Godji10/iStock via Getty Images

Investment Thesis

Covid-19 derailed Illumina‘s (NASDAQ:ILMN) 2020 progress, but 2021 has made up more than expected with 36% expected fiscal year growth in revenue, fueled by fulfilling delayed orders, easy competition, resumption of genome sequencing initiatives, and increased oncology testing demand.

Toward 2022, fading Covid tailwind and tougher competitors could hamper growth in based business. New competitors (PACB/Omniome, Singular Genomics (OMIC), BGI (OTC:BGII), Element, Ultima) are looking to penetrate the market where Illumina’s current patents roll off in 2022 and 2023.

However, Illumina will likely introduce at least one new product cycle in 2022, possibly an upgrade to the high-end NovaSeq, the company‘s top-tier sequencing system. In addition, Illumina‘s recent acquisition of Grail without EU approval will affect its ability to integrate and retain the business due to pending EU decisions and FTC case progression. Those antitrust challenges will raise the stakes for 2022, given the failed acquisition of Pacific Biosciences (PACB) sapped the confidence in the process. Grail‘s ability to win in cancer screening remains a question, and perhaps it will need heavy investment to put up a good fight with rising competitors (Guardant Health (GH), Freenome, Exact Sciences (EXAS), Delfi, Billion, to name a few).

Given mixed signals and the industry’s volatile nature, conservative investors might feel overwhelmed investing in Illumina; however, the company retains an overall buy rating due to its positive prospects and healthy financial status.

Company Overview

Illumina is the top producer of next-generation sequencing tools used by life science and drug researchers to isolate and analyze genes, including technologies to sequence pieces of DNA and RNA and put them through testing for genetic variation and biological function. Gene sequencing allows researchers to associate gene combinations with various diseases, enabling faster diagnosis, better drugs, and customized treatments. Illumina serves a specialized base of customers, including pharma and biotech companies, research centers, and academic institutions in the U.S., Europe, the Middle East, and Africa regions. As of March 26th, 2022, Illumina‘s market cap is almost $57 billion, with shares trading at almost $363 per share.

Life-Science Technology Industry

The life-science industry is coming into 2022 with a lot of positivity. Revenue growth is expected to reach the mid-to-high-single-digit range after a solid recovery of base businesses in 2021. Demand appears stable across all major customer groups.

Covid testing revenue is likely to be a decent revenue source for those involved in the process amid the recent wave of new infections and the threat of the Omicron variant. The M&A environment remains active, with liquid biopsy, a non-invasive blood test that searches for circulating tumor cells or DNA, being the main theme for a handful of players as new tests begin their commercialization.

Biopharma and Diagnostics Customers lead the Recovery

The damage from Covid-19 seems like yesterday for the life-science peers as recoveries continue and the end-market push beyond the pre-pandemic level. The pandemic affected academic and industrial clients equally as lockdowns and social distancing closed research labs and delayed instrument purchases. The peer group unanimously agrees that demand in those markets will continue to recover.

Companies exposed to Covid-19 testing and treatment will continue to see good income, at least for 1H 2022, since the emergence of new virus strains has pushed the number of new infections to the highest level since January 2021.

Both trends would benefit Illumina greatly since the company‘s top-of-the-class genomic sequencing technology is being deployed in a wide range of applications, including oncology, genetic health, public health, reproductive health, and agriculture. Illumina‘s technology is essential in fighting the pandemic as its COVIDSeq Test (ROU) and COVIDSeq Assay allow labs to identify new SARS-CoV-2 virus mutations. However, the company is projecting a slowdown in sales, from $220 million in 2021 to $130-$150 million in 2022.

Venture-back Biotech is the New Investment

Investments from venture capitals in early-stage biotech start-ups have been steadily rising over the past few years and show no signs of cooling down. Small and mid-cap biopharma companies are essential to established players, who look at acquisition at early stages to refill the pipelines.

Funding raised in 3Q 2021 surpassed that of the whole of 2020. Biotech IPOs have a good 2021 year, with current venture capitals exiting the older investment to support the early-stage funding environment.

Illumina captures this trend by creating the start-up Helix, a consumer genomics platform that makes gene sequencing more accessible. Helix has raised $100 million in total from two venture investors after the company was deconsolidated from Illumina‘s operation in April 2019. This is a prudent step as it frees up funds and resources for other sequencing drivers, such as the opportunity to acquire the cancer-screening Grail.

Although accessible genome sequencing is a nice addition to the consumer market, it is neither the most profitable segment nor the direction Illumina is heading toward, i.e., life science and liquid biopsy. The company took a necessary step to tighten its portfolio, refocus its resources, leave the majority of the investment risks to the venture capitalists, but at the same time retain a small stake in that market.

Financial Performance

The company‘s latest revenue topped at $1.2 billion, including $50 million of Covid surveillance revenues and $10 million from Grail, beating the analyst consensus figure by 5%. Sales increased by 26% in Q4 YoY, with revenue from the sequencing instruments up by 29%. Non-GAAP EPS, although reduced by 59.09% compared to the same period of 2020, exceeded the analyst consensus by 26 cents.

Looking ahead, Illumina‘s revenue guidance for 2022 is around $5.16-$5.25 billion (a growth rate of 14%-16%) and EPS of $4.00-$4.20. The guidance includes $70-$90 million of Grail revenue contribution, which confirms Illumina‘s confidence in a positive outcome for the antitrust cases in the EU market.

|

Particulars |

Q4 2020 |

Q4 2021 |

% Change |

|

Revenue ($ million) |

953 |

1,190 |

26% |

|

Net Income Available to Common Stockholders ($ million) |

257 |

112 |

-56.42% |

|

Basic Earnings per Share ($) |

1.76 |

0.72 |

-59.09% |

|

Diluted Earnings per Share ($) |

1.75 |

0.71 |

-40.57% |

|

Share Price ($) |

443.38 |

356.45 |

-19.61% |

Despite double-digit growth in sales for Q4, net income was affected by large Research & Development costs ($350 million) and M&A expenses ($39 million).

Financial Position

Illumina has a good liquidity position. Its current ratio is 2.48, and its cash ratio is 1.83, indicating its capability to cover every dollar of current liabilities (the current assets and current liabilities are $2.45 billion and $0.914 billion, respectively). Illumina‘s liquidity is on par with the industry median levels for the current ratio (2.48) and exceeds the industry average cash ratio of 1.23, continuing its legacy of being financially stable. Illumina‘s free cash flow for the MRQ is considerably lower than the previous year because of the outflow of cash for the acquisition of Grail.

Illumina‘s capital structure consists of 96.1% equity, 0.1% short-term debt, and 3.8% long-term debt. Since debt is relatively cheaper than equity, the management should optimize the cost of capital by adding more debt into the mix. It will also provide a tax shield to lower the effective tax rate. Nevertheless, staying low-leveraged could benefit the company when the economy is in a downturn.

Illumina does not pay out a dividend since the company seems to have plenty of projects to reinvest its earnings. Two of its closest competitors, Agilent Technologies (A) and Thermo Fisher (TMO), have a pay-out ratio (Dividend expense divided by Net Income) of 13.3% and 5.39%, respectively. In comparison, the median for the industry is 2.69%, with a handful of other firms not yet paying any dividends. Given the inconsistency of dividend policy across the industry, Illumina is not in a disadvantageous position to attract investors.

What‘s next for Illumina?

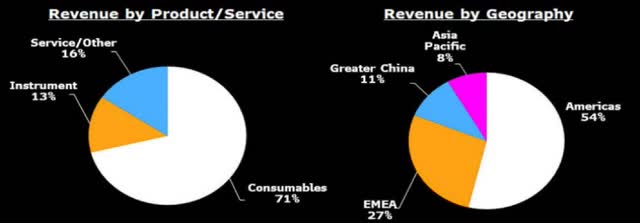

Illumina‘s genome sequencing technology is reaching more applications than ever, gradually being deployed in oncology, genetic health, reproductive health, population genomics, and infectious diseases, to name a few. According to the company’s estimation, its addressable markets are worth $20 billion in sales. It significantly penetrates only the life-science market, with about 50% captured, while the reproductive and oncology fields remain prospects.

Illumina has placed its next bet on biopsy-based cancer screening by acquiring Grail, its own spin-off company. However, the outcomes of the incoming antitrust challenges and potential competition will determine how successful this purchase will be. The company is confident in a positive outcome for the antitrust processes, which is reflected in the forecasted growth rate of 14%-16% for 2022.

Illumina has also identified the opportunity of moving genome sequencing out of the labs and into the clinics for wider accessibility by forming Helix with $100 million of funding from venture capitals. Many applications in genetic health, reproductive health, or agriculture that rely on genome sequencing surely provide Helix with new market opportunities.

Conclusion

Being the industry leader in genome sequencing, Illumina has shown the world lots of potential in this field and uncertainties from deploying new technologies into the market. The addressable market is estimated to be worth $20 billion, and the company has barely scratched the surface.

On the other hand, looming antitrust challenges and rising competition, especially in oncology, will likely be the headwinds for Illumina in 2022. Its new ventures, Grail and Helix, will need time to prove their worth in the company‘s portfolio.

Nevertheless, having a strong financial base helped the company weather the pandemic well and be on the right track to recovery. Illumina is a good long-term investment since its projects and research will take time to realize returns when its products and patents make their way into the market. Speculators should avoid the stock as it tends to exhibit short-term fluctuation.

Be the first to comment