marchmeena29/iStock via Getty Images

A Quick Take On Huize Holding Limited

Huize Holding Limited (NASDAQ:HUIZ) went public in February 2020, raising $55 million in an IPO of its American Depositary Shares.

The firm operates an online insurance marketplace for Chinese consumers.

It is difficult to determine whether to have a positive or negative outlook for HUIZ at this time, given the uncertain near-term prospects for the greater macroeconomic environment in China in the coming quarters.

For now, I’m on Hold for HUIZ, but the stock may be worth watchlisting for future consideration if the Chinese economy improves in 2023.

Huize Overview

Shenzhen, China-based Huize was founded in 2006 to develop an online marketplace where insurance companies can provide insurance products and services to consumers through a single platform.

Management is headed by Founder, Chairman and CEO Cunjun Ma, who previously served as the head of a subsidiary of Hua An Property Insurance.

Huize doesn’t bear underwriting risks as it operates as a licensed insurance intermediary, providing a medium for companies to reach a larger audience.

The company is focused on providing long-term life and health-related as well as property and casualty insurance products with a term that is at least one year, while management claims that a ‘substantial portion of these products has payment terms of 20 years or more.’

The firm’s primary source of income is insurance brokerage fees paid by its insurer partners.

The firm’s life and health insurance products cover critical illnesses, typically offering the insured a lump-sum payment if they’re diagnosed with a major illness as defined in the insurance policy.

Huize directly markets its offerings through professional financial media and social media channels as part of its cooperation with insurer partners.

The firm also utilizes social media influencers and financial institutions to promote its services.

Additionally, the company has a loyalty program that offers points to its users, which can be exchanged in a mobile app and a website for a variety of gifts and services that Huize purchases from third-party providers.

According to a 2018 market research report by Mordor Intelligence, the China online insurance market was projected to surpass $79 billion in 2019 and grow at an estimated CAGR of 41% between 2019 and 2024.

China Online Insurance Market (Mordor Intelligence)

Huize’s Recent Financial Performance

-

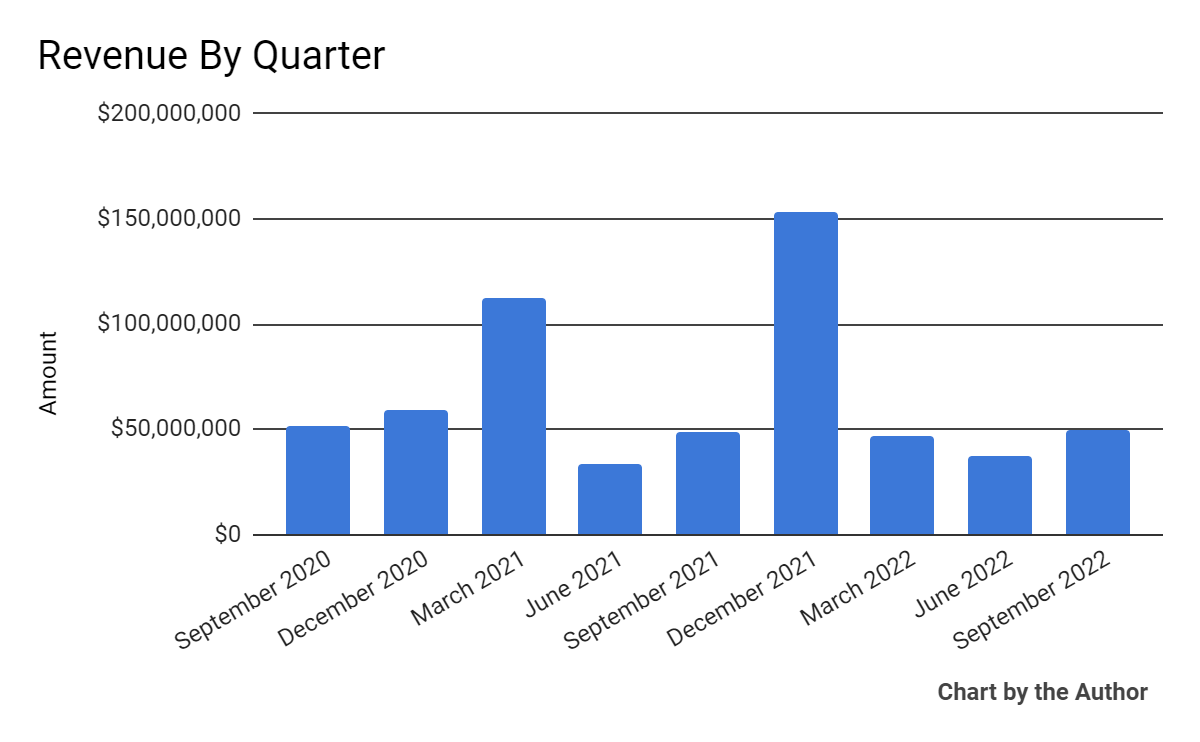

Total revenue by quarter has fluctuated materially in recent quarters:

9 Quarter Total Revenue (Seeking Alpha)

-

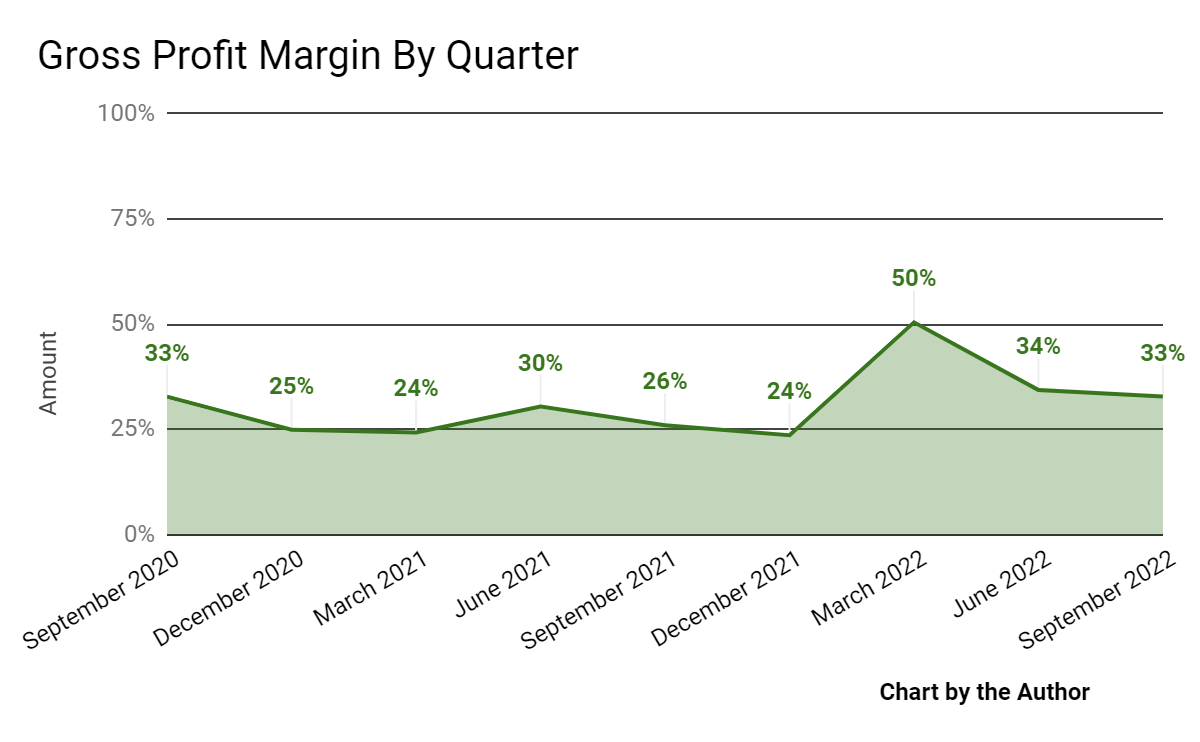

Gross profit margin by quarter has trended higher recently:

9 Quarter Gross Profit Margin (Seeking Alpha)

-

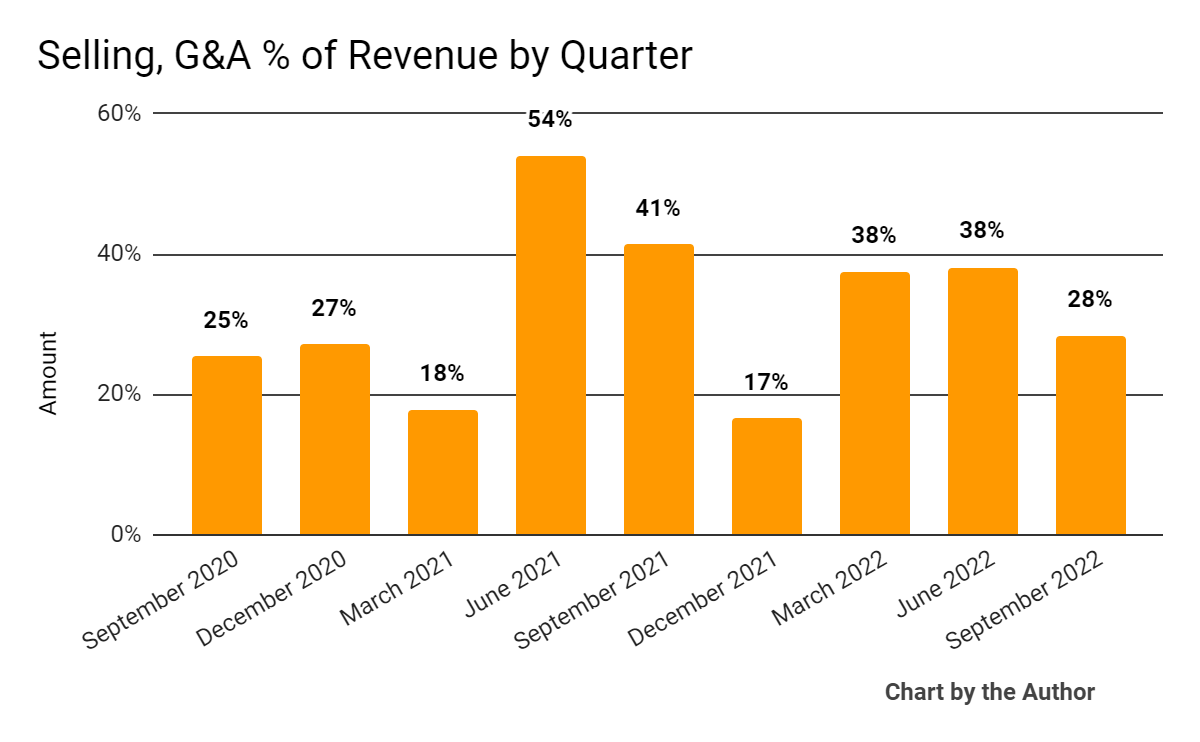

Selling, G&A expenses as a percentage of total revenue by quarter have varied markedly, as the chart shows below:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

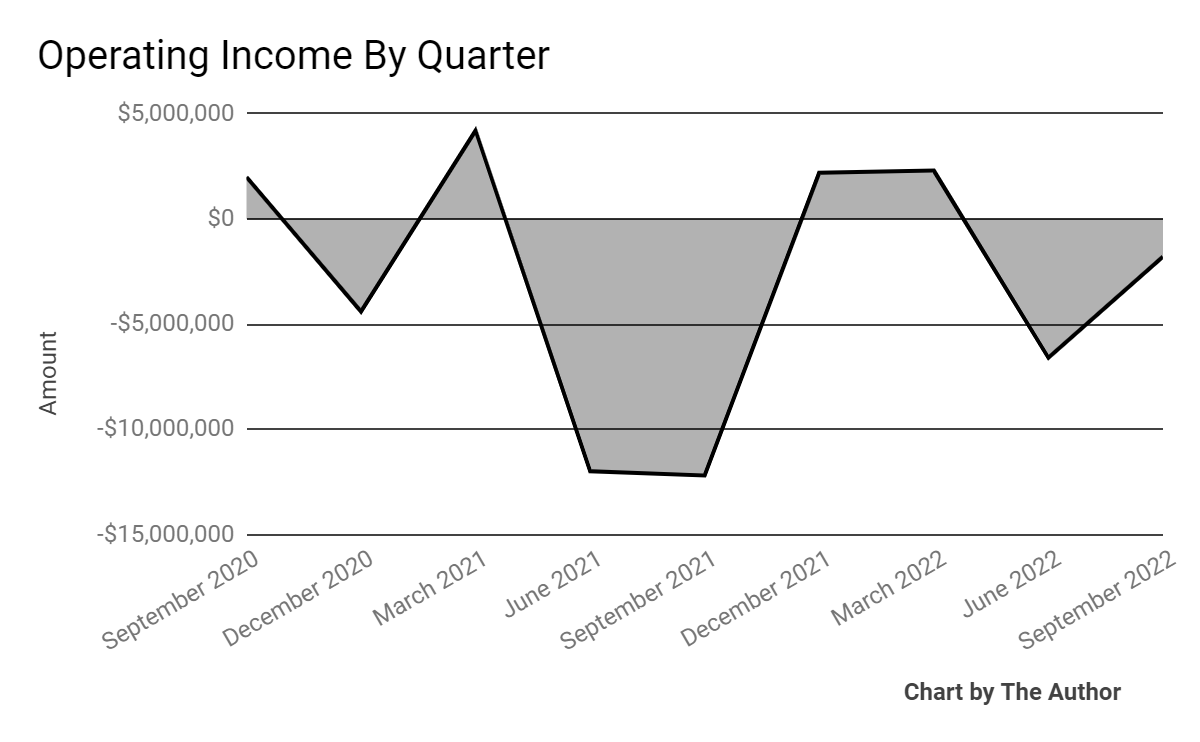

Operating income by quarter has mostly remained negative in the past nine quarters:

9 Quarter Operating Income (Seeking Alpha)

-

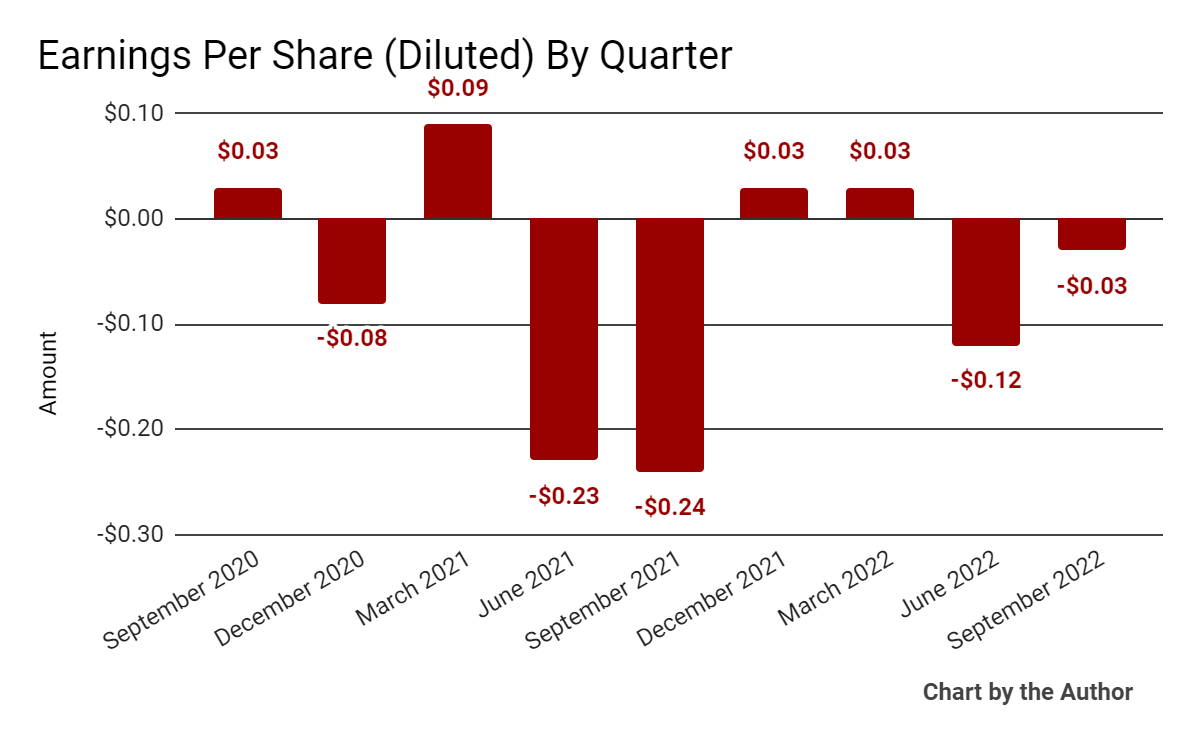

Earnings per share (Diluted) have turned negative in recent reporting periods:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

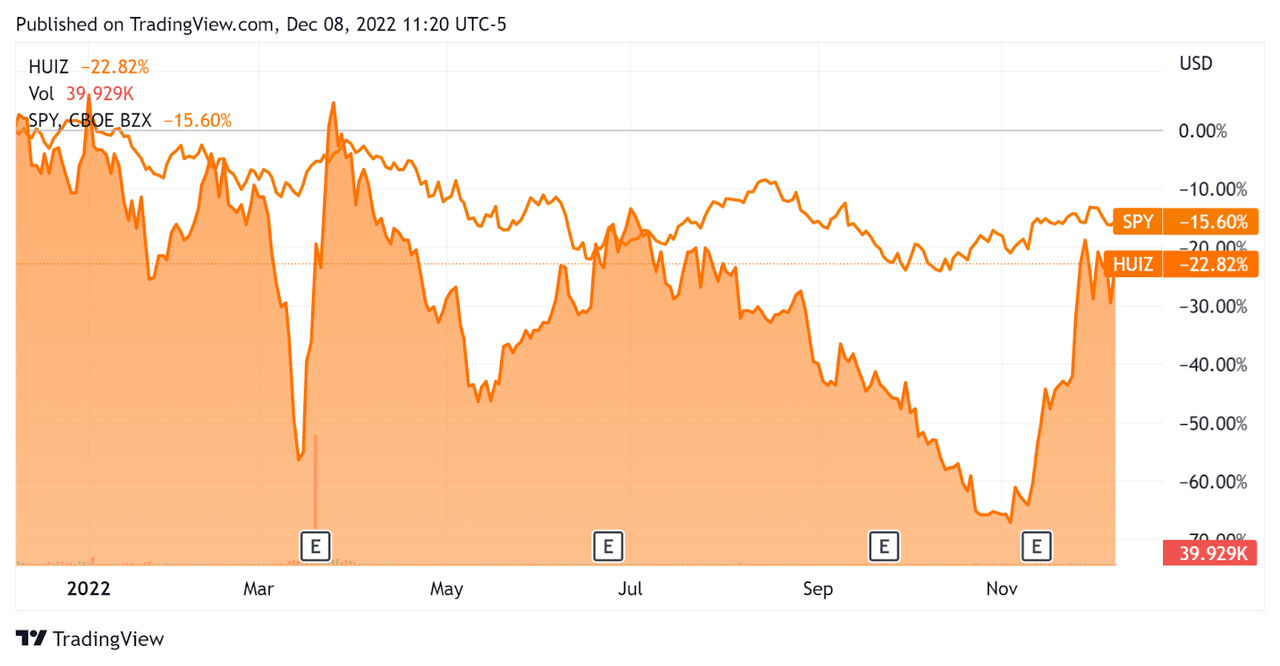

In the past 12 months, HUIZ’s stock price has fallen 22.3% vs. the U.S. S&P 500 Index’s drop of around 15.6% and has been considerably more volatile, as the chart below indicates:

52-Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Huize

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (TTM) |

Amount |

|

Enterprise Value/Sales |

0.3 |

|

Revenue Growth Rate |

13.2% |

|

Net Income Margin |

-1.0% |

|

GAAP EBITDA % |

-1.0% |

|

Market Capitalization |

$54,429,792 |

|

Enterprise Value |

$66,896,372 |

|

Operating Cash Flow |

-$27,681,668 |

|

Earnings Per Share (Fully Diluted) |

-$0.09 |

(Source – Seeking Alpha)

Commentary On Huize

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted its continued efforts to create an omnichannel digital insurance service ecosystem that connects agents, businesses, and customers.

Leadership responded to market demand by focusing on promoting savings insurance products. The strategy has performed well, with total first-year premiums increasing by 34% from the previous year and amounting to RMB685 million. Of this figure, RMB509 million can be attributed to savings products, a 49.3% year-over-year increase.

The company continues to tout the benefit of its asset-light business model and market-driven product offerings.

Additionally, the firm is seeing high user stickiness generated by its long-term insurance products, so its renewal premiums saw a 24.1% year-over-year increase to RMB564 million, providing us with a steady source of cash flow.

During the quarter, HUIZ launched Darwin Critical Care #7, the latest in the Darwin Critical Care series. It provides additional benefits for severe and mild malignant tumors, carcinoma in situ, and ICU hospitalization benefits for major diseases.

The company’s customer base has risen to 8.3 million by the end of the quarter.

As to its financial results, total revenue rose only 1% year-over-year.

The company’s renewal premiums increased 24.1% year-over-year, despite a difficult macroeconomic environment.

Gross profit margin grew markedly year-over-year, while SG&A as a percentage of total revenue dropped.

As a result, operating income, while still negative, closed in on breakeven, while earnings per share were negative ($0.03).

For the balance sheet, the firm ended the quarter with $43.2 million in cash and equivalents and $29 million in short-term borrowings.

Regarding valuation, the stock has recently jumped above the $1.00 price on several occasions, although it is unknown as the reason.

Management stated that they may adjust the ADS to the underlying share ratio in order to come back into compliance with Nasdaq listing rules in the wake of receiving a delisting notice.

The primary risk to the company’s outlook is the ongoing uncertainty with respect to Chinese regulatory actions, which have been unpredictable and in some cases hostile to business interests.

A potential upside for the firm is the very recent decision by Chinese authorities to reduce the COVID lockdowns, possibly removing the shackles from the economy, at least in that respect.

Time will tell if COVID infections rise sharply and whether this will have a negative effect on the company’s fortunes.

It is difficult to determine whether to have a positive or negative outlook for HUIZ at this time, given the uncertain near-term prospects for the greater macroeconomic environment in China in the coming quarters.

For now, I’m on Hold for HUIZ, but the stock may be worth watchlisting if the Chinese economy improves in 2023.

Be the first to comment