pedrosala

The Voya Infrastructure Industrials and Materials Fund (NYSE:IDE) is a closed-end fund that investors can use to gain exposure to sectors that otherwise may not have much presence in their portfolios. This is important because there might be opportunities in some of these sectors that have historically not gotten much attention. For example, Goldman Sachs is predicting a commodities supercycle led by China. From Reuters:

Goldman Sachs expects a commodities supercycle driven by China and the capital flight from energy markets and investment this month after concerns triggered by the banking sector.

We saw the early stages of this play out over the last year or so as copper surged early in 2024 due to expectations of rising demand for electricity needed to power artificial intelligence data centers, electric cars, and other things. We saw a similar surge in uranium around the same time due to expectations that nuclear power will become more popular as electricity needs rise. Finally, gold prices continue to surge as foreign central banks move to diversify away from the U.S. dollar and investors seek a hedge against expectations that inflation will not be going away anytime soon.

Certain types of infrastructure are also likely to benefit from some of these trends. For example, electric utilities are an obvious beneficiary of rising electric consumption. As I stated in a recent article in Energy Profits in Dividends, natural gas pipeline operators have also been experiencing a boom of sorts as natural gas is needed to supplement intermittent and unreliable renewable sources as coal use declines and nuclear power continues to encounter regulatory hurdles.

Most investors in developed Western nations tend to be underinvested to both materials and infrastructure due to these assets underperforming during most of the decade following the 2008 financial crisis and the high popularity of technology companies in those countries, along with their substantial weighting in the S&P 500 Index (SP500). The IDE Fund advertises itself as a way for investors to gain exposure to the opportunities that could be emerging in these sectors, along with providing a very attractive 11.27% distribution yield.

As just stated, the Voya Infrastructure Industrials and Materials Fund boasts an 11.27% distribution yield at the current price. This compares fairly well to the fund’s peers:

|

Fund Name |

Morningstar Classification |

Current Yield |

|

Voya Infrastructure, Industrials and Materials Fund |

Equity-Global Equity |

11.27% |

|

Allspring Global Dividend Opportunity Fund (EOD) |

Equity-Global Equity |

9.50% |

|

Calamos Long/Short Equity & Dynamic Income Trust (CPZ) |

Equity-Global Equity |

10.90% |

|

Lazard Global Total Return and Income Fund (LGI) |

Equity-Global Equity |

10.67% |

|

Macquarie/First Trust Global Infrastructure/Utilities Dividend & Income Fund (MFD) |

Equity-Sector Equity |

9.86% |

|

Mainstay CBRE Global Infrastructure Megatrends Fund (MEGI) |

Equity-Sector Equity |

11.07% |

Admittedly, not all of these are perfect peers for the Voya Infrastructure Industrials and Materials Fund. In particular, a few of these are more broad-based funds that simply invest in equities all over the world, regardless of the sector from which they come. A few of the remaining funds invest solely in utilities or infrastructure companies without the industrials and materials components. Nonetheless, I tried to select the funds whose strategies at least bear some semblance of similarity to the IDE Fund from the options that showed up on my classification screener.

As we can see, the Voya Infrastructure Industrials and Materials Fund has a significantly higher yield than most of the other funds on this list. This is something that certainly might appeal to any investor who is seeking to earn a very high level of current income from the assets in their portfolios. However, it can also be problematic since a fund with an outsized yield relative to its peers is perceived by the market as being unable to cover its distribution and is thus at risk of a near-term cut. Basically, the market is pricing the fund as though it already has the lower yield that would result from the expected cut. Thus, we will want to pay special attention to this fund’s finances going forward to determine how much of a risk this is likely to represent.

As regular readers might remember, we previously discussed the Voya Infrastructure, Industrials and Materials Fund in mid-May 2024. The global equity markets since that time have been remarkably strong, particularly in the infrastructure sector. This is partly due to the commodities supercycle that I mentioned in the introduction. It is also due to the market’s expectations that central banks all around the world will soon begin reducing their benchmark interest rates. Utilities in particular tend to trade much like bond proxies, so their share prices will frequently increase when investors expect interest rate reductions, similarly to bonds. As such, we might expect that shares of the Voya Infrastructure Industrials and Materials Fund will have delivered a fairly strong market performance since our previous discussion.

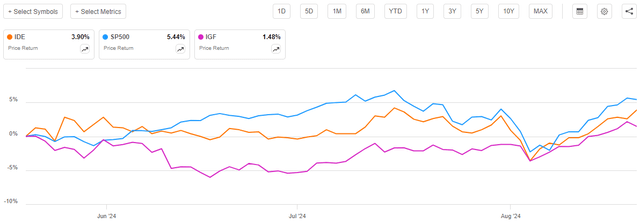

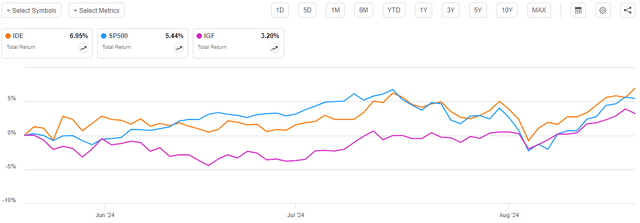

This is indeed the case, as shares of the Voya Infrastructure Industrials and Materials Fund have appreciated by 3.90% since our previous discussion:

As we can clearly see from the chart, shares of this fund did underperform the S&P 500 Index. This is unfortunate, but it is in line with the fact that infrastructure plays have been underperforming less tangible sectors (such as technology) over much of the past fifteen years. This is something that may turn off potential investors. This fund did outperform the iShares Global Infrastructure ETF (IGF) though, which is naturally very nice to see.

The fact that this fund has underperformed the S&P 500 Index may cast doubt on my previous statements about a commodity supercycle either currently taking place or about to begin. However, it is important to keep in mind that price charts of closed-end funds are frequently misleading. As I stated in my previous article on this fund:

A simple look at a closed-end fund’s price performance does not necessarily provide an accurate picture of how investors in the fund did during a given period. This is because these funds tend to pay out all of their net investment profits to the shareholders, rather than relying on the capital appreciation of their share price to provide a return. This is the reason why the yields of these funds tend to be much higher than the yield of index funds or most other market assets.

When we include the distributions that were paid out by the Voya Infrastructure, Industrials and Materials Fund, along with the indices shown above, we get this alternative chart:

As we can immediately see, the Voya Infrastructure Industrials and Materials Fund actually managed to beat the S&P 500 Index (SP500) over the period. This is due to the much higher yield that this fund possesses relative to the index. This, perhaps surprisingly, shows that the case for investing in infrastructure and related companies is far from over. After all, investors in this fund actually did better than those investors who simply purchased a domestic large-cap index fund. As such, we should clearly not dismiss a fund such as this one and should investigate further to see if it has the potential to continue to provide us with attractive returns.

About The Fund

According to the fund’s website, the Voya Infrastructure Industrials and Materials Fund has the primary objective of providing its investors with a high level of total return. This makes a lot of sense for an equity fund, which would describe this fund if the Morningstar classification is at all accurate. The fund’s website, however, does not specifically state if IDE invests solely in equities or if it may include other things. Here is the description provided by the fund’s website:

Voya Investments

There are two relevant bullet points here. The first reads:

[The fund] invests primarily in companies in the infrastructure, industrials and materials sectors that will potentially benefit from the building, renovation, expansion and utilization of infrastructure.

This alone does not state whether the fund is a pure equity fund, a debt fund, or some hybrid of the two. After all, most companies in the infrastructure and materials sectors issue common and preferred equity along with debt securities as a means of financing themselves. This description does not preclude the possibility that any of these securities might be included in the fund’s portfolio.

The second relevant bullet point states:

[The fund] sells call options on exchange traded funds. The underlying value of such calls will generally represent 15% to 50% of the total underlying value of the portfolio.

This is curious, as the fund’s description makes no mention of the portfolio including exchange-traded funds. The other two bullet points, on the contrary, strongly suggest that the fund will be doing single-company picking. Exchange-traded funds, after all, can provide investors with a good way to profit from trends or events that affect an entire industry cycle, but they generally do not offer a great way to profit from something that only benefits a specific company.

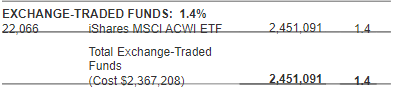

In addition, the fact that the fund is writing call options against individual exchange-traded funds suggests that these are naked calls. A look at the fund’s holdings appears to confirm this, as it does not have holdings of exchange-traded funds that are anywhere near the size needed to fully cover a 15% to 50% overwrite strategy. The fund’s first-quarter holdings report states that the fund had the following asset allocation as of May 31, 2024:

|

Asset Type |

% of Net Assets |

|

Common Stocks |

97.2% |

|

Exchange-Traded Funds |

1.4% |

|

Preferred Stocks |

0.4% |

|

Money Market Fund |

0.3% |

As we can see, the Voya Infrastructure Industrials and Materials Fund only had 1.4% of its assets invested in exchange-traded funds as of May 31, 2024. These holdings consist only of a single exchange-traded fund, the iShares MSCI ACWI ETF (ACWI):

IDE Q1 2025 Holdings Report

As we can see, the total value of the fund’s holdings in this fund was $2,451,091 on May 31, 2024. The fund owned 22,066 shares of this particular index fund on that date. If we assume that the fund is still holding 22,066 shares of the fund, they are valued at $2,559,215 at today’s per-share price of $115.81. That is certainly not bad, as the fund would have gained 4.41% in about two-and-a-half months.

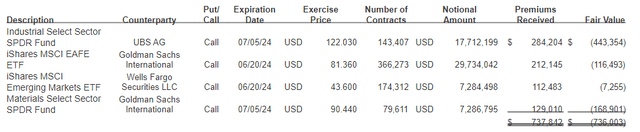

However, that is nowhere near enough to fully cover the call options that the fund currently has outstanding. The holdings report provides the following outstanding options:

We can immediately see here that the fund has written a number of call options contracts against index funds that it does not own. In fact, none of these exchange-traded funds are in the fund’s portfolio. The goal here appears to be for the fund to collect the upfront premiums, which totaled $737,872 and then have the options expire worthlessly. That alone is a fairly good strategy to generate income, and it is pretty safe if the fund already owned the exchange-traded funds against which the options are written.

The problem, of course, comes from the fact that the fund does not already have the exchange-traded funds. Thus, if the option is exercised against it, then the fund will need to go out and purchase the exchange-traded fund regardless of the price. This could obviously result in the fund realizing losses relatively quickly as the selling price is locked in due to the option.

Here are the highest prices that these exchange-traded funds reached during the periods where it could have been short these options:

|

Exchange-Traded Fund |

Highest Price At Which The Fund Traded, May 31, 2024, to Expiration Date |

Price at Close Of Option Period |

|

Industrial Select Sector SPDR Fund (XLI) |

$123.51 |

$121.22 |

|

iShares MSCI EAFE ETF (EFA) |

$82.16 |

$78.50 |

|

iShares MSCI Emerging Markets ETF (EEM) |

$42.89 |

$42.82 |

|

Materials Select Sector SPDR Fund (XLB) |

$91.53 |

$87.90 |

It is possible that the options against the Industrial Select Sector SPRDR Fund and the Materials Select Sector SPDR Fund were exercised against the fund, although neither one would have resulted in much of a loss for the fund. The iShares MSCI EAFE ETF and the iShares MSCI Emerging Markets ETF never traded at a high enough price during the option term for the counterparty to justify exercising the option. However, if these were European-style options, which they probably were, then the counterparty almost certainly would not exercise any of them.

The fund appears to have gotten lucky here, as all of its short naked options were out of the money on the exercise date. This allowed the fund to keep the premium without a corresponding outflow of cash. There is no guarantee that this will always be the case, though, so there is very much a risk here with the fund’s strategy that should not be ignored.

Here are the largest positions within the fund as of the time of writing:

Voya Investments

We see here various companies, but most of them can be classified as either infrastructure or industrials. For example, Cisco Systems (CSCO) and Siemens (OTCPK:SMAWF) both make communications products that are largely necessary for modern society to function the way that it does. Verizon Communications (VZ) and AT&T (T) each operate some of the largest communications networks in the United States, and without these companies (or other ones performing a similar function), then modern-day conveniences such as making phone calls, easily communicating our ideas with people in physically distant locations, or the Internet itself would not exist. The provision of products and services that are necessary for daily life to function in the modern world is the usual definition of an infrastructure play for most funds, so we can clearly see that this fund appears to be fulfilling its mandate.

Curiously, though, we can see that none of the fund’s largest positions are in utilities unless we consider Verizon Communications and AT&T to be utilities (which few investors do). This is not something that extends over the rest of the portfolio though, and indeed the fund’s first-quarter holdings report claims that electric utilities comprised the single largest sector in the fund as of May 31, 2024:

|

Sector |

% of Net Assets |

|

Electric Utilities |

7.6% |

|

Multi-Utilities |

3.7% |

|

Gas Utilities |

1.1% |

|

Independent Power Producers and Energy Traders |

0.7% |

|

Renewable Electricity |

0.7% |

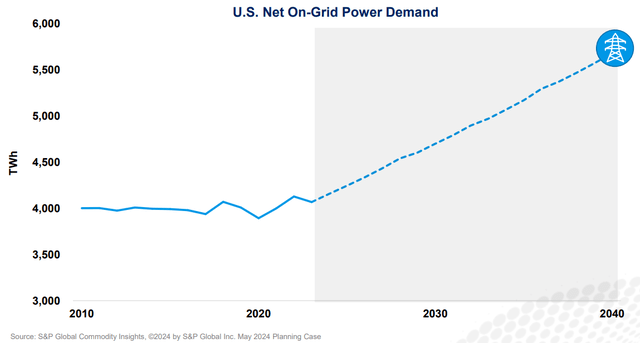

We can see here that 13.8% of the fund’s net assets were invested in the utility sector as of May 31, 2024. Of this, 12.7% is invested in companies that should benefit from growing consumption of electricity. As mentioned in the introduction, this is expected to be a very significant trend over the coming decades. According to S&P Global Commodity Insights, the consumption of electricity in the United States is expected to increase by about 50% from now through 2040:

The Williams Companies/Data from S&P Global

This comes after nearly a decade of no growth in electricity consumption. The fact that electric consumption was flat over the 2010 to 2020 period might explain the disappointing investment performance that electric utilities delivered during that time. From January 1, 2010, until December 31, 2020, the iShares U.S. Utilities ETF (IDU) delivered share price appreciation of 108.80% compared to 228.05% price appreciation for the S&P 500 Index:

When we consider the distributions paid out by utility companies, they performed better, but still did not manage to match the performance of large-cap stocks in general:

However, if the predictions are correct, then there could be a major tailwind that changes this dynamic. Generally speaking, rising electric consumption increases the revenues and profits of an electric utility. This makes sense considering that these utilities conduct their billing based on the amount of electricity that a customer consumes during a given period. As such, the revenues of these companies should grow more rapidly than they did during the 2010 to 2020 period going forward. All else being equal, revenue growth should translate to net income growth, all else being equal. As such, the nation’s electric utilities (and independent electric power producers) should be able to deliver better performance going forward than they have in the past.

Of course, the Voya Infrastructure Industrials and Materials Fund is not positioned to take advantage of this trend to the same extent as a pure utility fund like the Reaves Utility Income Trust (UTG). However, there are a few other things to consider that may position this fund well as a way for investors to take advantage of it. For example, the projected increase in electricity consumption will require electric distributors to strengthen their infrastructure. They will need new power substations, new transformers, more generation plants, more wires, and similar things. This requires significant amounts of copper, which causes an increase in demand for copper producers. It will require electrical generation equipment produced by a company such as Siemens. It will require natural gas, and possibly uranium, to be distributed to the new generation plants that are constructed.

The Voya Infrastructure Industrials and Materials Fund invests in companies that provide all of these things, not solely utilities. As such, this fund could be able to take advantage of some opportunities that a pure utility fund could not. This could work to the benefit of investors, depending on exactly how this development ultimately plays out.

There have been quite a few changes to the fund’s largest positions list since the last time that we discussed it. In particular, Parker-Hannifin (PH), AMETEK Inc. (AME), Compagnie de Saint-Gobain S.A. (OTCPK:CODGF), and Linde plc (LIN) have all been removed from their former positions among the fund’s largest holdings. The new additions to the list are Verizon Communications, General Electric (GE), Keyence Corp. (OTCPK:KYCCF), and BAE Systems (OTCPK:BAESF). In addition, several of the weightings have changed since the time of our previous discussion, but that could easily be explained by one company outperforming another in the market. It is not necessarily a sign that the fund’s management actively bought or sold stocks to change the weightings.

In any case, though, the fact that there have been four major changes in the roughly three-month period that has passed since our previous discussion suggests that the Voya Infrastructure Industrials and Materials Fund engages in a great deal of trading activity. This is indeed the case, as the fund had a 76.00% portfolio turnover in the full-year period that ended on February 29, 2024. While this is not excessively high for an equity closed-end fund, it is still higher than some of this fund’s peers, as shown here:

|

Fund Name |

Portfolio Turnover |

|

Voya Infrastructure Industrials and Materials Fund |

76.00% |

|

Allspring Global Dividend Opportunity Fund |

97.00% |

|

Calamos Long/Short Equity & Dynamic Income Trust |

210.00% |

|

Lazard Global Total Return and Income Fund |

5.00% |

|

Macquarie/First Trust Global Infrastructure/Utilities Dividend & Income Fund |

59.00% |

|

Mainstay CBRE Global Infrastructure Megatrends Fund |

25.00% |

(All figures come from the most recent annual report for each fund.)

As we can see, three out of the six funds on this list have a lower annual turnover than the Voya Infrastructure Industrials and Materials Fund. This places it above the peer median level, but it is nowhere near as high as some of its peers.

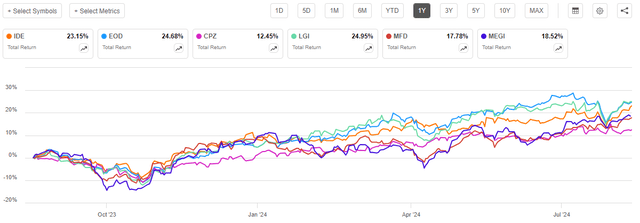

A high turnover is not necessarily a bad thing though as long as it does not cause expenses to be so high that they are a drag on the fund’s returns. This does not, fortunately, appear to be the case with this fund. As we can see, the Voya Infrastructure Industrials and Materials Fund delivered a higher total return than three of the peer funds listed over the past year:

The two funds listed that beat it are the Allspring Global Dividend Opportunity Fund and the Lazard Global Total Return Fund. These two funds are not perfect peers for this fund as they invest in a much broader range of sectors. The two funds that are the closest peers to the Voya Infrastructure Industrials and Materials Fund are the Macquarie/First Trust Global Infrastructure/Utilities Dividend & Income Fund and the Mainstay CBRE Global Infrastructure Megatrends Fund, and they both underperformed this one. As such, it does not appear that this fund’s comparably high level of trading activity has hurt the returns that investors ultimately receive.

Distribution Analysis

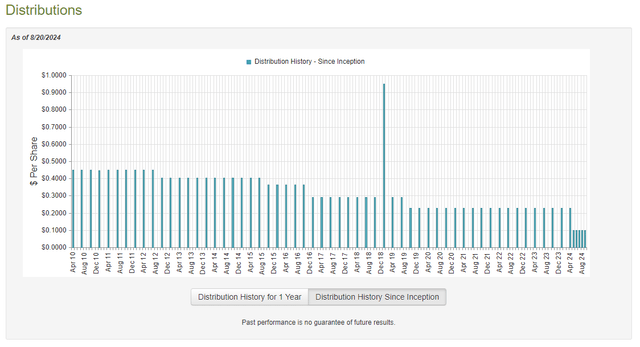

The primary objective of the Voya Infrastructure Industrials and Materials Fund is to provide its shareholders with a high level of total return. As is the case with most closed-end funds though, the fund primarily delivers its investment returns through direct payments to its shareholders. To this end, the fund pays a regular monthly distribution of $0.10 per share ($1.20 per share annually). This gives it a very attractive 11.27% yield at the current share price.

Unfortunately, the fund has not been especially reliable with its distribution over its history. We can see this here:

As I stated in my previous article on the fund:

This is not what we want to see, especially since today’s high rate of inflation requires that our incomes grow over time instead of decline. Nonetheless, if the fund can sustain its current distributions, then new investors should not be negatively impacted by distribution cuts, nor will they suffer declining income.

It should be noted though that this fund actually increased its distribution in May of this year, despite the chart appearing to show a decline. What the fund did is convert from a $0.2290 per share quarterly payment to a $0.10 per share monthly payment. A $0.10 per share monthly payment works out to $0.30 per share quarterly, so the most recent move was a 31.00% increase. That is a nice reversal given the fund’s disappointing history.

The most recent financial report that is currently available for the Voya Infrastructure Industrials and Materials Fund is the annual report for the full-year period that ended on February 29, 2024. This is the same report that was available to us the last time that we discussed it, so there is no sense in repeating that former analysis today. Please consult the previous article if you wish to see an in-depth discussion of the fund’s financial performance.

In the previous article, we saw that the Voya Infrastructure Industrials and Materials Fund was able to fully cover the distributions that it paid out during the most recent fiscal year, but it had to rely on its unrealized capital gains to do so. That could be concerning, as a weak market might cause the fund to give up some of those gains.

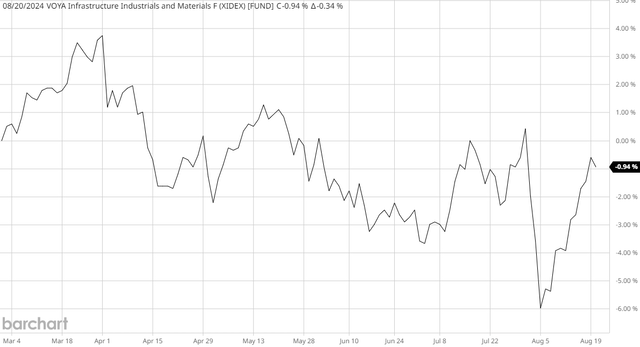

Unfortunately, it does appear that the fund has failed to cover its distributions fully so far this fiscal year. This chart shows the fund’s net asset value from February 29, 2024, until today:

As we can see, the fund’s net asset value has declined by 0.94% over the period. This means that the fund distributed more than its portfolio actually earned during the period. That is a problem if it continues, but we are only five months into the current fiscal year, so there is still some time for the fund’s performance to improve. Nevertheless, we should keep an eye on its net asset value, just in case.

Valuation

Shares of the Voya Infrastructure Industrials and Materials Fund are currently trading at a 7.75% discount to net asset value. This is a much worse price than the 10.28% discount that the shares have had on average over the past year. However, it is still a discount, so the current price is not horrible, it is just not as good as we have seen frequently in the recent past.

Conclusion

In conclusion, the Voya Infrastructure Industrials and Materials Fund could be a good way to play the expected surge in electricity demand over the coming years. The fund does not have as much utility exposure as some other funds, but it makes up for it by owning companies that provide equipment and supplies that will be required if the electrical grid is to be built out to the extent required to meet the growing demand. Thus, this fund might be able to provide exposure to opportunities that otherwise are difficult to get. Investors in this fund also get a very high yield while waiting for the story to play out. Overall, there is a lot to like here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment