Jae Young Ju

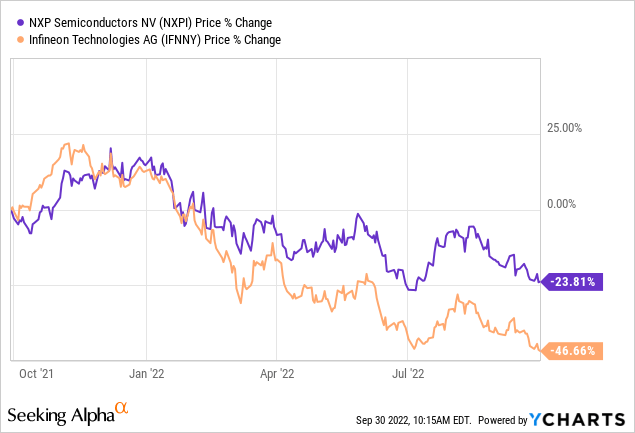

The share prices of NXP Semiconductors N.V. (NASDAQ:NXPI) and Infineon Technologies (OTCQX:IFNNY) have both followed a downwards trend for the last year, but amid the downside, the Dutch company has fared relatively better with a drawdown of less than 24% compared to nearly double by its German competitor. This is despite analysts at Bank of America (BAC) highlighting NXPI’s exposure to Apple (NASDAQ:AAPL) which was recently downgraded because of demand fatigue.

Far from making you dream about the fantasy world of advanced electronics to equip the EVs (electric vehicles) of tomorrow, this thesis aims to shed light on the realities in view of the economic slowdown risks and high energy costs impacting Europe being faced by both these companies which manufacture electronic components for car factories. At the same time, I highlight positives like backlog, and opportunities provided by the CHIPS Acts from both sides of the Atlantic.

I start with the revenue exposure, both on a sector and country basis.

Heavy Exposure to Automotive and China

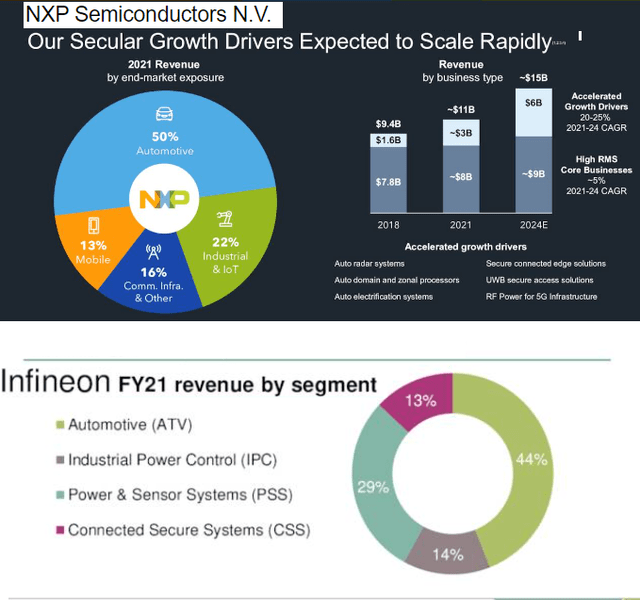

As shown in the diagram below, a significant part of both companies’ revenues comes from the automotive sector, at 50% and 44% for NXPI and Infineon respectively. Without going into details, the products vary from high-performance mixed-signal products including microcontrollers and analog systems. Both also have sizeable exposure to the industrial space with Infineon also possessing strength in Silicon Carbide, a technology that makes it possible to build more power-effective chips.

Company Presentations (www.seekingalpha.com)

Now, automotive, industrial applications, and IoT (Internet of things) are primarily based on mature process nodes, not the advanced ones used in chips equipping iPhones. With just 13% of NXPI’s revenues coming from smartphones, including a 10% exposure to Apple, it is understandable why the market has not punished the company in the same way as Cirrus Logic (CRUS), which is much more exposed, at 80%. On the other hand, with less exposure to a weak smartphone market in 2022, Infineon is better positioned with applications like renewables and data centers.

The German company also has less exposure to China, with 36% of sales in the second quarter of 2022 (Q2), lower than NXPI’s 54% for the same period. Now, this country which is the world’s largest vehicle market in front of the U.S. consumes a lot of chips as in addition to enjoying high demand, it is also the world’s largest manufacturer of cars. For this purpose, it is expected to reach an annual production of 35 million vehicles by 2025, but, in sharp contrast with its East Asian neighbors which are projected to experience a post-pandemic growth of 5.3% in 2022, the Chinese economy is expected to decelerate considerably, to 2.8%, from 8.1% in 2021.

Therefore, due to the large Chinese exposure, there are reasons to be prudent, as, both companies derive significant portions of revenues from Europe where a combination of factors ranging from high inflation, and hiking of interest rates by the ECB are increasing the probability of a winter recession occurring. For investors, Europe accounted for around 24% and 20% of Infineon’s and NXPI’s revenues respectively for Q2.

However, after all this pessimism, it is now time to adopt a more optimistic tone thanks to the backlog, or the customer orders which have yet to be fulfilled.

The Backlog, Growth, and Gross Margins

This is mostly explained by the fact that demand for semiconductors, especially for autos has been outpacing supply since the onset of the pandemic with both companies not being able to satisfy their customers. For Infineon, it stood at €42 billion at the end of June, or a 5 billion euros increase on a year-on-year increase, with half coming from automotive. According to the CEO, this is equivalent to 3x annual revenues, and in the event that there was a decrease in backlog, growth for 2023 should not be impacted.

As for NXPI, it does not provide numbers, but its backlog was estimated to be between 1.5 to 2 years in June 2022. More recently, during a tech conference the CEO mentioned that due to supply constraints, the company can only supply 80% of its requirements. Furthermore, the company uses the NCNR (non-cancellable and non-reschedulable orders) metric for measuring backlog more precisely. With NCNR for 2023 being larger than for 2022, following more orders for both the Automotive and Industrial segments, it means that NXPI has been spared from demand destruction in the same way as it could face for smartphones.

Now, in the current highly uncertain environment, the backlog is an important criterion to consider, as it confers both companies some protection against slumping demand especially given that they lack direct visibility of end customers, and are dependent on forecasts made by automakers.

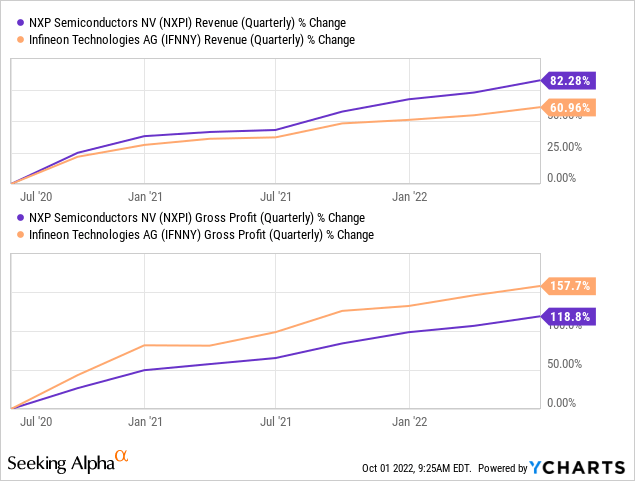

Having backlogs also ensures growth and for this purpose, while NXPI has grown more rapidly since the start of Covid as shown in the charts below in green, it is Infineon that has increased gross profits at a much faster rate (orange chart), showing better control on costs of production.

However, its German and Austrian factories are incurring higher energy costs and are not immune to partial production disruption in case of possible rationing of energy in Germany in view of prioritizing the population with winter not so far away.

On the other hand, NXPI with its European factory in the Netherlands is relatively more immune to a disruption in energy supply as the country has already made alternative provisions in order not to suffer from a halt in Russian gas. Moreover, with four facilities in the U.S. already, the company is further insulated against disruption of natural gas supplies.

Comparing Metrics, Valuations, and the CHIPS Act

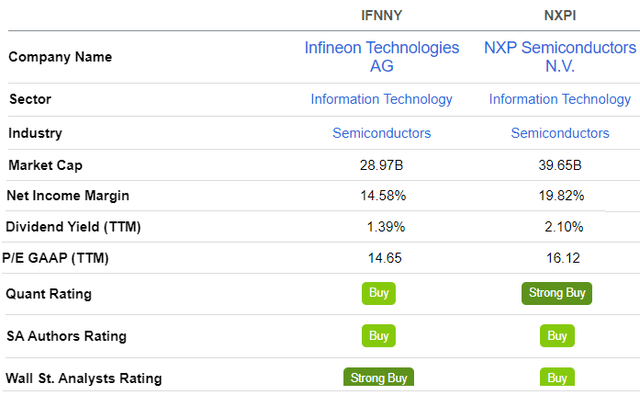

Therefore, in view of the above, I have a slight preference for NXPI, whose higher trailing GAAP P/E of 16.12x suggests that the market has already priced in its higher probability of achieving its 2022 growth targets without sacrificing much in terms of profitability. For this matter, its net income margins are higher too. Now, its P/E remains below the IT sector median of 20.19x. Thus, adjusting accordingly, I obtain a share price of $184.7 (20.19/16.12 x 147.5) based on the current share price of $147.5.

Comparison of key metrics (www.seekingalpha.com)

This said, Infineon is viewed as a buy by most analysts, and the company benefits from tailwinds due to a strong dollar in addition to higher volumes and pricing power. These three factors prompted it to raise the outlook for the fiscal 2022 fiscal year. Based on its P/E of 14.65x, I have a price target of $30.26 (20.19/14.65 x 21.96) based on its share price of $21.96.

This said, with energy bills possibly climbing by about 66.7% (€200 million to €300 million) in 2022 compared to last year, there may be an impact on profitability, but, as per my calculation, this constitutes less than 4% of 2021’s cost of revenues. Also to mitigate energy disruption risks, Infineon has switched from natural gas to oil for two third of its production, and its management is continually engaged in discussions with authorities to ensure a reliable energy supply. To this end, Germany intends to use coal as standby power “to mitigate the economic impact” of the Ukrainian war.

Pursuing further, a strong dollar is beneficial to those which produce in Asia and Europe and ship to the U.S. In this respect, Infineon obtains 12% of its revenues from the U.S. while it is 13% for NXPI. In addition to its Chinese and European operations, the Dutch company owns and operates four wafer fabrication facilities in the US, divided equally between Austin and Chandler. It is seeking to upgrade its Texas facilities to a tune of $2.6 billion, while at the same time also considering expansion of manufacturing in Europe.

As for Infineon, it has four manufacturing locations in China, in addition to those located in the U.S. and Europe. The company is weighing a $700 million expansion of its semiconductor fabrication campus in Austin.

Therefore, at the top two spots in the automotive semiconductor market share, these two companies should be involved in America’s strategy to onshore its supply chain for its auto industry, as well as to help Europe reduce its dependence on East Asia. For this matter, they are likely to benefit from subsidies through America’s $52 billion CHIPS act and Europe’s €43 billion equivalents.

Conclusion

While only six years back, the priority was geographical diversification and outsourcing, the heightened geopolitical risks landscape around Taiwan, and China’s proximity to Russia, has changed all that. Thus, Infineon and NXPI which in addition to chip manufacturers are also designers, have to adapt given that European semiconductor companies rely on U.S-intellectual property and chip design tools, while at the same time depending on manufacturing from East Asia.

This puts them in a delicate situation, one where, in addition to supply-demand dynamics, they now have to produce nearer to their customer base, which is the auto industry, normally prioritized by governments over other industries. Hence, two companies should benefit from subsidies in the form of tax breaks which can partially offset their capital expenses.

Finally, after going through the risks posed by slumping demand and energy issues, both companies are “buys” because of their considerable backlogs and diversified manufacturing base spanning three continents, as well as their pricing power in a low-supply environment. This said, with the Ukrainian conflict lingering on, volatility should persist as there is no lack of bad news to hit the market for the foreseeable future. Hence some may prefer to wait on the sidelines for the stocks to dip further before buying.

Be the first to comment