Kimberly White/Getty Images Entertainment

The Lidar market has long felt the pressure of Tesla (TSLA) not using such devices for autonomous driving plans and an industry leader placed more pressure on the Lidar sector calling them zombie companies. Innoviz Technologies (NASDAQ:INVZ) makes the clear point the market wants and needs Lidars to accomplish ultimate safety and reliability goals for AVs. My investment thesis remains ultra Bullish on the stock and the sector due to the immense opportunity in the decade ahead and the corresponding low valuations.

Booming Backlog

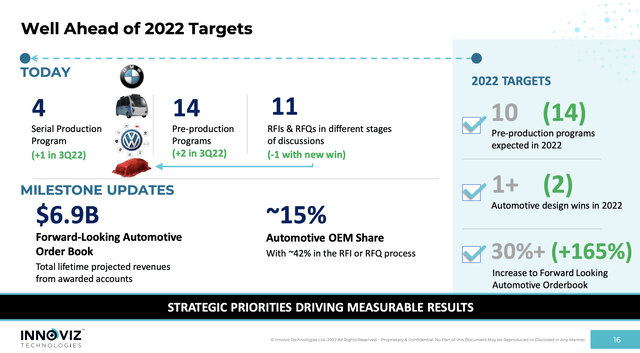

Innoviz reported Q3’22 revenues of only $0.9 million due to some corporate shifts delaying revenues. Most importantly, the Lidar sensor forward order book surged to $6.9 billion and is expected to surge further.

These Lidar stocks should generally trade more off the order book, or the increase to the order book each quarter more than current sales. For Q3, Innoviz boosted the order book to $6.9 billion, up from $6.6 billion in the prior quarter.

The company isn’t stopping with this massive backlog. The forecast is for the order book to grow by another 30% by the end of 2002 amounting to another $2.1 billion boost in orders leaving Innoviz with a potential order book of $9.0 billion ending the year.

Source: Innoviz Q3’22 presentation

Innoviz already has agreements for 3 auto OEMs with over 13.5 million units annually in the future. The company is working with another 11 OEMs on deals covering ~40 million units with expectations for up to 3 of these OEMs to decide on Lidar plans in the next 6 months.

In reality, Innoviz hardly needs another major OEM deal. The company primarily needs to deliver on Lidar series production via the deals with BMW (OTCPK:BMWYY), an L4 shuttle program followed by the major deal with Volkswagen (OTCPK:VWAGY). The stock market wants to see volume production deals, not quarterly revenues struggling to top $1 to $2 million.

Lidar Debate

The Lidar debate appeared to intensify last week. Until now, Elon Musk has generally been the only main force against Lidar.

David Hall, the founder of Velodyne Lidar (VLDR), made some bizarre comments last week to the Business Journal about Lidar that tripped up sector stocks.

The combination of cheap cameras and AI is a slam-dunk winner for the kinds of things that we bragged about using lidar to do…The merger of two “zombie” companies just yields another zombie.

Mr. Hall had sold his stake in Velodyne following a dispute with management, but his share sells were oddly at $2. The executive could’ve cashed out at much higher prices during the whole SPAC process where the company went public at $10.

The Innoviz CEO confirmed what Mr. Hall appears to not understand about the technology he developed.

When [Tesla] was a younger company, of course they needed to make ambitious statements and strong claims. Also there was no LiDAR available at the right price or from an industrialization point of view… Relying on an image sensor that could be blurred by a drop of water or affected by low-light conditions, these are non-rare conditions that could cause failure,” Keilaf concluded. “They will have to go to LiDAR eventually. It will be a difficult mistake for them to admit, but they will have to admit it eventually. They offer Level 2 today, which they call FSD, but in reality it is Level 2. It is in no way concerning to us because in reality there are so many automakers making the decision on LiDAR already, so [his statements] are just something that brings more attention to our technology, so that is nice.

All of the Lidar companies continue to sign new strategic agreements with the likes of Innoviz signing major deals with automotive companies. All of the industry players forecast Lidar getting down to $500 a sensor where the price point becomes more attractive for mass auto production compared to the safety issues with cheaper cameras utilized by Tesla for self driving technology.

These auto OEMS are making big decisions on incorporating Lidar into future auto safety features and autonomous driving plans. A shift to basic cameras would appear odd at this point when they are analyzing the best technology to achieve full autonomous goals based on the price points plunging in the future. Tesla was placing cameras in cars in the past when the option was the only practical way.

Innoviz is forecast to only generate $30 million in 2023 revenue with a big ramp to $138 million in 2024. The big question is when the stock valuation at $725 million ultimately catches up with the order backlog.

The ultimate risk is that Elon Musk and now the Velodyne founder end up being right and the auto OEMs back track on Lidar plans. Innoviz ended the quarter with a cash balance of $218 million and any delays in Lidar plans could pace the company in a tricky financial position.

Takeaway

The key investor takeaway is that Innoviz is far from a zombie company. The Lidar sensor company has an impressive backlog and investors should start valuing the stock based on the backlog, not revenues.

Investors should continue to use the weakness to load up on Innoviz.

Be the first to comment