Oselote

Extremely Uncertain Market Caused by Strong Persistent Factors Usually Leads to Higher Demand for Gold as a Hedging Tool

Equity markets are very uncertain under the strong influence of the daily problems worldwide. The energy and utilities sectors are the only sectors rising as these stocks continue to benefit from higher oil, gas and other commodity prices. However, a bullish market for precious metals such as gold and gold-back securities is expected to emerge.

This is why.

The factors driving the widespread bearish sentiment in equity markets are interest rate hike policies, leading economies to a recession, high inflation as long as the war in Ukraine and the energy crisis will persist, and the continuing geopolitical tensions between the US/EU and Russia/China.

In addition, there are the major oil exporters of OPEC, who are certainly not helping to ease the global turbulence with their dogged zeal for a policy that does not want to increase the supply of barrels of oil in commodity-hungry markets.

Upward pressure on energy prices continues and if the price stays high for too long, households and small and medium-sized enterprises [SMEs] will suffer dramatically, which is certainly not unimportant given that consumption and SMEs make 70 percent or more of an economy.

All of these negative factors, which go hand in hand, usually contribute to increased volatility in the markets from which investors seek refuge in gold, as it is well regarded as operating efficiently as a safe haven asset.

So gold demand is likely to go up as investors turn to the metal for hedging and leading the price, which is already high compared to historical valuations, to rise significantly from where it is today, around $1,701.30 at the time of writing.

i-80 Gold Corp Could Soar as Gold Rises

Since the companies that produce gold usually see the price of the stock rise much faster than the precious metal when this is in a bull market, it wouldn’t be a bad idea to increase positions in those miners who seem poised for a strong rally.

i-80 Gold Corp. (NYSE:IAUX) (TSX:IAU:CA) is very recent in the gold mining landscape as the company was founded just two years ago and is headquartered in Reno, Nevada, a state known for hosting one of the traditionally productive gold belts in the United States. The miner began trading on the New York Stock Exchange last May 19 with the IAUX symbol.

Nevada is also a state that has enacted legislation that benefits gold and silver mining, meaning investing in i-80 Gold Corp’s business involves a low risk from a political and social perspective.

Indeed, it is in Northern Nevada that the company’s precious metal reserves are located, consisting of 12,000 acres across an alignment of mineral deposits at Battle Mountain-Eureka, plus other properties, and a 31,000-acre mineral project at Battle Mountain Trend.

A Strong Upside Potential Lies in the Company’s Plan to Become a Mid-Sized Producer

Let’s dig a little deeper into i-80 Gold Corp’s portfolio of mineral operations to highlight the momentum and try to pick up on some trends that may spark investors’ interest in this young and fledgling gold miner.

In Ruby Hill and Lone Tree, two of the company’s gold assets in Northern Nevada, i-80 Gold Corp is engaged in leaching operations for the recovery of gold from the material.

Lone Tree, acquired in the last quarter of 2021 in an asset swap transaction with Nevada Gold Mines, a joint venture between Barrick Gold Corporation (GOLD) and Newmont Corporation (NEM), is the center of i-80 Gold Corp’s activities. Here there is a mill for processing the raw material from mining and other on-site infrastructures for the leaching activities.

There is tremendous potential around the property as drilling activity, which has focused on an area known for extensive mineralization – called Granite Creek – betrays no expectations about the presence of precious metals or the quality of the gold deposit.

This is fueling the shareholders’ hopes that Granite Creek will make a strong contribution to the company’s gold production, using resources accounting for 189,000 ounces at 10.5 grams per ton of gold [g/t] in the underground and 1.3 million ounces at a gold grade of 1.94 g/t in the open pit.

At present, this gold property could guarantee production for more than 5 years for a mid-range producer, which is the goal of i-80 Gold Corp. The US miner is aiming for middle-class gold producer status, and that goal doesn’t seem far off given the first shipments of Granite Creek ore sulfide to the processing plant in June this year.

Cash on hand totaling $101 million against total debt of $114 million, which implied an interest charge of $5 million in the June quarter, should provide adequate financial backing to support the continued development of Granite Creek and the other projects.

Essentially, the construction of the underground infrastructure – this project is called the McCoy Cove Project – will enable the exploration of a deposit of approximately 400 meters beginning in the last quarter of 2022 with significant potential to unearth profitable ounces.

In addition, a notable exploration campaign is being conducted on a property characterized by the presence of multiple gold deposits that can be exploited both longitudinally and at depth. The project is called Ruby Hill and was acquired in 2021 following the successful completion of negotiations with Waterton Global Resource Management, a private company with interests in the metals and mining sectors. This project will develop a system to connect the deposit’s most productive points, including refractory mineralization [which Lone Tree can also process], to the mine’s infrastructure network.

The positive impact on the share price of this encouraging project should already materialize with the resource update expected to be released soon after drilling activities in 2022.

Ruby Hill’s strong expectations do not stem from a pure impression, but more concretely from the trends that can be inferred from the second quarter of 2022. Ruby Hill may result in lower economic costs in the future which will certainly have a positive impact on the company’s profitability if the ore, still contained in the leach pad of the recently acquired property, is a true indication of the quality of the gold deposit.

Indeed, the mineral project experienced a very significant reduction in cash costs [-6.8% to $1,194 per ounce in the second quarter of 2022 and -5.5% to $1,211/oz in the first half of 2022, from $1,281/oz in the second quarter of 2021] and all-in sustaining costs [-10.8% to $1,282/oz in Q2 2022 and -9.4% to $1,316/oz in H1 2022, from $1,453/oz in Q2 2021].

Ruby Hill produced and sold more than 73% of i-80 Gold Corp’s total gold production for the second quarter of 2022 and approximately 64.3% of i-80 Gold Corp’s total gold production for the first half of 2022.

The company has accrued approximately 3,507 ounces of gold during leaching in the second quarter of 2022 and 4,996 ounces of gold year-to-date. The company incurred all-in sustain costs of $1,356 in the second quarter of 2022 and $1,326 in the first half of 2022. The miner sold those ounces of gold, generating revenue of $1,811 an ounce in the second quarter and $1,843 an ounce year-to-date for total revenues of $6.4 million and $9.25 million, respectively.

The other productive asset, Lone Tree, produced and sold nearly 27% of the company’s total output in the second quarter of 2022 and about 35.7% of the company’s total output in the first half of 2022.

The property incurred cash costs of $926/oz in the second quarter of 2022 and $879/oz in the first half of 2022 and all-in sustaining costs of $1,560/oz in the second quarter of 2022 and $1,343/oz in the first half of 2022, which were affected by expenditures for care and maintenance.

Lone Tree will continue to receive care and maintenance, so costs are likely to be above the company average for quite some time to come. However, these activities are expected to also upgrade the processing plant for both leach and refractory mineralization processing. The latter is what many miners leave untapped as this type of ore is difficult to extract using traditional techniques while it is made up of ultra-fine gold particles.

Stock Valuation – Shares are Low, as Few Tech Ratios Say

Under the IAUX symbol, i-80 Gold Corp.’s shares are exchanging hands at $1.70 per unit for a market cap of $403.97 million and a 52-week range of $1.52 to $3.28, as of this writing.

The stock price is currently trading below the midpoint of the 52-week range, which stands at $2.4, and is also trading below an indication of a long-term trend arising from a forecast of the 200-day moving average of $2.2759.

Under the IAU:CA symbol, i-80 Gold Corp.’s shares are exchanging hands at Canadian dollars [CAD] 2.36 per unit for a market cap of CAD531.21 million and a 52-week range of CAD1.98 to CAD4.03, as of this writing.

The stock price is currently trading below the midpoint of the 52-week range, which stands at around CAD3, and is also trading below the long-term trend of the 200-day moving average of CAD2.9023.

As such, current stock prices appear low, which, if used, increases the likelihood of maximizing the expected rise in gold prices associated with the company’s gold production growth project.

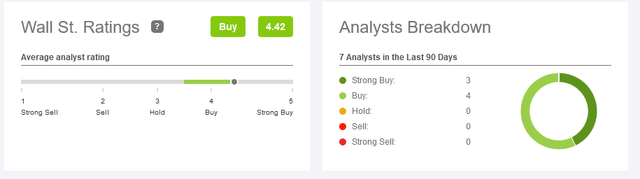

Wall Street Ratings Point to a Buy Rating and Higher Stock Prices for the IAU:CA Stock

A total of 7 analysts have covered i-80 Gold Corp.’s shares under the symbol IAU:CA for an average buy recommendation. Three analysts recommended a strong buy rating, while four analysts issued a buy rating.

seekingalpha/symbol/IAU:CA/ratings/sell-side-ratings

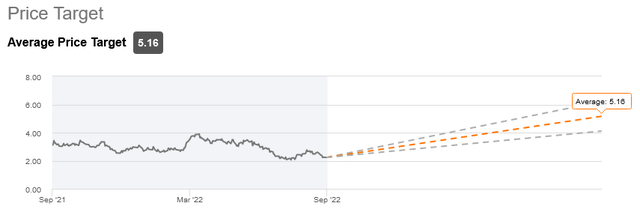

This stock has an average price target of CAD5.16, reflecting an 118.64% return from the current share price level.

seekingalpha/symbol/IAU:CA/ratings/sell-side-ratings

Conclusion – With Gold Likely to Rise Due to Higher Demand for Hedging, It Makes Sense to Take Advantage of the Strong Momentum of i-80 Gold’s Growth Plan

With gold expected to see higher prices in the future as the next recession combined with entrenched inflation and geopolitical issues leads to demand for gold for hedging purposes, it makes sense to increase exposure to gold miners as these stocks tend to behave more bullish than the rising precious metal.

Among the US-listed gold miners, i-80 Gold Corp cannot but be catching the attention of avid gold investors. The company wants to mature and become a medium-sized operator. The US miner has a portfolio of activities that together form a very interesting growth project.

Be the first to comment