yangna

Clean energy got a tailwind from the Inflation Reduction Act of 2022 (IRA) news late last month. The proposal, backed by the suddenly unpredictable Senator Manchin (D-WV) and Senator Schumer (D-NY) provides tax credits and incentives to many alternative energy companies domiciled in the United States. While this is certainly positive news for stocks in that space, price action had been strong even before last Wednesday night’s surprising bill.

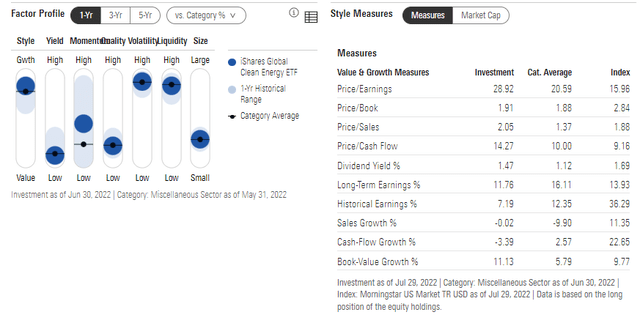

According to iShares, the iShares Global Clean Energy ETF (NASDAQ:ICLN) seeks to track the investment results of an index composed of global equities in the clean energy sector. The ETF features an expense ratio of 0.42% while its trailing 12-month dividend yield is 1.2%, according to Morningstar. ICLN’s P/E ratio is 28.

ICLN X-Ray: High Growth, High Volatility Fund

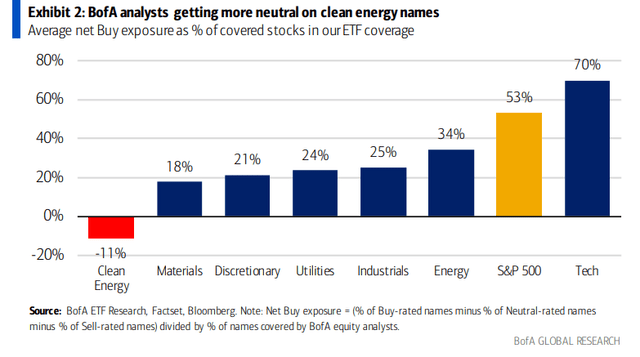

The industry had been quite unloved by Wall Street and money managers earlier this year. In the Bank of America (BAC) Global Research chart below, you can see how unimpressed analysts were on clean energy names back when oil was rallying. Other sectors, like tech, enjoyed more sanguine stances.

BofA Was Unenthusiastic on Clean Energy During Q2. A Contrarian Signal.

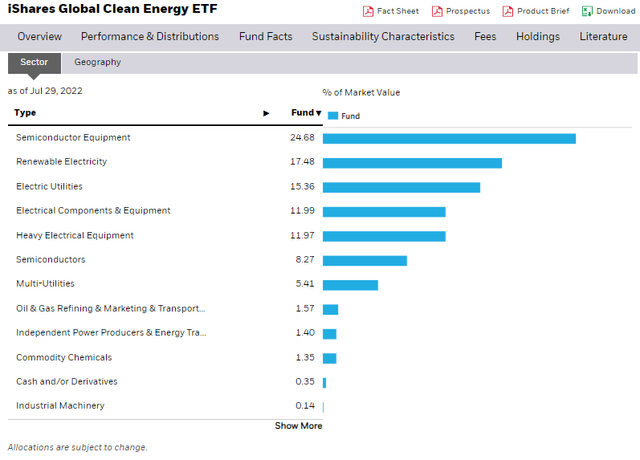

Since oil has fallen back, though, clean energy stocks have held up well. ICLN is heavily invested in the Semiconductor Equipment and Renewable Energy industries. You will also find some mainstay companies within the Utilities sector in ICLN’s top holdings.

ICLN’s Largest Sector/Industry Weights

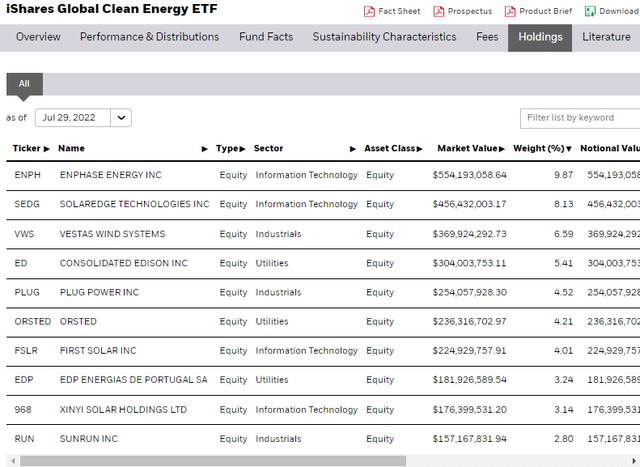

Specifically, Enphase Energy (ENPH) and SolarEdge (SEDG) make up precisely 18% of the ETF, so it will certainly move alongside the broader solar renewable energy area. And we saw that last week when so many solar stocks soared.

ICLN Top Holdings

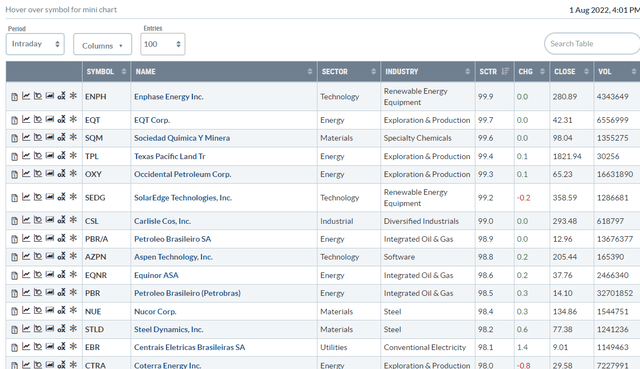

What I found encouraging from a momentum perspective was that both Enphase and SolarEdge are ranked as top stocks on Stockcharts.com’s SCTR scoring page. This simply shows that price action has been extraordinarily strong between these two top holdings in ICLN.

Stockcharts.com SCTR Momentum Rankings: ENPH, SEDG Among The Best

The Chart Report

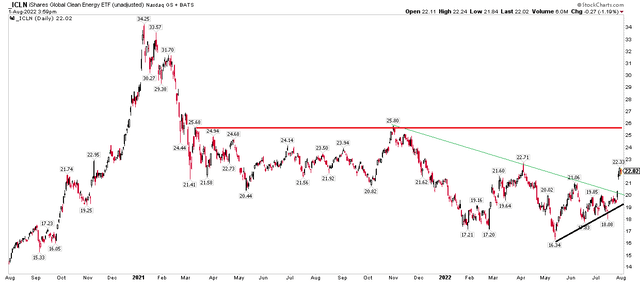

I like what I see in the technical price chart of ICLN. The fund consolidated during much of May through July before breaking out late last month. Based on the bullish move above a symmetrical triangle pattern, seen as a consolidation feature, the measured move upside price objective is $6 (the triangle range) added on top of the breakout point ($19.50). That yields an expected bullish advance toward $25.50 before long. That level aligns with previous resistance prices seen last year, so there is some confluence there.

Bullish Breakout From Symmetrical Triangle

The Bottom Line

I like ICLN here. While its valuation is elevated and there isn’t a big yield, strong relative strength and a favorable technical chart look good here.

Be the first to comment