Aranga87/iStock Editorial via Getty Images

It’s long been known that Tesla (NASDAQ:TSLA) has been selling something it doesn’t have, or know when or if it will ever have, for many years now.

Tesla has been selling “Full Self Driving”, which in its earlier incarnations promised everything up to and including a car fully able to drive itself empty (never mind without requiring driver attention).

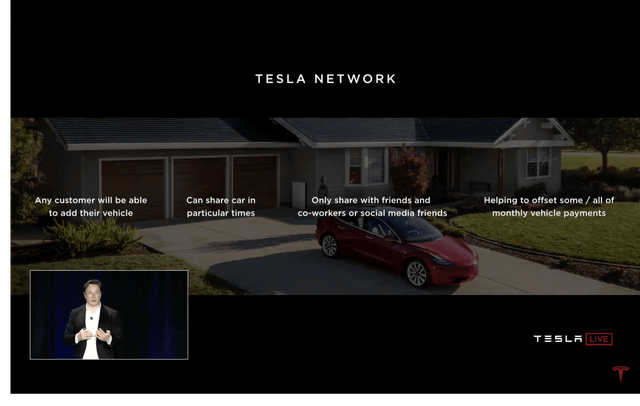

This was, for instance, shown on Tesla’s original full self-driving video, where at some point the driver left the car, and the car went to park itself on an unrelated street (not on the immediate parking lot). It was also implied because Tesla said the car would be able to participate in a robotaxi network – which straight implies the car has to be able to drive itself empty to pick up new assignments. Indeed, Tesla went as far as saying FSD Teslas would be required to sell their robotaxi services through the Tesla network.

Tesla has been selling FSD with such capabilities since the start of October 2016. Hence, it’s now been more than 6 years that Tesla has been selling something it doesn’t have, or even know if it will ever have. That this has been possible does tell us two things:

- One, that apparently Tesla is held to different standards, when it comes to the law. Theranos (THERA) selling single-drop blood tests it didn’t have was never allowed to run for so long.

- Two, Tesla, certainly to appease regulators and internal compliance, has changed how it describes this feature on its own order pages – all the while keeping vocal communication which is more in line with the original advertising (robotaxis!).

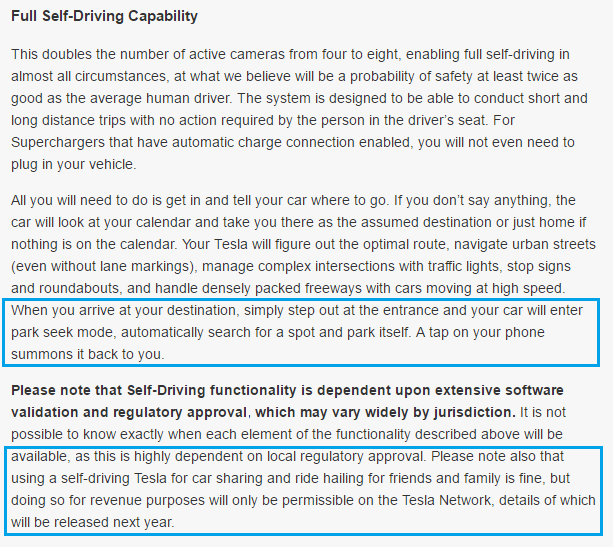

For those which are new to these matters, I’ll reproduce what Tesla actually sold, when it started selling this inexistent FSD product. Here’s a screenshot of the original relevant section in the order page (blue highlights are mine):

Tesla FSD order page, 2016

Now, I have for a very long time warned that Tesla wasn’t at all close to delivering what it was selling. This in spite of the constant proclamations by Tesla’s CEO that the product was just around the corner. Although I wrote many articles on the subject, I’ll highlight just one whose title is self-explanatory, which was already written as far back as December 2017: “Tesla: Check Your Full Self-Driving Snake Oil Expiration Date”

Since Tesla looks increasingly unlikely to ever deliver what it sold, especially as hardware changes to the car have now even gone beyond mere replacement of central processing units, a single question beckons. What kind of liability, per car and in total, might Tesla be facing in the future?

Let us explore this theme, first of all acknowledging that customers might simply have too much inertia to even request compensation. This is especially true the lower the amounts involved are.

The Minimum Liability – The Cost Paid

When discussing how Tesla hasn’t delivered FSD, and how Tesla should compensate for it, the opinion I most often encounter is “Tesla should just refund it”. In other words, Tesla should refund $3,000, $5,000, $10,000, $12,000, $15,000 to the customers who paid for FSD and never got it (depending on when the customer bought).

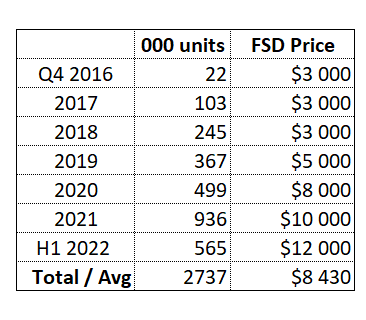

The many different prices I quote happen because Tesla has often increased the FSD option price. It started at $3,000 back in October 2016, but it was increased all the way to $15,000 nowadays.

For many delivered products, this logic often applies. You buy a product, and if it doesn’t perform to expectations, or especially if it’s not delivered, you just ask for a refund.

However, one should consider that FSD isn’t just a product a consumer is buying. It’s both part of a larger product, and also it changes the character of the entire product. Hence, just refunding this part of the product being refunded might well fall short of what’s required of Tesla.

The Easily Defendable Maximalist Liability – The Whole Car

That brings us to another possible claim the wronged customer can make. The wronged customer can easily claim he only bought the car and FSD, because with FSD the car would eventually drive itself, relieving him of his driving duties.

In this case, it becomes immediately evident that merely refunding FSD won’t cure the damage made. The customer would still be left with an expensive car which can’t drive itself. A car he would otherwise conceivably wouldn’t have bought. Since the motives for buying a product which clearly doesn’t perform its function rest solely with the customer, it would be hard for Tesla to argue the customer wasn’t right.

In this case, if a customer were to win on such claims, he’d probably have to be refunded for the value of the entire car (including any options, not just FSD). In return, the consumer would be expected to hand over the car, so all of that value wouldn’t be lost by Tesla – only the depreciation suffered by the car would be at stake.

The Potentially Devastating Liability – Lost Profit

Things might not stop with refunding a car, though. When Tesla began selling FSD, it also began saying its cars equipped with FSD would be able to work as robotaxis. That can be checked in the screenshot I already provided.

Hence, a customer might not simply claim he only bought the car because it would eventually drive itself. A customer can also claim he bought the car because this car wouldn’t just drive itself, but drive itself in the context of Tesla Network, and make him a bundle of money.

This would be a type of damage which can also be asked for in lawsuits. It’s called future damages / “lost profit”. The customer would have lost on the opportunity to profit from the FSD car, because Tesla didn’t deliver the promised product to him.

Now, “lost profit” cases aren’t easy to win. For instance, below we see what kind of threshold is required in California:

Section 3283 – Future damages

Damages may be awarded, in a judicial proceeding, for detriment resulting after the commencement thereof, or certain to result in the future.

It’s been in the law since 1872. This presentation is useful to get acquainted with the concept.

Lost profits are damages which haven’t happened yet, but are (nearly) certain to happen in the future, as a result of the breach/nonperformance of a contract. Of course, it’s hard to prove that owning a FSD car and then milking it on the Tesla Network would have produced large profits, or how large. It’s especially hard to prove this for a product or technology which doesn’t exist yet.

To any claims made by a customer/plaintiff, Tesla might be able to counter that it’s all unknowable. Both whether profits would exist, and how much profits might exist.

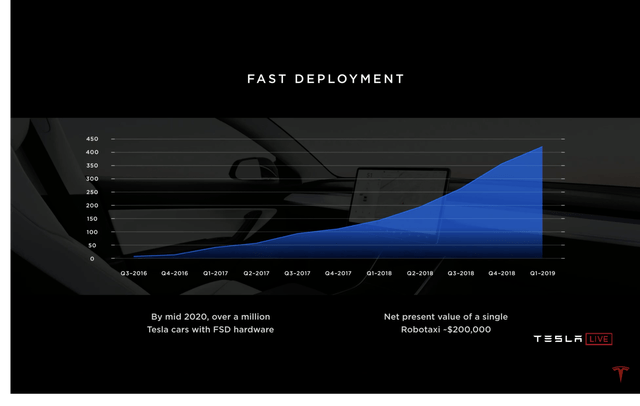

However, in this case, the customer might have help from the most unexpected of places. You see, Tesla itself made at least 2 different claims regarding how much a consumer could expect to make. Both claims were made during Tesla’s 2019’s Autonomy Day (the entire series of slides can be found here):

- In one case, Tesla said that a consumer using the car only partially on the network could likely offset some or all of the monthly payments for the car.

- And in another, Tesla, feeling helpful towards its customers, even provided the gold standard when it comes to quantifying lost profits: A Net Present Value calculation (Discounted Cash Flow). Tesla put a number to it. $200,000 NPV.

Therein lies something interesting regarding Tesla’s liability. In nearly any lost profit case, there won’t be much from the defender arguing that the plaintiff would make any profits, much less quantifying them. All of that work will fall on the plaintiff, and nearly all of it can leave doubts which will be enough to shoot down the entire claim.

When it comes to Tesla, though, it has been Tesla claiming that it would have the product soon and that it could be put to make money on the Tesla Network and that it would be profitable and pay for the car. And damn, that in truth the whole thing has a NPV of $200,000 per car.

What more could a customer ask for?

Putting It All Together – The Liability

So, per car, we’ve seen that the liability might be somewhere between:

- $3,000 – $15,000 if only the FSD option is refunded.

- Depreciation % of car x Price of car if the entire car is refunded (this depends on the model, the year, etc.) could be as little as 20% of a $40,000 car, or as much as 60% of a $120,000 car, roughly.

- $200,000, if Elon Musk is to be believed regarding the FSD NPV.

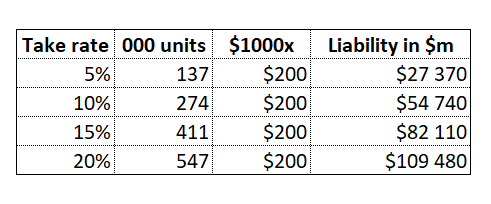

All we saw so far was the liability per car. But how many Teslas are there whose owners bought the FSD option? This is rather hard to answer. We do have a floor. It’s at least 100,000, since 100,000 FSD beta testers are now enabled. As for a ceiling, we can make an exercise. 2.74 million Teslas have been sold since Q4 2016, which had the hardware for FSD (every Tesla sold since then). Now, depending on the take rate for FSD, we’d have the following:

- 137,000 if 5% of owners bought the FSD option (this seems highly conservative).

- 274,000 if 10% of owners bought the FSD option

- 411,000 if 15% of owners bought the FSD option

- 547,000 if 20% of owners bought the FSD option (this might be too aggressive)

Let’s now try to calculate the floor for the total liability. FSD had different costs at different times, but overwhelmingly FSD-capable Teslas were sold recently, when FSD was the most expensive.

Below we have a rough price estimate for the FSD option on any given year (changes were made intra-year, so it’s rough). I also come up with an average cost (though this is flawed in the sense it assumes constant take rates, while the consumer probably wised up, and together with higher prices it led to lower take rates):

Author’s own work, Statista

Ok, now considering the 100,000 absolute floor for the number of FSD options bought, and this average FSD price which would have to be refunded, we have a floor for the FSD liability. That would be 100,000 x $8,430 = $843 million.

Of course, the ceiling for such a liability is much more interesting. I bet lots of lawyers would salivate over participating in a giant class action with the following numbers. The ceiling would be, depending on take rate and Tesla’s $200,000 NPV:

Author’s own work

And there it is, the FSD liability ceiling could be anywhere from $27 billion to $109 billion. And this is based on an actual legal liability concept which tends to exist the world over (not just in California). It’s also based on Tesla’s estimate for the NPV of these vehicles, had Tesla kept its end of the bargain by delivering what it promised and sold for 6 years.

Bear in mind that none of these liabilities even include punitive damages. After all, Tesla really was selling something it couldn’t deliver. Typically, this is the kind of rare behavior a court wants to punish so that others don’t replicate it in other fields, and scam other innocent consumers.

One other consideration to have. Tesla has over time redefined what FSD it promises to its customers in its order pages. However, in public communication, it has kept essentially the same messaging, where the mere presence of “robotaxis” immediately means “no driver necessary”, since the cars have to make empty trips to meet customers. One would expect that in any large lawsuit seeking compensation, all of these details would be hard fought over.

A large lawsuit, possibly turning into a class action, seems inevitable. Tesla has been really selling and not delivering a product beyond the actual life of many of the cars equipped with it. Hence, I do believe this liability, in some form, will materialize. To what extent is hard to predict, and it might well depend on the ambition of some lawyers wanting to make serious money and get seriously famous. I think the “lost profits” angle is incredibly juicy.

There are many other reasons to both like and dislike Tesla. But the Full Self Driving drama has got to be the most interesting of them all.

In my view, a company able to conscientiously sell something (relevant and expensive) it couldn’t (and didn’t) know whether it would ever be able to deliver, is not to be trusted as a customer or as an investor.

Be the first to comment