lamyai/iStock via Getty Images

How a looming recession may impact commodity prices

In a recent interview on Bloomberg TV (see here), I painted a longer-term bearish view in commodities. In fact, I began becoming concerned three weeks ago about the potential wash-out in cotton, grains, natural gas and other commodities; even Bitcoin (BTC-USD). Why? A flight to safety by investors who I expected would “cash in” on profits in many markets. This has indeed already happened, and now potential weather problems are beginning to help some commodities like natural gas (UNG) and soybeans (SOYB) rally back.

Jim Roemer BLOOMBERG INTERVIEW (Weather Wealth Newsletter)

My concerns about how a potential global recession could have on commodities are featured in my latest issue of Climatelligence.

Climatelligence Newsletter (Jim Roemer)

Natural gas prices bottoming on upcoming big-time heat

One of the most volatile and difficult commodities to trade for months has been natural gas. Following a stellar 100% price surge in less than 3 months, natural gas prices settled back on demand concerns, increased U.S. production, and more importantly, the shutdown of the Freeport LNG export facility in Texas. This is a big deal because LNG exports are the primary reason for the past natural gas price surge.

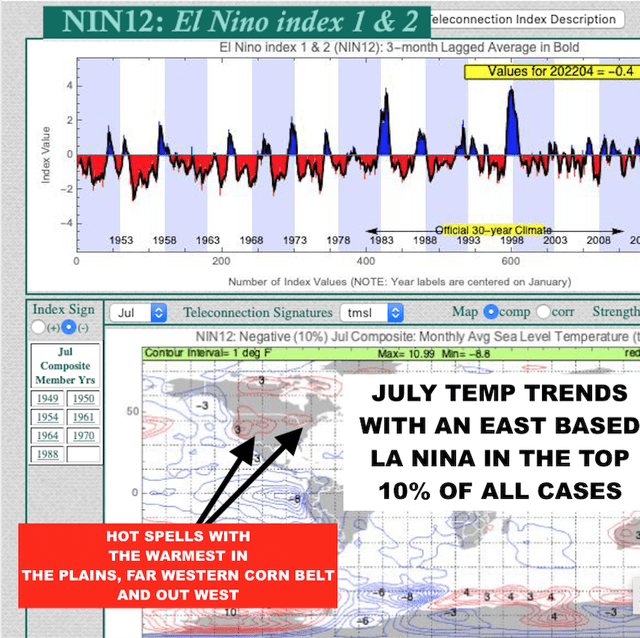

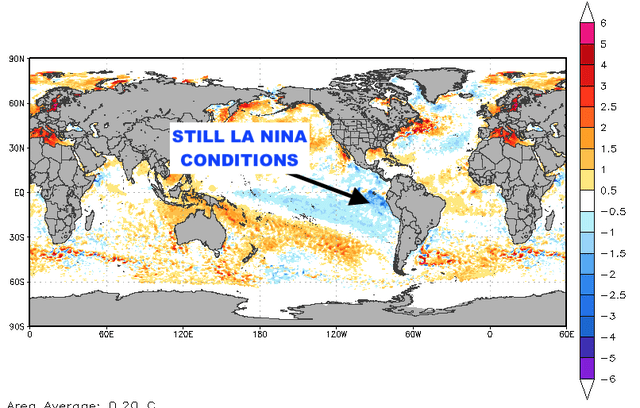

However, some of the hottest weather in years will affect many key Midwest, southern, and western natural gas and producing areas well into July. La Niña conditions are east-based. This means the correlation of July temps (see below) means a strong summer ridge over the western Midwest and Plains this summer. This is enhanced by climate change and the historic western drought.

Climate predict summer heat forecast (Weather Wealth Newsletter)

Why a potential active hurricane season in the Gulf?

Residents along the U.S. Gulf Coast cannot afford another active hurricane season. From Hurricane Harvey several years ago that wiped out Houston, Texas, to Hurricane Michael in Florida and more than four major direct hits from hurricanes in Louisiana, warming Gulf waters are a direct result from climate change.

An active hurricane season for the Gulf could develop again later this summer and fall. Historically, when you have cooling in the eastern Pacific and a NINO12 type of La Nina and above, normal hurricane season is typically the rule.

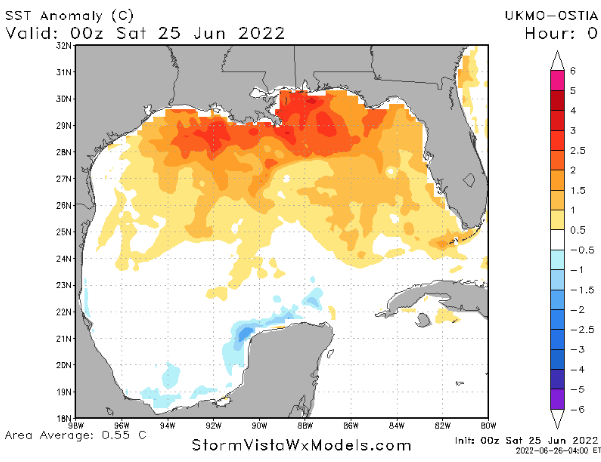

Warm Gulf waters (red) are already creating chatter about an active hurricane season for the Gulf of Mexico. There are no immediate concerns for natural gas or crude oil production from hurricanes but something to watch, for later.

Another warm start to summer for the Gulf (Weather Wealth Newsletter)

Conclusion:

While I am longer-term bearish about a variety of commodities, summer heat will provide plenty of trading opportunities in grains (CORN), (SOYB), cotton, and the natural gas market (UNG). Using bullish options strategies to catch a potential additional move up in natural gas is the way to be conservative and to lower risk.

Jim Roemer

Weather Wealth Newsletter

Be the first to comment