designer491

Main Thesis & Background

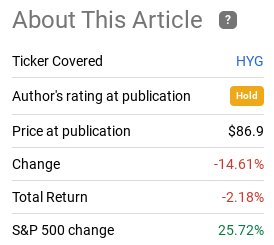

The purpose of this article is to evaluate the iShares iBoxx $ High Yield Corporate Bond ETF (NYSEARCA:NYSEARCA:HYG) as an investment option at its current market price. This is a very popular option for retail investors looking to own below-investment grade credit and it is one I have covered in the past. It has been a while since I wrote about HYG in particular, but it is approaching nearly three years since I placed a “hold” rating on the fund. In hindsight, this call has been vindicated, with HYG declining modestly over that time period:

Fund Performance (Seeking Alpha)

We head in to 2023, I think that investors would be wise to manage risk carefully. With that view, buying a “junk” bond fund does not seem to be a logical move. But I simply see some value here given the spike in yields we have seen across the fixed-income world. I think investors are finally see enough reward to justify the risk. I also like the idea of using a non-leveraged option because that removes some of the interest rate risk that has pressured the CEF space in 2022. Therefore, I am putting a “buy” rating on HYG for now, and will explain why in detail below.

Coverage Ratios Exhibit Strength

To start this review I want to touch on a fundamental reason why high yield doesn’t “scare” me at the moment. To be fair, I don’t want to give the impression I am completely risk-on here. I am not – and I have been very upfront about that in my recent reviews. However, I do think it is time to start rotating back in to bonds and fixed-income products more broadly given the income environment. With inflation finally starting to peak in the U.S., now seems to be the time to lock in some higher yields for the longer term.

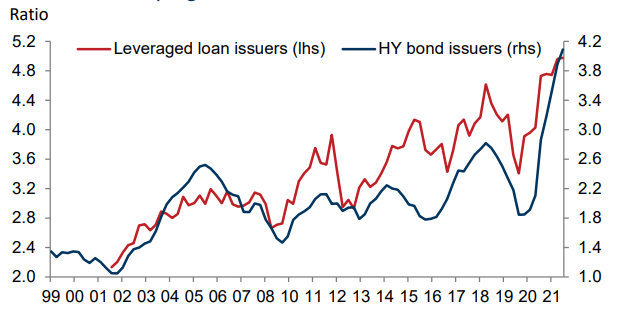

Of course, junk bonds carry more default risk than IG credit. With a potentially very difficult 2023 on the horizon it may not make sense for readers to get carried away with risk. But just how risky are high yield bonds right now? If we look at coverage ratios, the chances of mass defaults across the high yield spectrum actually seems low. To illustrate, consider that interest coverage ratios for HY bond and leveraged loan issuers are at historically high levels:

Coverage Ratios (FactSet)

What this means is that issuers are in reasonable shape to continue to make good on their debt obligations. This is a net positive for holders of the net in that it increases the likelihood of on-time, in full distributions.

Of course, the concern is whether leveraged corporate balance sheets can withstand a higher-for-longer cost of capital backdrop. If we see a deep or prolonged recession, than this outlook is going to be very contested. But in the immediate term, I don’t see an environment where we see a rapid rise in defaults. As we move deeper in to 2023 I will have to reassess the macro-outlook to be sure. But, for now, high yield doesn’t look all that scary.

The Income Story Is Hard To Ignore

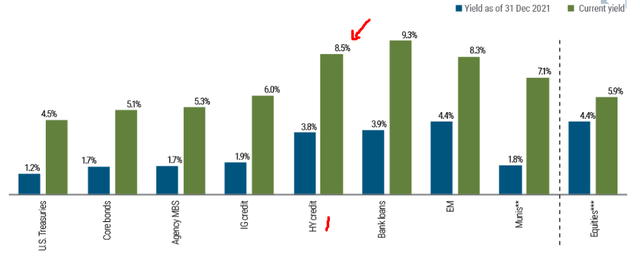

The next point focuses on income. This is a key component to total return for debt ETFs like HYG and many others. This is also central to why I think there is opportunity now. After years of low rates and low-yielding ETFs, the table has finally turned in the favor of investors. What I mean is, yields have spiked to the point where we can now finally earn yields that aren’t at historic lows. This is not just true for HYG, but for most credit sectors. While yields are up across the board, it is still worth noting that to beat inflation, one has to look beyond IG credit at this time:

Current Yields (By Sector) (PIMCO)

I should point out that if we annualize HYG’s most recent payout in November, the fund is showing a current yield around 5% ($.26/share divided by the current share price of $74/share). However, the ETF should be able to add higher yielding securities to its portfolio over the next few quarters that should boost this yield – given the reality of the current interest rate environment.

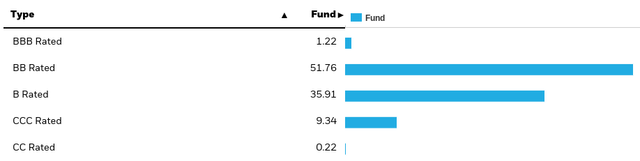

On top of this, the high yield sector is actually of higher quality than it has been in years past. Again, 2023 could change this if we see a broad economic slowdown, but for now the fact is funds like HYG are not as “junky” as they used to be. Over half the fund is rated BB (which is the highest rating within the junk bond market):

HYG’s Credit Breakdown (iShares)

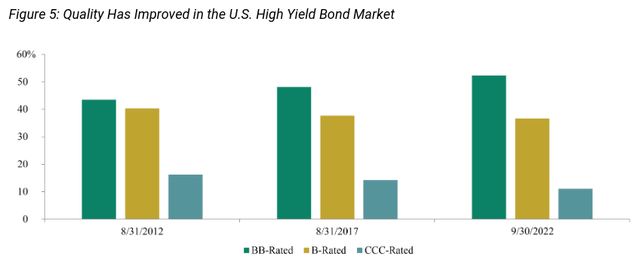

This is consistent with the broader high yield space, which makes sense since HYG passively tracks a high yield index. Over time, this index has seen more of its issues receive a BB-rating, as opposed to lower quality B’s and CCC’s:

High Yield Bond Market Credit Quality (St. Louis Fed)

The conclusion I draw here is that HYG is not actually as risky as it may sound on the surface. With a yield approaching 5% and likely to go higher in this interest rate environment, I see merit to owning a piece of it.

Bank Lending Standards Are Tightening

Another attribute that I view positively is the tightening of lending standards that we have seen across capital markets recently. As banks and other lenders prep for a more difficult economic environment, they are getting stricter with who they loan to. In fact, lending standards have spiked as 2022 wrapped up:

Bank Lending Standards (Commercial) (Bloomberg)

This tells me that even for issuers who will be rated “junk”, banks are going to be more confident in their ability to pay back the loans than they have in the past. This is because these borrowers will have passed more stringent requirements and beat out the competition, so to speak.

A Passive Index Looks Appropriate To Me

To wrap up this article, I want to again emphasize that I am in no way suggesting readers shift entirely risk-on at this juncture. I see a lot of headwinds in the market, and while I think high yield credit offers opportunity, there is risk as well. This is actually fundamental to why I am shifting my attention to funds like HYG, which are passive and non-leveraged options. This is sharply different than many of the leveraged CEFs I often write about (and own) for my junk/riskier exposure.

The reason being in this environment owning a leveraged product means carrying a disproportionate amount of risk. We have seen that in 2022 throughout the year fairly consistently. As interest rates spiked, so did interest expenses for those leveraged funds. This meant earnings took a hit, along with share prices. This story has been amplified by yield curve inversions, as managed and leveraged funds faced higher short-term borrowing costs but were limited in their yield pick-up opportunities further down the maturity curve. Add it all up, and this was a tough year for leveraged CEFs – and 2023 could very well bring more of the same.

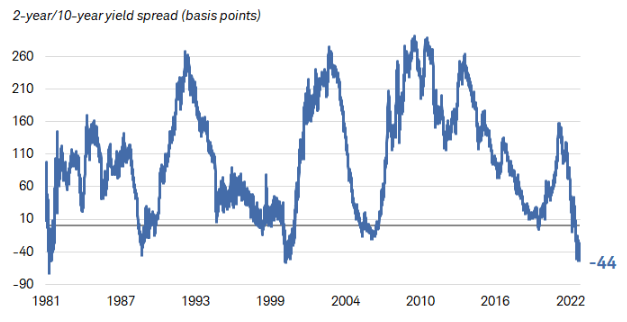

To be fair, if the high yield sector rallies, so too could those leveraged CEFs and to an amplified degree. But I am not wildly optimistic on that right now. THis is because we are currently in an inverted yield curve environment:

Yield Curve (Charles Schwab)

In sum, the backdrop pressuring both credit and leveraged credit-focused CEFs remains in place. I would wait a bit for this picture to clear before really doubling down on that investment idea. In the interim, a fund like HYG allows me to take advantage of widening spreads, but without taking on excessive risk that has not paid off at all this calendar year.

Bottom-line

I see merit to taking a stab at HYG right now. Within credit markets, yields and spreads are near the most attractive they have been in the past decade. This doesn’t mean we are guaranteed to see positive returns, but the risk premiums are at least compensating us for potential default risk. Readers should remember that high yield as a rule means greater volatility and more variable income streams if economic conditions deteriorate. THis is crucial in any evaluation when determining if a fund like HYG is right for any individual. But I see relative value here and also a way to stay ahead of inflation. Therefore, I stand firm on my “buy” rating for HYG, and I suggest readers give this idea some consideration at this time.

Be the first to comment