niphon

By Ashish S. and Harshit K.

Investment Thesis

In the third quarter of 2022, Ingersoll Rand Inc. (NYSE:IR) recorded a good revenue growth rate of 14% Y/Y with the top-line growth driven equally by both price and volume growth. In the quarter, the company generated increased orders augmented by the IRX process, which resulted in increased backlog value, up 40% Y/Y. The adjusted EBITDA margin improved by 110 bps Y/Y and 160 bps sequentially in the quarter, driven by improved operational execution and price/cost performance. However, global supply chain challenges continued to negatively impact performance.

Looking forward, I believe the company’s focus on sustainability and technology advancements through its IRX process, price increases, and higher backlog-to-sales conversion should benefit the revenue growth rate in the upcoming quarters. The company should also be able to generate a higher-than-normal price increase which coupled with easing supply chain constraints should improve price/cost resulting in margin expansion.

Ingersoll Rand Q3 2022 Earnings

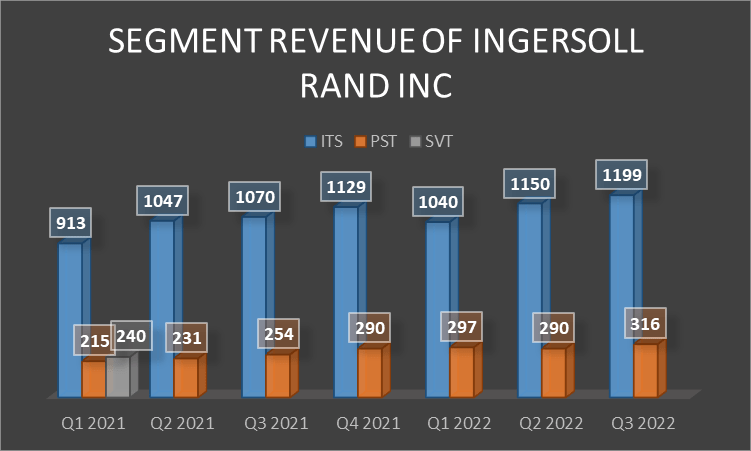

Ingersoll Segment Revenue in USD mn (Company Data, GS Analytics Research)

Earlier this month, Ingersoll Rand reported better-than-expected results for the third quarter of 2022. The net sales for the quarter stood at $1.52 billion, an increase of 14% Y/Y or 22% Y/Y on a constant currency basis, and was above the consensus estimate of $1.45 billion. This growth was driven by an equal contribution from both price and volume growth.

In the quarter, the revenue of the Industrial Technologies and Service (ITS) segment stood at $1.2 billion, up 12% Y/Y or 19% Y/Y on a constant currency basis while that for the Precision and Science Technologies (PST) segment was at $316.1 million, up 24.3% Y/Y or 15% Y/Y organically.

The adjusted EBITDA margin stood at 24.8%, an improvement of 110 bps Y/Y due to operation execution and price/cost performance. The improved revenue growth and margin expansion resulted in increased adjusted earnings per share, which was $0.62, up 8.7% Y/Y, above the consensus estimate of $0.59.

Revenue Analysis and Outlook

In the third quarter of 2022, Ingersoll Rand recorded revenue of $1.52 billion, up 14% Y/Y or 22% Y/Y on an FX-adjusted basis. Favorable pricing and sales volume contributed equally to the top-line growth in the quarter. However, foreign currency translation headwinds, due to the strengthening of the US dollar, played spoilsport. From the start of 2022, the company is seeing a strong revenue growth rate in most of the geographical locations except Mainland Europe and China. Due to the start of the Russia-Europe war, the company recorded a downward trend of marketing qualified leads or MQLs resulting in less revenue growth rate in the beginning of this year. China’s market was also seeing low growth due to the lack of the right sales structure or operational footprint. However, this has changed as the year progressed and the company started leveraging the IRX to improve MQLs. The company increased the MQL by 60% in Europe and created an improved product line in China resulting in an improved revenue growth rate from the last quarter.

In the quarter, the revenue of the ITS segment stood at $1.2 billion, up 12% Y/Y or 19% Y/Y constant currency organic growth rate. Notably, the growth is evenly split between price and volume. The foreign currency headwind impacted revenue by 7%. The demand remains robust for its products like compressors, oil-free products, and oil-lubricated products.

In the third quarter, the revenue of the PST segment was at $316.1 million, up 24.3% Y/Y, or 15% Y/Y organically, driven by both price and sales volume. Recently, the company acquired the Air Dimension business for its sustainable innovation initiative in this segment.

The orders in the third quarter of 2022 stood at $1.65 billion, up 10% Y/Y or 18% Y/Y on a constant currency basis. Book-to-bill ratio was also good at 1.09. The IRX process accelerated the growth of orders through increased investments in the development of new products, as evidenced by the launch of higher-pressure offerings that led to new orders from four major OEMs and system integrators. In the ITS segment, the organic orders were up 16% Y/Y, with a strong book-to-bill ratio of 1.13. In the PST segment, the orders grew a modest 3% Y/Y as third-quarter results were impacted by tough comps from the prior year as Q3 2021 witnessed very high demand in the Thomas business, which serve the patient care end market through products like ventilators and oxygen concentrators. Adjusting for these COVID-related orders last year, organic orders were up approximately 8% Y/Y.

The increased order level augmented by the IRX process led to a strong backlog value, which was up 40% Y/Y. The supply chain constraints are causing disruption in inventory level and were the major headwinds in backlog-to-sales conversion. However, the company increased the inventory level by $69 million to mitigate supply chain constraints and support backlog conversion.

Looking forward, I believe the company’s focus on sustainability & innovation, price increases, and improved backlog-to-sales conversion rate should result in an improved revenue growth rate in the upcoming quarters.

The IRX process, through which the company focuses on acquiring businesses in adjacent markets as well as product development with an emphasis on sustainability and technology, should also drive growth. The company had already identified several opportunities in this regard. An interesting example of the company’s focus on sustainable solutions is its Runtech turbo blower technology. This blower technology is used by leading pulp and paper manufacturers, and it replaces an alternative technology that requires a fresh water supply. According to management, its existing installed base around the world is currently saving 7.5 billion gallons of water a year and they estimate that over 50 billion gallons of water per year could be potentially saved with the full adoption of IR’s Runtech technology globally.

In addition to the IRX process, the company is also poised to benefit from the price increases. Usually, the company can get a 1% to 2% price increase every year due to the mission-critical nature of its products. However, given the recent inflationary environment, the company is implementing higher price increases, some of which will carry on to the next year as well. This should improve the revenue growth rate in FY2023.

Furthermore, the company should also benefit as it takes steps to overcome supply chain issues. In the third quarter of 2022, the company had increased its inventory level by $69 million to mitigate the supply chain challenges which I believe should support the backlog-to-sales conversion rate resulting in an improved revenue growth rate.

So, I am optimistic about the company’s near to medium-term revenue growth outlook.

Margin Outlook

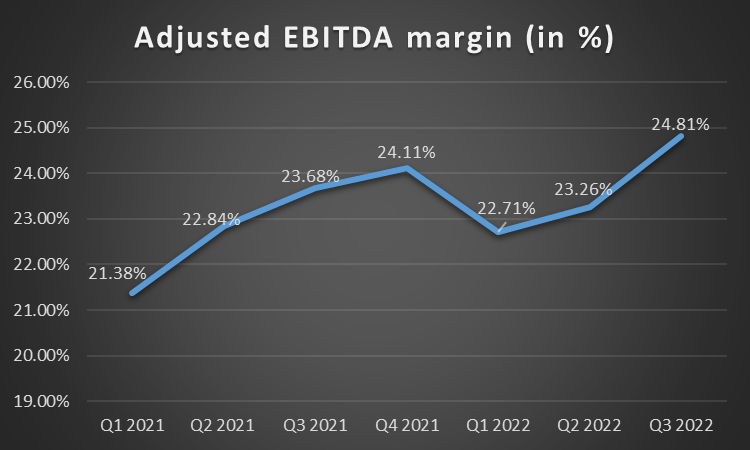

Ingersoll Rand Adjusted EBITDA margin (Company Data, GS Analytics Research)

In the third quarter of 2022, the EBITDA margins stood at 24.8%, reflecting a ~110 bps Y/Y improvement and ~160 bps sequential improvement. The global supply chain challenges are one of the major headwinds in margin expansion, and the company has invested $69 million in inventory to mitigate these challenges.

The adjusted EBITDA margin in the ITS segment was at 26.2%, up 70 bps Y/Y, with an incremental margin of 32%. In The PST segment, the EBITDA margin stood at 29.1%, down 60 bps Y/Y. The decline in adjusted EBITDA margin was due to a 120 bps impact from M&As and a 60 bps impact of tough comps from prior year COVID-19 demand. However, the sequential adjusted EBITDA margin significantly improved by 230 bps due to operational execution and price/cost performance.

As explained above, due to the mission-critical nature of its products, the company usually increases the price by 1-2% every year. The price increases this year were higher and implemented throughout the year due to rising inflation. Looking forward, I believe the carryover impact of price increases from the current year, especially the ones implemented in the back half, should help the company generate higher than the usual price increase in FY23 as well. As the inflationary environment is getting stable, I believe the cost of its raw material should also decrease. This should improve the price/cost, resulting in margin expansion.

Valuation

IR is trading at 23.62x FY2022 consensus EPS estimates of $2.27 and 21.70x FY23 consensus estimates of $2.47. This is a discount versus its 5-year average forward P/E of 39.77x. I believe the stock is a good buy given its encouraging revenue growth and margin expansion prospects.

Be the first to comment