kmatija/iStock via Getty Images

The short thesis

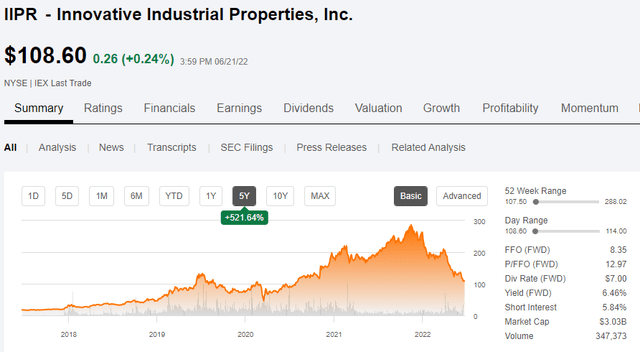

Innovative Industrial (NYSE:IIPR) has substantial tenant risk that I think will result in near-term interruptions of cashflow and impairment charges. With capital becoming less available due to rising interest rates, its tenants that are reliant on capital infusion are facing potential insolvency. IIPR would survive such a scenario, but earnings would drop considerably. I see fair value about 20-50% lower depending on severity of tenant bankruptcies.

History and business model

The original cannabis REIT is a company I have been following since its 2016 IPO. IIPR’s price dropped to $15.40 shortly after its $20 IPO and I saw this as a buying opportunity since even after factoring offering expenses the raw cash value of IIPR was $17.83.

The company also has a fantastic CEO in Alan Gold

IIPR

Gold cofounded Biomedical Realty (formerly BMR which was profitably sold) and also cofounded Alexandria (ARE). These were both stellar REITs and we liked his plan for IIPR as the funding constraints of the federally illegal marijuana business allowed IIPR to acquire properties from tenants at double digit cap rates while everything else real estate was at single digit cap rates.

Although profitable on our IIPR investment, we sold far too early, missing a large portion of the run-up to nearly $300 a share.

The reason we sold was a realization that IIPR’s property purchases were as much loans as they were acquisitions. They were buying industrial real estate for all-in costs that were in some cases over $300 per square foot while we were watching similar properties changing hands for $70 per foot.

The difference was massive amounts of tenant improvement capital in which IIPR provided capital to tenants such that they could build out the facilities for marijuana growing. The grow lights and other equipment may add some residual value to the property, but nowhere near the cost of the TI.

Thus, on each of these transactions IIPR is underwater in terms of their investment in the property being substantially larger than the residual value of the property.

Such transactions are reasonable and even potentially quite profitable because the tenant is scheduled to pay massive amounts of rent to IIPR over the roughly 20-year initial lease terms. So, while IIPR is losing money on the real estate, they are making so much on rent/loan amortization that the net profit is quite high.

It is this massive rental stream that has allowed IIPR to grow its FFO/share so rapidly

It was a good idea and IIPR hit the timing perfectly as the first mover which made them just about the only source of equity capital for MSOs and distribution facilities. Today, the opportunity is a bit diminished with other players entering the field such as fellow REIT NewLake Capital Partners (OTCQX:NLCP).

IIPR itself operates quite responsibly with a healthy balance sheet funded largely by equity raised while the company was trading at astronomical prices.

However, since its business model involves a large real estate capital loss that is to be refunded over time by high rental rates on 20-year contracts, it needs those contracts to be fulfilled. It is a great business when the tenants are strong but dubious when tenants are weak. Unfortunately, due to factors largely outside of IIPR’s control, the tenants are looking extremely weak.

If a significant portion of tenants go under, IIPR will lose the rental stream along with a large portion of the capital invested in the tenant improvement of the associated properties.

As is typical of a value focused analyst, I was too early in my call as I warned of this problem in May of 2020.

Quite simply, the gravy train was still flowing with the Fed Funds rate at essentially 0 and ample amounts of capital pouring into the venture capital space and other exciting startups such as the marijuana growers, distributors, and MSOs that make up IIPR’s tenant roster.

Today, however, easy money is gone. Inflation and the Fed have absolutely clobbered speculative investment and it will be significantly harder for these companies to continue to raise capital. Most of these are not cashflow positive and have been relying on continuous injections of fresh capital.

That capital is not flowing anymore so they will have to either find a way to very quickly become cashflow positive or somehow find a new source of funds.

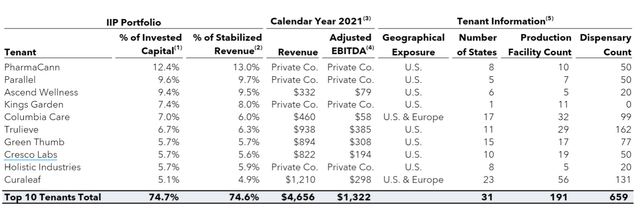

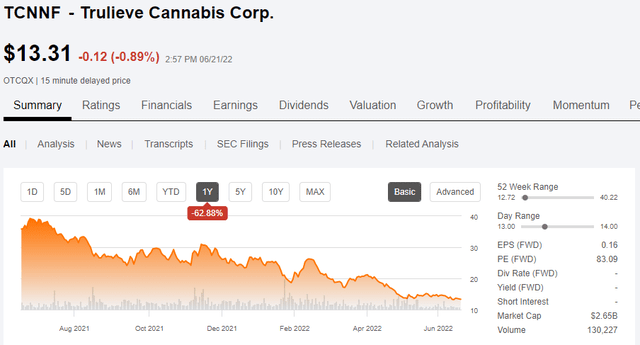

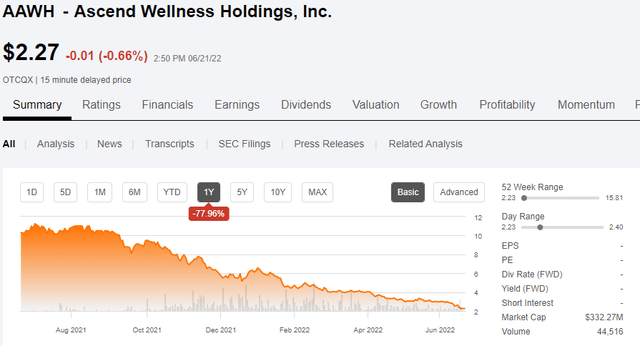

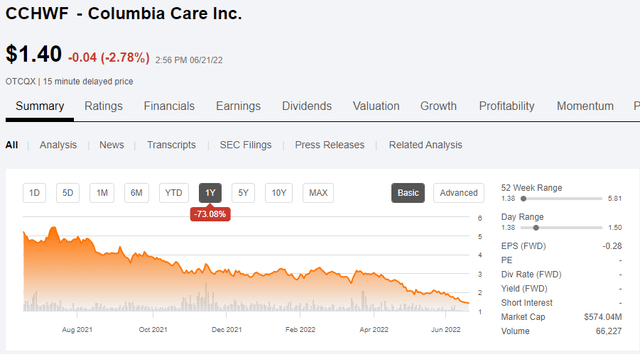

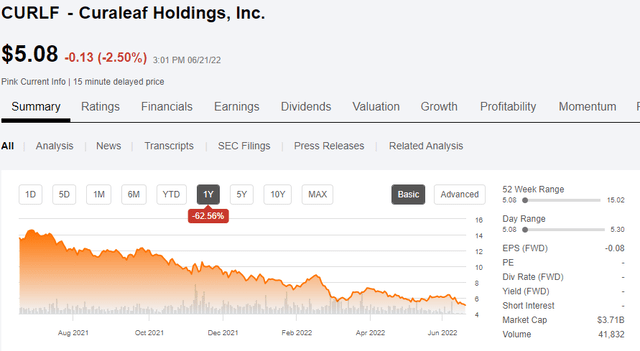

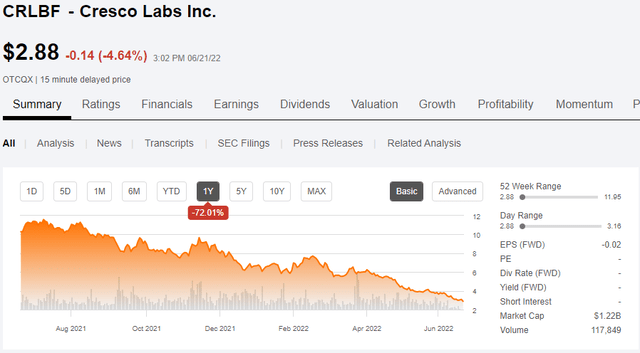

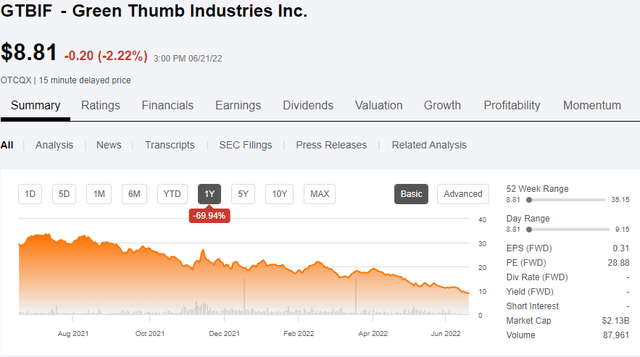

The market is starting to recognize the difficulty facing these small marijuana companies and the challenge is reflected in their stock prices. Each of the publicly traded tenants in IIPR’s tenant roster is down between 62% and 77% over the last 52 weeks.

Trulieve (OTCQX:TCNNF) is down 62% and has minimal earnings

Ascend Wellness (OTCQX:AAWH) is down 77% and has negative earnings

Columbia Care (OTCQX:CCHWF) is down 73% with negative earnings.

Curaleaf (OTCPK:CURLF) is down 62%, also with negative earnings.

Cresco Labs is down 72%, also with negative earnings.

Green Thumb (OTCQX:GTBIF) has legitimate earnings but even it is down 70%.

In addition to the publicly traded tenants, IIPR has major tenants that are private. Its largest tenant PharmaCann is a private company so the public does not have full access to PharmaCann’s financials, but its financial positioning was almost certainly shared with investors in the latest round of financing.

In January of 2022, PharmaCann’s 39.5 million debt issuance consisted of 12% senior secured notes. This speaks volumes as to their credit. Specifically, there are 3 aspects that worry us:

- January was well before interest rates spiked and credit worthy companies were able to get below 3% notes so that is a 9%+ risk premium over credit worthy companies.

- Secured is rough for a company that has so little in assets. It likely means they did not have the option to issue unsecured.

- Rent to IIPR comes above senior secured financing if and only if PharmaCann continues operating. If the company shuts down I don’t see much left in the waterfall for IIPR to claim toward their remaining rent owed.

How this affects IIPR

The majority of IIPR’s tenant roster consists of high-risk or very high-risk tenants. IIPR’s business model is banking on these tenants paying rent for the full term in order to get back their capital investment plus some profit.

The weighted average remaining lease term is 16.4 years. I don’t see these companies remaining solvent for 16.4 years. Some of them probably will, but for the less profitable or poorly capitalized I don’t know how they will get through this Fed inspired funding freeze.

I am not one to fear REIT tenant bankruptcies. REITs have shown time and time again that they can replace bad tenants with new tenants. The challenge here is that since these were as much loans as leases, the rent consists largely of amortization of the loan (in functional terms) and is therefore at a multiple of market rent.

If a company like Prologis (PLD) loses a tenant in their industrial space they can just find a new tenant who will pay the exact same rent. When IIPR loses a tenant paying about 3X market rate, they might be able to find a new tenant for their industrial space, but they lose 2/3 of the rental stream.

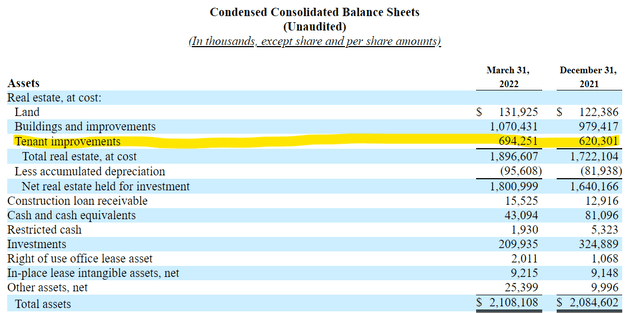

The potential damage is evident in IIPR’s balance sheet.

Tenant Improvements are sitting on the balance sheet at $694 million. This amount would normally amortize over the duration of the lease, but if a tenant defaults, the portion of TI associated with their lease would be written to zero.

If the tenants start defaulting, IIPR could be looking at impairment charges in the hundreds of millions.

Valuation

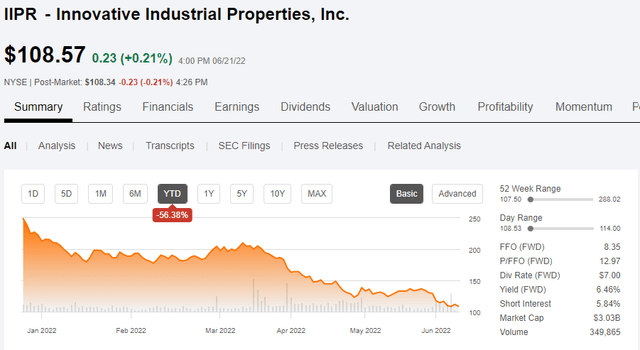

Given the 56% drop in IIPR’s market price year to date it is nominally in value territory. Its forward FFO multiple is just 13X which is highly attractive in most circumstances.

The analyst consensus estimates make it even juicier as IIPR is expected to grow FFO/share at a great pace for the next few years. 2025 FFO is estimated at $12.14 and 2025 AFFO at $12.76.

S&P Global Market Intelligence

This is what IIPR’s growth trajectory looks like if 100% of tenants pay rent reliably.

I just don’t see how that is going to happen regardless of what legalization/decriminalization happens between now and then.

Quite simply, the amount of investment dollars thrown at this space when marijuana was the hot sector of the market created far too much competition. A 2000 internet bubble style gravy train does not lead to fiscally responsible capital investment. The space got massively overcapitalized and the price is about to be paid. There are too many little players and this will end in some combination of bankruptcies and consolidation.

IIPR, despite being managed responsibly, will get hit with the backlash as their tenancy consists mostly of financially weak operators. Strong companies do not take out loans at a 12% cost like PharmaCann did in January because a strong company would have taken out a 3% loan.

Fair value

While I believe the wave of tenant defaults will drastically lower IIPR’s revenue and cause a multi hundred million dollar impairment, IIPR will survive. The company has minimal debt and just a small preferred (IIPR-A) that is about to be redeemed.

Its properties will retain value either as growing facilities for whatever entity takes over for failed tenants or simply as default industrial real estate. The property value will be positive, just lower.

Whoever the new tenant is will still pay rent, just significantly less rent than the current above market rates. If tenant defaults happen as significantly as I am anticipating, FFO/share will drop substantially but still be positive.

IIPR is not doomed, it is just trading at an aggressive valuation given the magnitude of risk present. I anticipate another 20%-50% downside to fair value depending on the severity of tenant defaults.

Be the first to comment