morfous/E+ via Getty Images

Unlike the U.S where tower companies (towercos) like American Tower (AMT) and Crown Castle (CCI) have been around for years, the European landscape is still rife with telecom operators (telcos) devoting large chunks of their capital expenditure to building tower masts in the countryside or on top of buildings from where they can hang 5G radio antennas.

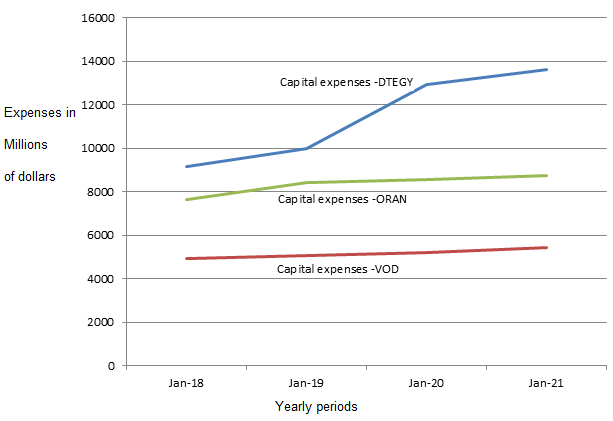

With inflation running high in Europe and pressures on the European Central Bank to raise interest rates, the era of cheap money may be over and in this new economic scenario, the big telcos Deutsche Telekom (OTCPK:DTEGY), Vodafone (VOD), and Orange (ORAN) have to reconsider or accelerate the way mobile towers are monetized given that their yearly Capex spends have all trended higher since 2018 coinciding with initial 5G investments. This is shown in the chart below.

Yearly capital expenses (www.seekingalpha.com)

The individual amounts spent depend on individual strategies and also include expenses made in expanding fiber connectivity, especially from 2020 after the pandemic struck, but nonetheless, a substantial amount goes towards the fifth-generation wireless where the European top carriers struggling to achieve returns on investments.

One solution is to monetize the tower infrastructure, which consists of towers, masts, rooftop sites, distributed antenna systems, and even small cells (the small antennae located on street light poles). These are considered passive assets and I start with the largest of the three, Deutsche Telekom (“DT”).

DT’s GD Towers/DFMG

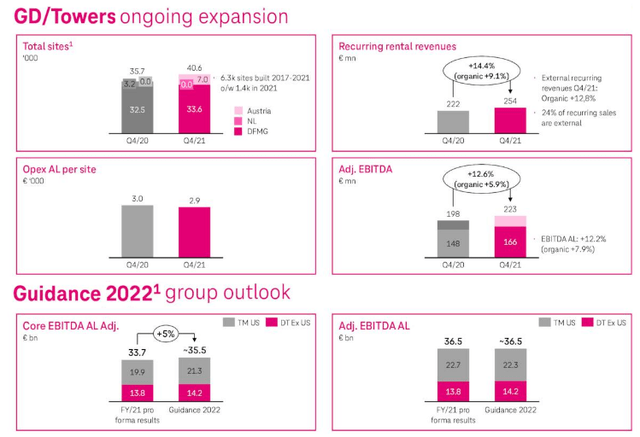

First, contrarily to the image they portray as bulky metal constructions which taint green countrysides, towers do generate revenues and the 1,400 units built during 2021 generated 9.1% of organic recurring revenue growth for DT with EBITDA growing by 7.9%. This is just like a landlord renting a building to tenants and getting paid on a recurrent basis. The German company also generated leasing revenues through renting tower space to mobile network operators (MNOs).

For investors, tower assets are owned and managed by GD Towers with a portfolio of 6.3K tower sites as shown below. This includes Deutsche Funkturm (DFMG) plus the cell towers of T-Mobile Netherlands. Tower assets are located mostly in Germany, Austria, and the Netherlands.

Company presentations in (seekingalpha.com)

Looking at finances, the company estimates that the cash Capex will grow from €17.7 billion in 2021 to €19.9 billion in 2022, but the problem is that in the meantime, European revenue should be stable (not increase), with a slight increase expected only in 2023. Adjusted EBITDA (excluding U.S operations) should grow by 10.5%, but the achievement of this target may prove difficult with the cost of doing business rising.

Moreover, business confidence in the EU also fell to a one-year low in March 2022 and this may lead to uncertainty in demand for telco services and may be one of the reasons the company may have invited bids for its tower business for an amount estimated at €18 billion for 40.6K towers, or around two-thirds of the total number. This move is in line with the executives’ objectives of deconsolidation and monetizing infrastructure assets, an area where Vodafone is a step further.

Vodafone’s Vantage Towers

Vodafone, which I covered in February, floated Vantage Towers (OTCPK:VTWRF) in March 2021 on the Frankfurt stock exchange last year with 82K sites and owns 81% of the $17.94 billion business.

According to some sources, the company has already been approached by Brookfield Infrastructure Partners (BIP) and Global Infrastructure Partners (GIP), two companies that acquire and manage real assets in the telecom, energy, water as well as other sectors.

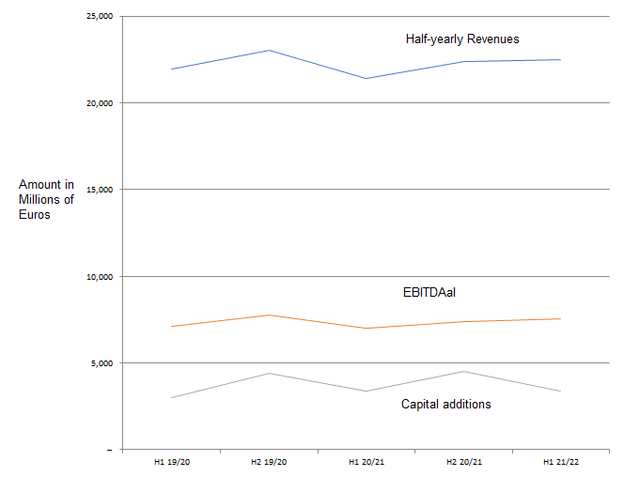

Besides success in towers, revenues have only progressed slightly as shown in the chart below, with the increase in EBITDAal (which is the EBITDA plus the leasing of assets part) made possible partly by cost savings of €500 million, plus income from fiber where the group’s participation in digitalizing smaller enterprises as part of EU-funded programs has started to benefit the business segment.

Chart built through data from Q3 financials (seekingalpha.com)

Due to the high level of capital additions and the need to reduce debt, the U.K.-based telco is facing pressure from some activist investors to increase returns.

Moreover, its strategy to simplify its portfolio by divesting from some key markets where it is facing pricing pressure like in Italy and Spain seems not to be advancing rapidly. In this respect, it turned down an 11 billion euros bid for its Italian operations at the beginning of February this year. Additionally, in Spain, it is Orange that seems to be in the pole position for a potential merger with MásMóvil Ibercom (OTCPK:MMBMF) after entering into exclusive talks with the Spanish company. Orange may have short-circuited such a move by Vodafone, which was hiring investment bankers for merging purposes earlier in January.

With this update, I move to the French company and its tower strategy.

Orange’s Totem

Orange, which is also facing tough competition in Italy and Spain, has also embraced the monetization trend, by spinning off its network assets in November 2021, more specifically 26K towers and roof terraces where cellular antennas are installed. Totem, the newly formed entity is 100% owned by Orange and has an annual turnover of 500 million euros for an Ebitdal of 300 million euros. By some estimates, the company is valued at €5.8 billion.

Totem, just like DT’s DFMG aims to continually grow by supporting the growth of mobile networks for its own usage as well as attract new customers like Free, Bouygues Telecom (OTCPK:BOUYY), and SFR. These are French MNOs.

In addition to organic growth, Orange is open to acquisitions in order to extend its geographical footprint in countries where it is present, such as Poland, Romania, and Belgium. One reason could be that it wants to replicate the good performance seen for mobile in France, where sales were up by 3%, at 2.27 billion euros. Still, overall sales in that country were down by 1.6%, but, good results in Africa and the Middle East regions resulted in the group’s revenues increasing by 0.8%. Still, there was a decrease in EBITDA by 0,5%. while CAPEX increased by 7%.

Totem and 2021 financial results (orange.com)

Of the 26K towers that Orange has transferred to Totem, 18K are in France and 8K in Spain. This country also happens to be home to Cellnex Telecom (OTCPK:CLLNY), the European leading towerco with a market cap of nearly $33 billion. The infrastructure company acquired Hivory, SFR’s towerco which manages 10.5K towers for 5.2 billion euros in February last year.

The same Cellnex merged its tower business in the Netherlands with DT’s assets in that country at the beginning of 2021, leading to the creation of an independent infrastructure company.

The Monetization Strategies

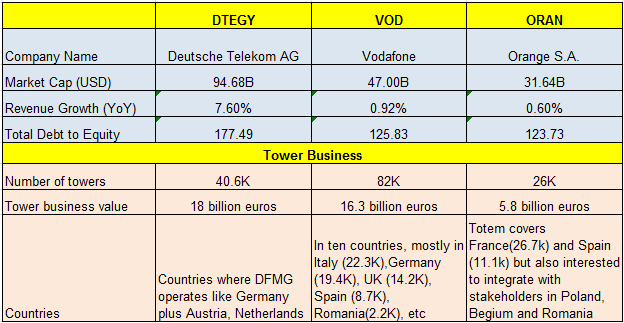

Therefore, to optimize infrastructures while keeping 5G investments in a highly competitive backdrop, the European tower industry has already been consolidating. Going forward, M&A activities should accelerate given the sluggish revenue growth of the three telcos, except for their German peer whose superior growth is due to the shine of its U.S. subsidiary T-Mobile (TMUS). They also bear high debt levels as evidenced by the table below.

Peer comparison + Tower business (seekingalpha.com)

Pursuing further, as shown in the Tower Business part of the table above, there is Germany which is common to both Vodafone and DT. This can translate into more synergistic growth through co-locating antennae on a common infrastructure in case they merge their tower businesses. The same can be the case when pairing together the U.K. company and its French peer with Spain and Romania being common countries where consolidation benefits can be obtained.

Thinking aloud, due to more commonalities (in terms of country of operation) with each of its peers, Vodafone appears to be in a better position if there is a preference for a telco industry-level merger, rather than an outright buy-out of assets by an infrastructure company like Brookfield or GIP. There is also the possibility of towercos like Cellnex or AMT, which is on an internationalization drive, stepping in.

Whatever, the option is chosen, any deal will have to obtain regulatory approval.

Valuations and Key Takeaways

As for the tower business values in the table above, these are not directly proportional to the number of tower sites. The reason is that there are other factors that come into play like tenancy ratio, regional collocation demand, and whether the towers are located on the ground or are rooftop-based. There are also industry verticals to consider as the Internet of Things for use in Industry 4.0., where 5G enables connected devices to access applications faster.

Furthermore, as evidenced by the EBITDA margins of Cellnex, AMT, and Vantage which lie between the 53.5% and 63% range, the tower business is synonymous with much higher profitability than what is possible with telcos as shown in the table below.

Comparison with peers (seekingalpha.com)

Additionally, a comparison of Cellnex’s and AMT’s metrics reveals that there are more growth opportunities in Europe currently. Profitability should be higher too as exemplified by the fact that only 25% of Deutsche Telekom’s tower assets are currently utilized in some sites. This signifies the ability to host a lot of rent-generating antennae without additional investments.

Finally, Vodafone’s trailing EV/EBITDA is higher, partly explained by its shares moving higher after interest from infrastructure funds for its tower business in mid-March. However, this does not apply to Orange since it has not invited any bids for its infrastructure yet. Consequently, with European towerco prospects, it deserves higher valuations, and just assuming an EV/EBITDA of 6x, its shares should be about $15.9 (7/5.18 x 11.8) based on the current stock price. Along the same lines, DT could also move higher to $21.6 (8/7.1 x 19.6) based on an EV/EBITDA of 8x. On the other hand, I have a neutral instance on Vodafone given that its valuation is relatively high at 8.55x, and, updates as to its tower business during this quarter are likely to prove volatile for the stock.

Be the first to comment