michaelbwatkins

Shares of Huntington Ingalls (NYSE:HII) have gained about 11% over the past year, participating in the defense contractor rally since the Russian invasion of Ukraine. However, this solid performance comes after several years of underperformance vs other major contractors, particularly trailing its former parent, Northrop Grumman (NOC). Given it is primarily a shipbuilder, its business has less upside from increased demand for weapons to supply Ukraine as that is primarily a ground conflict. Given a history of checkered performance, I would sell shares of HII in a sector that otherwise has positive tailwinds.

Seeking Alpha

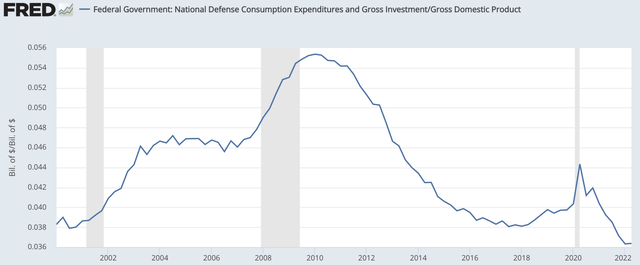

There is a reason the defense contractors have almost uniformly rallied this year. The scarier the geopolitical environment seems; the more politicians will be willing to spend on defense. This is especially the case because sequestration and inflation have greatly reduced the Pentagon’s purchasing power as a share of GDP over the past decade.

St. Louis Federal Reserve

Defense spending could rise $90 billion and just get back to our Q4 2019 level. As a consequence, the Pentagon budget proposal for a $31 billion increase to $773 billion is likely to be exceeded by congressional appropriators. The Senate is targeting $857 billion, and even the House is targeting $840 billion in its version of the National Defense Authorization Act. When this bill is passed after the midterm election, the Pentagon will have the ability to place significantly more orders.

Now while rebuilding the inventory of arms and missiles supplied to Ukraine will be a priority, a growing Navy is also definitely a longer-term defense priority. The Navy wants to grow its fleet, but it lacks the funding (and arguably the US shipbuilding industry lacks the capacity) to achieve its goal of reaching 355 ships by 2045. Instead, it expects the fleet to shrink to 280 in five years and only reach 320 by 2045 from 298 today. Achieving this aim would require a larger Naval budget, which should benefit HII, given it is our largest defense shipbuilder. Unfortunately to profit from a favorable backdrop, strong execution is required, and here is where I have concern.

In the company’s second quarter, EPS came in at $4.44. Revenue was $2.7 billion, which was up 19% as its aircraft carrier construction accelerates, and M&A benefits the size of its mission technologies unit. The company generated $208 million of free cash flow during the quarter.

Operating income grew 49% to $191 million as margins increased 150bp to 7.2%. This was aided by a 417bp increase in margins in the Ingalls Shipbuilding unit, due to favorable changes in contract estimates, which can swing each quarter, as well as price increases, a more sustainable positive. For perspective though, in Q4 2019, operating margins were 8.9%, and in Q4 2018, they were 9.7%.

The challenge for the company is that with the Naval budget not sufficient to really grow the fleet, and limited supply of qualified workers to build ships, the shipbuilding unit that drives nearly 80% of revenue and 90% of profits will be a slow-growth unit that slowly works through its share of the company’s $47 billion backlog. The unit will never struggle to stay busy, but it is not as though it can double aircraft carrier production tomorrow.

In fact, the company has struggled to deliver the orders it has. For instance, the USS Gerald Ford ended up costing about $13 billion, several billion more than expected, and it was delivered two years behind schedule, an underwhelming start to the new aircraft carrier program. This is where the mission technologies unit comes in to try to shift HII’s reliance from these long-term and operationally complex construction projects.

Mission technologies is HII’s effort to diversify away from shipbuilding with a focus on unmanned systems, cyber and electronic warfare, and nuclear remediation. At $600 million, this accounts for about 22% of the business, though operating margins were lower at 4.4%. Unfortunately, in Q2, the unit had a book to bill-ratio of just 0.8x, ideally there would be a ratio over 1x to suggest growing demand and potential revenue. As a consequence, management has cut its outlook for this unit’s revenue, and margins will remain a weak 2.5%, clearly signaling this unit remains sub-scale. HII has diversified some of the firm’s revenue, but from a profit perspective, it has not really diversified the business in a meaningful way.

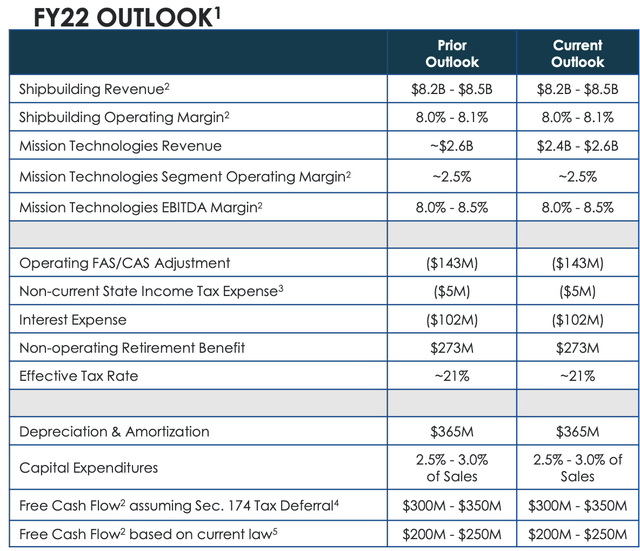

Huntington Ingalls

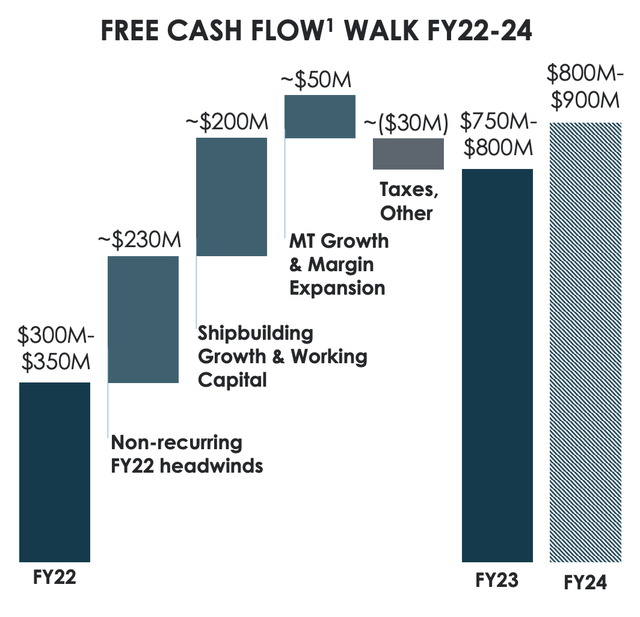

Now, the bull thesis for the stock is that management is forecasting over $750 million in free cash flow next year and $800 million in free cash flow in 2024. This would be a significant acceleration and enable the company to grow its dividend “low single digits” and repurchase $1 billion in stock by the end of 2024, implying a step up to about a $100 million pace each quarter from $20 million currently.

Huntington Ingalls

Here, I again would urge caution. First, you may notice the company is using $300-350 million as its 2022 baseline, though under current law its guidance assumes $200-250 million. This is because starting in 2022 research and development spending has to be capitalized rather than expensed for tax purposes. It is possible congress could delay its implementation to a later year after the midterm elections, but this is unknown and immediately creates downside risk to the 2023 target of about $100 million.

It is also important to remember that at the end of 2019, HII pledged they would become a $700 million free cash flow business sometime in 2021-2023. Holding working capital swings normal, in 2020, the business generated $495 million of free cash flow, and in 2021, $545 million. In 2022, guidance is for at best $350 million. This is not what investors had in mind when that ambition was outlined. This is a business where, given the capital intensity of shipbuilding and difficulty diversifying the business, risks have been skewed to the downside vs forecasts.

Given the mission technologies unit has a book to bill ratio of below 1x, it will be difficult to build the scale needed to expand margins. There has been a $280 million working capital headwind year to date, which has kept H1 free cash flow at just about $80 million, though to achieve guidance of $300-350 this year, some of that will have to unwind. While there will be some improvement, whether $200 million will be achieved is not certain. This business has consistently had some “non-recurring headwinds” as it faces difficulty delivering complex new ship systems.

Even granting a favorable tax change, these categories offer about $150 million in downside risk to guidance, and that suggests free cash flow in the $650-700 million range. After years of disappointing free cash flow and stagnant shares, HII is a “show-me” story that will have to prove it can increase shipbuilding in a margin accretive fashion and get Mission Systems’ orders growing before it earns the benefit of a doubt. For a company with low-single digit growth and high fixed costs and questions over whether the Navy will get the increases in budget it needs to grow its fleet the 7% free cash yield it offers is fair value, particularly as management works to reduce its $3 billion debt load. Shares have spent much of the past five years stuck between $200 and $250, and I expect that to continue. Ultimately, investors should look to the other major defense contractors whose bookings are showing more upside from the war and increased Pentagon budget, like General Dynamics (GD) and Northrop Grumman. I would sell HII here given better opportunities elsewhere.

Be the first to comment