magicmine/iStock via Getty Images

Humacyte, Inc. (NASDAQ:HUMA) is founded by Yale’s Laura Niklason, a world renowned expert on bioengineered tissues who did postdoc work at Bob Langer’s lab at MIT. In 2010, Time magazine named her “engineering of whole lung tissue that could exchange gas in vivo” as one of the 50 most important inventions of the year.

Given that 2010 was not the year that saw the discoveries of penicillin, relativity, and the Internet, I think this was the understatement of the year. A reengineered whole lung that can exchange oxygen and CO2 would be an epoch-making discovery. So could be implantable, reengineered blood vessels that could be grafted onto the human body without infection or rejection, just what Humacyte is trying to do.

Humacyte is a developer of universally implantable regenerative human tissue “for the treatment of diseases and conditions across a range of anatomic locations in multiple therapeutic areas.” These are bioengineered off-the-shelf tissues that need no immuno-suppression before implant and can regenerate with human tissue. Market for this technology exists in indications as diverse as dialysis, peripheral artery disease, trauma, diabetes, coronary bypass, and is potentially valued at $150bn. The company is planning a BLA in mid-2023 for vascular trauma, followed by BLA submission in AV access for dialysis. In their latest earnings call, they provided the following update on this:

The FDA has previously indicated that the HAV for the indication of vascular trauma qualifies for the accelerated approval pathway. We’re pleased to report that we completed a meeting with the FDA in late October. Discussions in the meeting were productive and they focused on a statistical plan that incorporate data from our current ongoing V005 clinical trial and from patients who we have treated in Ukraine.

The discussions during this meeting inform our plan to file the BLA for the common indication in mid-2023. Our V005 Phase 2/3 trial, which is a single arm study, evaluating the use of the HAV and trauma injury setting currently has 56 patients enrolled, and the results of these patients were shared with the agency at our recent meeting. In addition to the V005 patients, we’ve treated nine patients to date in Ukraine with the HAV, and results of these implants were also shared with the agency.

I should note that enrollment in a trauma trial takes time because patients are not always easy to be signed up for trials, especially if the trial locations are not near an area like Ukraine at present.

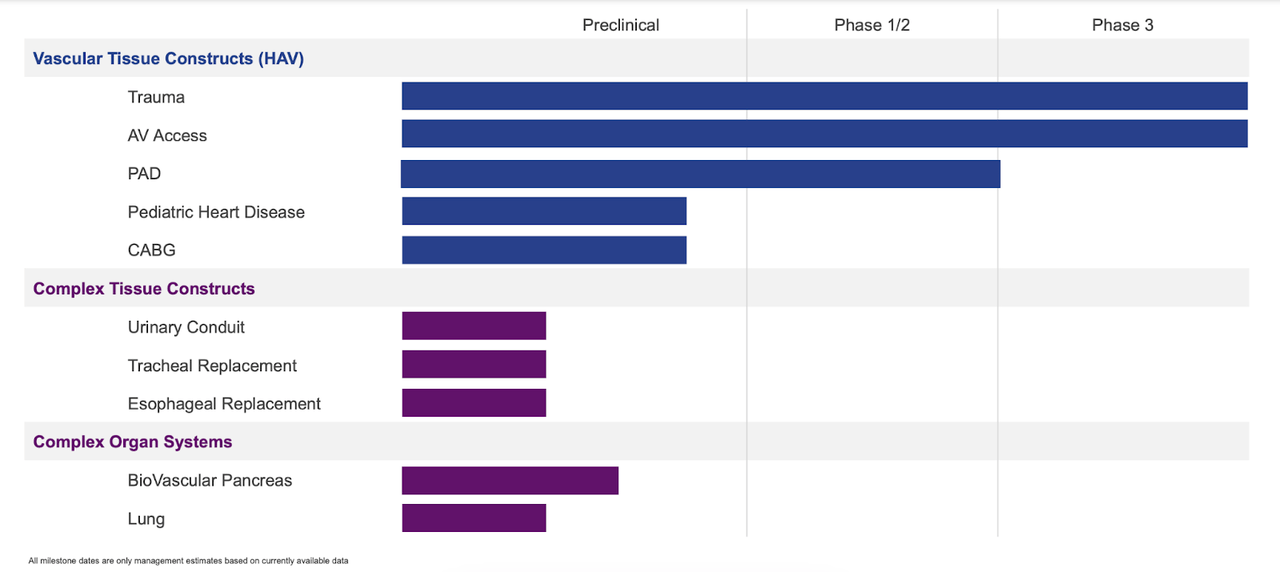

Here’s a look at Humacyte’s pipeline:

Humacyte pipeline (Humacyte website)

Humacyte came to the market through a merger with a SPAC launched by Rajiv Shukla, who has become a well-known SPAC entrepreneur after launching Dermtech in 2017 through a SPAC. Human Acellular Vessel or HAV is Humacyte’s core technology; lead indication is vascular trauma, where the current standard of care are Saphenous Vein Grafts and ePTFE Grafts. Each of these has a number of limitations like long harvesting time and delayed revascularization for vein grafts, and very high infection rates for ePTFE grafts. Both come with up to 15% amputation risks.

HAV in vascular trauma, having a Department of Defense priority designation (because of its wartime usability), has immediate availability because it is off-the-shelf (shelf life 18 months), and low infection and low amputation rates. However, trial data is from open label studies; there is no randomized trial data available yet.

The second target is AV access for dialysis. Current method is AV fistula, which has severe limitations. 40% of these fistulas fail to mature. Even if they mature, they may take up to 6 months to do so. Meanwhile, a catheter needs to be used for dialysis, which causes 2 infections on average per year. HAV is expected to help with these limitations. A phase 3 trial completed enrollment last year, and will topline in 2023 after 12-month follow up.

In 2019, a phase 3 trial comparing HAV to ePTFE in AV access requiring patients (n=350) failed to show non-inferiority despite some measure of success. As the company notes:

It did not meet its primary endpoint, which was secondary patency compared to ePTFE at 18 months. The secondary patency of the HAV was greater than that of ePTFE at 6 and 12 months, but lower at 18 and 24 months.

Numerous other trials have been conducted, and HAVs have demonstrated very good primary patency rates that required no interventions, with no clinical rejections.

Fresenius, one of the largest global providers of dialysis services, has a collaboration agreement with Humacyte, and a few years ago invested $150mn.

Early last year, Humacyte sent its HAV products to war-torn Ukraine and helped treat wounded patients on compassionate grounds. Doctors there were either familiar with the procedure, or were trained in it. The company says it received very strong feedback for the product, and at least in one case, they say that despite infection in the wound bed, a patient treated with HAV remained infection free. Ukrainian surgeons, in a medical conference in Europe last year, said that “HAV greatly assisted in limb salvage by improving their ability to perform vascular reconstruction and by eliminating the need to harvest saphenous vein or venous conduit.”

Financials

HUMA has a market cap of $266mn and a cash balance of $172mn. Research and development expenses were $17.3 million for the third quarter of 2022, while G&A expenses were $6.2mn. That gives them a cash runway of some 7-8 quarters, considering increasing expenses as they approach a potential approval.

The defence sector in the US has taken a strong interest in Humacyte. As the company noted:

In October, the U.S. Army published an update in task and purpose, describing the use of the HAV and treating more — the war wounded in Ukraine. In the article, it was also noted that officials with the Defense Department encouraged Humacyte to collaborate with the Medical Technology Enterprise Consortium or MTEC. MTEC has provided more than $6.8 million in funding to Humacyte to develop the HAV for vascular trauma

Bottom Line

To a certain extent, I like Humacyte, Inc. They have a solid scientific base, and they have proven its merit in real-world situations over the years. Enrollment delays, for obvious reasons, have hindered their progress to an extent. However, they are now nearing not one but two BLAs, and with the interest from the U.S. DoD and the data from Ukraine, I think Humacyte, Inc. is in a good spot. The cash runway is also quite good. The HUMA stock is trading near 52-week lows probably due to lack of near term catalysts. I may be a buyer of Humacyte, Inc. at these prices.

Be the first to comment