solarseven

Bitcoin and Crypto decrease the velocity of money

My thesis and opinion in this article will not debate a price point at which to buy Bitcoin (BTC-USD) or other cryptos but analyze why the currencies are assisting the fight against inflation in our US dollar economy. I am personally not a crypto investor, but understand some of its virtues. Bitcoin assists in keeping inflation down. Cryptocurrency is an asset that is not used for the purchase of goods and services in large part and it absorbs around $1 trillion in US dollar value of world currency that may otherwise be used to purchase items or commodities that directly affect the consumer price index. This helps to control the velocity of money.

Furthermore, it is in some ways just a wiring method similar to Zelle or Venmo, but its borderless and allows investors from other countries to evade strict currency controls. Even though the means of production is no longer a zero-sum game, the virtuous cycle of sharing, in the end, has the producer country’s citizens clamoring to send their riches back home to where they came from. I believe Bitcoin and Crypto assist in the delivery.

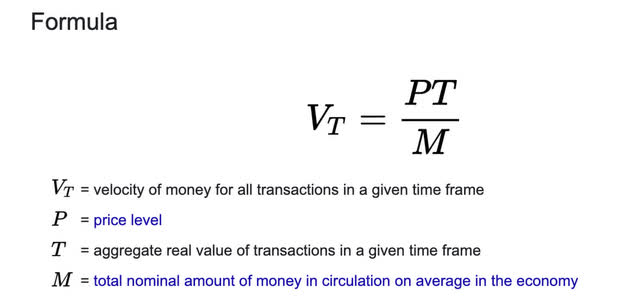

The velocity of money

In simpler terms, as it relates to an economy, Velocity of Money = GDP ÷ Money Supply. The more money that there is in an economy as a percentage of GDP, the more transactions an individual can make. In a similar fashion to the stock market, the more transactions we make with each other, the faster we drive up the price of equities. The more dollars we have chasing fewer goods, the more suppliers can raise the price. Dollar in, dollar out, crypto has not created any more money in the system, but my observation is that it has sidelined many potential transactions of goods and services.

Crypto investor profile

Crypto investors come from diverse backgrounds. The prevailing attitude from the bloggers and vloggers I follow seems to be more on the pessimist versus optimist side, using Bitcoin as a hedge against excessive money printing and the risk of the US dollar collapsing. These points may be valid and have merit, even famous investors like Ray Dalio, Bill Miller, and Jeremy Grantham have dipped their toes in the water. While this is a smallish slice of investors from the equities world, my perception is that commodities investors are even more inclined to invest in Bitcoin being that it presents some of the same “store of value” qualities that commodities provide.

My question is, where would the money outflow if Bitcoin and crypto were canceled?

Flow to gold

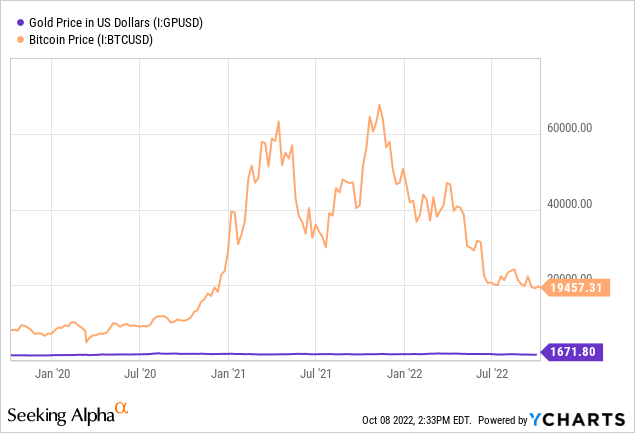

Here we can see in the past 3 years of the Covid market run-up, gold has remained relatively flat. Crypto might correlate with being a release valve in the price of gold during the massive money printing that the Treasury engaged in during this period.

Ray Dalio sees it as a digital alternative to gold in a January 2021 piece from Bridgewater:

Bitcoin offers some attractive attributes, such as limited supply and global exchangeability, and is evolving quickly. For now, though, we do not see it as a viable storehold of wealth for large institutional investors, thanks mainly to a high degree of volatility, regulatory uncertainty, and operational constraints. Rather, we see it as more like buying an option on potential “digital gold”-it has a wide cone of outcomes, with one path leading to it becoming a true institutionally accepted alternative storehold of wealth

My first thought in the event of a crypto cancellation in the US would be an outflow into gold and silver. Both of these are stores of value similar to Bitcoin. While gold and silver are inflation hedges, they also contribute to CPI (consumer price index) increasingly with the usage in electronics. Gold and silver plating will become more necessary for electrical conduction, especially in electric vehicles.

During the last decade-plus of excessive money printing, the price of gold has been relatively flat. I think crypto has been a good release valve to take pressure off commodities as some gold bugs may opt for “digital gold” instead. As more and more investors see Bitcoin and Bitcoin-like crypto as an alternative to gold, it would be logical to assume a portion of the investors would pile into the gold trade as an alternative to their favorite banned crypto.

Cash and cash equivalents

Cash and Bank Leverage (shutterstock)

Cash and stocks would be the next logical target if crypto was banned. This would increase the velocity of money by turning nearly $1 trillion of low-to-no transaction assets into assets now available to be transacted. If GDP continues to shrink but the M in the equation was to increase suddenly and rapidly, the velocity would speed up dramatically. It could undo some of the interest rate hikes that the Fed has been performing and put us back closer to square one. Meaning even more, and higher hikes on the horizon.

Extra dollars in the bank also provide more capital to be loaned into the economy for home/car purchases, consumer credit and business loans. The conversion of crypto assets into dollars without the intention of the transaction would still lead to more transactions through banks providing leverage. As it stands right now, Bitcoin and crypto do not facilitate banks with this capability from my understanding.

The way crypto functions today, it is almost like treasury stock on a balance sheet after a buyback, sidelining some of the shares outstanding. In this case, we’re just substituting dollars for shares. As long as crypto more or less serves this purpose versus being a competitor of transactions to the US dollar, I believe it provides far more benefits to the United States than it does detriment.

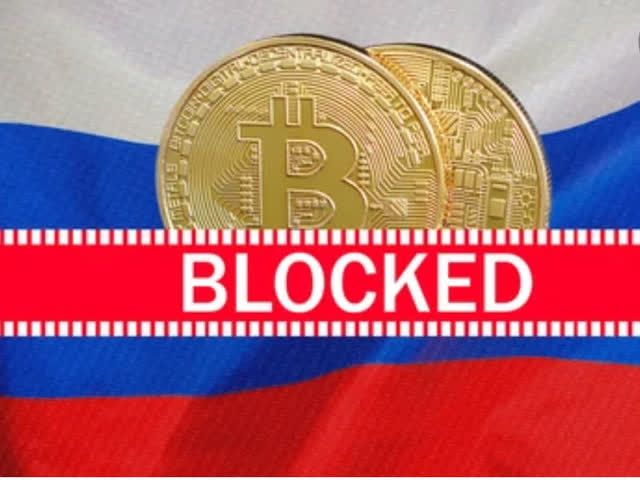

Why was it banned in other countries?

The regulation of crypto in my opinion for Russia and China has not to do with the currencies’ competition against their own, but to do with the wiring limits and flow of funds. China is at USD 50,000 in conversion/wiring limits of USD per year per person, Russia has just decreased theirs to USD 10,000, and Bangladesh is at $10,000 as well. You can run down the list of emerging markets that are prospering and see where their flow of funds is going. Spoiler alert, they mainly flow to Canada, the United States, and the EU. It happens so much that there are migration agencies throughout the world, that assist their citizens in finding suitable countries to invest in and move to. The vast majority of these agencies are in developing nations.

With the United States being one of the beneficiaries of these fund flows, the restriction of currency movement is not in America’s best interests. Wealthy and highly skilled individuals are welcomed with open arms. Although the capital inflows might create inflation, inflows are certainly preferable to outflows for long-term prosperity from my point of view.

What if Bitcoin becomes more transactive?

This is where I see the risk of regulation arising from, the day when Bitcoin and crypto go from becoming a majority store of value to a majority device of transactions for goods and services. If the shift comes in an inflationary period, such as the one we are in now, a move to ban could be a rational choice by the government. If on the other hand, the shift arises after a long period of deflation, it might be supported by the government due to it providing an added layer of stimulus without intervention by the Treasury or the Fed.

Summary

With inflation not subsiding even in the wake of the Fed raising interest rates at every meeting, crypto holders should be wary of trying to make the currencies more than a store of value. If the crypto economy begins to add transactions in the dollar-based economy, the effect on inflation might force the government to regulate the asset or ban it for some uses. In my opinion, as it stands right now, being used as a store of value is best compared to sidelining shares through buybacks while not retiring them.

I don’t believe that Bitcoin has another significant run-up until we enter a deflationary period and crypto in general can expand its use cases without government interference. If it were to be banned, I would pile into the SPDR Gold Trust (GLD) or something similar as I would expect inflows into gold. Both gold and crypto investors expecting either asset to appreciate due to the devaluation of the US Dollar have to realize that the dollar will probably continue to strengthen regardless of the amount printed in an inflationary environment with rising rates. Rates are like gravity and even enemies of the United States will be looking to buy treasuries with few poor alternatives.

In the previous GFC circa 08′, we had the Euro and the Chinese Yuan on an uprise, looking to become competitors with the dollar as a reserve currency. Now, the EU is struggling to keep its members and is running an economy lacking energy inputs. China has a faltering commercial real estate market with once pristine borrowers now seen as giant liabilities combined with rolling lockdowns. The Dollar is also required for oil and commodity transactions internationally. In short, this worldwide economy struggling to get its hands on energy might be short of dollars rather than complaining about their excess. This can be seen in recent demand for dollar swap lines.

The crypto community should wait until the Fed is directed to rip the cover off the ball after the US economy has fallen into the doldrums and every stimulus item is on the table. In my opinion, if the community moves to make it an active part of transaction velocity during inflation, then the risk of draconian regulation is on the table.

Be the first to comment