Liudmila Chernetska

Ingredion (NYSE:INGR) is a good company competing in the commodity agricultural products sector. It has a good balance sheet and has delivered good growth over the years. The stock has had a nice run over the past three months, and its momentum may be fading. Dividend income seekers may be better off waiting for a better yield before buying.

Revenue growth and profitability

The company has grown by using a combination of organic sales growth, joint ventures, and acquisition-led growth strategies. For example, in November 2020, the company increased its 20% stake in Verdient Foods, a Canada-based producer of pulse-based protein concentrates and other products for human food applications. It acquired 100% of outstanding shares of Verdient Foods, Inc., in November 2020. In 2021, the company formed a joint venture with Grupo Arcor, an Argentine food company, to create ingredients for food and beverages.

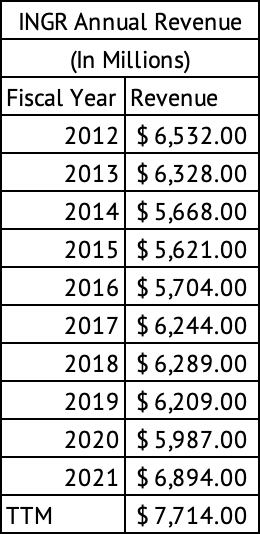

In July 2020, the company acquired 75% ownership of PureCircle Ltd., an Asia-based producer of plant-based stevia sweeteners and flavors for the food and beverage industry. Ingredion now boasts global annual sales of over $7.7 billion in the trailing twelve months (Exhibit 1).

Exhibit 1:

Ingredion Annual Revenue (2012-2021) (Seeking Alpha, Author Compilation)

Although this broad growth strategy has helped the company grow its revenue, the products that Ingredion produces are commodities, hence face stiff competition from the likes of Archer-Daniels-Midland Company (ADM), Cargill, Inc., Tate & Lyle plc (OTCQX:TATYY).

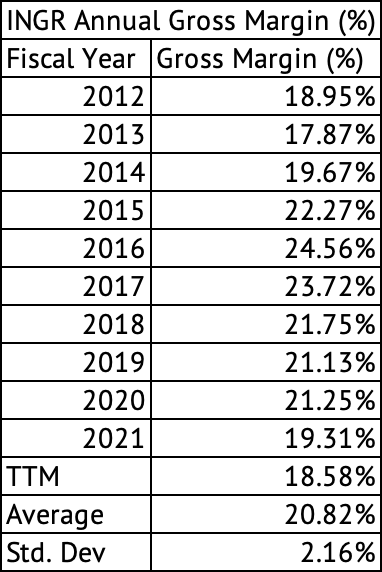

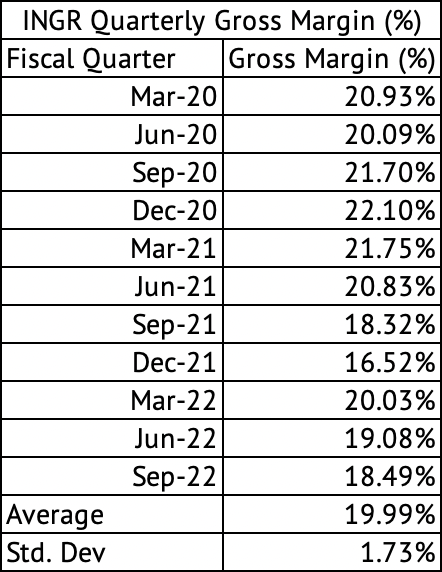

The company’s annual gross margins have averaged 20.8% over the past decade (Exhibit 2). Inflation, a strong dollar, supply chain constraints, and increased labor costs have reduced gross margins below 20% in 2021. Quarterly gross margins have dropped below 20% for 4 of the five quarters since June 2021 (Exhibit 3). The company’s operating margins have averaged 11.6% over the past decade.

Exhibit 2:

Ingredion Annual Gross Margin (%) (Seeking Alpha, Author Compilation)

Exhibit 3:

Ingredion Quarterly Gross Margin (%) (Seeking Alpha, Author Compilation)

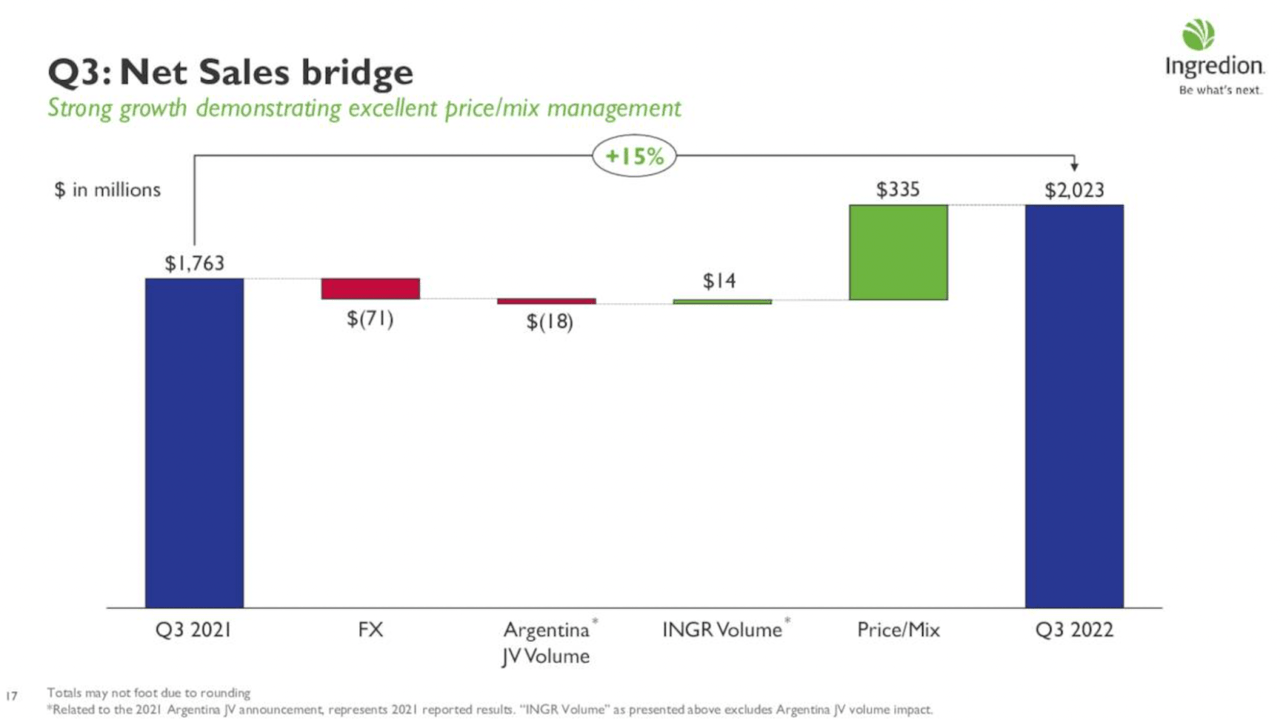

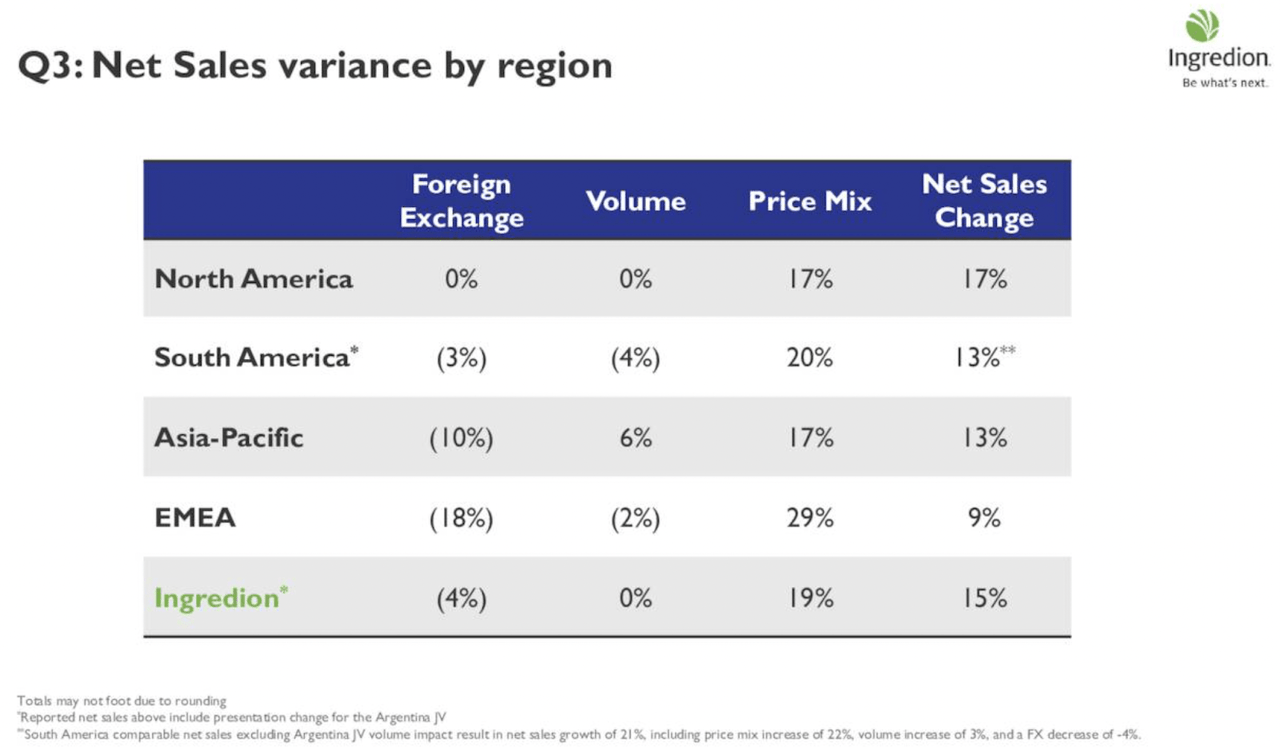

In Q3 2022, price increases were the primary reason behind the sales growth, but surprisingly the company showed a small overall volume growth despite the double-digit price increases (Exhibit 4). The company’s sales volumes dropped in South America and EMEA, with Asia-Pacific showing good growth (Exhibit 5). The company has seen a negligible impact on volumes in the last few quarters despite the double-digit price increases. But, investors should not expect this inelastic demand to last. Economic weakness in the U.S. and Europe may start putting a damper on further price increases, and volumes may show substantial declines in the coming quarters.

Exhibit 4:

Ingredion Q3 2022 Net Sales Bridge (Ingredion Investor Presentation)

Exhibit 5:

Ingredion Q3 2022 Net Sales Variance (Ingredion Investor Presentation)

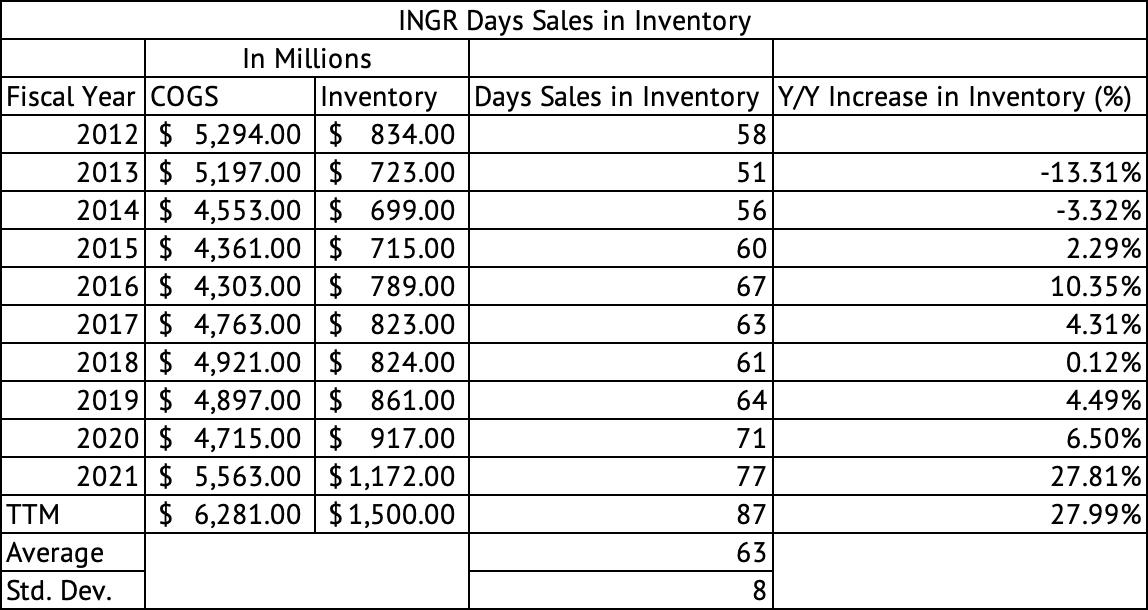

High inventory may signal trouble

The company has seen a substantial increase in its inventory on its balance sheet. In 2021, the company’s inventory increased by 27% compared to the previous year (Exhibit 6). The company has 87 days’ worth of sales in stock based on the last reported data, compared to an average of 63 over the past decade. Even if one account for the standard deviation of 8, the 87 days’ sales in inventory are more than one standard deviation away from its average. One would expect that 68% of the time, the days’ sales in inventory would fall between 55 and 71. The current inventory level is well above that range. In comparison, Archer-Daniels-Midland had 53 days of inventory as of the last report and, based on trailing twelve months of data, compared to its average of 56 days of sales.

Exhibit 6:

Ingredion Days’ Sales in Inventory (Seeking Alpha, Author Calculations)

The increase in inventory has put a dent in the cash flows, with operating cash flows dropping from $829 million in 2020 to $392 million at the end of 2021. For the twelve-month trailing, the operating cash flow has fallen to $213 million due to increased inventory and receivables. The number of days’ worth of sales outstanding in receivables has grown and now stands at 60 as of the last report, compared to an average of 53.

It has brought new manufacturing capacity online with the expectation of continued growth in sales in China. The increased inventory may position the company for gain when the COVID crisis passes in that country. The management mentioned the following during the Q3 2022 earnings call about the growth prospects in China:

“And as a reminder, as we noted at our Investor Day, modified starch consumption per capita in China is significantly less than in the U.S. or Europe. Thus, with a consumer market of 1.5 billion people, this is an exciting long-term growth opportunity for our company.”

Ingredion is fully valued.

In the last three months, the company got one boost to its EPS and three down estimates. The company has beaten its earnings estimates seven out of eight times in the previous two years. That is an excellent earning record for the company. But, things are changing quickly in the global economy with the prospect of further rate increases in the U.S. and COVID-related disruption in China. One may have to err on the side of caution and estimate that the company will see demand erosion that could reduce profits. The company may be fully valued, trading at a trailing GAAP PE of 14.9x and a forward PE of 14x.

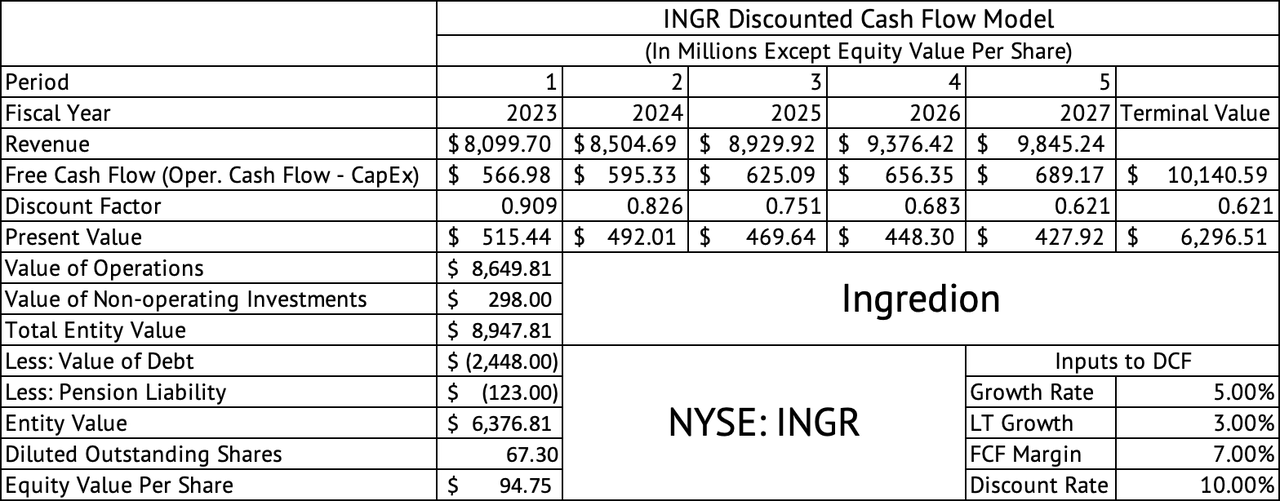

A discounted cash flow [DCF] model assuming a 5% revenue growth rate between 2023 and 2027 and 3% after that yields an equity value of $94 (Exhibit 7). The stock last traded at a value of $98.92. The DCF model indicates that the company is fully valued. In the short term, the company can make more acquisitions and grow its revenue faster than 5%, but the long-term growth rate of 3% is a fair assumption. The model also assumes a weighted average cost of capital of 10%, which is used as the discount rate. A free cash flow margin of 7% is used to calculate the cash flows.

Exhibit 7:

Ingredion Discounted Cash Flow Model (Seeking Alpha, Author Calculations)

The dividend yield is good but not great.

The company offers a dividend yield of 2.8%, which is good but could be better in this rate environment where the U.S. 2-year Treasury yields 4.25%. Investors may be better off waiting for a yield well above 3%. Over the past five years, the company had a high payout ratio of 84% and grew its dividend by 4% annually. The company has increased its dividend for 12 years and has continuously paid a dividend for 18 years. The company has a manageable debt load with a 2.4x debt-to-EBITDA ratio. The company’s short-term liquidity situation has deteriorated slightly, with its current ratio below 1x.

Sell covered calls

The company has performed exceedingly well, returning 18% over the past three months and 9% over the past six months. This price momentum may not continue, which may be an excellent opportunity to sell a covered call on the stock. The Feb 17, 2023, $100 strike price call last sold for $2.15. That price equates to a yield of 2.15%, a good return for six weeks until expiry. If the company announces good earnings on Feb 2, the call could get assigned. But, the assignment scenario looks like a low probability event given the company’s build-up in inventory, the current price momentum, valuation, and the downgrade to its earnings. An investor sitting on good returns but hesitant to book profits can consider a covered call option to generate income.

Ingredion has grown well over the past decade with an acquisition and joint venture-driven strategy. But the company plays in a commodity market and faces much competition. Price increases have helped bolster sales with minimal impact on volumes. But, the company is carrying more inventory than in the earlier periods, and any slowdown in sales will negatively impact its profitability and margins. Existing holders with gains on these stocks can take advantage of the strong momentum and sell covered calls to generate income. Dividend investors looking to buy Ingredion may be better off waiting for a higher yield.

Be the first to comment