Editor’s note: Seeking Alpha is proud to welcome Consistent Income Investor as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

IvelinRadkov/iStock via Getty Images

On Oct. 1, 2021, I began trading my $100,000 portfolio with the sole goal of being able to withdraw a consistent, monthly income for the lifetime of the account. With a background in construction engineering and a substantial amount of cash to invest, I decided to develop a strategy to provide me with a reliable secondary source of income. This strategy is ideal for anyone who is looking to maximize their income throughout retirement, or simply add second stream of income while focusing on their career.

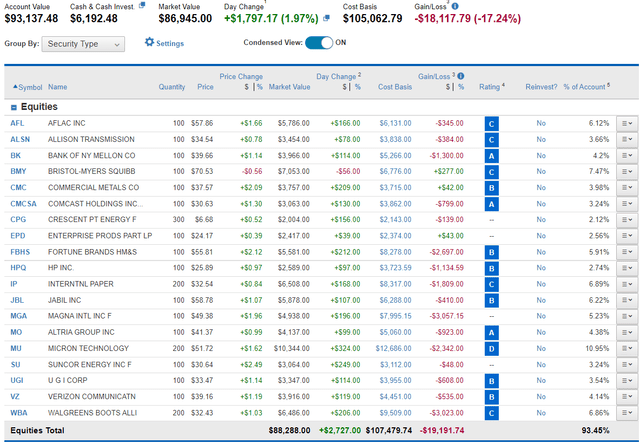

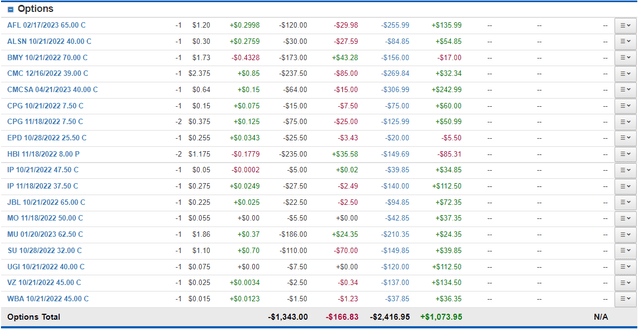

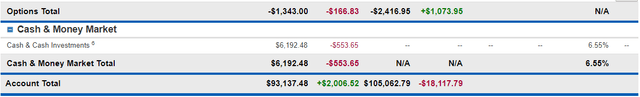

For me, this is $800/month, which roughly comes out to 10% of the original $100,000 per year. After taking a few months to fully allocate my account, I began taking monthly withdrawals of $800 on Feb. 1 – so, nine withdrawals thus far for a total of $7,200. The current account value (as of the market close on Oct. 3, 2022) is down to $93,137.48, but accounting for withdrawals results in a current value of $100,337.48, for a 0.34% return. Normally this would look unimpressive, but over the same time period, the S&P 500 lost 14.28% of its value, while I somehow didn’t lose a penny. How then did I weather the storm?

The most important component of my strategy is picking safe, undervalued, income-producing stocks. Ideally, there should be a history of consistent earnings and cash flows, as well as a strong forecast of earnings over the next two years. This means my main valuation metrics are the price/earnings ratio (P/E) and the price/free cash flow ratio (P/FCF). Critically, I’m not just looking at the present P/E and P/FCF, but also those of the past few years and any future forecasts.

The forecasts are the most important to consider, as they provide the consensus between many industry experts of how the company will be performing in the future. While these are not always reliable, they’re much better than you or I could do on our own, and will save hours of trying to piece together information from earnings calls and news headlines. Raw earnings estimates and past financial statement data are available for free at Yahoo Finance. I also use the tools on FAST Graphs, which display past and future earnings from a graphical perspective. These are the main sources I use; however, there are many other paid or free options.

In addition to looking at earnings and cash flows as a valuation metric, I also like to look at a few other factors to verify the safety of a company. Mainly, I like to see a net debt/EBITDA ratio of less than 4. This means the company can theoretically pay off all of their debt in four years or less if they decided to. Of course, the lower this ratio the better. Some companies can even have negative values because they might have more cash than they have debt, which would make them even more attractive. This is not a valuation metric, but rather an indicator of safety. A company could have zero debt, but also not be making money. I first want to make sure the company is undervalued according to its past, present, and future earnings, and then verify that it will have no issue paying off its debt.

The other main safety factor I will look at is the profit margin. I consider this a safety factor because it can tell you how much a company will be affected by a small change in sales or operating expenses. I generally like to see a profit margin over 5%, but this isn’t necessarily a hard rule for me.

The final thing I consider when buying a company is the dividend. With a few exceptions, I require most companies I invest in to pay at least some dividend. The higher the yield, the better, but only if all other aspects of valuation have already been met. Many high-yielding stocks can be risky, which is why this always comes after I verify that I have an undervalued and safe stock.

Even if a company fills all of these above requirements, I still have no way of knowing what is going to happen in the future. Past returns never guarantee future results, analyst estimates are constantly changing, and the macroeconomic picture, which ultimately effects every stock I invest in, is completely unpredictable. In other words, no matter how much research and analysis I do on any given company, I can never be completely sure of any of my investments. The only thing I can do to mitigate the effects of this reality is to diversify my portfolio as much as possible. The more stocks that I can find that meet the above criteria, the better – especially if these are spread across different sectors and industries.

In addition to diversifying between different stocks, sectors, and industries, I also want to diversify across the dates that I open positions, also known as dollar-cost averaging. Timing the market is impossible, so I want to consistently open new positions as the old ones close. This way I can spread out my purchases across both the lows and the highs of the market to produce more consistent returns. This is why I took four months to fully allocate my account before I began placing withdrawals.

When it comes to actually placing trades, I use “the wheel” strategy. Before trading this strategy, I strongly recommend you consider its feasibility with your current account size. As you will see, this strategy requires you to purchase (or agree to purchase) a minimum of 100 shares of each stock you plan to invest in. This can make it more difficult diversify your account the less money you have. Even with the $100,000 I am trading, I am greatly limited in the number of stocks I feel comfortable investing in. For example, if I invest in a $50 stock, I am allocating 5% of my account just to that stock. Generally, I try to avoid stocks with prices higher than $60 unless I feel very comfortable with them. If your account is too small to safely diversify enough, I would avoid the options portion of this strategy altogether, and simply focus on buying the right stocks in smaller quantities.

If you do plan to trade the wheel strategy, you should already understand the basics of selling call covered calls and cash secured puts. The premium received from selling these contracts is the primary source of income. This is why I want to be consistent in selling new options as often as is reasonable. If you’re unfamiliar with the wheel strategy, here is very briefly how it works. You either start your trade with a buy-write or a cash secured put. First, let’s start with a buy-write:

- Buy 100 shares of stock, and sell a covered call against it.

- If the call expires, sell another call.

- If the call is assigned, you will be forced to sell your shares, and you can start over again with another buy-write.

And now with a cash secured put:

- Sell a cash secured put against a stock you want to own.

- If the put expires, sell another put.

- If the put is assigned, you will be forced to buy 100 shares of the stock, and you can now sell a covered call against it.

- If the call expires, sell another call.

- If the call is assigned, you will be forced to sell your shares, and you can start over again with another cash secured put.

When placing these trades, you will find that there are a lot of variables at play such as expiration dates, strike prices, and whether or not you start with a buy-write or a cash secured put. Generally, I choose options that expire between one and three months from now, but will occasionally go with shorter and longer periods. I also tend to place my trades at strikes just out of the money (above the current price for calls, and below for puts), but occasionally will go in the money or much further out of the money. You generally can’t go wrong with sticking to monthly contracts, and strike prices one or two dollars out of the money. However, I want to be certain I’m picking the best contracts, which is why I have been developing a tool that calculates the “expected return” of trading each contract, according to the historic volatility of the underlying stock.

All of the methodologies outlined above regarding stock picking, account management, and trade placing are the exact processes I have been using to manage my account for the past year, and how I survived the current bear market. Below you will see screenshots of my account after all nine $800 withdrawals, showing all equity, option, and cash positions as of the market close on Oct. 3, 2022.

Screenshot of my account on Schwab.com Screenshot of my account on Schwab.com Screenshot of my account on Schwab.com

While we are currently in a period of fear and uncertainty, my plan is to continue trading the same strategy. The beauty of this strategy is that it does not change regardless of what market cycle we are in. There will always be value somewhere and we should never stop looking for it.

Be the first to comment