PashaIgnatov/iStock via Getty Images

The Intercontinental Exchange (NYSE:ICE) operates electronic platforms (exchanges, listings, and clearing houses) for the commodity, derivatives, financial, fixed-income, and equities markets. While the company has used M&A to diversify into recurring revenue businesses, it still derives roughly half of total revenue from businesses driven by average daily volume (“ADV”). With Putin’s invasion of Ukraine, the global commodities and energy derivatives business is booming. Unfortunately, that positive catalyst (for ICE, certainly not for Ukraine …) could last for quite some time to come. As a result, I find ICE to be attractive here.

Investment Thesis

ICE has done a good job of diversifying its business into recurring revenue streams (primarily services and data offerings) into ~50% of revenue. In addition, the 2020 acquisition of Ellie Mae significantly boosted ICE’s position in the mortgage technology arena. While rising interest rates are obviously a headwind to the mortgage industry, I suspect given ICE’s large-scale presence, the company should continue to gain market share this year.

However, given Putin’s invasion of Ukraine and the resulting disruption of global energy and commodity markets, the most positive growth catalyst going forward may well be in ICE’s more traditional energy & commodity derivatives business.

As Seeking Alpha recently reported, ICE’s ADV grew 9% yoy in March. The higher interest rate environment boosted Financial ADV by 15% while Commodity ADV rose 8% – driven by ADV growth in the cocoa market of 20% yoy. ICE CEO Ben Jackson said:

In the first quarter of 2022, the war in Ukraine brought both geopolitical risk and supply uncertainty across commodity markets as inflationary pressure underpinned activity in interest rate markets. Our benchmark futures contracts help to price commodities that millions of people rely on, providing our customers with the risk management tools they need in the midst of a crisis.

The big jump in the cocoa market points out another positive catalyst for ICE: global warming. With the increasing impact of drought (and flooding) on global agriculture markets, investors are likely to turn to derivatives to protect their positions. ICE also has a large presence in European asset complexes, which are likely to strongly benefit from the macro geopolitical environment as well.

Earlier this month, BofA boosted its Q1 EPS estimate for ICE to $1.48/share. I think ICE could earn in excess of $6/share this year. Given Friday’s close of $129.89, I estimate ICE currently trades with a forward P/E of ~21.6x. That said, I expect that as the war in Ukraine drags on, EPS estimates for ICE will likely continue to rise throughout the remainder of the year.

Earnings

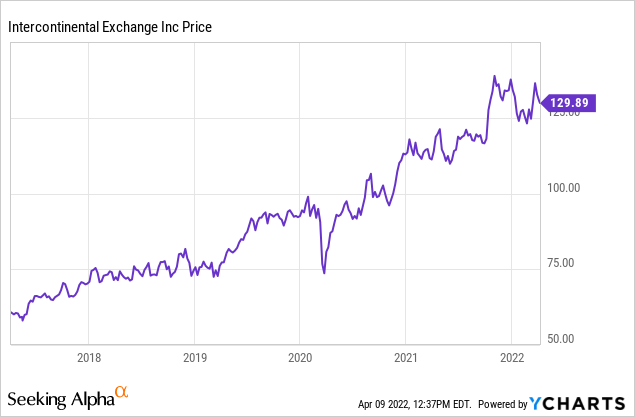

As shown in the graphic below, ICE’s traditional energy business was already growing by leaps & bounds in Q4 due to the massive covid-19 down-cycle followed by the resulting bounce-back recovery and a shortage of natural gas in key markets like the EU:

At the same time, recurring revenue grew 8% yoy on a constant currency basis. Overall, total revenue in Q4 was up 17% yoy.

For full-year 2021, total revenue of $7.15 billion was up 7% yoy. However, as the company continues to digest and ring-out efficiencies of various recent acquisitions, FY21 EPS was $5.15/share – up 17% yoy (i.e., much greater than revenue growth). Free-cash-flow of $2.82 billion was also up 17% yoy. Based on the 565 million fully-diluted shares at the end of 2021, that equates to an estimated $5/share in FCF, which obviously bodes well for shareholders given the current $1.52/share annual dividend.

As you can see, ICE was hitting on all cylinders in Q4 – even before Putin invaded Ukraine – and I suspect that development will mean the company continues on a similar trajectory this year. Indeed, ICE has a 15-year track record of growing adjusted EPS at a CAGR of 17%. All things being considered, that means the stock should double every ~5 years.

Shareholder Returns

On the Q4 conference call, ICE CFO Warren Gardiner commented on the company’s capital allocation strategy moving forward:

… consistent with our track record of growing our dividend as we grow, we plan to increase our quarterly dividend by 15% year-over-year from $0.33 per share to $0.38 per share. In addition, and now that we are within our targeted leverage range, we expect to deploy approximately $475 million towards share repurchases in the first quarter, representing a nearly 20% increase versus the second quarter of 2020, the last full quarter of buybacks prior to our acquisition of Ellie Mae.

Risks

ICE’s balance sheet is relatively strong (though it could be better in my opinion). ICE ended 2021 with $607 million in cash and net-debt of $13.6 billion. Which although a bit high in my opinion, is quite manageable and reasonable given ICE’s market-cap of $73 billion, its solid FCF generation, and its recurring revenue base. At year-end, gross leverage was 3X EBITDA.

Increased competition in ICE’s electronic markets are always a possibility. That said, the company’s size and scale is a competitive advantage. Meantime, SEC scrutiny and regulations are always a risk for market makers and exchanges.

The normal macro environment market headwinds that all of you are by now very familiar with (higher inflation, higher interest rates, massive geopolitical risks due to Putin’s invasion of Ukraine and the resulting economic sanctions placed on Russia by the US and its Democratic NATO allies, etc.) could result in a significant contraction in global economic growth and, specifically for ICE, declining ADV’s across its various platforms and market verticals.

Lastly, ICE has a long-term track record of growing via M&A. A large and unwise acquisition announcement could hurt shareholders in the short-term.

Summary & Conclusion

Overall, ICE’s risk/reward proposition appears to be relatively positive here. Energy & commodity derivatives are likely to remain strong throughout the remainder of the year. In my opinion, EPS estimates have yet to catch up with the company’s improving outlook. Indeed, Seeking Alpha (which I believe uses an automated service to report consensus EPS estimates), still has ICE’s forward EPS estimate at $5.40/share. As we saw from the recent BofA upgrade, I think that is significantly below what ICE could achieve this year given the generally bullish backdrop. I think ICE could easily generate EPS of closer to $6+/share in FY21.

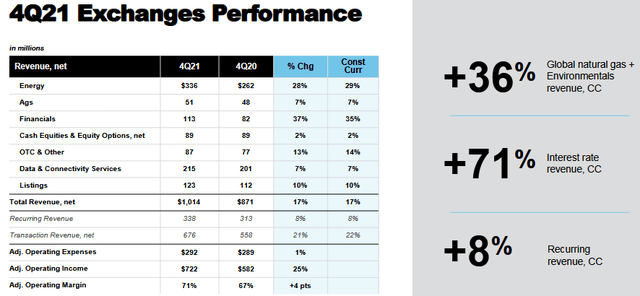

I’ll end with a 5-year chart of ICE’s rather impressive stock price:

Be the first to comment