allanswart/iStock via Getty Images

Introduction

In April, I wrote a bullish article on Hudson Technologies, Inc. (NASDAQ: HDSN), and this has to be one of my best stock picks to date. The company booked record financial results for Q1 2022, and its market valuation has soared by more than 40% since my article came out, briefly surpassing the $9.70 share price I gave just over two months ago.

However, the Q1 margins look unsustainable, and I expect them to come down over the coming months as the cost of inventory starts to increase through the year. Also, I think that joining the Russell 2000 Index could drag the share price down and that this could be a good time to take profits. Let’s review.

Overview of the latest developments

In case you haven’t read my previous article, Hudson Technologies is a provider of sustainable refrigerant products and services to the HVACR industry, and it has developed reclamation technology that can recover all refrigerants. The company holds around 35% of the reclamation market in the USA, which is crucial as the country aims to phase down climate-damaging hydrofluorocarbons (HFCs) to 15% of their baseline levels by 2036.

The start of this year marks the start of the implementation of the AIM Act regulations, which means that there is a 10% decrease in the production and consumption allowances for HFCs for 2022 and 2023. The reduction increases to 40% of in the baseline in 2024 and this means that reclaimed HFCs should increase from about 6 million pounds in 2020 to around 40 million pounds by 2024.

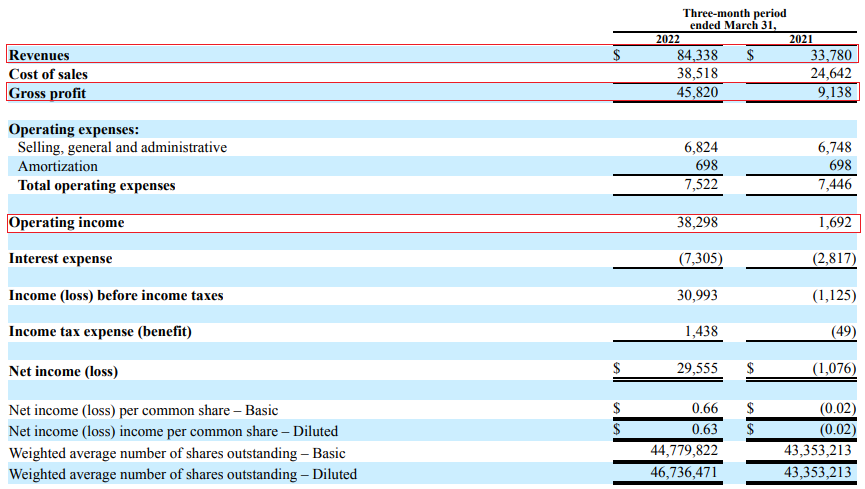

Hudson Technologies is already starting to reap the benefits of its leading position in the refrigerants reclamation market. In Q1 2022, revenues soared by almost 150% to $84.3 million while the operating income came in at $38.3 million. The gross profit margin, in turn, rose to 54.33% from 27.05% a year earlier.

Hudson Technologies

Revenues were higher mainly as a result of strong prices of certain refrigerants due to increased demand and limited industry supply and this means that this performance is not sustainable over the long term. The margins are likely to be under pressure as the cost of inventory increases through 2022 due to high inflation across the globe. Hudson Technologies itself said during its Q1 2022 earnings call that it expects margin performance for the full to moderate to levels similar to 2021. Last year, the company’s gross margin was 37.18%, which means we could see levels of below 30% by the end of 2022. As a reminder, this is a seasonal business with a traditional 9-month selling season that starts at the beginning of the year.

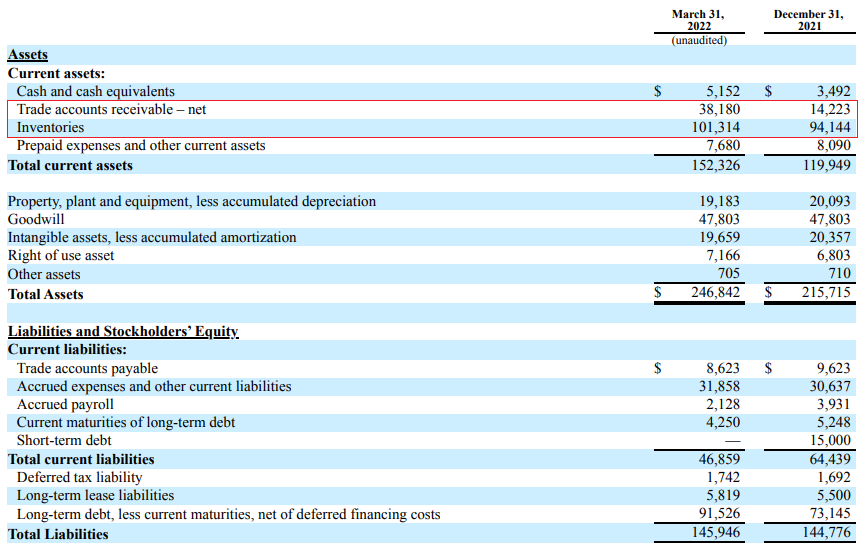

Turning out attention to the cash flow situation, cash flow from operating activities in Q1 2022 was just $5.1 million as there was a significant increase in receivables and inventories due to the higher sales.

Hudson Technologies

This also led to a small increase in debts. Speaking of which, Hudson Technologies refinanced its debts in Q1, which resulted in a one-time interest expense of $4.6 million. Its long-term debt now stands at $100 million, with $83 million of it maturing in 2027.

Overall, I think that this was a great quarter for Hudson Technologies that puts it one step closer to achieving its long term annualized revenue and operating income targets of $350 million and $72 million, respectively. However, the next few quarters should be weaker from a financial point of view, and I think that this could put pressure on the share price. Also, the strong Q1 2022 financial result and the influx of investors have helped Hudson Technologies become a part of the Russell 2000 Index effective June 27, which I think could lead to a decline in the share price. You see, indexers will need to buy about 4 million shares of the company, and many retail investors are expecting this event to provide a boost for the share price.

However, many indexers pre-position themselves by buying up Russell additions and short selling the deletions in front of the reconstitution date, which means that the effect of joining the index is likely to be minimal. This could disappoint some retail investors in Hudson Technologies and thus hurt market sentiment.

Investor takeaway

The financial results of Hudson Technologies were unusually strong in Q1 2022, and I think that this has provided a strong boost for the share price. However, the company itself admits that these margins are not sustainable over the long term and that its gross margin is likely eventually to fall to the 2021 levels. Also, the stock is joining the Russell 2000 Index, and I think that this has created overly optimistic expectations among some investors that the share price will increase, as indexers have to add about 4 million shares. I think that this could be a good time for investors to take profits, as the share price could come under pressure over the next few months due to these two factors.

That being said, the implementation of the AIM Act will limit virgin HFC refrigerant production, and this should benefit reclamation companies like Hudson Technologies over the coming years. I think that the company has a good chance of achieving its ambitions of reaching revenues of $350 million and operating income of $72 million by 2024.

In my view, there is a compelling investment opportunity here, but the share price has increased too fast and there are no catalysts in the near future.

Be the first to comment