Kevin Dietsch/Getty Images News

The worst sort of business is one that grows rapidly, requires significant capital to engender the growth, and then earns little or no money. Think airlines. – Warren Buffett

If you want to be a Millionaire, start with a billion dollars and launch a new airline. – Richard Branson

One of the toughest industries in which to make a profit is the airline industry. It is famous for the amount of bankruptcies it has seen. In fact, Southwest (NYSE:LUV) used to joke that they have to beat the competition not only once, but many times as they keep entering and exiting bankruptcy.

Why is it such a tough industry? There are many reasons, including the fact that there is relatively little differentiation between flying with one airline or another. It also has the problem that it costs almost the same to fly a plane with one passenger as it does a full one, incentivizing very aggressive price competition among the airlines to make sure the planes fly full, creating intense competitive rivalry. And if we look at some of Porter’s forces, it is clear that airlines have a difficult bargaining position with oil companies and airplane manufacturers, as well as threat of substitution (people can decide to drive or just not travel if prices become too high). All of this is reflected in the very poor margins the industry has, with the worse gross margins of any industry according to this list maintained by respected Professor Aswath Damodaran.

| Industry Name | Number of firms | Gross Margin |

| Air Transport | 21 | 1.41% |

Competitors

Southwest has a large number of competitors, including legacy carriers such as Delta Air Lines (DAL), American Airlines (AAL), and United Airlines (UAL); low-cost carriers like JetBlue (JBLU), Alaska (ALK), and Virgin America; and ultra-low-cost carriers such as Spirit (SAVE), Frontier (ULCC), and Allegiant (ALGT).

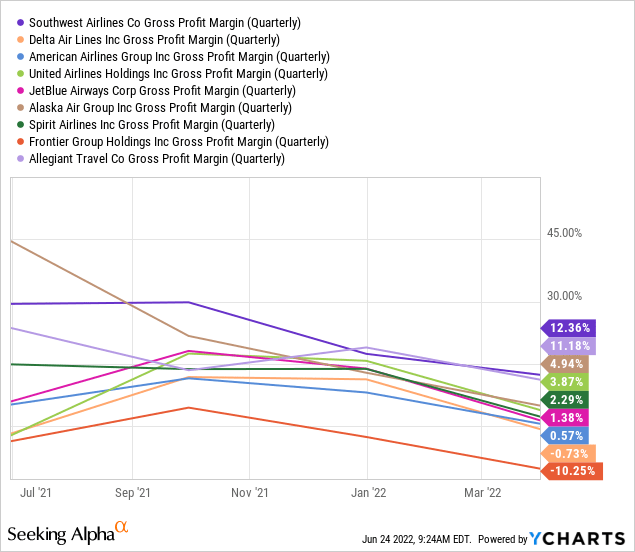

Southwest’s domestic operating expenses per available seat-mile, excluding fuel, are lower than those of the legacy and low-cost carriers. Only the ultra-low-cost carriers have even lower costs per seat-mile. Southwest’s business model and point-to-point network provide unit cost advantages compared with the majority of the domestic airline industry. This competitive advantage is reflected in Southwest having the best recent gross profit margin of the entire group.

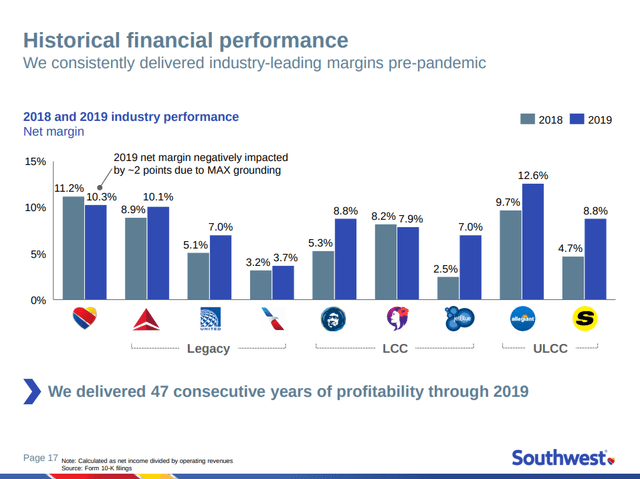

This is more the rule than the exception, as can be seen below, even pre-pandemic Southwest consistently delivered industry-leading margins. Just as impressive, the company delivered 47 consecutive years of profitability through 2019. Of course, remaining profitable during the worst of the pandemic was next to impossible for an airline.

Southwest Investor Presentation

Balance Sheet

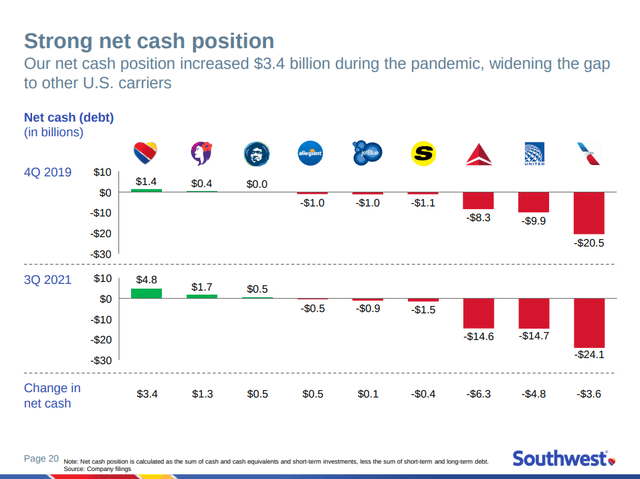

The company also has a really strong balance sheet, with more net cash than competitors, especially the legacy carriers that are deeply in debt.

Southwest Investor Presentation

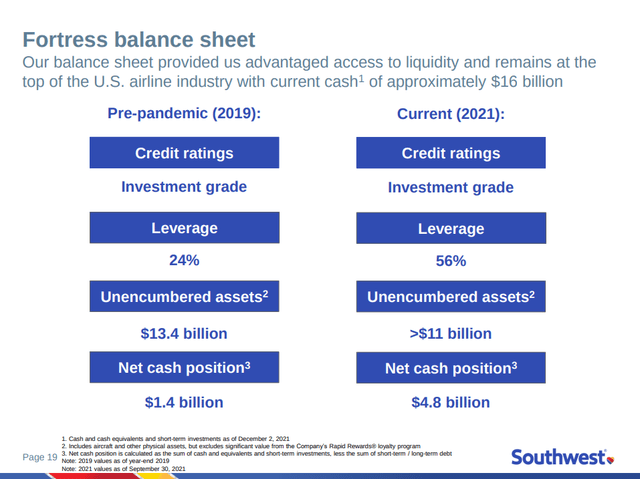

Southwest has maintained an investment-grade credit rating, even if the company is more leveraged now as a result of the pandemic. It still has a good amount of unencumbered assets and a solid net cash position.

Southwest Investor Presentation

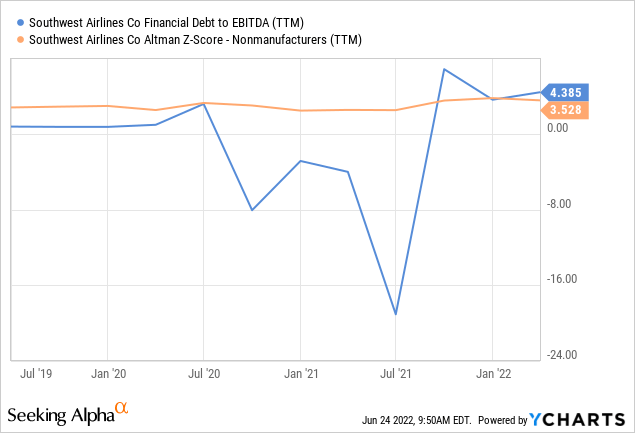

The financial debt to EBITDA ratio is still a little high, in our opinion, and hopefully will continue to come down if the recovery continues. The Altman Z-score is above 3.0, meaning there is little risk of bankruptcy in the short to medium term for the company.

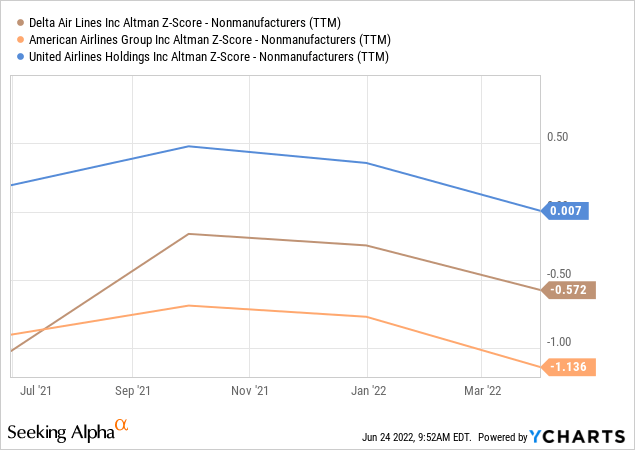

Its legacy competitors meanwhile have Altman Z-scores significantly below the 3.0 threshold, so investors should be very cautious before investing in these companies.

Pandemic Impact

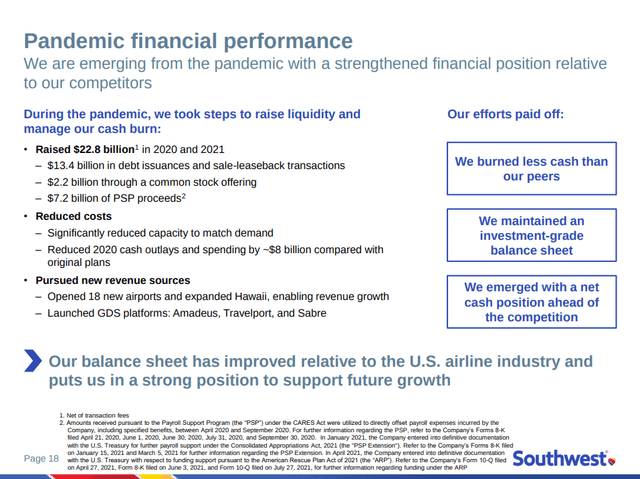

Overall, Southwest’s response to the harsh conditions resulting from the pandemic was relatively good, managing to burn less cash than its peers, maintaining an investment-grade balance sheet, and finding a way to significantly reduce capacity to match demand.

Southwest Investor Presentation

Oil Prices Impact

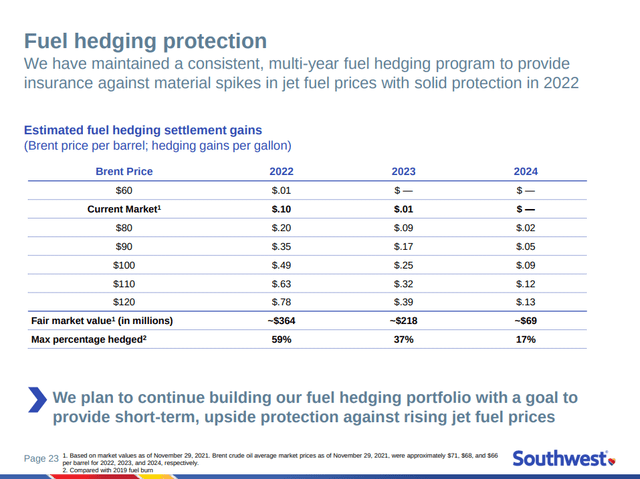

Of course, one of the new key challenges in 2022 is the elevated oil prices. Fortunately for Southwest, they have had a fuel-hedging program for a while, which provides insurance against material spikes in jet fuel prices, and which is helping in 2022.

Southwest Investor Presentation

Competitive Advantages

Southwest’s main competitive advantage is that it is a very efficient operator. It also benefits in that over 85% of Southwest’s sales are through its own distribution channel, where prices among carriers are difficult to compare.

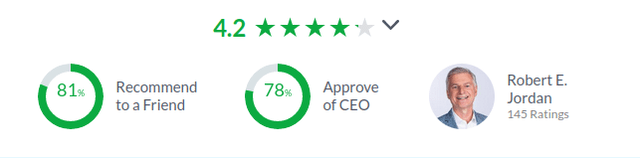

Southwest also likely has a history of treating its employees better than the competition, and this has resulted in a more motivated work force, and better treatment of passengers. Looking at Glassdoor, we see that its average rating is a very high 4.2, and that most employees would recommend the company to a friend and approve of the CEO.

Five-Year Targets

As part of its five-year targets, the company expects to grow its available seat-miles by mid-single digits. It expects to reinstate the dividend in 2023, and implement share repurchases depending on free cash flow generation and debt repayments. It also plans to maintain carbon-neutral growth to 2019 levels and minimize the company’s carbon footprint, supporting its long-term goal to be carbon-neutral by 2050.

Valuations

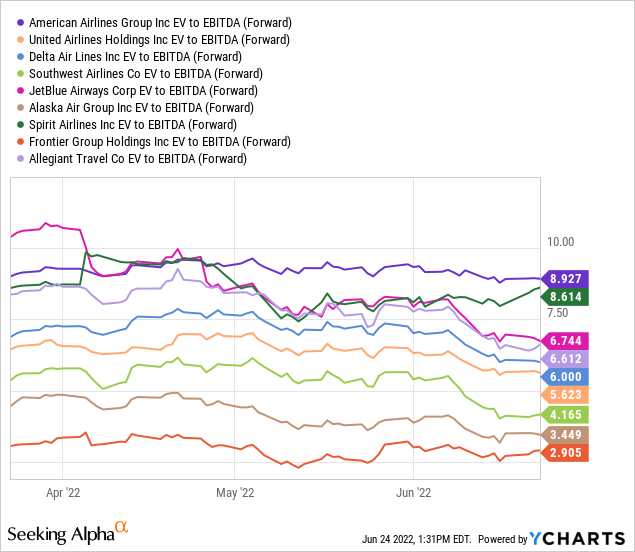

One of the few reasons to invest in the airline industry is that valuations are not too demanding. For instance, if we look at forward EV/EBITDA most of the companies look pretty cheap. We are actually surprised that Southwest being one of the strongest airlines, if not the strongest, is trading with only a 4.1x forward EV/EBITDA multiple.

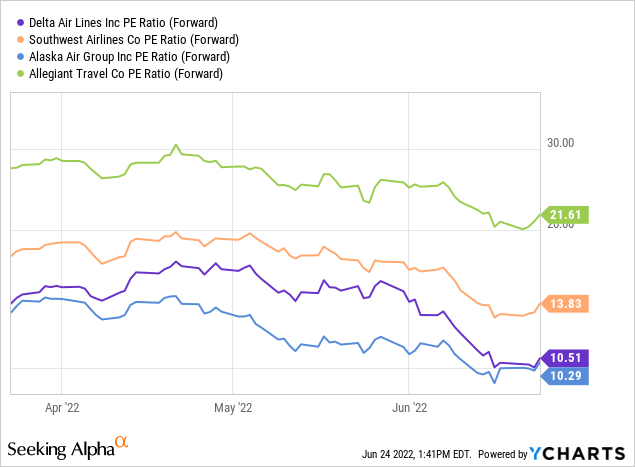

Looking at the forward price/earnings ratio for those companies for which analysts expect meaningful earnings, we see that Delta and Alaska have multiples around 10x, Southwest is a little more expensive as we would expect given the higher quality at ~14x, and Allegiant is trading at ~21x. Given that this is possibly only the start of the recovery, these multiples could turn out to be bargains if there is a full travel recovery to pre-Covid levels. Unfortunately, at the moment, none of the companies is paying a dividend.

Risks

The air transport industry is a very tough industry, and the pandemic only made it worse. Complicating things further in 2022, fuel prices are extremely high and there is growing risk of a recession. Still, Southwest is one of the best-positioned airlines to face these challenges, and we believe it is one of the best investment options should one choose to invest in this industry.

Conclusion

Southwest has done something extremely hard, being profitable for many years in the extremely competitive airline industry. We believe this is an industry that should probably be avoided by most investors, but if one decides to invest, we believe one of the best options is Southwest. Southwest has industry-leading margins, a strong balance sheet, and a history of efficient operations.

Be the first to comment