gremlin

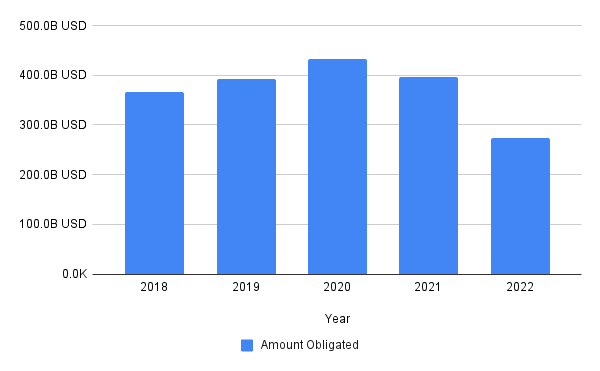

Trends in Defense Spending

Defense spending growth varies a lot from one decade to the next. For example, absolute world defense budgets more than doubled in size in the period 2000-2010. More recently, world defense spending growth slowed in the 2010s to about 1% per year in the aftermath of the financial crisis. There’s reason to believe that the 2020s will be another period of strong defense spending growth given the heightened geopolitical uncertainty and the need to build up defensive capabilities following the war in Ukraine. After this period of above trendline growth is over, it is likely that defense spending growth will average about 3% per year, in line with nominal GDP growth for developed countries.

Figure 1. Contract awards by the U.S. Department of Defense, 2018-Q3 2022

TenderAlpha

The Role of Government Contract Awards in Defense Companies’ Financial Health

Keeping track of government contract awards is crucial to assessing the financial health of companies operating in the defense sector. As the world is eerily watching whether a recession is around the corner, these government contracts will prove to be a lifeline to companies should their commercial business take a hit.

After our in-depth article on the biggest player in the defense group, Lockheed Martin (LMT), which you can read here, in this piece we will look at Boeing (BA), Raytheon Technologies (RTX) and Booz Allen Hamilton (BAH) (which has seen its share price increase more than 13 times in the last 10 years) and compare the four companies at the end.

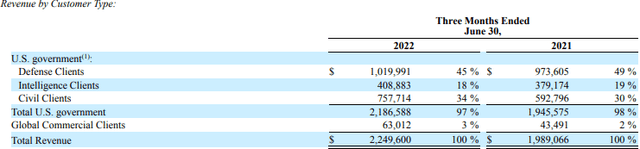

Boeing 2022 Q2 Results Overview

Boeing reports results in three main divisions, namely “Commercial Airplanes” (BCA) at 37.2% of Q2 2022 revenues, “Defense, Space & Security” (BDS) at 37.1% of Q2 2022 revenues and “Global Services” (BGS) at 25.8% of Q2 2022 revenues:

Figure 2. Boeing Revenue Breakdown

The Defense, Space & Security segment recorded the weakest revenue performance in the quarter, with a 10% Y/Y drop. Boeing recorded a number of one-off charges in Q2, including a $147m in the MQ-25 program and a $93m charge in the Commercial Crew program.

Backlog at Defense, Space & Security was $55 billion, of which 33% percent represents orders from customers outside the U.S.

Growth in the Global Services segment was driven by higher commercial services volume, partially offset by lower government services volume. Boeing expects the recovery in the segment to continue in the coming years as the industry returns to pre-pandemic levels, albeit at a slower pace than observed until recently.

The big news for Boeing came after the Q2 results with the resumption of 787 Dreamliner deliveries. The company still anticipates 787 abnormal costs of approximately $2 billion, with most being incurred by the end of 2023, including $283 million recorded in the quarter. Nevertheless, the company is optimistic on the medium-term market prospects:

Continue to expect passenger traffic to return to 2019 levels in 2023 to 2024; return to long-term growth trend a few years thereafter

Source: Boeing Q2 2022 Results Presentation

Overall, CEO David Calhoun reaffirmed Boeing’s inspiration to be cash flow positive in 2022:

And again, the result of all of this work, a big step forward with respect to stability, we did get to cash flow operating cash flow positive. So that puts us a little bit ahead of our internal plan and we feel good about that. And we are still committed to be cash flow positive for the calendar year 2022.

Source: Boeing Q2 2022 Analyst Call

The next near-term catalyst for the stock will be Boeing’s Investor Day on November 1 and 2.

It seems Boeing is finally turning a corner and operational performance will improve in 2023 and beyond. However, as CFO Brian West stated on the conference call:

Our investment grade credit rating is a priority and we remain committed to reducing debt levels through strong cash flow generation over time.

Source: Boeing Q2 2022 Analyst Call

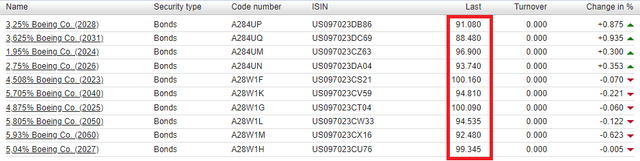

It is clear that investors will have to wait quite a bit before Boeing is in a position to reestablish a dividend, let alone think about buybacks. Back in Q2 2019, when the stock was trading at circa double today’s prices, shareholders’ equity was negative $4.943bn – in Q2 2022 it is negative $14.791bn. In Q2 2019, debt was circa $19bn – it has ballooned to about $57.2bn in Q2 2022. Add to that ongoing one-off costs related to the 787 Dreamliner and it is fair to say the stock lacks positive momentum in the near-term. Furthermore, the vast majority of the company’s bonds trade below par, implying higher interest rate costs in the future:

Figure 3. Boeing Bond Prices

As we see Boeing focusing on retiring debt in the coming years, an alternative approach to opening a position in the company through bonds trading below par could prove to be more beneficial.

Boeing Government revenue share

Boeing has exposure to government contracts primarily via its “Defense, Space & Security” (BDS) segment, which as per the 2021 report:

BDS’ primary customer is the United States Department of Defense (U.S. DoD). Revenues from the U.S. DoD, including foreign military sales through the U.S. government, accounted for approximately 84% of its 2021 revenues. Other significant BDS customers include the National Aeronautics and Space Administration (NASA) and customers in international defense, civil and commercial satellite markets.

Source: Boeing 2021 Annual Report

Summing it all up, 89% of BDS revenues came from the U.S. government in 2021.

Government spending is also important for the “Global Services” (BGS) segment, with 40% of 2021 revenue coming from the U.S. government.

Overall, 49% of Boeing’s 2021 revenues were earned pursuant to U.S. government contracts.

Raytheon 2022 Q2 Results Overview

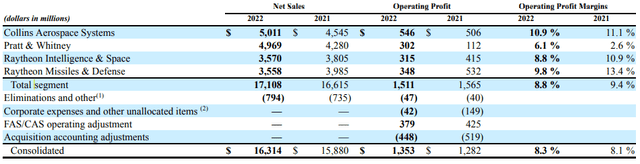

Raytheon reports results in four main segments, namely Collins Aerospace Systems at 29.2% of Q2 2022 net sales, Pratt & Whitney at 29% of Q2 2022 net sales, Raytheon Intelligence & Space (RIS) at 20.9% of Q2 2022 net sales and Raytheon Missiles & Defense (RMD) at 20.8% of Q2 2022 net sales:

Figure 4. Raytheon 2022 Q2 Sales Breakdown

Raytheon Technologies Form 10-Q For Q2 2022

Collins Aerospace Systems saw sales growth of 10.2% Y/Y on the back of recovering commercial air traffic, partially offset by weakness in military sales.

Pratt & Whitney reported the highest revenue growth in the quarter at 16% Y/Y fueled by both commercial and government orders.

In contrast to buoyant market conditions enjoyed by the former two segments, results at RIS & RMD were lackluster with sales coming in at -6% for RIS and -11% for RMD respectively. Backlog at both divisions was relatively flat, up $1bn to $30bn at RMD but down $2bn to $16bn at RIS.

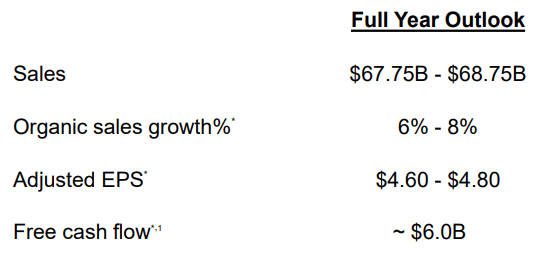

All in all, Raytheon confirmed its full-year 2022 forecast, with free cash flow seen at circa $6bn, up from $5bn in 2021:

Figure 5. Raytheon 2022 Forecast

Raytheon Technologies Q2 2022 Investor Webcast Presentation

It can be expected that growth will moderate going into 2023 on the back of a more gradual recovery in air traffic, offset by a pick-up in government defense spending.

Highlights from the conference call include some details on a potential $1.5bn payment in Q3 related to the capitalization of R&D expenses and the inability to offset the R&D expense for tax purposes:

And on the cash front, we continue to expect free cash flow of about $6bn for the year. It is important to mention that our cash flow outlook continues to assume that the legislation requiring R&D capitalization for tax purposes is deferred beyond 2022, which as I have said before, the free cash flow impact of this legislation is approximately $2bn for the year. If the legislation isn’t deferred by September 15, we will have to make an incremental cash tax payment of about $1.5bn here in the third quarter. However, this payment is a timing issue only as we will receive a refund in 2023 for the overpayment if the legislation is ultimately deferred by year end as we continue to expect.

Source: Raytheon Technologies Q2 2022 Conference call

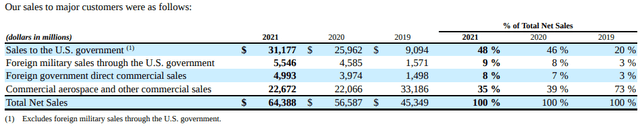

Raytheon Government revenue share

As per Raytheon’s 2021 annual report, U.S. government sales made up 48% of total 2021 sales:

Figure 6. Raytheon Sales Breakdown 2019-2021

Raytheon Technologies Form 10-K for 2021

Adding the 9% in foreign military sales through the U.S. government and the 8% in direct foreign government commercial sales, total government exposure in 2021 was 65%.

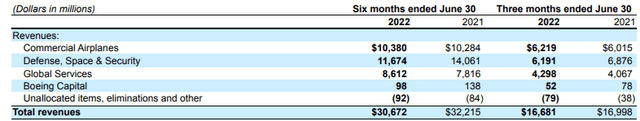

Booz Allen Hamilton 2023 Q1 Results Overview

Bearing in mind that Booz Allen Hamilton’s financial year starts in April, the company reports revenues in three main customer segments, namely Defense Clients at 45% of Q1 2023 revenue, Intelligence Clients at 18% of Q1 2023 revenue and Civil Clients at 34% of Q1 2023 revenue:

Figure 7. Booz Allen Hamilton Revenue Breakdown Q2 2021-2022

Booz Allen Hamilton Form 10-Q for Q1 2023

Of the 13.1% revenue growth in the quarter, 8% was organic with the rest made up by inorganic contributions. CEO Horacio Rozanski highlighted on the conference call that the company will continue to be active on the M&A front to help it reach its adjusted EBITDA target of $1.2bn to $1.3bn in fiscal 2025 (2023 guidance is for $0.95bn to $1bn):

And fourth, we must deploy capital in a way that creates maximum value and drives our strategy forward. In the past few months, we have remained active in building our M&A pipeline focusing on acquisitions that will accelerate our VoLT strategy. I firmly believe that strategic M&A, like our proposed acquisition of EverWatch increases both innovation and competition, and that the interest of the government and strategic acquirers are fully aligned. We remain disciplined and committed to deploying capital in a manner consistent with our investment thesis.

Source: Booz Allen Hamilton Q1 2023 Conference call

Turning to the backlog, it saw growth of 6.8% Y/Y to $28.6bn.

All in all, the outlook was confirmed, including the adjusted EPS range of $4.15-$4.45, with the caveat relating to taxes which we highlighted in the Raytheon section as well (circa 27% of the total $550mn tax headwinds):

Today, we are reaffirming our fiscal year 2023 guidance. As we discussed last quarter, the first half, second half dynamics we provided are still the guiding framework for our full fiscal year growth expectations. We expect revenue growth to be between 5% and 9%, inclusive of inorganic contributions. We expect adjusted EBITDA in the range of $950 million and $1 billion, and adjusted EBITDA margins in the mid- to high 10% range. We expect operating cash flow to be between $850 million and $950 million, which excludes our expectations for approximately $550 million of cash tax headwinds this fiscal year.

Source: Booz Allen Hamilton Q1 2023 Conference call

Finally, Booz Allen Hamilton relied on U.S. government contracts for 97% of its fiscal 2022 revenue, comparable to Lockheed Martin’s 99% government contract exposure.

Defense Group Comparison

Figure 8: Defense Suppliers Government Sales Share out of Total Sales (2021)

|

Source: Company 10-K Filings for 2021 & Author’s calculations

*Note that Boeing and Booz Allen Hamilton do not break down total government sales

Looking at the above figures, Boeing stands out as the most distressed investment from a financial point of view, and is at greatest risk of having to raise equity. That said, it seems Boeing is turning a corner and will manage to stabilize its financials without having to tap equity markets. The upcoming Investor Day on 1-2 November may prove to be a catalyst for the stock as the company is expected to detail its plans for 2023 and beyond. More conservative investors may want to look at the bonds as it is likely that the company focuses on retiring debt in the coming years.

Lockheed Martin, which we covered in great detail here, has the least intensive debt capital structure of the four companies while only slightly behind Raytheon in terms of earnings yield. The high proportion of government spending as a percentage of revenues, comparable with Booz Allen Hamilton, makes Lockheed Martin an excellent pick should a recession begin sometime next year. Lockheed’s bonds are an excellent pick as they offer a greater current yield with a much lower level of risk. The common stock is also a good buy on pullbacks as the healthy financial situation of the company, especially compared to Boeing, will allow a high payout ratio over the long term.

Raytheon offers a higher earnings yield than Booz Allen Hamilton and will continue to experience growth above the industry average as the aviation industry emerges from the pandemic. However, as the recovery from the pandemic is finalized in 2023-2024 growth should revert to a more normal 3% over the long term. The stock looks attractive from a long term perspective, albeit lacking the turnaround play Boeing offers, and investors could use price weakness to accumulate a position.

Booz Allen Hamilton seems to be the most expensive of the group, with an earnings yield of just 4.4%. The company is operating in fast growing markets such as cyber security and will continue to expand at an above-average pace for years to come. The high level of government revenues gives predictability of the cash flows and will make Booz Allen Hamilton a safe bet in a market downturn or a recessionary environment. With a 13% year-to-date gain in a down market and no immediate catalysts, it would be wise for investors to wait for a pullback before starting a position in the name.

Booz Allen Hamilton has also recently been expanding its work with NASA on the cyber security front. You can keep track of the latest contract awards with TenderAlpha’s federal contracts data.

Conclusion

After lackluster growth in the previous decade, the defense sector is poised for a comeback in the years to come. Against the backdrop of a looming recession and rising interest rates needed to temper down inflation, some players such as Lockheed Martin and Booz Allen Hamilton are in a better position to weather economic headwinds. Of the four companies, Boeing remains a turnaround play and is most exposed to commercial developments in the aviation sector. Raytheon will also benefit should the air traffic recovery continue, and is also shielded to an economic downturn with its sound financial health and 65% government spending exposure.

All four companies rely heavily on government sales. For Booz Allen Hamilton, U.S. government sales make up as much as 97% of the company’s sales. As we discussed in our previous article on Lockheed Martin, the defense heavyweight’s 2021 revenues from government sales amounted to 99%, with 71% coming from sales to the U.S. government alone.

Just below the 50% mark, Boeing and Raytheon have also generated much of their sales in 2021 from entering contracts with the U.S. government (49% for Boeing and 48% for Raytheon).

Monitoring the public procurement activity of major players within the defense sector is a worthwhile investment due to their well-documented dependence on government contracting, especially considering the relationship between government receivables and stock movement.

Be the first to comment