Tijana87

Co-produced with Treading Softly

It’s no secret that the common logic on the street is that when interest rates are rising, fixed income will be falling. Falling in trading value, that is, not falling in their payouts – that’s due to their fixed nature.

There is also a trend known as “The Santa Claus Rally” where the market frequently rallies during the last couple weeks of the year. Often, stocks that were down earlier in the year lead the rally.

Is the Santa Claus rally going to benefit fixed income? With the Fed likely to slow down and hike only 50 bps in December, this is very likely. It doesn’t matter that much to me. Someone who buys a bond at par is getting the same annual income as someone who buys it at half of its par value, the only variance is the yield on their investment is different.

This key understanding has consistently driven me to buy fixed income while it is on sale. While the market is selling, I have been buying long-term reliable income. Sure, its value may drop further tomorrow, but my income will be unchanged. Even better than that, I’ll enjoy the upside along with everyone else when it gets redeemed at par.

My patience is rewarded in the long term, and my bank account is rewarded in the near term. I don’t buy my daily coffee with the principal value of my holdings, I buy it with the income they produce!

So while others squabble over the best time to buy or sell to game the market, I look at attractive yields. When I find one I know I can rely upon, I buy it. Lock down that victory and move on.

For fixed-income picks, it’s about finding a reliable income source that pays you at a yield you’re willing to live with for the long run.

I have two such opportunities to talk about today and to lock in before the Santa Claus Rally makes them more expensive.

Let’s dive in.

Pick #1: PDI – Yield 13.2%

When discussing debt investments, you would be remiss to ignore PIMCO. PIMCO has been one of the most successful bond investment managers of the 21st century. PIMCO has demonstrated an ability to navigate bond markets with a high degree of success through several Fed and market cycles.

PIMCO Dynamic Income Fund (PDI) is a CEF managed by PIMCO that emphasizes “non-agency” mortgage-backed securities. When the rest of Wall Street was running away from mortgages in terror, PIMCO bought up MBS as fast as they could. Those MBS found their way into funds like PDI, and account for about 1/3rd of PDI’s portfolio.

This wise decision has led to great income for investors for well over a decade. PDI continues to enjoy the benefits as those older mortgages continue to make interest and principal payments. The best part is that the risks have declined substantially. Mortgage loans “amortize”, meaning that the principal is repaid with every payment. Additionally, house prices have risen considerably since 2009. As a result, the amount owed goes down while the value of the collateral goes up. PIMCO has not been involved with buying new mortgages, though, with mortgage rates over 6%, they might start moving back into that sector!

The main reason to invest in PIMCO’s bond funds is to benefit from their expertise and management. PDI has a great base of income coming from its MBS, but over time, this fund will change. Recently, PDI has added Commercial MBS exposure and leveraged loans.

When turmoil hits the debt markets, it is time for PIMCO to shine. PIMCO takes advantage of distressed sellers and fear. Stepping in when others are throwing in the towel, setting up shareholders for long-term success.

PIMCO has proven its ability to outperform, and PDI is trading at a modest 6% premium to NAV. Well below its historical heights. PDI’s dividend is well covered, with dividend coverage of over 127% in the past six months. PDI has UNII (undistributed net investment income) of $0.98. Historically, PIMCO has announced special dividends in early December to bring UNII down.

Investing in bonds can be difficult for retail investors. PIMCO funds can be a great option, allowing PIMCO’s expert team to manage the portfolio, protect it with hedges, benefit from leverage and identify bond opportunities worldwide.

Pick #2: PFFA – Yield 9.9%

Preferred stocks are not debt, but they are “fixed-income”. Preferred shares float in the grey area between equity and debt. Like debt, preferred equity pays a predetermined coupon. Unlike debt, preferred equity payments can be suspended and usually do not have a maturity date.

As a result, preferred equity typically pays a higher yield than debt while providing more predictability and stability than common equity. This makes it a very attractive investment opportunity for investors willing to take on the risk of equity but looking for more stability and predictability in income.

Virtus InfraCap U.S. Preferred Stock ETF (PFFA) is a unique investment option. PFFA is an ETF, which means that it trades at or near NAV and is very liquid. However, it also shares many features that are more typical of CEFs. PFFA is actively managed, meaning management decides what to buy or sell instead of just following an index like most ETFs. Also, PFFA utilizes leverage, which amplifies returns (both positive and negative).

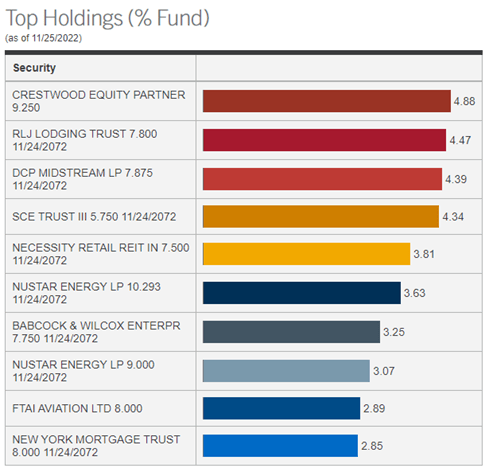

When we look at PFFA’s holdings, we can see that management’s investment style is very similar to ours at HDO. HDO members and followers likely recognize several of the names in PFFA’s top 10:

Virtus.com

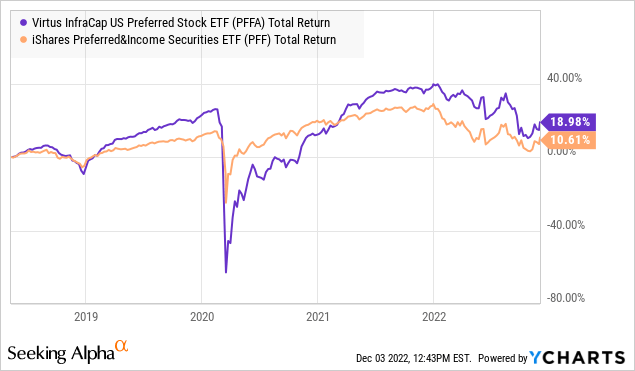

One risk of using leverage is that when there are large sell-offs in the market, a leveraged fund can underperform. Leverage increases volatility. In PFFA’s history, we can see how that impacted the fund, especially in March 2020.

However, despite the Black Swan of COVID and the significant sell-off in preferred in 2022, PFFA has materially outperformed PFF, a preferred ETF that doesn’t use leverage. We can thank PFFA’s active management for that.

When preferreds recover, PFFA will be well-positioned to outperform. One of the main negatives to holding preferred shares is the lack of liquidity. PFFA provides a liquid option to invest in preferred and is paying a great dividend too!

Conclusion

PFFA and PDI offer us significant monthly income via actively managed fixed-income investments. Let others decide when to dance around bonds and preferreds while you sit back and collect the income.

Why do all the work when you can still get almost all of the pay?

I love to own individual fixed-income holdings and discuss them frequently with my community – High Dividend Opportunities. I firmly believe every portfolio must hold at least 42 individual investments if it’s an income portfolio. This way, your portfolio is highly diversified while also being a very easily manageable size!

Once your income-generating machine is up and running, it’s off to the races, and you’re off to your hobbies and spending time with your family. It’ll let you buy those gifts for loved ones without stressing over how they fit into your budget. It’ll allow you to plan holiday travel, including some extras that might’ve otherwise been off the table.

If your portfolio can’t pay for the holidays without you having to dig into your principal value, you may want to switch out Scrooge stocks that don’t pay a dividend, keeping the cash for themselves. Switch to Santa – he gives better gifts!

Be the first to comment