Olivier Le Moal/iStock via Getty Images

Investment thesis

Every biotechnology company has its moments of breakthrough where major goals are reached and substantial value for its investors is created. This is one of those moments for Idorsia Pharmaceuticals Ltd (OTCMKTS:OTCPK:IDRSF). The company is now turning from being a research and development company into a commercial company with its first product just approved by the Food and Drug Administration (FDA) and its second product expected to be approved in Japan during Q1 2022. This year is fulfilled with potential positive catalysts for Idorsia, which have the potential to strike out risk factors and value the company at a higher price. I don’t consider only the potential of its now approved product, which is indeed a blockbuster candidate, but I will show how promising other products in the pipeline are and the potential impact they can have on Idorsia’s revenue and cash flow. Investors who want to take advantage of a company still valued at a price where the market is pondering more its risks than its opportunities, should consider a position in Idorsia.

Company Overview

Idorsia Pharmaceuticals is an independent biopharmaceutical company headquartered in Allschwil/Basel, Switzerland. The company started in early 2017 when Actelion Pharmaceuticals Ltd, as part of the overtake-transaction by Johnson & Johnson (NYSE:JNJ), agreed to spin out its research and early-stage clinical development assets into a new legal business structure, which was then listed on the SIX Swiss Stock Exchange (SIX:IDIA) by June of the same year. Idorsia began its operations with over 650 highly qualified professionals, more than CHF 1B in cash, and 11 compounds in the pipeline. Today Idorsia has grown to a fully operational biopharmaceutical company, specialized in the discovery, development, and commercialization of innovative small molecules with over 1,000 employees from 38 nationalities, a significant Research and Development (R&D) pipeline, state-of-the-art facilities, and a strong balance sheet. As the company states, their success depends on their people, and Idorsia can count on a strong and visionary executive team, led by CEO Jean-Paul Clozel, Founder and CEO of Actelion which in 2017 was taken over for $30B by Johnson & Johnson. Jean-Paul Clozel and his wife Martine Clozel, Executive Vice President and Chief Scientific Officer of Idorsia, are deeply involved in the success of Idorsia, by capitalizing on the triumphant transaction with Actelion, the couple now owns 34.42% of Idorsia’s voting rights and a position of 29.02% of the share capital valued at over $1B at the actual share price. A commitment that shows confidence and leads to thinking that the couple is determined to repeat the success story of Actelion with Idorsia and bring the company to sustainable profitability.

Jean-Paul Clozel and his wife Martine Clozel Idorsia

Target Diseases, Pipeline, and Partnerships

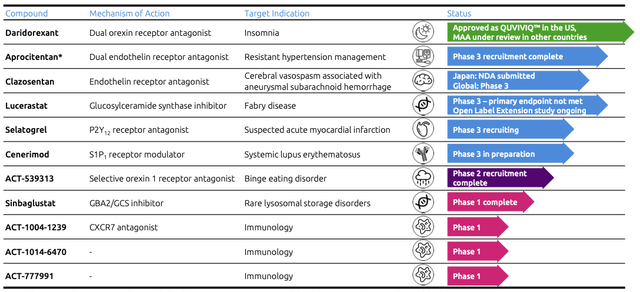

Idorsia has a balanced and diversified clinical development pipeline that covers multiple therapeutic areas such as cardiovascular and immunology disorders, the central nervous system, as well as orphan disease. Four compounds are in Phase 3, Cenerimod is in preparation for Phase 3, one compound is in Phase 2 and the remaining are still in the early stages of development.

To develop and commercialize some compounds, Idorsia entered partnerships and collaboration agreements with different companies. Jannsen Biotech, a subsidiary of Johnson & Johnson, collaborated with Idorsia to jointly develop Aprocitentan, a compound for resistant hypertension management, with a market size of an estimated $41.12B by 2023. The two companies are sharing the costs of Phase 3 development equally, Jannsen has sole commercialization rights worldwide and Idorsia will be entitled to royalty payments of 20% of annual net sales up to $500M, 30% of annual net sales between $500M and $2B and 35% of annual net sales above $2B. Jannsen also shares 8% of the net sales of Ponesimod with Idorsia, a compound that was developed by Actelion and treats adults with relapsing forms of multiple sclerosis. Peak potential sales for this compound are estimated at $200M to $400M per year.

Idorsia entered into a global agreement with Antares Pharma (NASDAQ:ATRS) to develop an innovative subcutaneous auto-injector of its fast-acting compound Selatogrel, against acute myocardial infarction. While Idorsia will be responsible for the development of the compound, the application and obtaining of global regulatory approvals, as well as the global commercialization of the product, Antares will supply Idorsia with fully assembled and labeled products, by providing its QuickShot auto-injector, at cost plus margin. The global myocardial infarction market is expected to grow at 5.9% compound annual growth rate (CAGR) during the period between 2021 and 2028. During 2020 in the 7MM countries (the United States, Germany, Spain, Italy, France, the United Kingdom, and Japan) the estimated myocardial infarctions reached 13,123 cases and those markets are estimated to grow by 3.59% (CAGR) between 2018 and 2030. In the US alone, 7.5 to 8M people have survived a heart attack, and are potentially at risk for another heart attack or myocardial infarction, which makes them the audience for Selatogrel.

Another collaboration agreement was entered in 2020 with Neurocrine Biosciences (NASDAQ:NBIX) for the development and commercialization of ACT-709478, a selective, orally active, and brain-penetrating T-type calcium channel blocker, for the treatment of rare pediatric epilepsy, and research collaboration to discover, identify, and develop additional novel T-type calcium channel blockers. The global pediatric epilepsy drug market is estimated to surpass $1.6B by 2026. Neurocrine Biosciences has a global license to develop and commercialize the compound, which is currently investigated in Phase 2 studies. Idorsia already received payments of $50M and Neurocrine Biosciences will provide additional $7M in funding to Idorsia for the research collaboration to discover, identify and develop additional novel T-type calcium channel blockers. In addition to those initial payments, Idorsia may also receive up to $365M in additional development and regulatory milestone payments, as well as one-time commercial payments based on sales thresholds. Upon completion and commercialization of the product, Idorsia will have the right to receive a tiered royalty ranging from the low double-digits to upper teen percentage in the US and a tiered royalty at moderately lower rates outside the US, based upon combined global net sales.

Idorsia transferred its license, collaborative development, and commercialization agreement with ReveraGen BioPharma for Vamorolone, a treatment in Duchenne Muscular Dystrophy, to Santhera Pharmaceuticals Holding AG (SIX:SANN) obtaining $3.5M in cash and 4M shares of Santhera. By the end of September 2021, Idorsia held a position of 18.45% of the voting rights and 16.10% of the share capital of Santhera, becoming by far the biggest shareholder of the company. In their agreement, Idorsia will be entitled to development and sales milestones, as well as low single-digit percentage payments on net sales of Vamorolone.

Last but not least, Idorsia entered two collaboration agreements in regard to Daridorexant for the treatment of insomnia, the first product which just recently on January the 10th, 2022, got approval from the FDA for being sold in the US and is under review by the health authorities in Europe, Switzerland, and Canada. In Japan, Idorsia entered into an exclusive license agreement for the supply, co-development, and co-marketing of Daridorexant with Mochida Pharmaceutical Co., Ltd. (TYO:4534). Other than development and regulatory milestone payments, in the agreement, Idorsia will be entitled to sales milestones and tiered royalty payments based on net sales of Daridorexant by Mochida. For launching the product in the US, Idorsia entered a commercial agreement with Syneos Health (NASDAQ:SYNH), a leading Contract Commercial Organization (CCO) which will significantly accelerate the introduction and commercialization of Daridorexant in the US.

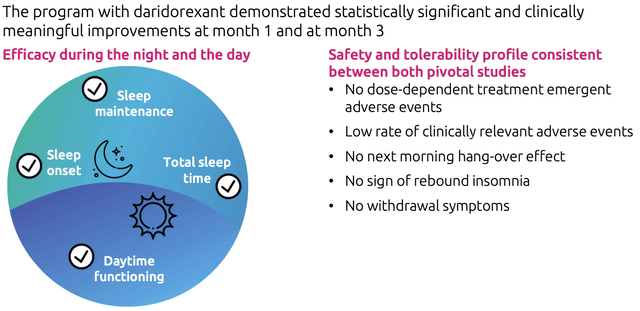

Daridorexant

The chronic insomnia market is growing at an estimated 7.29% CAGR over the years 2018-2030 in the 7MM countries and this type of insomnia represents only 10-15% of the known sleep disorders with 30-50% of the adults experiencing short-term or intermittent insomnia. However, both disorders are relevant to Daridorexant. With estimated 25 million Americans affected by insomnia and only about 30% of them diagnosed, the market potential is huge. The US accounted for approximately 66.42% of the global market size of chronic insomnia in 2020 with more than 2,500,000 patients in 2020. For patients affected by chronic insomnia, the primary goal is to improve sleep habits and alleviate symptoms such as distress and dysfunction. Those symptoms can be managed with the help of psychological therapy, pharmacologic treatments, or a combination of both. The traditional prescription drugs for the treatment of insomnia are benzodiazepines which are known, as the CEO of Idorsia Jean-Paul Clozel affirmed in a recent interview, to carry a high risk of addiction other than being labeled with some black box warning for serious safety risks. Approved under the name of QUVIVIQ in the US, Daridorexant is a dual orexin receptor antagonist (DORA) with significantly better sleep maintenance, fast absorption for rapid sleep onset, and a pharmacokinetic profile with 80% of the substance being eliminated after a night of sleep. The drug works differently from traditional benzodiazepines, which modulate neurotransmitters and have sedative, sleep-inducing, and muscle relaxant properties; Daridorexant instead, inhibits the binding of orexins to reduce excessive wakefulness. It has shown to have a significant improvement in daytime functioning, which is basically what everyone would like to experience when taking a sleeping drug: fast sleep-in, good and lasting sleep maintenance, and no or just slight residual effects the day after.

Despite being an innovative treatment for insomnia, Daridorexant is not the only DORA drug on the US market. Merck’s (NYSE:MRK) Belsomra has been available since 2014 but comes with several warnings on its label regarding next-day residual effects, abuse and dependence potential, avoiding driving or drinking alcohol, among other safety risks and side effects of concern. Eisai’s (TYO:4523) Dayvigo was approved in December 2019 and launched during 2020 but comes with similar warnings. Other than in the US, Belsomra is available only in Japan and Australia, while Dayvigo is approved in Japan, Australia, India, Hong Kong, and Canada. Both competitive products are not allowed to be sold in Europe or Switzerland, where instead Daridorexant is now under revision. As Jean-Paul Clozel explained, it’s been 30 years since the last innovation in insomnia drugs in Europe and the market is really eager to get a new drug with fewer safety warnings and secondary effects. In his point of view, the market potential in European countries is still underestimated, since e.g. in France benzodiazepines are considered to be addictive and treatments should not exceed two weeks. Considering its favorable safety profile, Daridorexant is poised to be the “best-in-class drug” available in the US and Japan and has the potential to be the only DORA-drug on the market in the EU, if the drug gets approval from the health authorities.

Sales of Daridorexant are estimated to peak an average of $1B, while lower range estimations are more pessimistic with analyst Bruno Bulic at Baader Helvea Equity Research estimating peak sales at CHF 378M (equivalent to $415M), on the higher range analyst Stefan Schneider at Bank Vontobel (SIX:VONN) estimates CHF 1.30B (equivalent to $1.42B). The high variation in sales estimations is caused on one side by the massive potential in the insomnia market while considering the positive drug profile of Daridorexant, on the other side, sales for Merck’s Belsomra have been much lower than expected, reaching just $327M in 2020, and also sales of Eisai’s Dayvigo started slowly, making only Yen 3.10B (equivalent to $27.30M) in 2020. My take here is, these drugs are first of all coming with quite a negative labeling regarding safety risks and secondary effects when compared to Daridorexant, and the market, in general is still flooded by low-cost/high-risk generic insomnia drugs while awareness of a more safe and efficient DORA drug, ist still missing and can be achieved through a better market penetration strategy as Idorsia is implementing, starting with its unbranded awareness campaign “Seize the Night & Day” in partnership with actress Jennifer Aniston.

Financial Overview

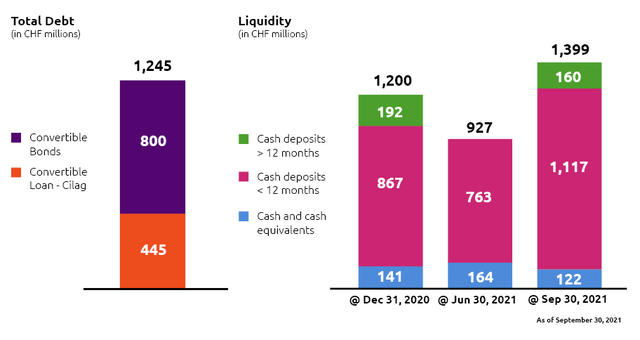

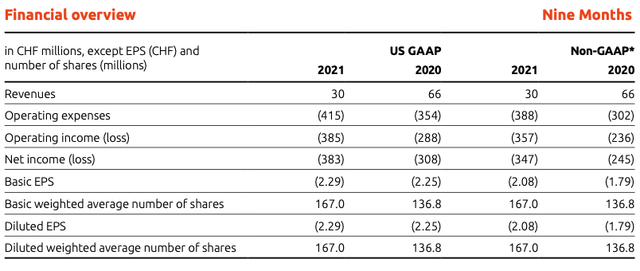

Idorsia still doesn’t have a product on the market, which generates sales, therefore, its source of revenue exclusively comes from either collaborations agreements, milestone achievements, or royalty payments. On September 30, 2021, Idorsia’s liquidity reached CHF 1.39B (equivalent to $1.52B), composed by CHF 1.11B (equivalent to $1.21B) in cash deposits under 12 months, CHF 160M (equivalent to $175M) in long-term deposits and CHF 122M (equivalent to $1.33M) in cash and cash equivalents. Revenue for the first nine months of the year 2021 was CHF 30M (equivalent to $33M) compared to CHF 66M (equivalent to $72.20M) during the same period in 2020.

The revenue stream was generated from the collaborations agreements with Neurocrine Biosciences (CHF 3M, equivalent to $3.28M), Jannsen Biotech (CHF 8M, equivalent to $8.75M), Roche (CHF 4M, equivalent to $4.38M), Mochida Pharmaceutical (CHF 4M, equivalent to $4.38M), settlement of exchangeable notes with Santhera Pharmaceuticals (CHF 12M, equivalent to $13.11M) and the revenue share from Johnson & Johnson (CHF 0.40M, equivalent to $0.43M). Idorsia’s cash-burn rate accelerated from CHF 354M (equivalent to $386.92M) during the first nine months of 2020 to CHF 415M (equivalent to $453.60M) during the same period in 2021.

Until consistent profitability will be achieved, Idorsia has to rely on external capital sources, such as loans, capital increases, or convertible debt to cover its expenses and develop its pipeline. As of September 30, 2021, Idorsia’s total debt amounted to CHF 1.24B (equivalent to $1.35B), composed of CHF 800M (equivalent to $874.40M) in convertible bonds and CHF 445M (equivalent to $486.38M) of convertible loan granted by Cilag AG a Swiss-based subsidiary of Johnson & Johnson. Cilag started with a loan of CHF 580M (equivalent to $634M) on June 15, 2017, which was agreed to be convertible into ordinary shares of Idorsia, accounting for 32% of the total share capital at the time the loan was provided. In the meantime, Cilag already converted CHF 135M (equivalent to $147.55M) into 11.79M shares in 2017 and sold them in a secondary offering, while converting another CHF 110M (equivalent to $120.23M) into 9.6M shares in October 2021. The remaining convertible loan is therefore still valued at CHF 335M (equivalent to $366.15M) which can be converted into approximately 29M shares of Idorsia. The debt maturity of this convertible loan is on June 15, 2027. Idorsia also issued two convertible bonds with a denomination of CHF 200M (equivalent to $218.60M), 0.75% annual interest rate, and a conversion price of CHF 33.95, with maturity on July 17, 2024; and CHF 600M (around $655.80M), a coupon of 2.125% and a conversion price of CHF 31.54, with maturity on August 4, 2028. The credit facility over CHF 250M (equivalent to $273.25M) offered by Johnson & Johnson for 15 years since the foundation of Idorsia, was in fact still undrawn and terminated in the third fiscal quarter of 2021. Until today, Idorsia raised capital three times through the issuance of new shares. In July 2018, as well as May and October 2020, by receiving gross proceeds of total CHF 1.37B (equivalent to $1.5B). The company will still need to increase its liquidity through debt or equity issuance, since its actual liquidity is estimated to last for the coming 18-24 months and the development of its pipeline, despite being very promising, is still consuming approximately $500-600M yearly.

Potential sources of revenue and cash flow

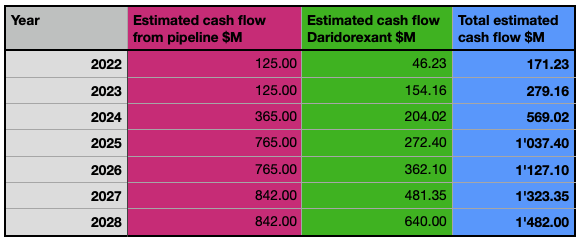

Idorsia is among the most promising and interesting biotechnology companies in Europe. Besides Daridorexant, its pipeline has the potential to grow to a very profitable product portfolio. Based on the data I already exposed and the progress of the individual products in the pipeline, I want to give a quick and simplified estimation of the revenue and cash flow in the coming 7 years.

-

Ponesimod: Estimated yearly sales of $200-400M, of which Idorsia receives royalties of 8% equivalent to approximately $20M yearly, starting from 2022.

-

ACT-709478 (in Phase 2): Expected milestone payments of $365M and subsequent license royalties averaging 15%, which will generate an estimated yearly revenue of $30M. The milestone payments distributed over the next 5 years could average $73M yearly, after that I estimate $30M yearly of revenue starting from 2027-2028.

-

Clazosentan: Considering that the global cerebral vasospasm market is expected to account for $2.85B by 2028, and assuming an average 5% market share for Idorsia with the launch of the product in 2022 in Japan, I estimate an initial average revenue of $40M for the years 2022-2024 and $140M yearly starting from 2025.

-

Aprocitentan: Assuming an average of $800M in global sales (peak sales are estimated to reach $2B) and Idorsia obtaining royalty payments averaging 30% yearly from its license agreement with Jannsen Biotech, this product could generate around $240M yearly in cash, starting from 2024-2025.

-

Selatogrel: Assuming 4M units sold yearly at a price of $100, this very promising product could generate approximately $400M in yearly revenue, starting from 2025.

-

Cenerimod: The global Systemic Lupus Erythematosus (SLE) treatment market is expected to reach $3B by 2025, assuming an average 5% market share for Idorsia, I estimate $150M yearly revenue starting from 2027.

In these estimations, I don’t consider Lucerastat, which will now be discussed with the health authorities and define the regulatory pathway after the product did not meet the primary endpoint of reducing neuropathic pain during 6 months of treatment. Despite this, the global Fabry Disease treatment market is expected to exceed $3B by 2026, a significant market in which Idorsia still has the potential to take its market share. I also don’t consider the other products in the pipeline, as well as eventual further partnerships or milestone payments (e.g. from Vamorolone) aside from the one I listed previously. For the revenue which is not coming from milestone payments or royalty agreements, I suppose Idorsia will generate an 80% margin on it. The consensus for the revenue made with Daridorexant during 2022 amounts to CHF 52.80M (equivalent to $57.71M), rising to CHF 176.30M (equivalent to $192.70M) by 2023. Considering a constant growth rate of 32.93% CAGR until achieving, let’s be more pessimistic than the consensus, only 80% of the estimated peak sales of $1B, we can add its cash stream during the estimation period of seven years.

Author

In my model, the convertible bonds are refinanced e.g. with a lower strike price, without having a significant impact on the financial structure of the company. The costs of the company will increase in terms of selling, general, and administrative expenses, but most probably decrease in terms of research and development expenses for the products which will reach market maturity. These two opposite effects will probably result in the costs averaging at approximately $500-600M yearly, resulting in a possible break-even for Idorsia in 2025 and therefore a substantial upside potential for the stock price in the coming years.

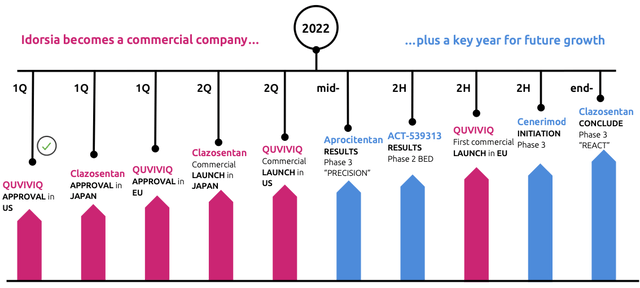

The road ahead in 2022

In 2022 Idorsia will experience what the CEO calls a “transformative year”. Two products are expected to be launched in Q2 2022, transforming the company from a pure developer to a commercial biotechnology company. Daridorexant (QUVIVIQ) will first start in the US, while Clazosentan just got approval in Japan on the 20th of January. Other compounds are expected to get the results of their development in phase 2 (ACT-539313) or phase 3 (Aprocitentan and Clazosentan). After the expected approval of Daridorexant in the EU during Q1, Idorsia is expected to launch the product in the major countries in Europe.

Risks

As a biotechnology company with not yet any revenue-generating product on the market and substantial cash consumption for its pipeline development, Idorsia is exposed to considerable risks which have to be considered from an investor point of view. As every pharma- or biotech-company, Idorsia can be confronted with failures in its drug development at any stage. Even if a product reaches successfully the end of its development path, it still has to be accepted by the healthcare authorities. A major failure could significantly affect potential revenues and further postpone the profitability of the company.

Idorsia can count on a very experienced research team led by Martine Clozel, with a lean and fast decision-making process and which is used to collaborate for decades. This setup is ideal for avoiding major failures, other than the fact that the pipeline is broadly diversified and Idorsia can count on many very promising compounds, by targeting different indications and diseases. The reliance on key personnel like its two founders, who are undeniably two major pillars in the company, carries its risks. Jean-Paul Clozel and his wife Martine Clozel are both 66 years old, and Idorsia will need a solid succession plan for achieving its targets.

Competition is another aspect which Idorsia has to consider now while introducing its first product in the market. In particular related to Daridorexant, the market is still dominated by the established generic insomnia drugs, and despite Idorsia’s product being clearly a better and safer product, the consumer needs to be informed about its advantages and converted to a customer. Aside from the two discussed competitive products, another compound, Seltorexant developed by Johnson & Johnson, could affect the potential revenue of Daridorexant. Idorsia will need to be creative and efficient in its marketing approach in order to exploit the full potential of its first product.

Last but not least, the risk of being diluted as an early investor in a biotechnology company, is a major concern. Idorsia’s reliance on external capital sources such as convertible loans or bonds, as well as the issuance of new shares, bears the risk of dilution for the actual shareholders, especially if the capital increases are oriented to only few preferential investors, the common shareholder is unable to participate and will certainly be diluted.

Conclusion

Investing in biotechnology companies is almost always associated with a higher risk, that’s why it’s reasonable to invest in companies with a higher probability of success and which can mitigate risks better than its peers. Idorsia has many elements which could lead to great success, bringing back memories of what happened with Actelion back in 2017. Despite being highly dependent on external capital, the company is now looking forward to a promising medium-term development of its pipeline, starting already this year with the launch of two products in its most important markets. Investors who are confident about the market potential of its products and trust the management with its proven achievements should definitely consider Idorsia at this point, since the coming year, will show how the company will turn into a completely developed biopharmaceutical company with sustainable profitability in the near mid-term.

Be the first to comment