Michael Derrer Fuchs

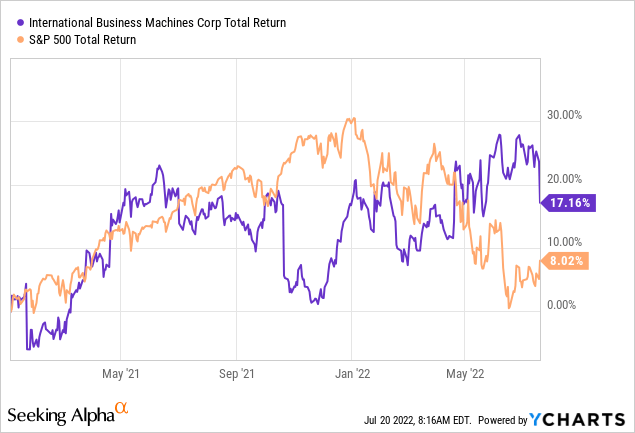

In the past few months International Business Machines (NYSE:IBM) has turned into one of the best performing tech names. Since I first covered the company in January of 2021 IBM returned 17%, compared to merely 8% for the broader equity market.

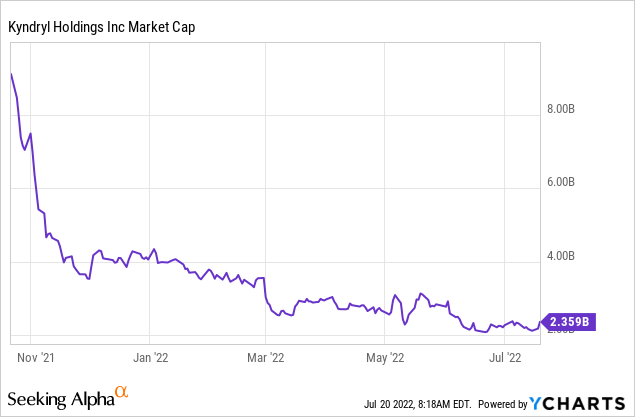

During this timeframe the spin-off of Kyndryl (KD) was completed and now that the underperforming assets have been unloaded, expectations around the ‘New IBM’ are running high. Unfortunately, however, the strong share price performance since November of last year has little to do with IBM’s fundamentals.

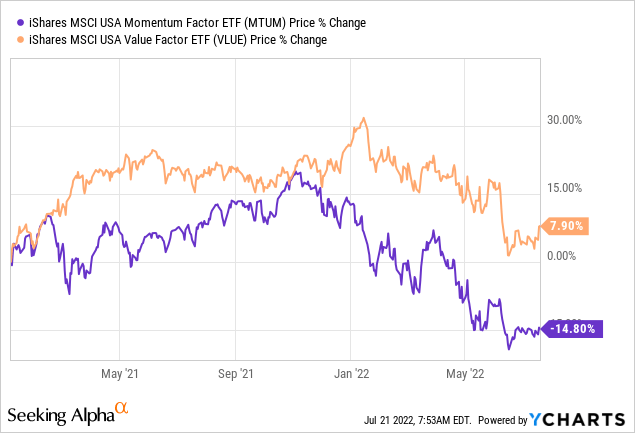

As we see in the graph below, the iShares Edge MSCI USA Momentum Factor ETF (MTUM) peaked also in November of last year and since then the gap with the iShares Edge MSCI USA Value Factor ETF (VLUE) has been expanding.

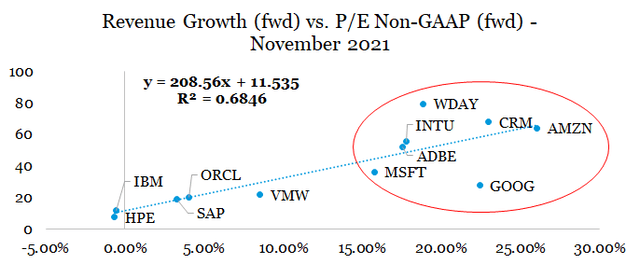

As expectations of monetary tightening begun to surface and inflationary pressures intensified, high duration and momentum stocks begun to underperform the lower duration value companies. I talked about this dynamic in my recent analysis called ‘The Cloud Space In Numbers: What Matters The Most‘, where I showed why the high-growth names were at risk. More specifically, I distinguished between the companies in the bottom left-hand corner and those in the upper right-hand corner in the graph below.

prepared by the author, using data from Seeking Alpha

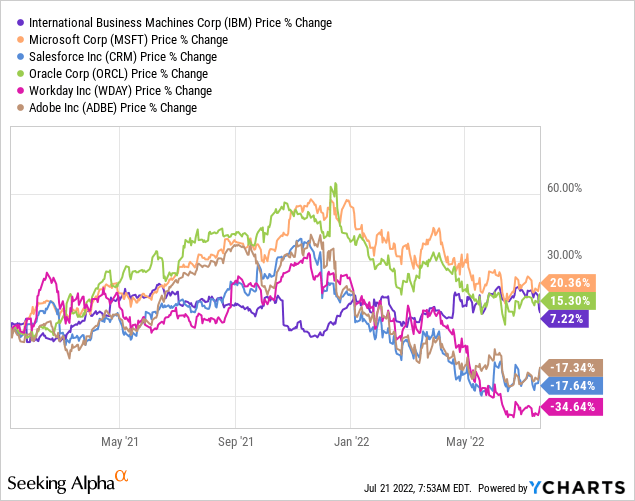

As we see in the graph below, the high flyers, such as Workday (WDAY), Salesforce (CRM) and Adobe (ADBE), have become the worst performers, while companies like IBM and Oracle (ORCL) that were usually associated with low expected growth and low valuation multiples became the new stars.

Although this was good news for value investors as a whole and is a trend that could easily continue, we should distinguish between strong business performance and market-wide forces. Having said that, IBM shareholders should not simply assume that the strong share price performance is a sign of strong execution. Needless to say, the Kyndryl disastrous performance of losing 75% of its value in a matter of months also lies on the shoulders of current management of IBM.

A Closer Look At IBM’s Recent Earnings

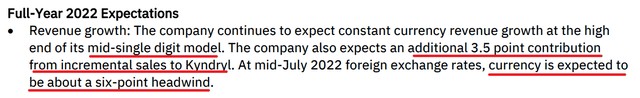

IBM’s recently reported quarterly numbers once again disappointed and the management seems to have largely attributed the U.S. dollar movement to the slightly lower guidance.

IBM Earnings Release

Alongside the guidance gross margins also fell across the board, with the exception of the Financing division, which is relatively small to the other business units.

IBM Q2 2022 Earnings Release

Rising labour and component costs were also to blame during the quarter and the management is addressing these through pricing actions which should take some time.

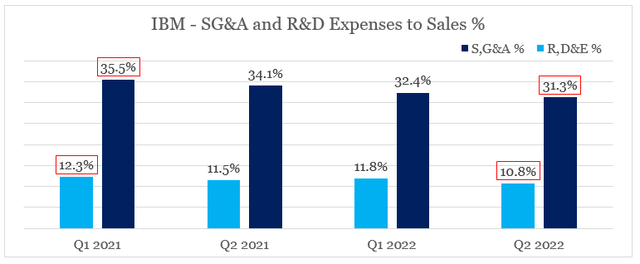

Although this is likely true, IBM is also reducing spend on research and development and selling, general and administrative functions. Such actions are usually taken as a precaution during downturns, however, consistent lower spend in those areas could often have grave consequences.

prepared by the author, using data from annual and quarterly reports

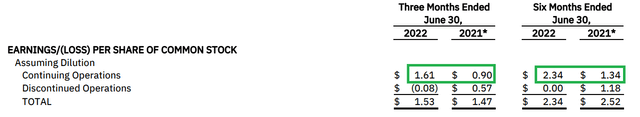

Last but not least, the reported EPS numbers from continuing operations should also be adjusted as I have outlined before.

IBM Q2 2022 Earnings Release

I usually exclude the royalty income and all income/expenses grouped in the ‘other’ category. These expenses/income usually have little to do with IBM’s ongoing business and as such I deem them to be irrelevant for long-term shareholders.

IBM Annual Report 2021

IBM Annual Report 2021

On an adjusted basis, EPS increased from $1.08 in Q2 2021 to $1.33 in Q2 2022, which although is a notable increase remains low. Just as a back of the envelope calculation, if we annualize the last quarterly result, we end up with a total EPS number of $5.3 or a forward P/E ratio of almost 25x. Given all the difficulties facing IBM and its growth profile, this still appears as too high.

Has Anything Changed Following The Recent Earnings?

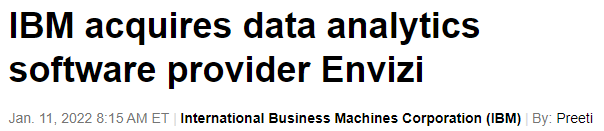

As expected, IBM continued on its strategy to fuel its growth through a frenzy of acquisitions and divestitures. Following the Kyndryl spin-off, the company completed four deals in a matter of just few months.

Seeking Alpha

Seeking Alpha

Seeking Alpha

Seeking Alpha

As I have said before, all that does not bode well for the prospects of IBM’s legacy businesses. Moreover, the management does not seem to be focused on organic growth numbers in their quarterly reviews which is even more worrisome.

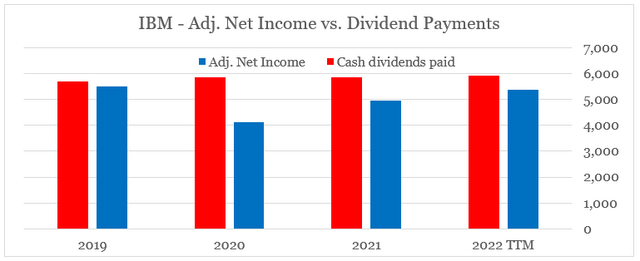

Now that the underperforming assets have been off-loaded, IBM’s dividend payments are still too high relative to its adjusted income.

prepared by the author, using data from annual and quarterly reports

* adjusted for Intellectual property and custom development income, Other (income) and expense and Income/(loss) from discontinued operations, net of tax

As previously noted, this puts the company between a rock and a hard place. However, reducing or discontinuing the dividend could potentially result in an exodus of long-term shareholders.

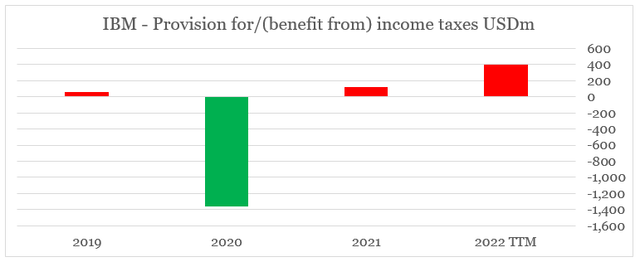

We should also mention that IBM has been barely paying any taxes over recent years due to various tax credits (see below). This, however, is gradually changing and will likely provide yet another headwind on EPS numbers in the future.

prepared by the author, using data from annual and quarterly reports

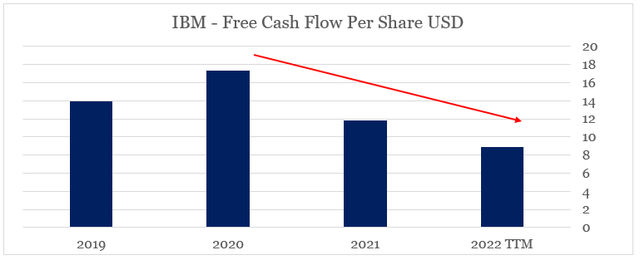

Even though the narrative around IBM has been largely focused on its business turning around, the company’s free cash flow per share continues to decline.

prepared by the author, using data from annual and quarterly reports

Conclusion

A potential upside based on a successful turnaround story of IBM that is gravitating around the hybrid cloud is a major reason for many current and potential shareholders of IBM to hope for a light at the end of the tunnel. However, little seems to have changed at IBM following the spin-off of Kyndryl and a declining business also creates a significant moral hazard problem for management where more risk taking is incentivized. All that combined with the fact that IBM is doing M&A deals almost on a monthly basis, creates significant risks for long-term owners of the business.

Be the first to comment