JHVEPhoto/iStock Editorial via Getty Images

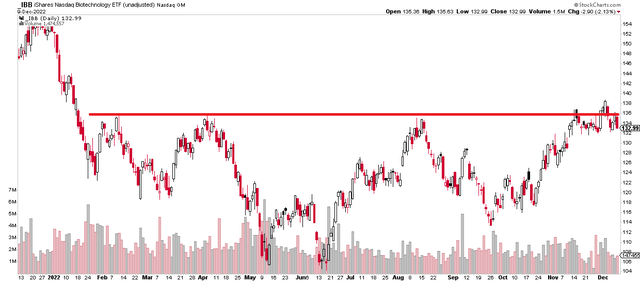

Biotech stocks, as measured by the iShares Nasdaq Biotechnology ETF (IBB), poked above resistance earlier this month, but then failed to confirm the upward thrust. The industry is now on bearish false breakout watch. It closed at the low of the day on Friday.

One large-cap member, nearly 5% of the fund, took a massive impairment charge earlier this year, but still features robust EPS growth. Is it a buy here? Or will shares take biotech lower? Let’s diagnose the situation.

IBB: Bearish False Breakout?

Stockcharts.com

According to Bank of America Global Research, Illumina (NASDAQ:ILMN) is a life sciences company offering instruments, consumables, and services for genetic analysis. The company’s proprietary products and services are used by researchers in a broad spectrum of scientific activities to gain a greater understanding of genetic variation and biological function. As such, Illumina’s tools play an important role in helping advance disease research, drug development, and the creation of molecular tests.

The California-based $33.1 billion market cap Life Sciences Tools & Services industry company within the Health Care sector has steeply negative trailing 12-month GAAP earnings care of a $3.9 billion impairment charge from its GRAIL acquisition and does not pay a dividend, according to The Wall Street Journal.

Illumina’s technology in the robust genomics market is impressive, but there are key risks around how the management team executes on the GRAIL acquisition. Moreover, competition is growing in the space which could threaten growth prospects and margins. Academic funding is important while overall demand in a post-COVID world should be a tailwind.

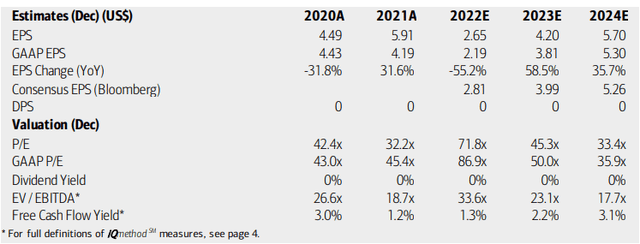

On valuation, analysts at BofA see earnings reverting to pre-impairment levels in 2023 and strong growth through 2024. Using those forward profit estimates, the earnings multiples are still quite high. The Bloomberg consensus outlook is not as positive as BofA’s forecast. Trading more than 20 times 2023 EV/EBTIDA and with a very low free cash flow yield, this stock’s PEG ratio using an optimistic 20% long-term growth rate is still high using 2023 EPS.

Illumina: Earnings, Valuation, Free Cash Flow Forecasts

BofA Global Research

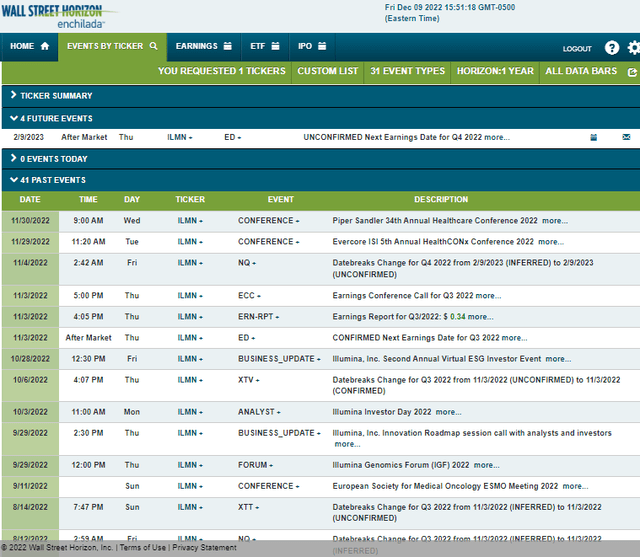

Looking ahead, corporate event data from Wall Street Horizon shows a quiet next two months. Illumina’s Q4 2022 earnings report is unconfirmed for Thursday, Feb. 9, after market close.

Corporate Event Calendar

Wall Street Horizon

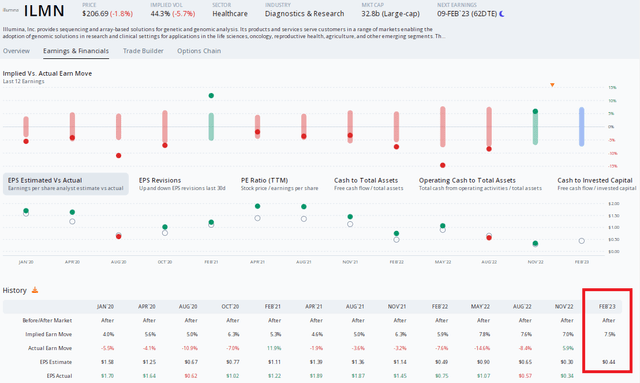

Digging into the earnings report, data from Option Research & Technology Services (ORATS) show a consensus EPS forecast of $0.44 which would be about a 10% drop from the same quarter a year ago. Meanwhile, options traders have priced in a 7.5% earnings-related stock price swing using the at-the-money straddle nearest to that date. The options appear fairly priced when assessing previous moves after earnings. Notice how bearishly shares have traded post-earnings in the last three years.

ILMN: A Modest YoY EPS Drop Expected

ORATS

The Technical Take

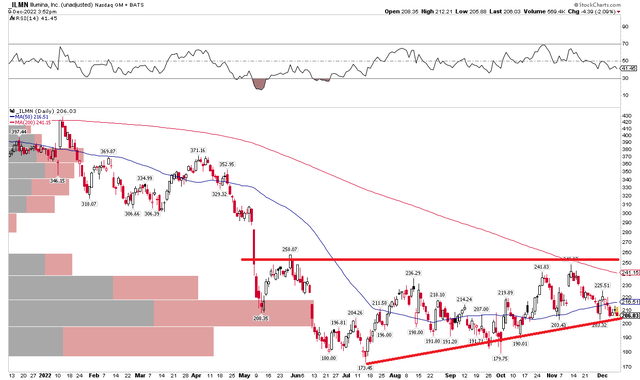

ILMN is consolidating after a massive downward move in the second quarter. I see general support for the shares at a rising support line, but there’s resistance in the $248 to the $258 range – above that, however, there is a lot of open space for the stock to rise above $300. Bulls want to see ILMN rise above the downward-sloping 200-day moving average and the Late May high near $260. A drop below $203 would trigger a bearish price objective significantly lower with the first stop being the $173 to $180 range.

ILMN: Shares In A Bearish Consolidation

Stockcharts.com

The Bottom Line

ILMN appears expensive but impressive earnings growth after the next few quarters could be positive headlines for holders. Still, the chart suggests the next move is more likely to be lower but keep your eye on this one if it climbed above $260.

Be the first to comment