monticelllo/iStock via Getty Images

Dear readers/followers,

In this article, we’ll look at the consumer goods space – specifically ingredients and Ingredion (NYSE:INGR). What could, after all, be safer than a company providing ingredients for some very basic products? This company is investment-grade rated, employs over 10,000 people, and produces its goods at over 40 plants across the world, selling them in over 120 countries.

Let’s dig down and see what exactly we have here.

Reviewing Ingredion and its upside

So, a few basics for the company. Ingredion transforms several inputs, but mainly corn, tapioca, potatoes, plant-based stevia, grains, fruits, gums, and vegetables into what are known as value-added ingredients and biomaterials for the food, beverage, and brewing industries. Oh, other end uses are also included – but these are really the main ones.

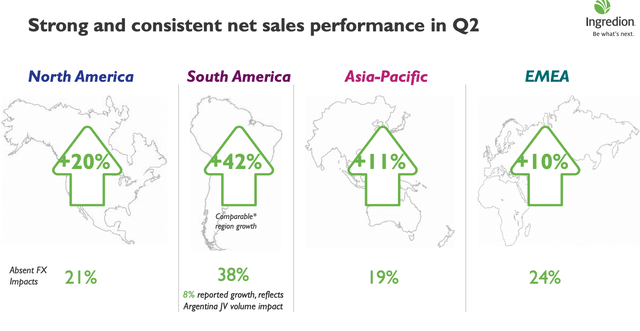

The company organizes its operations and sales not into product categories, but instead into geographical revenue sources, – NA, SA, APAC and EMEA – fairly standard operations and industries, all things considered here.

This business wins lots of ethical, ESG, and admirable awards and has been named among Fortune magazine’s “most admired” companies for almost 14 consecutive years at this point.

The products coming from its inputs include a variety of things – they begin with starches, sweeteners, and animal feed products, and move to edible corn oils. This breaks down further into glucose syrups, maltose syrups, HFCS, caramel colors, dextrose, polyols, maltodextrins, glucose, and syrup solids – all of these are derived from the aforementioned ingredients.

Manufacturing is of course a consideration here. The company’s capabilities are global, with recent investments going into plant-based protein product lines, such as flours, isolates, and pulse-based concentrates. Investments in production are always capital-intensive, so the company typically does these in steps. The company has 22 sites in North America but is both investing in and acquiring capabilities outside of the US, with assets in South America, Asia, and Europe. Basically, where the company has sales, the company typically has manufacturing as well.

The company’s mix is fairly transparent. Around 45% of sales are in starch – it’s a core product used in adhesion, clouding, dusting, expansion, freshness, and other areas central to food manufacturing, but are also used in things like paper manufacturing and textiles as well as other industries.

Sweeteners are then around 33-35% of annual sales, depending on what year you’re looking at. Much like starches, sweeteners have both food and industrial applications, with common industrial applications aside from biopharma being in things like wallboard, biodegradable surface agents, moisture control, and so forth.

Remaining sales are found in what are called “co-products”, typically averaging about 20%. This includes products like refined corn oil, which is sold to packers of cooking oil, margarine, dressing, shortenings, mayo, and other food products. It also includes things like gluten feed, which in turn is sold as animal feed.

While Ingredion can be considered to be in a market-leading position in their industry, they do move in a highly competitive market, including plenty of overall competition. Competitors include businesses like Archer-Daniels-Midland (ADM), Cargill, Tate & Lyle (OTCQX:TATYF), and others, while non-US segments are facing competition in their geographies, respectively. There are also geographical differences – where for instance Europe does not use even remotely as much HFCS as the American market does, as our primary sweetener remains sugar/cane sugar.

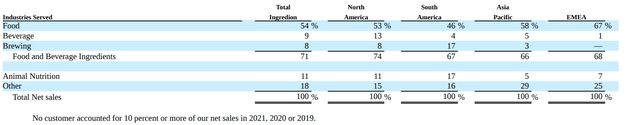

End customers are split as follows.

Ingredion 10-K (Ingredion 10-K)

As it says, no customer accounts for a worryingly high concentration, making the company well-diversified as things go. The company does not post its largest customers.

Ingredion is, in a large way, a play on its raw materials, including corn, specialty grains, and other commodities which by themselves have a fair bit of volatility in their pricing and trends. This requires the company to use hedging strategies to protect gross margins in the face of ups and downs in the pricing of these resources.

The advantages of such a company as an investment are obvious. While there are ups and downs in the pricing of the input commodities, the demand stability for these resources is considerable. Earnings, therefore, and at least theoretically, are stable.

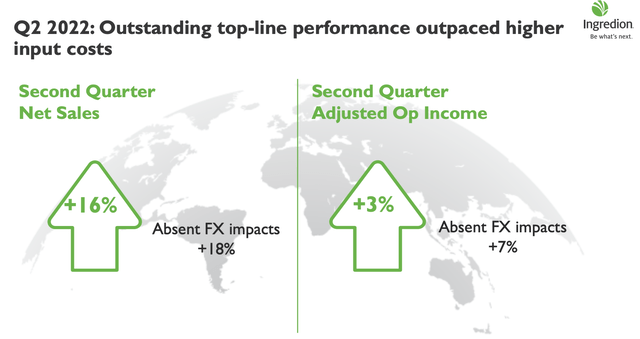

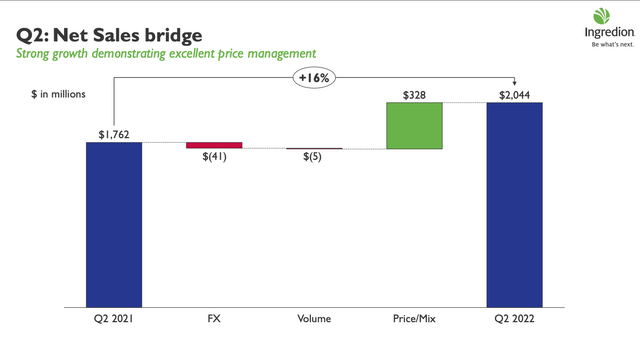

FX and commodities are the primary up and down here – if things go well, and the recent set of results, mostly confirm the positives here.

Unless there are very specific regional impacts pushing things down, there is also theoretical stability to these trends. Again, we get this confirmed in the recent results.

Recent results saw net sales grow double-digits and triple digits in specific segments. It should not be a surprise to anyone that plant-based protein is on a significant growth trajectory, with a 185% YoY growth. The company has fully dynamic contracts, meaning pricing for the company’s products has been fully updated, while its commodity risk coverage has been expanded to mitigate further downside – while at the same time increasing production.

Specialties are the growth area for the company here. Starch-based texturizers are growing across the world, and overall, the trends are moving from sugar to sweeteners. Risks are not absent from this company, but they are no different from anyone in this environment – namely, Inflation, Supply Chain, Energy, and FX.

Why is the company up?

Pricing, most of it.

The highlights are consistent on a YTD basis. Sales are up 17%, and the company’s pricing actions have managed to push the actual gross profit up – but margins are down around 180 bps, with significant improvements in EBIT and EPS. The company has updated its guidance, anticipating an EPS close to $7.5 on the high end, with double-digit sales growth, and low double-digit EBIT growth.

Risks and considerations beyond the standard ones?

Neutral or negative analysts following Ingredion focus on the company’s poor performance in terms of revenue growth next to its competition. Corn processors aren’t exactly rare in the industry – even if Ingredion is a significant part of the market. And some of its competitors, ADM specifically, are more vertically integrated than Ingredion. In the current environment, cost control, SCM control, and logistical control is an advantage due to volatility – and ADM has perhaps a somewhat better structure here, in addition to a better recent 5-year sales/EPS trend.

However, this argument ignores a number of other differences. Ingredion has a better worldwide diversification of both manufacturing and sales, as well as customers. The company also has better product diversification, which in this environment is leading to expectations of higher EPS growth in the next few years, not just the past few, compared to its competitors like ADM. It’s also far cheaper valued than is its competitors, leading to the company’s valuation.

Ingredion’s valuation

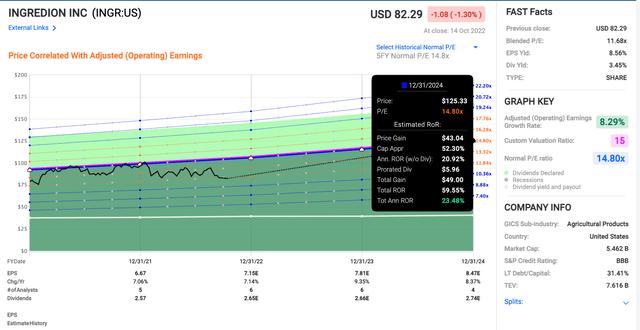

Ingredion has typically been at a premium for the past 20 years – but has declined to below that premium for the past few, now trading at below 12x P/E. The company has averaged single-digit EPS growth and is expected to average high-single-digit EPS growth going forward as well.

INGR is BBB rated and comes with a very well-covered yield of 3.4%+ at a payout ratio below 40%.

Plenty of companies have conservative upsides in this market. It’s doubtful that the current market situation will change In the closest few years. The company-specific upside here is easily double-digits – and as much as 60% at a 15x P/E on a forward basis.

Ingredion Upside (F.A.S.T graphs)

The accuracy here is good enough. Over 70% of the 2-year forecasts with a 10-20% margin of safety usually come in on target. This combined with the company’s operations means that taking a conservative stance here could be very profitable indeed. We’re talking about more than 50% RoR in less than 3 years. Even looking at the competition, the company isn’t as expensive or as premium as it once was – and it’s actually in a far better comparison to say, ADM. The comparative conservative upside for Archer-Daniels-Midland is less than 10% annually.

Both companies have upside, both companies have quality. Both companies are needed going forward, regardless of how to things go, or how inflation or macro goes.

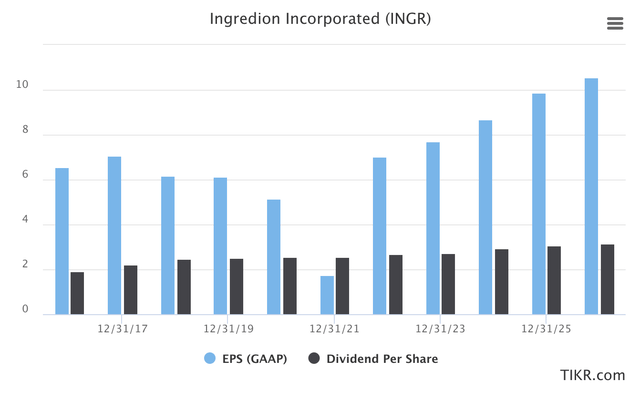

Current S&P Global estimates are for earnings to increase over the next few years – as are the expectations for the dividends. However, this company’s dividend growth is very muted, all in all, compared to how other companies grow their payouts.

Ingredion EPS/Dividend (S&P Global/TIKR)

I consider these forecasts, at least for the next few years, to be likely enough for a positive stance and thesis. The current average valuation estimates call for the company to trade at around $101, from an average of range $89 to $120/share. The exact target that the company will achieve over the next few years is hard to know, but I would consider it unlikely that the current price is even a fair sort of estimate for the company.

Based on EPS growth estimates, company forecasts, analysts’ forecasts, and solid fundamentals, I would say that the company is at least worth even a conservative 15x P/E if the EPS growth rate comes in at 3-4% lower than expected. This puts the company at around $95/share, bringing us a more than 10% upside here.

That is my introductory target for Ingredion.

Thesis

My thesis for Ingredion goes as follows:

- Ingredion is among a market-leading group of companies in the corn processing/ingredient space. It has excellent fundamentals, a good, well-covered yield, and has lower forward volatility, and better estimates than most of its competitors.

- Trading below 12x P/E, the company is now undervalued compared to most times in its history.

- Based on the upside, I would give the company a “BUY” with a $95/share conservative price target.

Remember, I’m all about:

-

Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

-

If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

-

If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

-

I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment