NoDerog/iStock Unreleased via Getty Images

A few months ago, I wrote a positive article on Ingredion Incorporated (NYSE:INGR). My bullish thesis was predicated on the specialty ingredients segment reigniting topline growth for the company.

The recent Q3/2022 earnings continues to demonstrate the resilience of INGR’s business. INGR was able to grow revenues by 15% YoY while expanding gross margins and modestly raising the full year guidance. Despite strong business fundamentals, INGR continues to trade at a substantial discount to peers. I continue to rate INGR a Buy.

Brief Company Overview

Ingredion Incorporated is a leading global producer of sweeteners, starches, and specialty ingredients. Starches make up 45% of INGR’s sales, while sweeteners such as high fructose corn syrup (“HFCS”) make up 33%. Co-products such as refined corn oil and corn meal make up the rest.

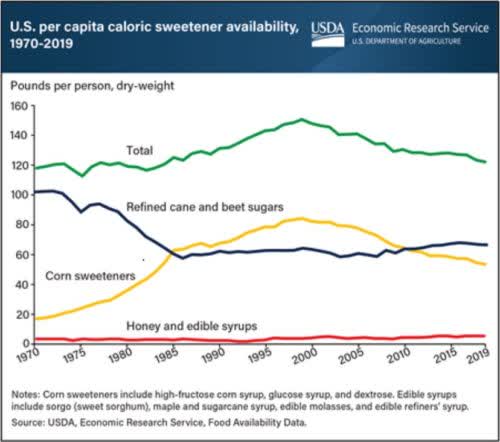

Ingredion’s revenues stagnated in the past decade as HFCS was linked to serious health conditions like obesity and diabetes, so consumers started to consume less of it (Figure 1).

Figure 1 – U.S. per capita sweetener availability (USDA)

In recent years, management has been investing heavily in “specialty ingredients” in an attempt to reignite topline growth. Ingredion branched into alternative sweeteners by buying Purecircle, a stevia sweetener manufacturer, and invested in Amyris, A Brazilian Reb-M sweetener. It also invested $250 million in expanding plant-based protein manufacturing and non-corn-based starches.

Solid Quarterly Results; Steady As She Goes

Recently, on November 3rd, 2022, Ingredion announced solid Q3/2022 results, with revenues of $2 billion (+15% YoY growth) and non-GAAP EPS of $1.73, handily beating consensus estimates of $1.62.

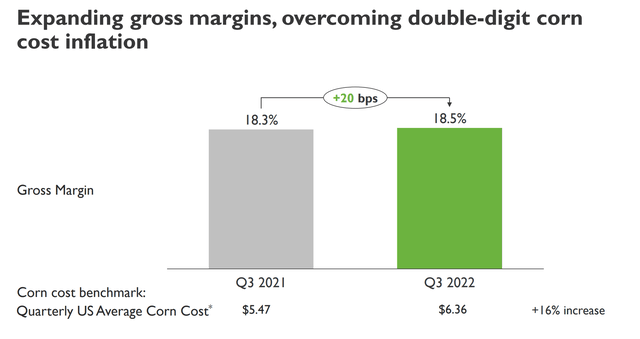

Highlights of the third quarter include gross margins of 18.5% vs. 18.3% in the same period last year and 19.1% in Q2. I had concerns regarding Ingredion’s gross margins given soaring global inflation, so it was reassuring to see the company was able to maintain strong gross margins despite corn costs increasing 16% YoY (Figure 2).

Figure 2 – INGR Q3/2022 Gross Margins (INGR Q3/2022 Investor Presentation)

Price/Volume Trade-off A Slight Concern

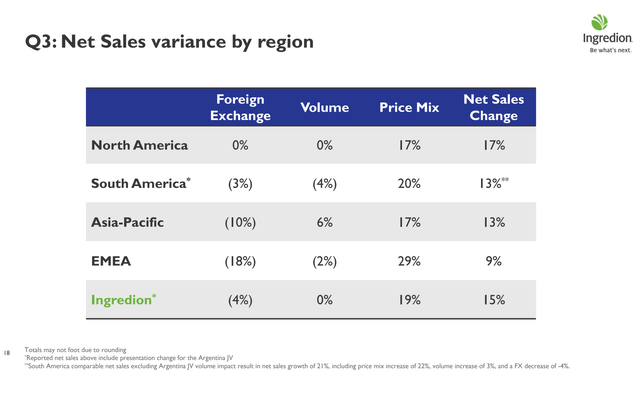

Similar to many other consumer staples companies, Ingredion made a trade-off between taking price actions vs. maintaining volumes. Fortunately for Ingredion, demand remained fairly robust, as Asian volume increases offset volume declines in South America and EMEA, leading to flat corporate volumes and a 15% growth in net sales. The company also had to contend with a negative foreign exchange impact of 4% in the quarter due to the strong U.S. dollar (Figure 3).

Figure 3 – INGR Q3 Volume vs. Price/Mix By Region (INGR Q3/2022 Presentation)

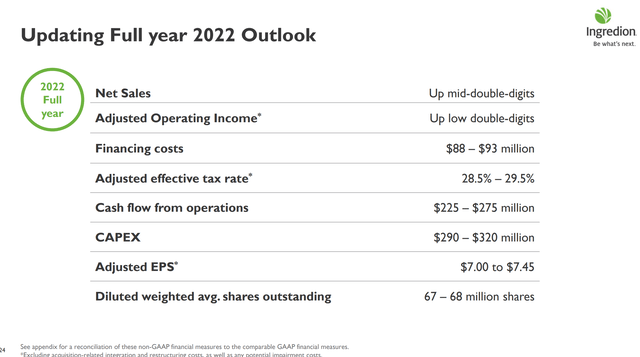

Raises FY Guidance Modestly

As part of the Q3 release, Ingredion also updated its FY guidance, with the notable change being the Adj. EPS range of $7.00 to $7.45 vs. the prior range of $6.90 to $7.45, which effectively raised the midpoint by $0.05 (Figure 4).

Figure 4 – INGR FY 2022 Guidance (INGR Q3/2022 Investor Presentation)

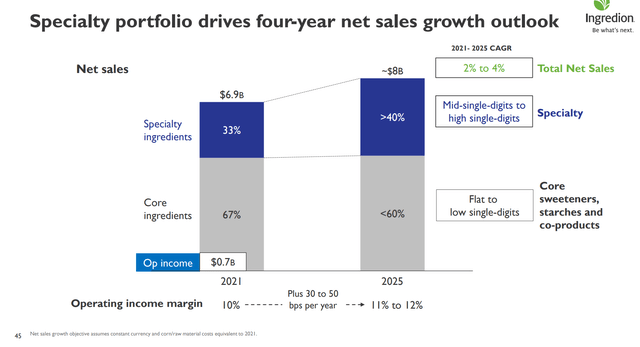

Remains On Track To Achieve Management’s 2025 Goal

Financially, Ingredion remains well on track to achieve management’s goal of ~$8 billion in revenues by 2025 and 11-12% operating margin, set out during its investor day (Figure 5).

Figure 5 – INGR 2025 Goal (INGR Investor Day Presentation)

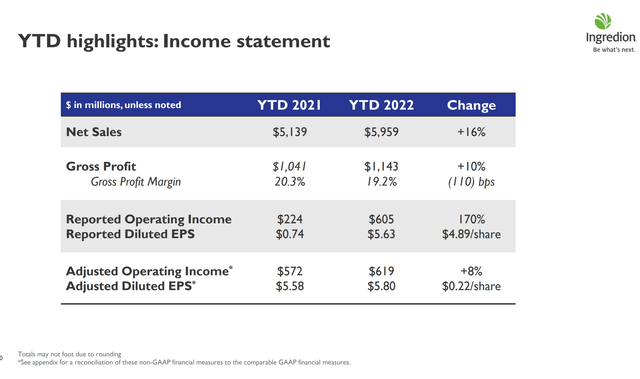

In fact, YTD sales growth of 16% to $5.95 billion puts Ingredion on pace to achieve ~$8 billion revenue as quickly as this fiscal year. However, the secondary goal of 11-12% operating margin will require more work, as margins have been pressured in 2022 due to the raw material inflation mentioned above. YTD 2022 adj. operating margin was only 10.4%, a decline from 11.1% in 2021 (Figure 6).

Figure 6 – INGR YTD Q3/2022 Financial Highlights (INGR Q3/2022 Presentation)

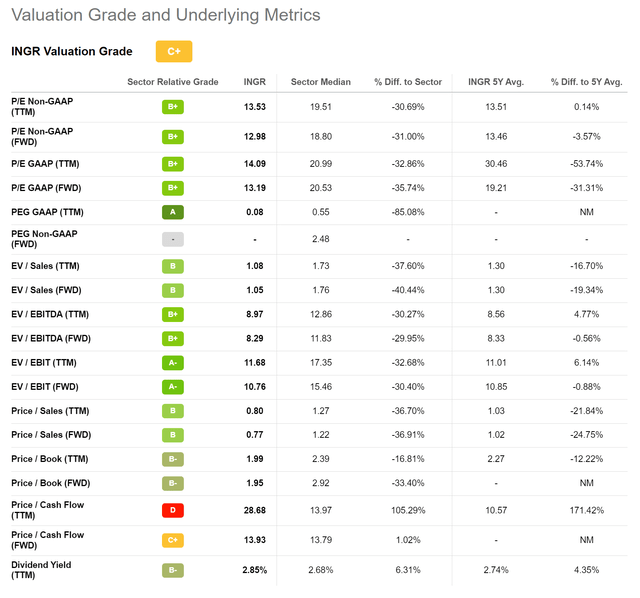

Valuation Remains Compelling

Trading at just 13.0x Fwd P/E vs. the sector at 18.8x, Ingredion remains a compelling investment opportunity (Figure 7).

Figure 7 – INGR Valuation (Seeking Alpha)

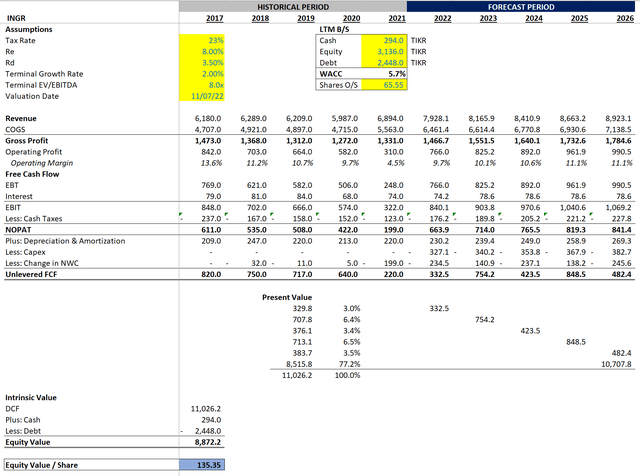

After updating my financial model for the third quarter, I continue to believe substantial upside exists if Ingredion can achieve management’s goal by 2025. My discounted cash flow (“DCF”) model indicates Ingredion shares are worth $135 / share, using an undemanding 8x EV/EBITDA exit multiple and 11.1% operating margin by 2025 (Figure 8).

Figure 8 – INGR DCF Valuation (Author created)

Risks To Ingredion

To date, Ingredion has done a fantastic job maintaining gross margins. However, from Figure 3 above, we can see the company has been trading off price vs. volumes in certain geographies. As the global economy continues to weaken in the face of high inflation, there is a risk that volume declines will worsen, limiting Ingredion’s ability to manage margins.

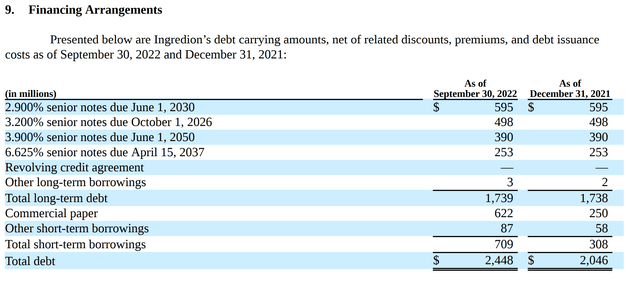

Furthermore, Ingredion has taken on substantial levels of debt to grow its business. Debt currently stands at $2.45 billion (Figure 9). High levels of debt may hinder the company’s operations, particularly if the company is not able to or cannot refinance the debt at favorable interest rates at maturity. Ingredion has $622 million in commercial paper and $87 million in short-term borrowings that are the most troublesome in the near-term.

Figure 9 – INGR debt schedule (INGR Q3/2022 10Q Report)

Conclusion

Ingredion continues to be an attractively valued consumer staples company, trading at a substantial discount to peers. Recently, the company has been able to grow the topline at substantial rates through a combination of price action and shift to higher growth specialty ingredients. This is yet to be reflected in the valuation. I continue to rate INGR a Buy.

Be the first to comment