Ridofranz/iStock via Getty Images

Investment Thesis

There are a variety of factors to consider when building an investment portfolio. If you want to build a long-term investment portfolio with the objective of generating an additional income in the form of Dividends, you should have a balanced mix between Dividend Income and Dividend Growth companies in your portfolio.

This way you can receive a relatively attractive Dividend today, and, at the same time, this Dividend can grow at a relatively high rate over the long-term. This strategy helps you to increase your additional income that you generate year over year. In this way, you can achieve a high Yield on Cost over the long term, which can really help to generate a large amount of extra income for your retirement.

Using this strategy, you can also get back your initial investment by receiving Dividend payments from the companies you have invested in while having a long investment-horizon. By focusing on Dividend payments, you can care less about the ups and downs of stock prices, which will not only help you sleep better at night but you’ll also be able to enjoy even more of your spare time.

Wouldn’t it be nice if when you next buy a Coca-Cola, for example, you buy it with the Dividend payments that you received from the company? And isn’t it even better to know that these dividends are expected to increase from year to year and with this your additional income? In this article I aim to help you build the basis of an investment-portfolio, that can help you achieve this objective.

When building an investment portfolio, I pay particular attention to there being a healthy balance in regards to the following factors:

- Relatively high Average Dividend Yield of the companies

- Relatively high Average Dividend Growth Rate

- Attractiveness in terms of risk and reward

- Companies with strong competitive advantages that provide an economic moat

- Companies with strong financials

- Companies with a relatively high brand value

- Consumer familiarity with the products of these companies

- Attractive Valuation of the companies

- Aiming to achieve a relatively high Yield on Cost when having a long investment horizon

- Risk diversification across sectors and industries

The above factors form the pillars of my investment approach.

The 10 companies I have selected to help you achieve a balanced mix between Dividend Income and Dividend Growth are as follows:

- BlackRock (NYSE:BLK)

- Realty Income (NYSE:O)

- Altria (NYSE:MO)

- Visa (NYSE:V)

- Apple (NASDAQ:AAPL)

- Microsoft (NASDAQ:MSFT)

- Exxon Mobil (NYSE:XOM)

- Nike (NYSE:NKE)

- Unilever (NYSE:UL)

- Bank of America (NYSE:BAC)

BlackRock

BlackRock, which was founded in 1988, is the world’s largest asset manager (AUM: $9.464T) and I consider it to be an excellent choice in regards to risk and reward. The company’s strong competitive position is underlined by its high EBIT Margin [TTM] of 37.55%, which is 51.87% above the sector median (24.72%). The company’s Return on Common Equity [TTM] of 15.04% is also significantly higher than its sector median (11.55%).

At the time of writing, BlackRock has a P/E [FWD] Ratio of 21.21 which is in line with its P/E [FWD] Ratio over the past 5 years (19.14), indicating that the company is currently fairly valued.

In addition to that, several numbers demonstrate that BlackRock is on track when it comes to Growth: the company has shown an Average Revenue Growth Rate [FWD] of 8.65% over the past 5 years and an Average EBIT Growth Rate [FWD] of 9.54% over the same period. In addition to that, its Free Cash Flow Per Share Growth Rate [FWD] of 22.75% is significantly higher than the sector median (7.72%), which demonstrates the ability to grow its earnings at higher rates than its competitors.

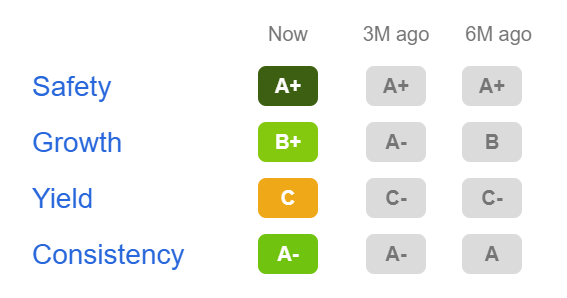

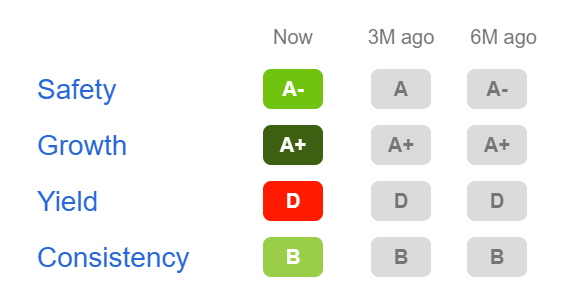

Below you can find the Seeking Alpha Dividend Grades, which provide us with evidence that BlackRock has a rock solid Dividend: in terms of Dividend Safety, the company receives an A+ rating and for Dividend Consistency an A-. For Dividend Growth, it gets a B+.

Source: Seeking Alpha

Realty Income

Realty Income is structured as a REIT (real estate investment trust) and pays monthly dividends which are supported by the cash flow from over 11,700 real estate properties.

In my opinion, Realty Income is an excellent choice in terms of risk and reward. The company provides an outstanding mix between Dividend Income and Dividend Growth. At this moment in time, Realty Income pays its shareholders an attractive Dividend Yield of 4.62%. At the same time, the company has shown a Dividend Growth Rate [CAGR] of 5.63% over the past 10 years. This combination of Dividend Income and Dividend Growth makes Realty Income a perfect choice for this portfolio.

Proof of Realty Income’s strong competitive position is its EBIT Margin of 39.46%, which is 68.23% above the sector median (23.46%).

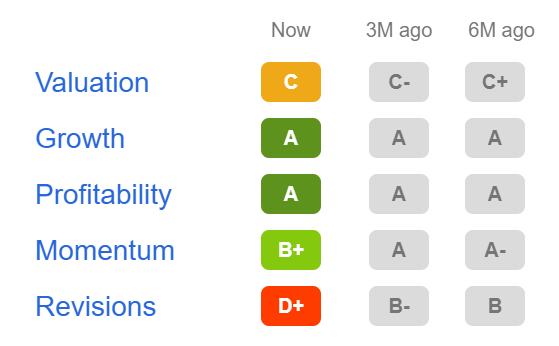

The Seeking Alpha Factor Grades underline my theory to select Realty Income for this portfolio of Dividend Income and Dividend Growth. The company is rated with an A for both Growth and Profitability. For Momentum, it receives a B+ and for Valuation a C.

Source: Seeking Alpha

Altria

Altria is one of the largest tobacco product manufacturers in the world and the company disposes of strong competitive advantages and a wide economic moat. It currently has a Dividend Yield [FWD] of 8.05%. At the same time, the company’s Dividend Growth Rate of 7.89% over the past 5 years is a strong indicator that it should be able to provide significant Dividend Growth over the next years, which makes Altria an excellent choice for this type of portfolio.

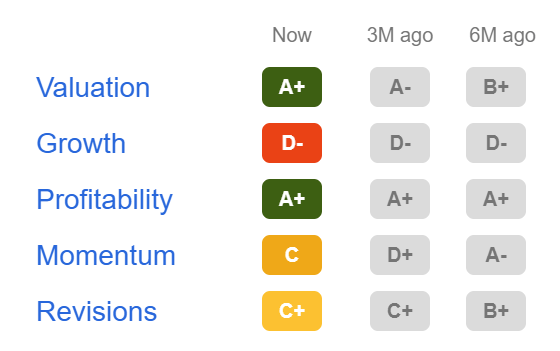

Furthermore, the company has a Dividend Payout Ratio of 76.63%, indicating that there is enough room to increase its dividend in the coming years. With a P/E GAAP [FWD] Ratio of 14.75, the company’s Valuation is 30.84% below the sector median (21.33), indicating that it’s currently attractive in terms of Valuation. This is also confirmed by the rating of the Seeking Alpha Factor Grades: Altria receives an A+ rating in terms of Valuation and also for Profitability.

Source: Seeking Alpha

In my comparative analysis on Altria and Philip Morris, I discuss why I currently consider Altria to be the slightly more appealing choice for dividend income investors.

Visa

I consider Visa to be an excellent choice for this type of portfolio because I expect the company to provide you with strong Dividend Growth over the long-term.

Proof of this is not just its high Average Dividend Growth Rate of 17.95% over the past 5 years. The company has also shown 14 Consecutive Years of Dividend Growth; at the same time, its low Dividend Payout Ratio of just 20.97% indicates that there is enough scope left for future Dividend enhancements.

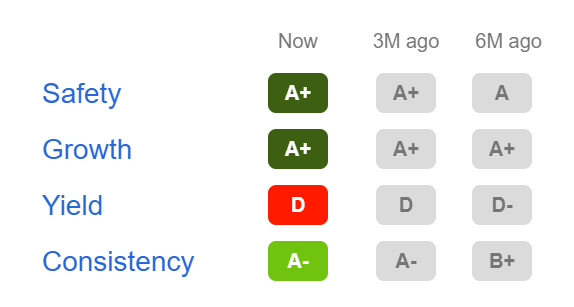

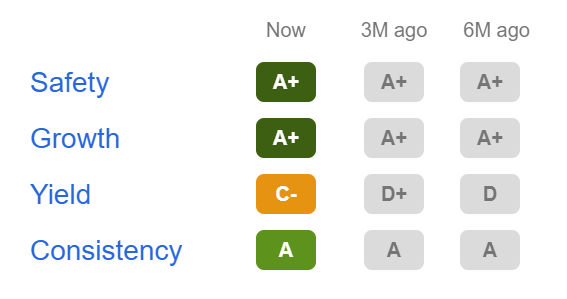

Visa’s attractive Dividend is confirmed by the Seeking Alpha Dividend Grades: in terms of Dividend Safety and Dividend Growth, the company is rated with an A+. For Dividend Consistency, it gets an A-. Only for Dividend Yield is Visa’s rating less attractive (D rating).

Source: Seeking Alpha

Visa currently shows a P/E [FWD] Ratio of 25.33, which is 21.96% below its Average P/E [FWD] Ratio over the past 5 years, indicating that the company is currently attractive when it comes to Valuation.

Apple

In my opinion, Apple is an excellent choice when it comes to risk and reward: the company has strong competitive advantages (such as its broad and diversified product portfolio, its own ecosystem, its high customer loyalty etc.), underlined by its high EBIT Margin of 30.29%. Apple has shown an Average Dividend Growth Rate of 8.15% over the past 5 years and I expect the company to show similar Dividend Growth Rates in the years to come. Apple’s low Dividend Payout Ratio of 14.73% strengthens my opinion that it should be able to raise its dividend significantly over the next years and even decade.

The Seeking Alpha Dividend Grades confirm the attractiveness of the company’s Dividend: for Dividend Growth, Apple is rated with an A+ while it gets an A- in terms of Dividend Safety. For Dividend Consistency, Apple receives a B rating and for Dividend Yield, a D.

Source: Seeking Alpha

At this moment in time, Apple has a P/E GAAP [FWD] Ratio of 22.59, which is in line with its Average P/E [FWD] Ratio over the past 5 years (22.91), indicating that the company is currently fairly valued. In my in-depth analysis on Apple you can read more about the company’s current Valuation.

Microsoft

Microsoft is another company from which I expect relatively high Dividend Growth Rates in the years to come: the company has shown 18 Consecutive Years of Dividend Growth and its Payout Ratio of 27.37% indicates that there is plenty of room for future Dividend enhancements.

Microsoft has strong competitive advantages (such as its broad product portfolio, its high switching costs for customers as well as the company’s patents). At this moment in time, Microsoft has a P/E [FWD] Ratio of 25.60, which is 16.85% below its Average P/E [FWD] Ratio of the last 5 years (30.79), indicating that the company is currently slightly undervalued. In my in-depth analysis on Microsoft, you can read more about its competitive advantages and current Valuation.

The Seeking Alpha Dividend Grades reinforce my theory that Microsoft is a great dividend growth stock: the company is rated with an A+ for Dividend Safety and for Dividend Growth. In addition to that, it gets an A in terms of Dividend Consistency. For Dividend Yield, the company receives a C-.

Source: Seeking Alpha

Exxon Mobil

I consider Exxon Mobil to be an appealing company for dividend income investors. Proof of this is its Dividend Yield of 3.52% in combination with a low Payout Ratio of 27.69%. In addition to that, Exxon Mobil has raised its dividend 20 years in a row.

Exxon Mobil’s Free Cash Flow Yield [TTM] is currently 13.56%, suggesting the enormous amount of cash the company is generating. Exxon Mobil has shown a Dividend Growth Rate [CAGR] of 7.29% over the last 10 years, indicating that it’s not only an excellent dividend income stock, but can also contribute to the dividend growth of your investment portfolio.

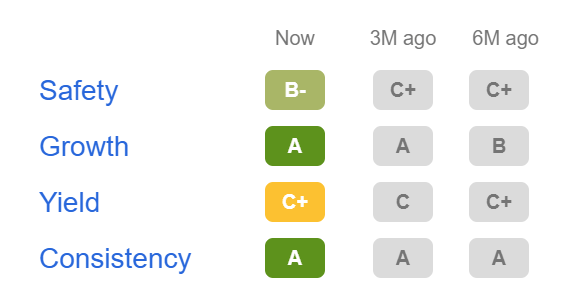

The Seeking Alpha Dividend Grades underline that Exxon Mobil is an excellent choice to be part of your investment portfolio. The company is rated with a B- for Dividend Safety, and an A for Dividend Growth and Dividend Consistency.

Source: Seeking Alpha

In my analysis on Exxon Mobil, I explain why I consider the company to be a must have for dividend income investors.

Nike

In my opinion, the world’s largest sporting goods manufacturer is an excellent choice for long-term investors seeking dividend growth. I consider the company’s strong brand image as well as its endorsements with the world’s best sports teams and athletes to be among its strong competitive advantages.

At this moment in time, Nike has a Dividend Yield [FWD] of 1.24% and a low Payout Ratio of 33.64%. The company has shown a Dividend Growth Rate of 11.14% over the past 5 years, reinforcing my belief that it will be able to significantly increase its dividend in the coming years.

At the moment, Nike has a P/E GAAP [FWD] Ratio of 35.67, which is in line with its Average P/E [FWD] Ratio of the past 5 years (36.37), demonstrating that the company is currently fairly valued.

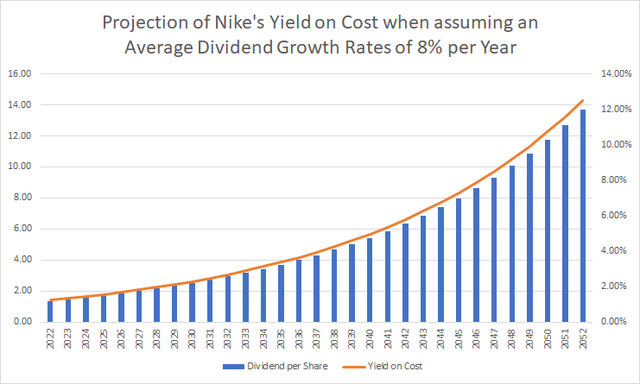

Below you can find the Yield on Cost for Nike when assuming a Dividend Growth Rate of 8% in the following 30 years. The graphic illustrates that you can achieve a Yield on Cost of $2.68% in 2032, 5.79% in 2042 and 12.51% in 2052.

Unilever

Unilever is a multinational consumer goods manufacturer with a broad product portfolio (with brands such as Dove, Knorr and Rexona). The company currently has a Dividend Yield [FWD] of 3.35% and its Average Dividend Growth Rate of the last 5 Years is 2.85%.

Despite the fact that neither the company’s Dividend Yield or Dividend Growth Rate is very high, Unilever is still part of this portfolio which aims to provide a balanced mix between Dividend Yield and Dividend Growth. The reason being that I consider the stock to be an excellent fit that contributes to reducing portfolio volatility: proof of this is its 60M Beta Factor of 0.14.

Unilever’s excellent competitive position is underlined by a high EBIT Margin of 17.50%, which is 111.55% above the sector median (8.27%).

The Seeking Alpha Quant Ranking also suggests that Unilever is an excellent choice to be part of your investment portfolio: the company is ranked 5th out of 31 within the Personal Products Industry and 38th out of 193 within the Consumer Staples Sector.

Source: Seeking Alpha

Bank of America

I consider the Bank of America to be an excellent choice because it provides you with an appealing mix between Dividend Income and Dividend Growth. The bank’s current Dividend Yield [FWD] is 2.72%. Furthermore, its Dividend Growth Rate of 17.14% [CAGR] over the past 5 years serves as an indicator that the company should be part of your portfolio, which is also underlined by a low Payout Ratio of just 26.90%.

The company’s P/E GAAP [FWD] Ratio is currently 10.28, which is 16.75% below the company’s P/E [FWD] Ratio of the last 5 years, indicating that the bank is currently undervalued.

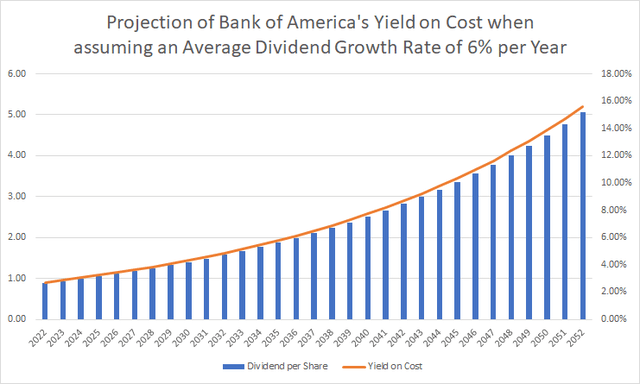

The graphic below shows its Yield on Cost when assuming a Dividend Growth Rate of 6% in the following 30 years. It can be highlighted that you could reach a Yield on Cost of 4.86% in 2032, of 8.70% in 2042, and 15.58% in 2052 when assuming this Dividend Growth Rate of 6% for Bank of America.

Overview of the Selected Companies

Assuming that you would invest $10,000 equally among the companies chosen for this portfolio ($1,000 in each), you would get an Average Dividend Yield of 2.87%. The Average Dividend Growth Rate of the selected companies over the past 5 years has been 9.61%. Below you can find an overview of the companies.

|

Company |

Sector |

Industry |

Dividend Yield |

5 Year Average Dividend Growth |

|

Altria |

Consumer Staples |

Tobacco |

8.05% |

7.89% |

|

Apple |

Information Technology |

Technology Hardware, Storage and Peripherals |

0.65% |

8.15% |

|

Bank of America |

Financials |

Diversified Banks |

2.72% |

17.14% |

|

BlackRock |

Financials |

Asset Management and Custody Banks |

2.76% |

14.31% |

|

Exxon Mobil |

Energy |

Integrated Oil and Gas |

3.52% |

3.02% |

|

Microsoft |

Information Technology |

Systems Software |

0.97% |

9.71% |

|

Nike |

Consumer Discretionary |

Footwear |

1.24% |

11.14% |

|

Realty Income |

Real Estate |

Retail REITs |

4.62% |

3.93% |

|

Unilever |

Consumer Staples |

Personal Products |

3.35% |

2.85% |

|

Visa |

Information Technology |

Data Processing and Outsourced Services |

0.86% |

17.95% |

|

Average |

2.87% |

9.61% |

Source: Seeking Alpha

Assuming that the companies were able to continue raising its Dividend with an Average Dividend Growth Rate of 9.61% in the future, you would achieve a Yield on Cost of 7.18% in 2032, of 17.98% in 2042 and 45.02% in 2052.

Conclusion

Different factors play a key role in whether your investment portfolio will succeed over the long term. In this article I have built the basis of a potential investment portfolio consisting of 10 companies that can help you reach an attractive Dividend income today, and at the same time, aspire for Dividend Growth. This type of portfolio can also contribute to achieving a high Yield on Cost while having a long investment-horizon.

At the same time, an investment portfolio, which is based on a balanced mix between Dividend Income and Dividend Growth and which provides excellent perspectives in terms of risk and reward can contribute to you sleeping better at night: as you don’t need to care so much about the ups and downs of the stock market. In addition to that, you can enjoy the fact that this additional income should grow steadily year over year, representing an additional source of income for the moment you retire.

Author’s Note: I hope that I was able to give you some ideas on how you could build the basis of an investment portfolio that provides an attractive mix between Dividend Income and Dividend Growth and I would appreciate any feedback on this article! Thank you very much!

Be the first to comment