as needed.)

Note: This is a company that reports in Canadian dollars unless otherwise noted.

InPlay Oil (OTCQX:IPOOF) (TSX:IPO:CA) is yet another oil play that originally went public through a reverse merger with the old Anderson Energy (AXLFF). Despite the relatively small company size, I thought the backing of the entity doing the reverse merger was impressive enough to cover the stock. This company had quite a scare during fiscal year 2020 when cash flow sunk to previously unimaginable levels. But quick-thinking management embarked upon enough accretive mergers to be able to repay the debt this fiscal year. After that, the company will be growing and, at some point, selling for the right price.

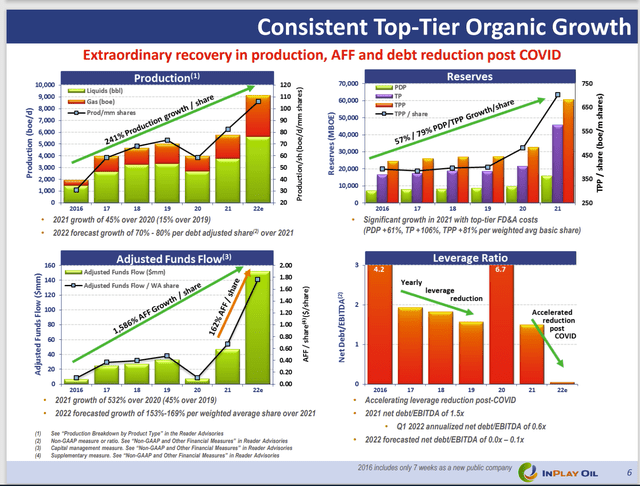

InPlay Oil Growth History and Profitability History (InPlay Oil May 2022, Corporate Presentation)

Management impressively grew funds flow through a combination of skillful acquisitions aided by stronger commodity prices. That sent the worrisome leverage ratio way down fast. Management intends to repay almost all of the debt this fiscal year to permanently “put to bed” any market worries about leverage.

The latest second quarter report demonstrated management focus on the debt repayment by showing about C $25 million repaid compared to the year before. The current environment has significantly decreased debt issues through some rather generous cash flow amounts.

The combination of organic growth and acquisitions has led to impressive growth per share from a very small initial production base. This company, like many, went public with high hopes of profitable growth only to run into the challenges of fiscal year 2020. Management has been agile enough to meet the demands of Mr. Market quickly.

This company is not likely to be an income vehicle due to the very small size of the company. Instead, the first priority will be to grow production to an appropriate level so that the company gets through the next downturn with far better leverage and cash flow ratios than was the case in fiscal year 2020.

Most know that 2020 is unlikely to repeat in the near future. But there has now been an industry downturn in 2015, 2008, and of course the one in 2019 that rapidly worsened beyond anything anyone could have predicted. This has caused many to operate far more conservatively than has been the case in the past.

Many companies that acquire either do so using stock or sell stock as part of the process to keep debt levels low. The market no longer accepts a “leverage up” acquisition followed by asset sales due to the scare that accompanied the challenges of fiscal year 2020. As a result, the industry will be sporting a fair number of very strong balance sheets for the foreseeable future. The money that allowed a lot of unsound production and leverage is now gone. The money that knows this industry is not going to all of a sudden “go wild” and do things that lenders know will not be profitable.

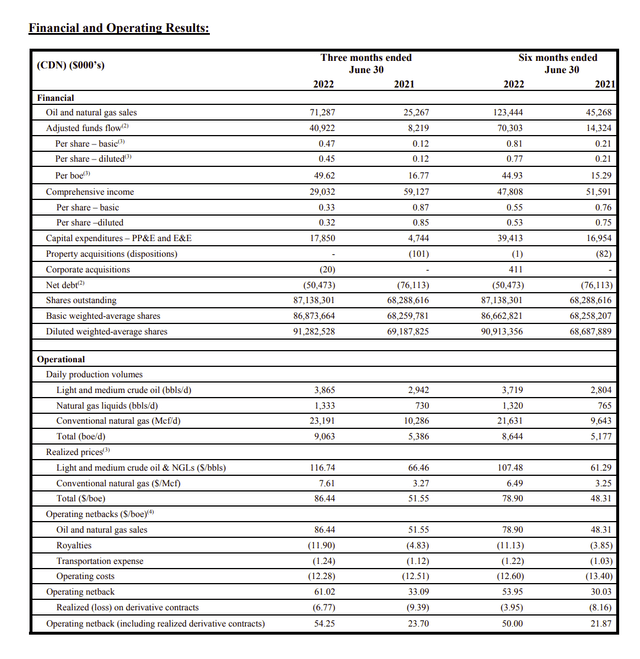

InPlay Oil Second Quarter 2022, Operating And Financial Results (InPlay Oil Earnings Press Release Second Quarter 2022.)

InPlay Oil has long had some of the more impressive netbacks in the industry. The production amounts combine with that netback to produce one of the more profitable small companies in the industry.

It should be noted that the previous years’ earnings include the reversal of impairment charges that are allowed under Canadian accounting rules but now allowed in the United States GAAP accounting.

Fast growth can be a risk all by itself in that the logistical challenges can lead to quality and production issues. That has not happened here so far. Some of that can be attributed to the experience of management and the backers of building and selling companies in the past. The saying “practice makes perfect” is particularly applicable to this company.

There is every chance that the company can grow fast in the future without running into a lot of growth “hang-ups” that hamstring other managements.

The allure of small companies is often that per share growth rate. Here, projected cash flow is around one-third of the stock price. Given the probability of more deals in the future and decent organic growth in the current environment, that price is on the cheap side.

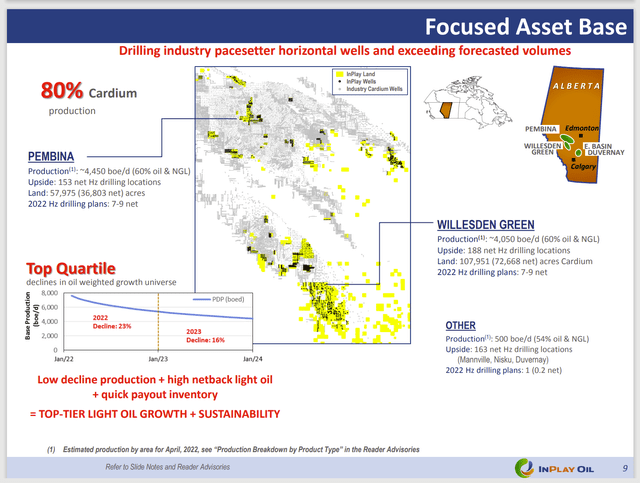

InPlay Oil Alberta Operating Results (InPlay Oil May 2022, Corporate Presentation)

InPlay Oil is able to take advantage of smaller holdings than is many of its larger peers. The company grows oftentimes by acquiring “bolt-on” acquisitions of those smaller holdings. This type of acquisition is lower risk because management is familiar with neighboring acreage.

The Alberta province is very supportive of the oil and gas industry. So, the Cardium is a good area to conduct operations.

The wells are relatively cheap wells with lower reserves per well. But that characteristic makes it far easier for the company to adjust production to industry conditions. The payback of these wells is very short under current industry conditions.

The Cardium itself has long been a productive area like the Austin Chalk is in Texas. The play, like the Austin Chalk, has been revolutionized by the advancement of technology. This has allowed both plays to make a comeback that was unanticipated several years back.

The Cardium is a stacked play. So, there are several intervals that contain potentially commercial reserves that have not yet been explored. The result of continually improving technology likely means that the Cardium and the associated intervals will be a major producing basin for years to come.

The Future

Management is going to be focusing on the Cardium and Alberta for the next few years as the company increases in size.

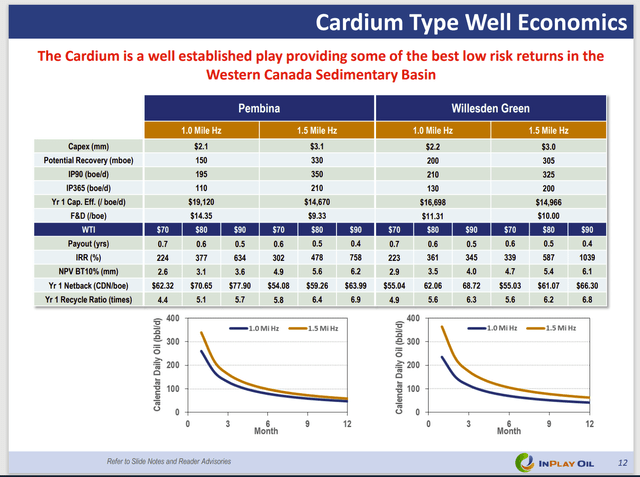

InPlay Oil Cardium Profitability Characteristics (InPlay Oil May 2022, Corporate Presentation.)

Clearly, the wells are very profitable in the current industry pricing atmosphere. The only real objective is to maximize cost efficiency by obtaining a desirable amount of production. This objective is aided by operating in a basin with a lot of supporting infrastructure and takeaway capacity.

There is currently some cost inflation that the industry must contend with. Whether management can offset that inflation through technology advances, or some management actions is currently unknown probably until the next presentation is posted.

This small company is one of the few that can grow and reduce debt. Many in the industry are concentrating on balance sheet repair in the current fiscal year. The well decline rate aids cash flow growth because it is far lower than is the case for many unconventional wells. Therefore, payout happens at a considerably higher level of production than is the case for many companies operating in the United States.

Not only is payback happening at a relatively higher level of production (compared to initial rates), but it also happens fast enough to enable management to be able to drill a second well with the same capital in the same fiscal year. That hastens cash flow build so that the next downturn will happen with considerably more production that breakeven at lower levels.

Wells that have achieved payback will be producing during an industry downturn as long as the selling price provides an adequate cash flow in excess of production costs. The reporting can look far different as costs are allocated in quarterly reports over the estimated life of the well. However, an environment like the current one allows the company to repay debt while preparing for the next downturn with a lot of repaid well costs. There will not be a lot if any costs to recover during the downturn outside of current production costs. That would enable management to just cash checks for production sold while waiting for the next recovery.

This management will likely continue to build the company as long as the environment is favorable while looking to eventually sell the company at the right price. For long term shareholders, that may be a very enticing proposition.

Be the first to comment