maybefalse

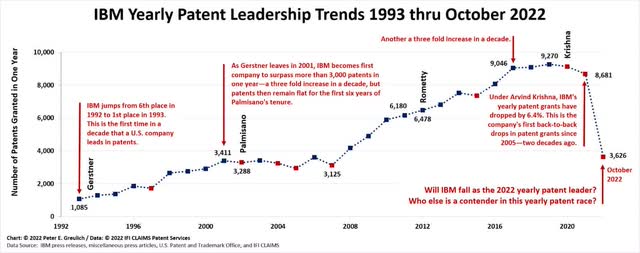

IBM’s Patent Grant Leadership 1993 To October 2022

Image from Pixabay by Rosy in Bad Homburg, Germany

American corporations have transformed whole industries through aggressive patenting practices—and most, at the time, were highly-valued, long-term investments.

Eastman Kodak, as an example, transitioned the entire photographic industry from a professionals-only vocation into an enjoyable form of mass recreation—“You press the button – – – – we do the rest.” It was a patented service for which the corporation and its four stakeholders—customers, shareholders, employees, and society, were well rewarded.

Since its founding, patents have also been important to IBM (NYSE:IBM). In 1938, Tom Watson Sr. told his shareholders that in the twenty-four years since he had taken over the company, it had obtained 1301 patents—a little over 50 patents a year. In comparison, over the last three years IBM has received, on average, 9,025 yearly patent grants. This is astronomical growth—mostly achieved since 1993, and there is no taking away IBM’s decades of patent leadership from those employees who responsibly moved their ideas from the conceptual arena into the realm of revenue-producing, patentable offerings.

For the last three decades, IBM has been industry-leading in this measurement.

Peter E. Greulich produced chart with publicly available information and information from IFI CLAIMS Patent Services. IFI Claims Patent Services’ information used with permission.

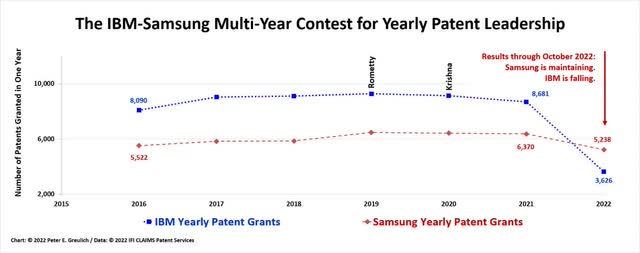

But through October of this year, IBM’s patent production has fallen off a cliff. This is giving Samsung (OTCPK:SSNLF) an opening to become this year’s pennant winner. If so, IBM will close out its third full decade of patent leadership with a whimper rather than a flourish.

Either way, it will be a newsworthy event to evaluate in kicking off your 2023 investments!

Let’s look at the yearly patent details and then consider the investment options.

A Possible Changing Of The Guard In Yearly Patent Leadership

Samsung is on track. It is maintaining its consistent year-over-year performance. Through each of the Octobers of the last three years, Samsung has had patent grants of 5310, 5348, and 5372, respectively. Through October of this year, Samsung has 5,238 patent grants—only down a recoverable 2%.

Through each of the Octobers of the last three years, IBM has had patent grants of 8,537, 8,003, 7,010, respectively—falling 6% and then 18% over the two years. Through October of this year, IBM only has 3,626 patent grants—a shortfall, now, of almost 60% over its 2019 October attainment.

As reflected in the following chart, Samsung has now registered a fourth-quarter first: As of the end of October, it pulled ahead of IBM in yearly patent grants: 5,238 to 3,626.

Peter E. Greulich produced chart with information from IFI CLAIMS Patent Services. Used with permission.

Samsung is positioned to capture the flag: The 2022 Patent Pennant!

Can IBM recover?

The previous year, IBM received 1,671 patent grants in November and December—its largest two-month closing number since 2015. If IBM turns in another similar, two-month run—and Samsung stands still, the corporation may be able to pull off another win.

IBM: Short-Term Or Long-Term Investment Decisions

Whether IBM pulls out another victory or not, this will be a newsworthy event: IBM will either close out a full three decades—exactly thirty years, of patent leadership with a flourish or a whimper. In either case, headlines are going to fly. Your level of interest and the timing of your next investment in either of the two companies will depend on if you are a short-term investor or long-term investor.

If you are a short-term investor who practices “buy on the rumor, sell on the news” or its antithesis “sell on the rumor and buy on the news,” this article is stating facts as of October 2022, not rumors—but no one can see the future.

So, although this isn’t a rumor, it will be a year-end, photo finish where the two top contestants are going full out for the finish line—and the winner is up for grabs.

Make your “rumor-buy” or your “rumor-sell” before the end of the year.

I have never been a short-term investor though.

Tread carefully, eh?

If you are a long-term investor who is looking for indications that the IBM destroyer is continuing a turnaround, has started to turn—for the better or worse, or is just taking on more water, you will have one more indication as to the state of the IBM warship in January 2023.

For me, whether IBM pulls this off or not, I see a three-year drop in patent production. As can be seen from 2007, this can be quickly fixed, but as a long-term-outlook type of guy, even if IBM doesn’t fall from its yearly patent leadership position, I will just add another “p” to my long-term view of the corporation as stated in THINK Again! The Rometty Edition:

IBM’s corner office doesn’t understand “business-first investing.” For three-decades, its corner offices have invested in paper instead of investing to make its people more productive, its processes more effective, its products more valuable … and now,

its patents of higher quality in ever-higher quantities.

In either case, January 2023 will be an investor newsworthy event. Remember that as either a short-term or long-term investor:

Forewarned is forearmed.

The latest 2022 yearly-patent grant numbers cited above are through the end of October 2022. The latest patent numbers have already been updated, and as of November 8, 2022, it was Samsung 5,349 and IBM 3,745.

IFI CLAIMS Patent Services’ provides monthly, yearly, near real-time, and historical patent information by company. The yearly patent-grant information cited above and more can be accessed on its rankings home page [here].

Cheers,

Peter E.

Be the first to comment