artiemedvedev

Introduction

Here’s our verdict on our previous coverage:

- Hut 8 Mining (NASDAQ:HUT) is expanding and operating at the expense of shareholders’ claim of profits (dilution) to continue its commitment to the 100% HODL strategy. As a result, HUT increased its outstanding shares by more than 85% since the beginning of 2021.

- HUT is one of the most inefficient Bitcoin (BTC-USD) mining companies.

- HUT’s investment value proposition lies in its hard assets being worth more than its market cap.

HUT’s recently released Q2 quarterly report cements our thesis while taking a turn for the worse. There’s a lot to unpack. Therefore, this article aims to break down HUT’s Q2 performance in a comprehensive and quantifiable manner.

Adding inefficiency to existing inefficiencies

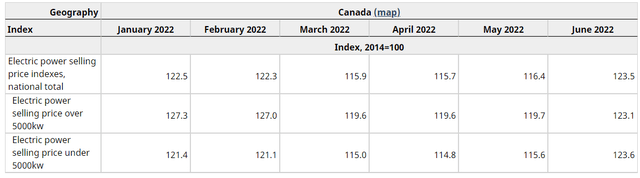

HUT operates solely in Canada. According to the Canadian Electric Power Selling Price Index, energy cost remains relatively stable in Q1 and Q2. There’s even a 12% decline in energy cost.

Canadian Electric Power Selling Price Index (Canadian Electric Power Selling Price Index)

Using this data, we should expect HUT to have relatively stable cost expenditure. For the most part, HUT’s Q2 cost expenditure remains stable. General & Administrative expenses ($8mil) remain anchored to the historical average over the previous 3 quarters ($8.2mil), no spikes in share-based compensation (“SBC”) at $1.56mil (vs $1.72mil average), and High-Performance Computing (“HPC”) gross margins remain stable near 50%. The higher depreciation expense is understandable since there is new acquisition of properties and equipment (value increased from $114.62mil to $152mil QoQ).

Hence, the only significant cost increase is from Bitcoin mining. HUT managed to mine 946 Bitcoins in Q2, compared to 942 in Q1 (a 0.4% increase). However, Bitcoin mining operating cost has increased to $19.1mil, compared to $13mil in Q1 (a 50% increase).

According to HUT:

The increase in average cost of mining Bitcoin was primarily due to higher power prices

This increase in energy cost resulted in a 50% increase in mining operating cost or a 30% increase in all-in business cost per BTC. HUT’s total business cost is $46.8mil or $49,500 per BTC. This is a 30% increase from Q1’s $38,400 per BTC. It is also important to note that the industry average all-in business cost per BTC in the low $30,000 range.

Table 1: Q1 all-in business cost per BTC (or equivalent) mined.

Source: Author

On the other hand, HUT’s operating cost per BTC (excluding depreciation) in Q2 is $20,200, up from Q1’s $13,800. This implies that HUT was operating at a loss when Bitcoin traded below $20,000. Hence, there is significant risk of halting operation should operating loss (mainly cash expenses) eat into its cash position faster than cash raised through issuing new shares (dilution).

Is another round of major dilution in the works?

Out of the $46.8mil total cost in Q2, about $21.5mil is cash expense but HUT’s cash position only decreased by $13mil. Moreover, total liabilities have also decreased. Therefore, the logical source of capital (cash) is share issuance.

HUT’s Q2 total outstanding shares increased by 2% which resulted in a cash influx of $43.4mil. After repayment of loans (which explains the decrease in total liability), net influx was about $36mil.

There is a case to be made that another round of major dilution is already in the works (Table 1). HUT’s cash expense is about $20mil every quarter, and its cash position could only provide about 2 quarters worth of liquidity. In addition to low liquidity, the previous major dilution was carried out when HUT’s cash position was around $30mil.

Perhaps HUT foresaw this situation and announced a $65mil at-the-market (“ATM”) offering which would result in a ~25% dilution.

Table 1. Dilution vs Cash Position

|

QR(CY) |

Shares Outstanding (mil) |

Cash ($mil) |

|

2022Q2 |

178 |

47 |

|

2022Q1 |

174.2 |

60.4 |

|

2021Q4 |

170 |

107.8 |

|

2021Q3 |

164.4 |

171.7 |

|

2021Q2 |

143.3 |

71.31 |

|

2021Q1 |

118.6 |

30.8 |

Valuation

Our previous valuation model isn’t applicable in a situation where Bitcoin is trading below its all-in business cost per BTC, which is $49,500 in this case. Hence, we reverse engineered our model to evaluate the Bitcoin price required to justify its valuation.

Our model is a function of the Bitcoin network hash rate, mining capacity, capacity growth project, business cost, and earnings multiple of 4. For instance, HUT’s actual business value ($225mil) is the market cap ($570mil) net of Bitcoin reserve and assets ($345mil). Based on an earnings multiple of 5, HUT needs profit of $45mil annually. Based on its annualized Q2 production rate (3784 BTC), Bitcoin needs to be $61,400 to earn that $45mil annually.

An earnings multiple of 5 is a baseline and we could be even more conservative. This is because mining rigs have an expected lifespan of 4 years, but newer and more efficient rigs can also hit the market within the same period. The efficiency (e.g. Antminer S19) could be double the previous-generation rigs (e.g. Antminer S17).

Verdict

The already inefficient HUT just got more inefficient in Q2. The major risk HUT faces is Bitcoin sustainably falling below its operating cost per BTC ($20,200 in Q2), which Bitcoin did for a short while.

Should this scenario play out, we expect HUT to continue to severely dilute shareholders. According to our Bitcoin outlook, we do not expect Bitcoin to recover to its all-time high within the next 1.5 years. Considering a near all-time high Bitcoin is required to justify HUT’s valuation and the major risk of dilution, our suggestion is to hold the underlying asset (Bitcoin) directly, which has significantly less risk.

Be the first to comment