Sean Gallup

Dear readers/Subscribers,

It’s not exactly a huge secret that I look at valuation specifically when I make my investments. For that reason, the only time in the last 2-3 years that Infineon (OTCQX:IFNNY), a great German company, had any appeal to me, was during a brief drop during the COVID-19 trend. However, at the time, I had my sights on other businesses and only did a few small buys of shares in the company before moving on.

Since that time, I’ve sold, divested, and left behind Infineon at a significant profit, and swore off investing in the business until it went back down. Many contributors called this stock a “steal” or a “good buy” at prices of nearly $50/share. I viewed this, and view this as ridiculous.

Infineon Article (Seeking Alpha)

However, as things stand now, the company is far more interesting. Because to my COVID-19 article, shares are up 41%.

Let’s review.

Reviewing Infineon Technologies

Infineon was originally a part of Siemens, and the company became its own thing when divided from its Siemens parent.

Until that point, it consisted of mostly Siemens semiconductor manufacturing division/s. The spinoff in 1999 represented the moment the company became its own entity, and since that time, the stock has appreciated greatly in value. It was one of the first Siemens Spin-offs, in a journey that’s been ongoing for 20 years when Siemens (OTCPK:SIEGY) divested most of what had previously been core holdings and operations.

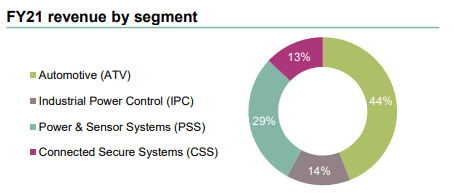

The company’s current operations encompass the following reportable business segments.

- Automotive (ATV)

- Industrial Power Control (IPC)

- Power & Sensor Systems (PSS)

- Connected Secure Systems (CSS)

The company is heavily tilted towards Automotive operations, with a current revenue split that looks something like this.

Infineon IR (Infineon IR)

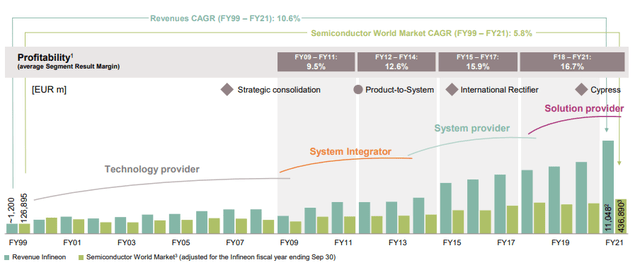

The company is trying, with this split and these ambitions, to address the two current trends of digitization and decarbonization – and so far, the resulting financials from this target look excellent. Looking at its split from Siemens, trends are very impressive in terms of long-term growth.

Infineon IR (Infineon IR)

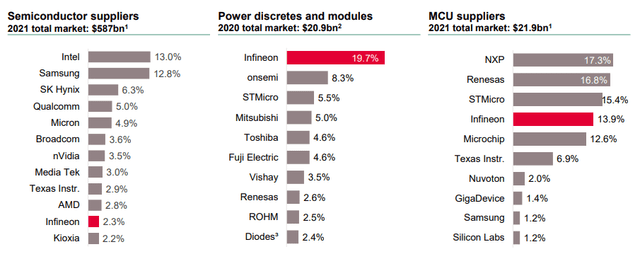

The company is the holder of the largest market share in the world when looking at power discrete and modules, easily doubling the market share of #2. This has, for the most part, been achieved in record time, showcasing the company’s growth potential. The company is an absolute market-leading beast here, and it’s catching up on MCU, and even holding its own in general semi-supplying.

Infineon IR (Infineon IR)

The company’s current operating model calls for top-line growth of 9% per year, while maintaining at least 19% segment result margin, and it expects full-year 2022 revenues that reach around €14B, with a current segment result margin of above 23% (though this is likely to go down). Out of this €14B, the company expects FCF of around €1.4B, which is more than enough to cover its very modest dividend of €0.25-€0.3. For 2022 fiscal, that dividend is expected to rise to €0.32, implying a current yield of 1.2%. It’s not great, but also not the worst we’ve seen from the company.

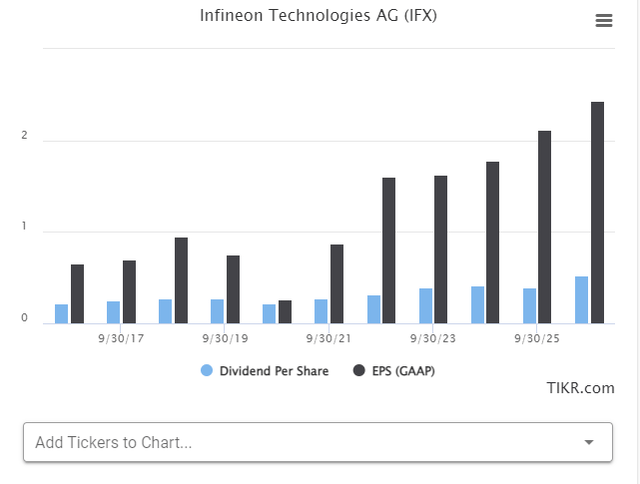

This dividend is easily covered by GAAP, and that spread is set to increase. We might technically see higher dividends, but remember that IFX has gone through EPS bounces without adjusting their dividends all that much. Instead, the typical strategy for IFX is reinvestment into the business – so know this going in and don’t expect massive DGR from this investment.

Infineon Earnings/Dividends (Tikr.com/S&P global)

The company is, simply put, in extremely attractive and current segments, and its customers contain the largest businesses on earth, working in areas like Industrial power Supplies, Photovoltaic power, Transportation, Automotive, EV charging, and drives. The customer number of 3,000, and for SiC alone, there is a €1B revenue target which isn’t hard to reach here in the mid-2025’s if this continues, where Infineon competes with Industry giant STMicro (STM). IFX has the highest YTD growth ratio of every peer in the industry, while also offering the broadest portfolio to fit all customer needs.

The company is also expanding its manufacturing base in SiC, with a €2B investment – not in China, but in Malaysia, being the business’s first wafer fab in Asia.

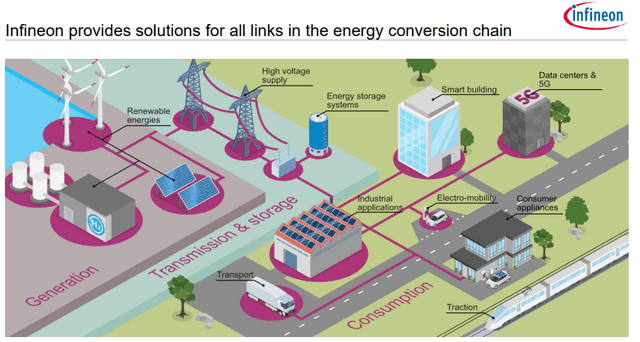

We could go deeper into every segment – but let’s just say for the purpose of this article, that every segment is expected to deliver decent growth going forward – either that or stability. The company provides solutions for every step of what it calls the conversion chain and given the current picture, it’s easy to see why this is what the company says.

Infineon IR (Infineon IR)

The fact is, the current increasing pace of renewables will demand expansion of the national energy grids – and not just Germany. Infineon will be a prime producer of such things, including IGBT modules and other products for converter stations. This company is so much “in the now” that I can understand why some people thought the premium half a year or a year ago was worth it – almost, at least.

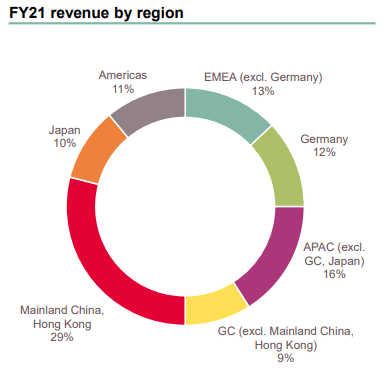

The company’s top-10 customers include businesses like Bosch, Continental (OTCPK:CTTAF), Hyundai (OTCPK:HYMLF), Samsung (OTCPK:SSNLF), Siemens, Vitesco, Huawei, and others. Revenues are extremely well-split on a global basis, though perhaps just a touch too high to China, given what’s ongoing.

Infineon IR (Infineon IR)

Also, the company’s backlog is now up over €40B, which is a doubling from around a year ago. Revenues are growing, and segment margins are increasing impressively, even if I see the margin increases as somewhat temporary (at least potentially). R&D has been stable, with around 12-13% of revenue spent on it, and another 11-12.5% on SG&A. At the same time, the company has been growing revenues. Let me reiterate – the company has grown gross profit by around 50% in less than a year, without seeing a corresponding percentage increase of S&GA or R&D – in fact, both of these numbers are down by about 100 bps each.

Infineon therefore, as such things are measured, is doing extremely well indeed. ROIC isn’t as high as in FY18, but still at impressive levels of 12-13%, and the company debt is at record-low levels as things stand, with a maturity profile that’s in no way worrying here.

Let’s move from such positives into the valuation, because that’s where things are getting interesting here.

Infineon Valuation

Infineon is pretty much your basic school thesis on valuation. The company has a very established P/E range – a premium at which it usually trades. At times, it can go well beyond that range. The time to buy the company is not at the time, which investors that did got to feel if they held onto their shares throughout this year.

Infineon IR (Infineon IR)

It’s a very KISS-oriented approach. If someone tells you “This, X, will do that this company is now worth 2-3x as much/completely worthless”, you should be the one to raise your eyebrows. It usually does not work like this. I say usually because sometimes it does (See BlackBerry (BB), Blockbuster, Polaroid Toys R Us, etc.). I’m not saying it doesn’t happen. But usually, at that point warning signals are pretty evident, and it rarely goes the other way (by which I mean a company that legitimately is worth 10-100x more).

So when people were calling for IFX to suddenly go at twice the current going price, I stayed far back.

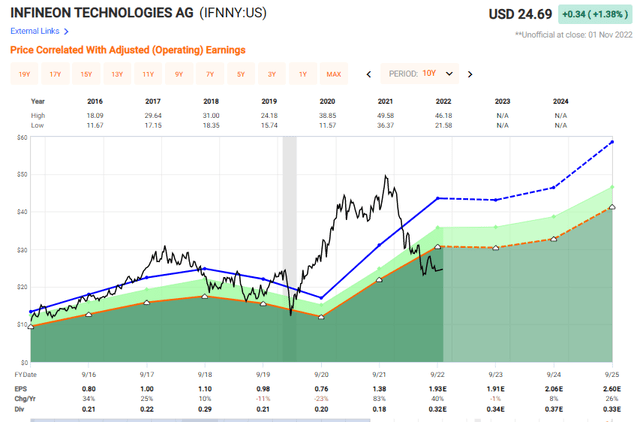

But, when the company is now being traded well below a 15x P/E, that’s when we pounce back in with a vengeance and say “Wait just a minute”. Because 12.5x is nowhere near where the company should be trading, given everything I just said.

Some facts. The company’s ADR trades around 22-25x P/E. This is a solid premium for a Semi company, but given its market position, it’s not insane per se. And we don’t even need to forecast the company at 22-25x P/E to get a solid return here. Forget those numbers, in fact.

Go for 17-19x P/E. Anyone should be able to agree that a world-leading semi should be worth that in the long term.

What could you get from that?

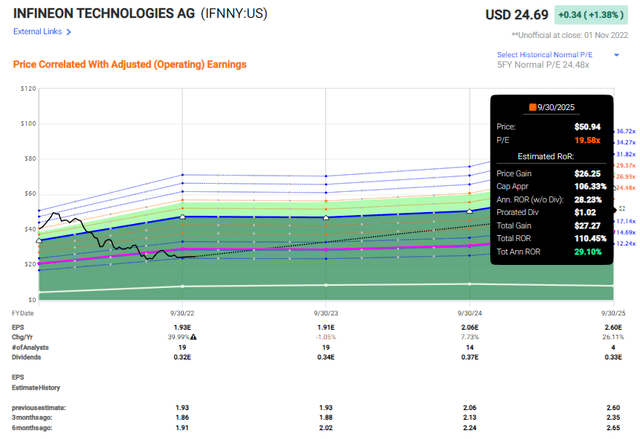

IFX Upside (F.A.S.T graphs)

Triple digits, or thereabout, in around 3 years. This is more or less the “baseline” performance I’m looking for when I invest.

I pick companies – solid companies – that are undervalued by the market. I look for good comparative yields and triple-digit, or close to triple-digit upsides – realistic ones, mind you – and I invest. Never more than 2-5% in one particular company – but an appealing mix, and usually investing in “slow steps”.

I very rarely stray from this approach, and it’s worked out extremely well for me.

Infineon is one of the few Semi picks that meet my current requirements. I wouldn’t touch “growth tech” with a 10-foot pole, but I’ll happily pay 12x P/E for the growth and the yield that’s what we have here.

S&P Global gives the company a very attractive target range, starting at around €17 but going all the way up to €52/share, with an average of €37. Out of 22 analysts, 19 are currently at a “BUY”. This forms a very clear thesis in terms of overall expectations for this business – and one I can get on board with.

My latest article was when Infineon was in a different environment. I believe here, that Infineon should be valued at no less than a stable 17-20x P/E for the long term, accounting for close to a double-digit earnings growth rate. Based on those expectations, and where current closer peers are trading, I would give the company a PT of €35/share for the longer term – and this accounts for the growth for the next few years as well.

If you buy under €35, it’s my stance that you’re buying at a good price.

And that’s also my target and thesis for the company.

Thesis

- Infineon is an excellent former part of Siemens, and a very attractive company from a fundamental point of view, potentially delivering triple-digit upsides from a necessary part of power innovation on a 3-5-year forward basis.

- The company is not a high yielder but can be bought and held for the combined upside until it materializes if bought at an attractive valuation that allows for alpha compared to the market.

- The price I see for that to be realized is to buy the company at a price of €35/share. I, therefore, view Infineon as a “BUY” with this as a basis.

Remember, I’m all about:

-

Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

-

If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

-

If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment