Justin Sullivan

Introduction

Warren Buffett took a significant position in HP Inc. (NYSE:NYSE:HPQ) of $3.4 billion in the first quarter of 2022. His HP position represented about 1.14% of his stock portfolio and HP ranks 11th in terms of portfolio weight, a fairly high position. Meanwhile, the stock is down 24% as HP came up with lower revenues and FCF guidelines.

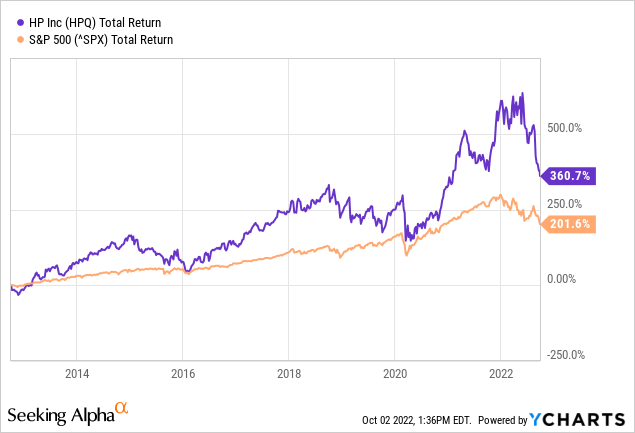

Since its IPO in 2012, its total return, including dividends, has exceeded that of the S&P500. And with a PE ratio of 6.1, it’s worth taking a closer look at HP.

HP shocked the market with their lowered expectations, and analysts expect the demand for computers and peripherals to ease in 2023 due to a decline in consumer spending. Analysts expect demand to pick up again after 2024. I think it is too early to buy the stock now, but if/when HP shows an improved guidance, I will consider buying the stock.

Company Overview

HP is known for its personal computers, computer peripherals, and printers. Today HP is also strong in 3D printing of different materials such as various plastics but also metals.

The company operates through 3 business segments:

- Personal Systems (68% of 2021 revenue)

- Commercial and consumer desktop and notebook personal computers, workstations, thin clients, commercial mobility devices, retail point-of-sale systems, displays and peripherals, software, support, and services.

- Printing (32% of 2021 revenue)

- Consumer and commercial printer hardware, supplies, solutions, and services.

- Corporate Investments

- HP Labs and business incubation, and investment projects. It serves individual consumers, small- and medium-sized businesses, and large enterprises, including customers in the government, health, and education sectors.

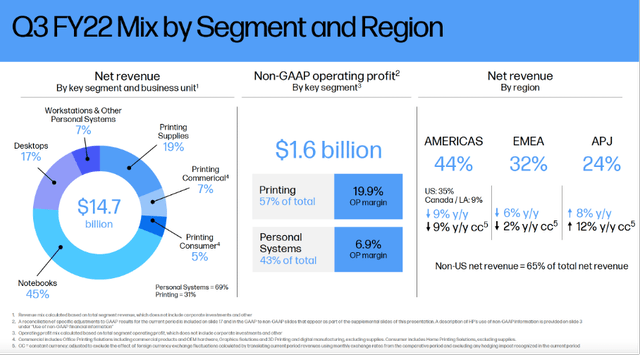

The mix of business segments is shown in the figure below.

Q3 FY22 Mix by Segment and Region (HP Q3 investor presentation)

HP Financial Results And Outlook

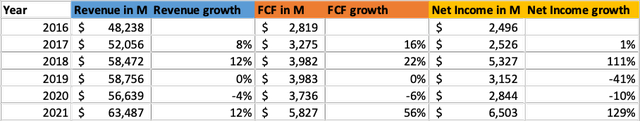

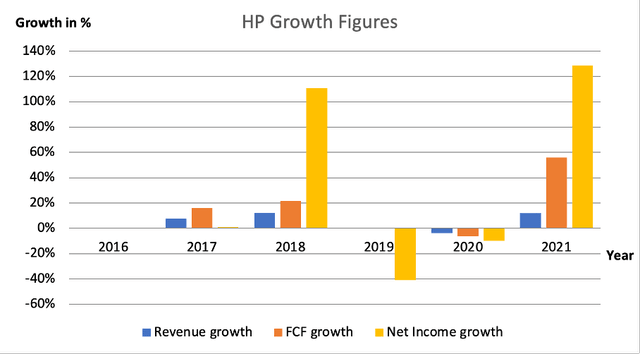

HP’s revenue grew steadily over the past few years through 2019, after which revenue declined slightly in 2020 but continued to grow in 2021. Over this 5-year period, revenue grew by an average of about 6% per year. Free cash flow followed a similar path to sales.

HP’s Financial Results Over The Past Years (SEC and Own Calculations)

HP is a cash flow machine. In 2021 their FCF return was a strong 9% and in other years it was a strong 6%. 2021 was a strong year with their Print segment showing strong revenue growth of 14%. The Print segment has a high operating margin of 18.1%, while the Personal Systems segment’s operating margin is much lower at 7.2%. Free cash flow is returned to shareholders in the form of dividends and share buybacks.

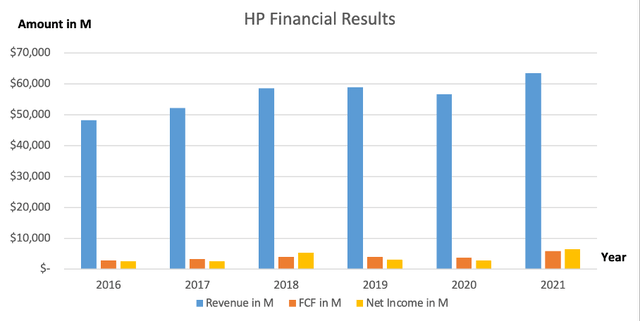

From the chart below, we can clearly see that revenue, free cash flow and profit follow a stable path.

HP’s Financial Results Over The Past Years (SEC and Author’s Own Graphical Representation)

Net income growth has shown significant leaps, especially in recent years. Free cash flow shows a stable growth pattern, better in line with sales growth than net profit.

HP’s Growth Figures (SEC and Author’s Own Graphical Representation)

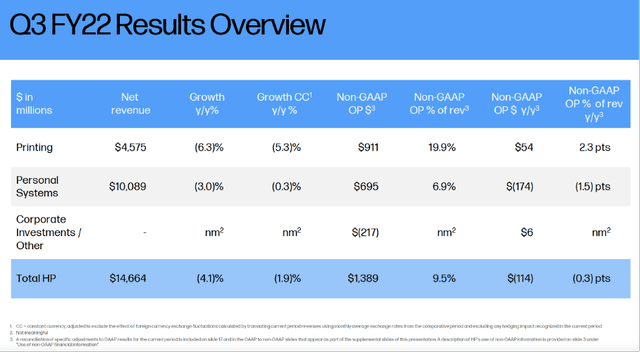

Recent Quarterly Earnings Were Mediocre

Recent third quarter results came in with a revenue decline of 4% compared to the same period last year. Non-GAAP EPS came in at $1.04 (year-on-year growth of 4%), at the lower end of their previously announced outlook. This is notable as it delivered top performance in their previous quarter, at the high end of their announced outlook.

Revenue decreased in both the Printing and Personal Systems segments. The Printing segment is the more profitable of the two. If this trend continues, it will negatively impact HP’s consolidated profitability.

Q3 FY22 Results Overview (HP’s Q3 Investor Presentation)

About 65% of the Personal Systems business segment comes from notebook sales. Notebook revenues were down 10% year-over-year and unit sales were down 32% year-over-year. Desktop sales accounted for 25% of sales, growing 13% year-over-year, and units sold were up 1% year-over-year. Consumer revenues were down 20% year-over-year, while commercial revenues were up 7% year-over-year. High inflation hits consumers in their wallets and they can delay purchases like notebooks.

If we look at the Printing business segment, we see that Printing supplies make up 62% of the segment revenue. Printing supplies revenues were down 9% year-over-year, commercial revenues were down 3% year-on-year and consumer revenues were up 1% year-on-year. I’m surprised that sales of printing supplies have fallen because they are consumables.

HP lowered its guidance for FY2022, HP expects mid-range non-GAAP EPS of $4.08 and free cash flow of $3.5B. The expected free cash flow is somewhat disappointing because it is as high as in 2020 and represents a decrease of 40% compared to last year.

Looking to 2023, analysts expected growth in the PC market to return from 2024. I quote:

Further contraction is also expected in 2023 as consumer demand has slowed, the education demand has been largely fulfilled, and enterprise demand gets pushed out due to worsening macroeconomic conditions. The combined market for PCs and tablets is forecast to decline 2.6% in 2023 before returning to growth in 2024.

Dividends And Share Repurchases

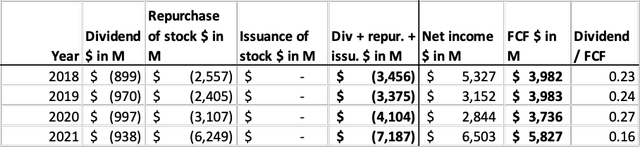

HP returns much of its free cash flow to shareholders through dividends and share buybacks. Share buybacks offer a tax-free “return” of company-generated cash to shareholders. This is an indirect return, but more tax efficient than the payment of dividends.

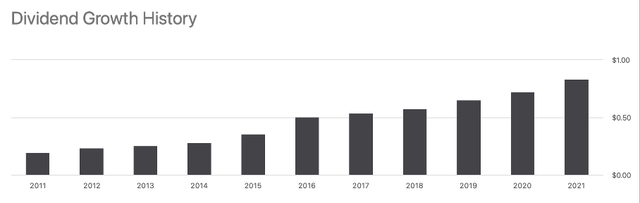

The dividend per share has been growing steadily for years, partly due to share buybacks. Over the past 10 years it has grown at an average of 15% per year and the dividend is now $1.00, representing a high dividend yield of 4%.

Dividend Growth History (SA HP Ticker Page)

The free cash flow to dividend ratio is only 16%, which likely makes their dividend sustainable in the long term.

Shares are repurchased from the remaining part of the free cash flow. In 2021 this was a strong $6.2 billion, representing a very high buyback yield of 25%. The share price rose 60% to $40 but fell as the company lowered its outlook.

HP’s Cash Flow Highlights (SEC and Authors Own Calculations)

Year to date, HP has repurchased more than $2 billion in shares, paid out $0.5 billion in dividends, and returned a total of $2.5 billion to shareholders. This is a lot because their free cash flow over this period was only $1 billion. I expect HP to repurchase less stock than before.

Looking further into FY2022, HP expects free cash flow of $3.2 billion to $3.7 billion. On average, the free cash flow is equal to that in 2020 (see table above). With approximately $1 billion in dividends, HP could repurchase shares for approximately $2.5 billion. Year to date, HP has already repurchased $2 billion worth of shares, leaving just $0.5 billion for share repurchases. So, there are few possibilities for the rest of 2022.

Valuation Looks Favorable

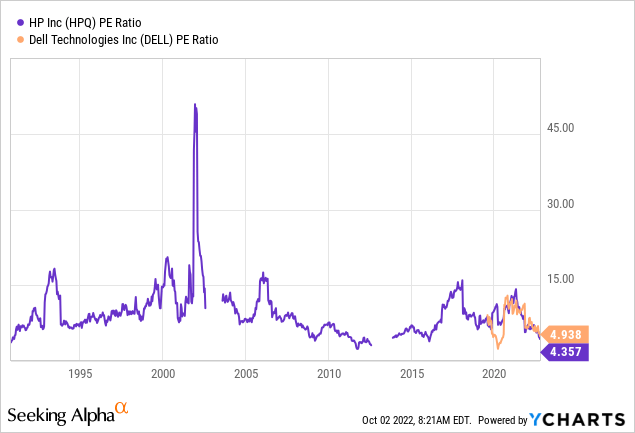

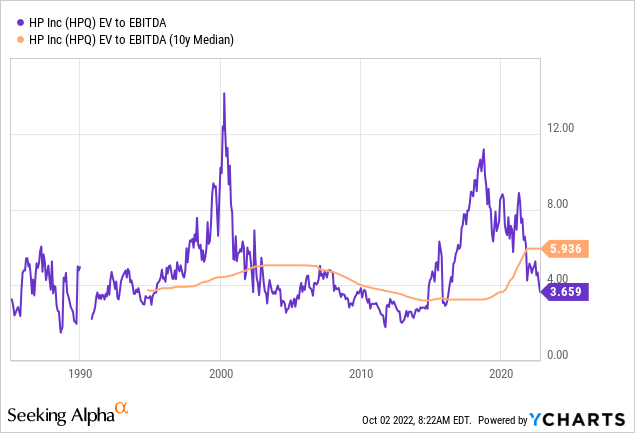

The valuation metrics PE ratio and EV/EBITDA ratio provide a clear picture of the current valuation and the historical valuation. The EV/EBITDA ratio also includes debt and cash, and because HP repurchases shares, this is a valuable valuation metric.

The PE ratio of HP and competitor Dell (DELL) is mapped on the chart below from YCharts. Both companies have a low PE ratio of less than 5. Their ratio is very low compared to the S&P500’s PE ratio of 18 because the personal computer market is very volatile.

If we zoom out, we see that HP’s PE ratio is at the lower end of their PE ratio range. It seems like an attractive buying opportunity.

If we take the EV to EBITDA ratio chart, we see a slightly different picture. This chart shows that the ratio is currently below the 5-year median, more recently the ratio was lowest in 2011.

So, is this a buying opportunity? EPS estimates for FY23 show a 7% decline in EPS before it is expected to rise again in FY24. Despite the low valuation, I’m waiting to buy until the PC market outlook is positive.

Key Takeaway

Pros:

- As the print segment grows, HP’s consolidated operating margin increases.

- Attractive stock valuation metrics and a high dividend yield of 4%.

- The dividend to FCF ratio is very favorable, the dividend is sustainable at the current level.

- The management is very shareholder-friendly by repurchasing shares in addition to dividend.

Cons:

- Personal Systems Business Segment: Consumer sales were down 20%.

- Printing business segment: Sales of printing supplies were down 9%.

- Lowered FY2022 outlook and analysts expect growth to return only after 2024.

Be the first to comment