gorodenkoff/iStock via Getty Images

Financial Advisors Know How to Perform Well

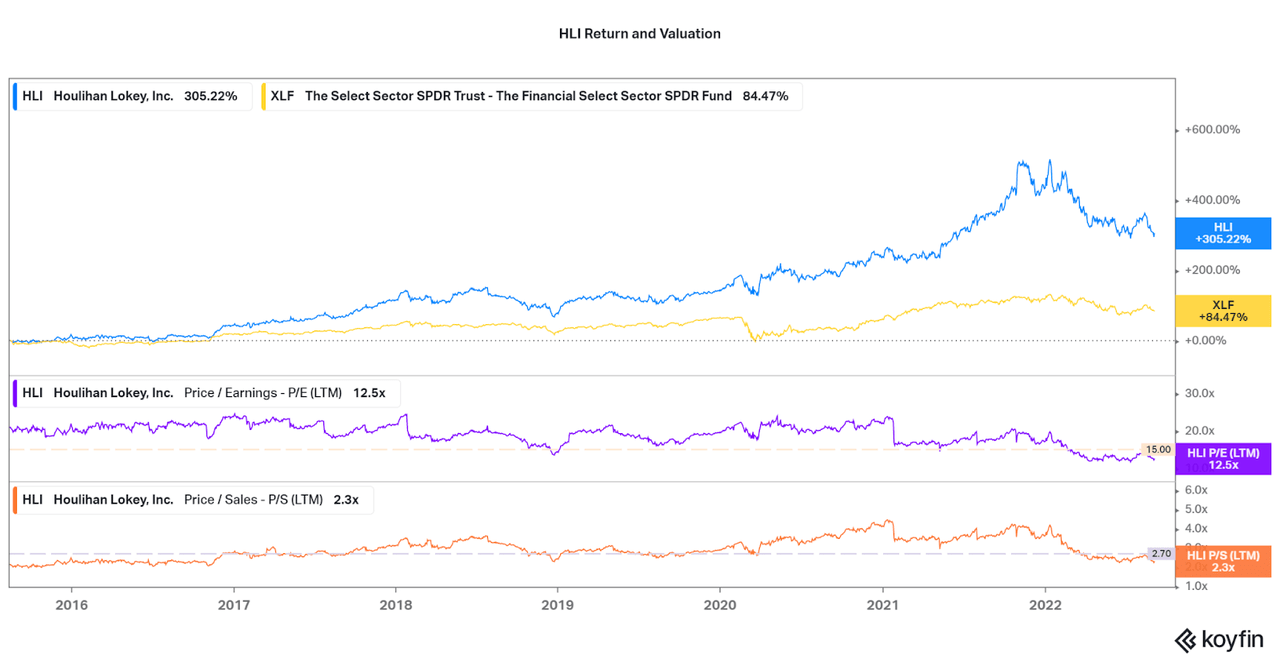

Trust is a great theme to base an investment on. Uncertainty, or a lack of trust, can be reflected in valuation volatility, underperformance, and a poor overall financial state. In the financial industry, this can be seen with the extremely low valuations and poor performance of major banks and firms as historical issues weigh on investor sentiment. Therefore, it is important to go with a company that is trusted by customers and has multiple ways to reflect stability and certainty. I believe Houlihan Lokey (NYSE:HLI) reflects this sentiment, and the company is my largest, and only, financial holding.

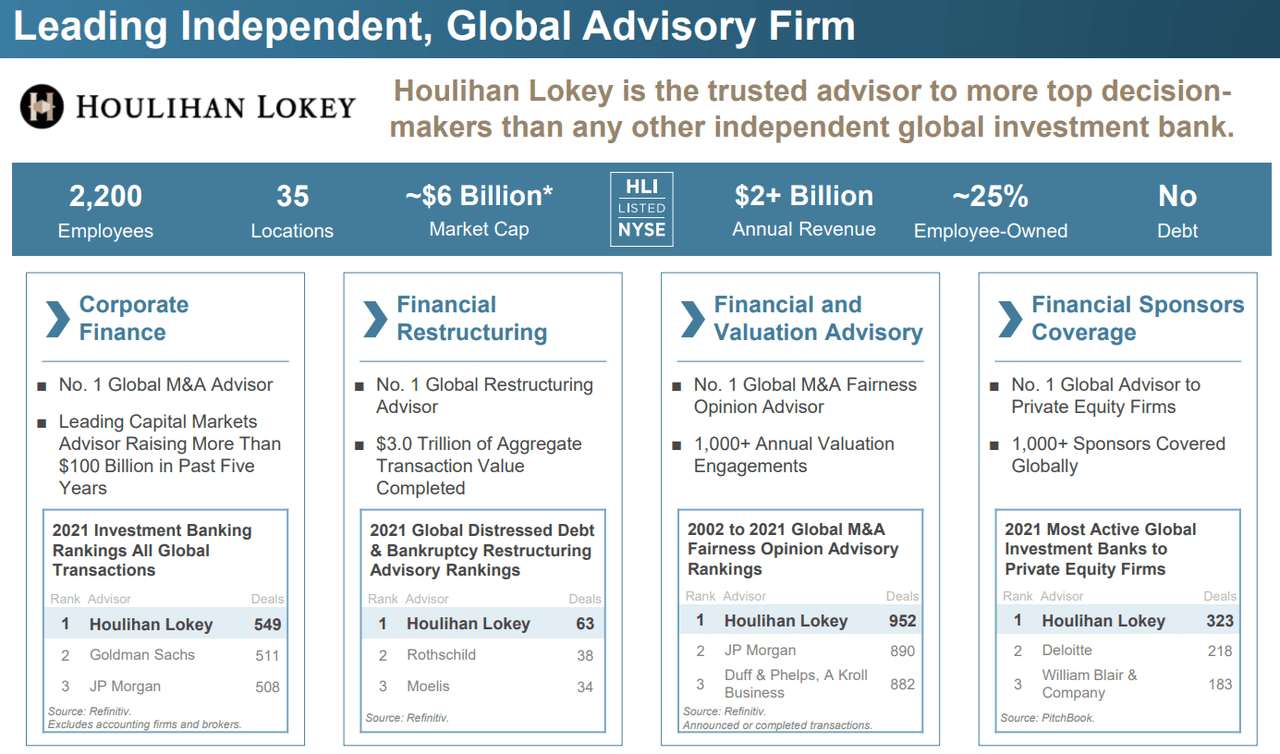

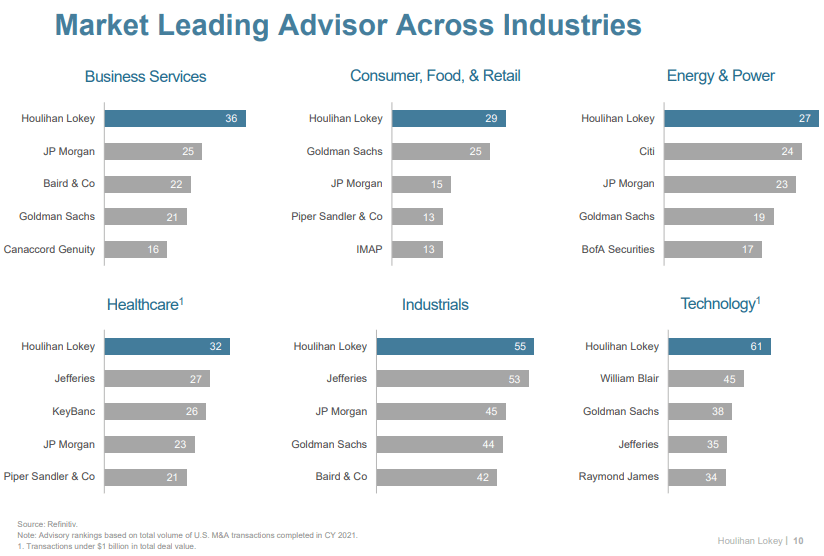

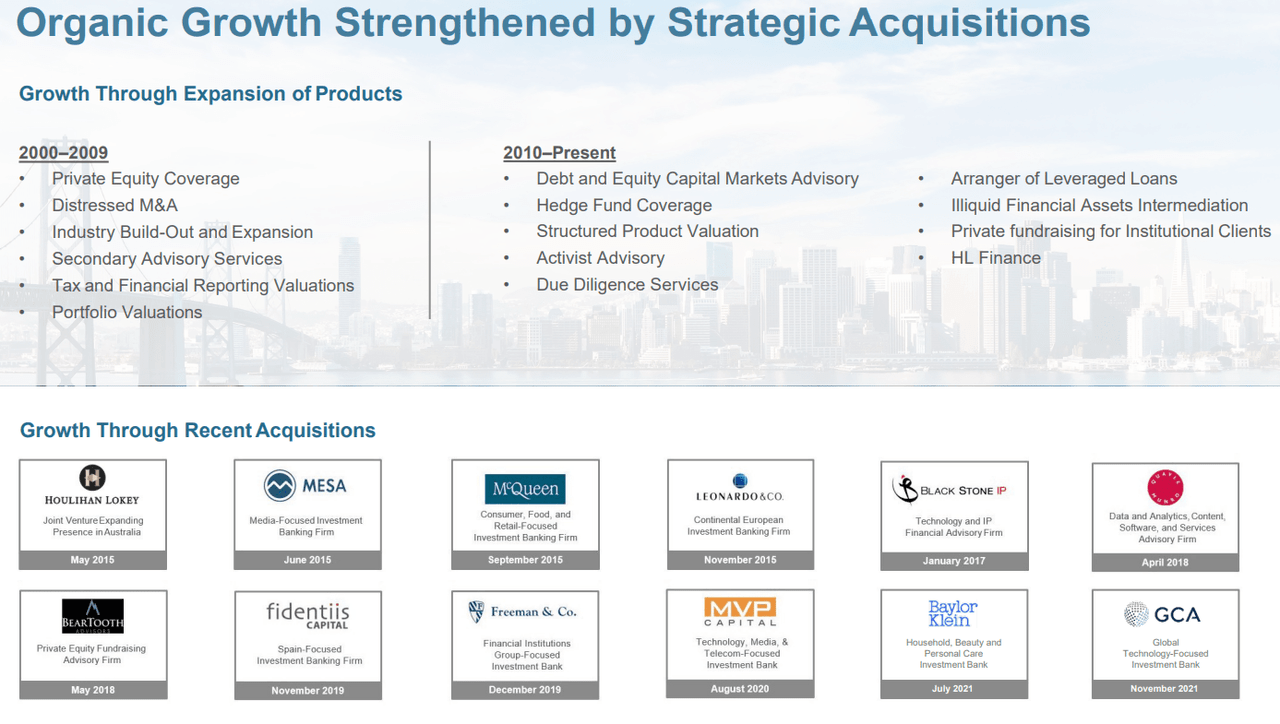

HLI is a leading financial advisor with a leading market share in multiple segments worldwide. In fact, HLI is #1 globally in M&A, restructuring, valuation, and fairness advising, along with private equity sponsorship. This puts HLI ahead of competitors such as Goldman Sachs (GS), JP Morgan (JPM), Moelis (MC), and Raymond James (RJF). I discuss the details of the company in depth in my first coverage, and I would recommend gaining the background details there. In this article, I will highlight the main reasons why HLI offers a level of certainty, both quantitative and qualitative, that investors can rely on.

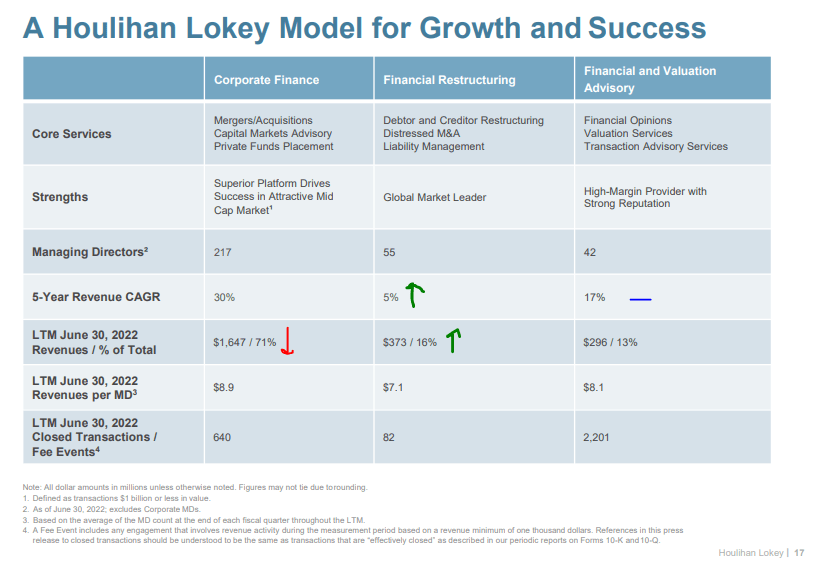

HLI July Investor Presentation

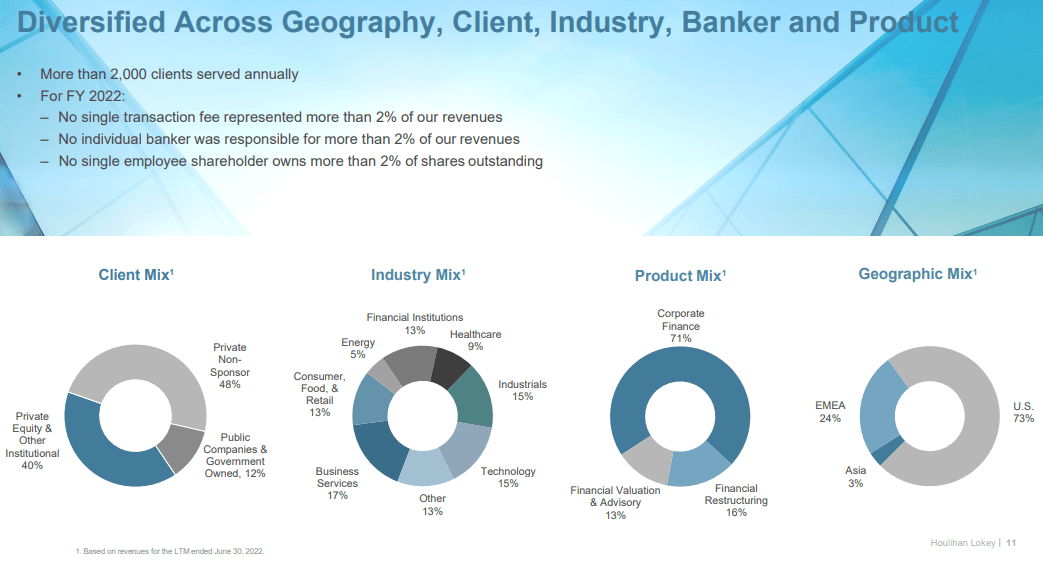

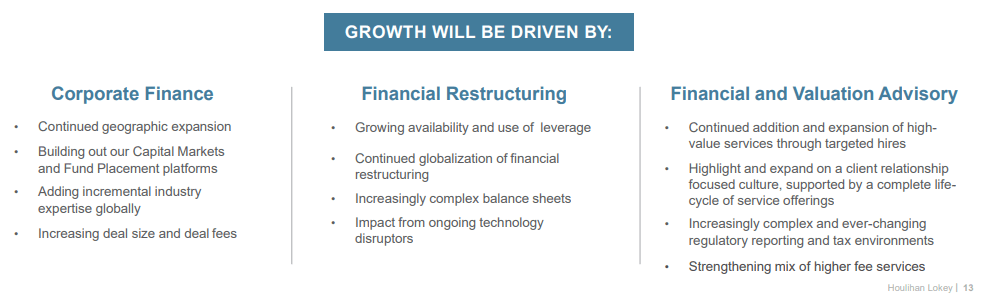

There are some important qualities to HLI’s revenue mix that showcase qualities to look for. Financials are not high-growth industries, so it will be important to assess how the company can negate volatility and cyclicality. The three main strengths are as follows:

-

Diversification across industries allows for reduced risk from industry cyclicality.

-

Leadership in transactions less than $1 billion USD and a mainly mid-sized customer base reduces volatility of revenues from individual transactions.

-

Most clients are private companies and institutions, reducing volatility from publicity, market sentiment, and transaction speed.

Diversification is key, along with flying under the radar. By focusing on mid-caps and the private markets, HLI can continue to earn praise within financial circles but not face shareholder scrutiny. I believe if HLI worked on high-profile cases the shares would see increased volatility. Also, while some worry about bear markets and economic slow-downs, HLI is quite unaffected as M&A and restructuring continue to occur. As recently reported, bankruptcies are back on the rise after a hiatus during the pandemic and this will drive growth into the looming “recession”.

HLI July Investor Presentation HLI July Investor Presentation

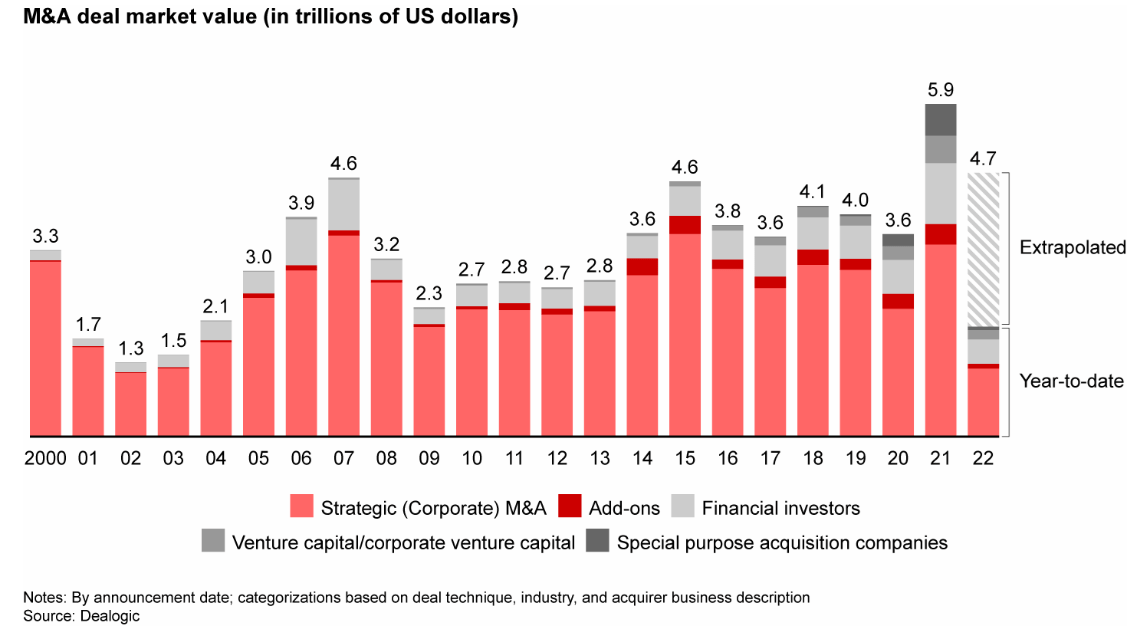

There is financial data to support the ebb and flow of each revenue segment. A shown in the image below, financial restructuring revenues are only growing at a 5% annual rate over the past five years while corporate finance has been on a tear. This creates an imbalance in the mix, but as the corporate finance market cools, restructuring will begin to grow again. However, due to the unique nature of the current bear market where most companies are financially healthy, M&A is maintaining high volumes. As per Bain research:

Bain

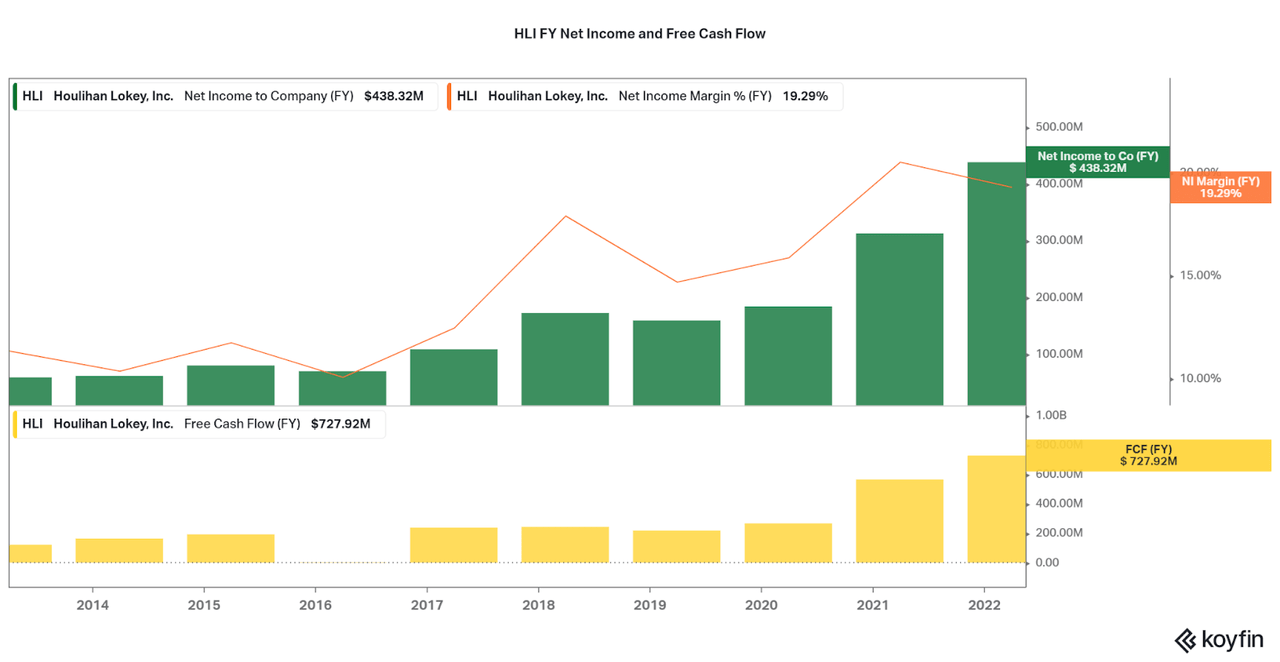

Therefore, I expect solid growth to continue across the board for HLI, mainly with corporate finance. Then, if markets cool off after the high levels seen the past few years, restructuring may become the leading segment. Thankfully bear markets tend to not inhibit the volume of transactions, and issues with HLI’s growth are likely to end up limited. Take advantage of short-term pessimism, and trust HLI to continue their upward trend. This would relate to ~15-17% CAGR revenue growth historically, with recent growth exceeding that. Also, high growth has not come at the expense of profitability, and in fact net income margins are at a peak over the past few years.

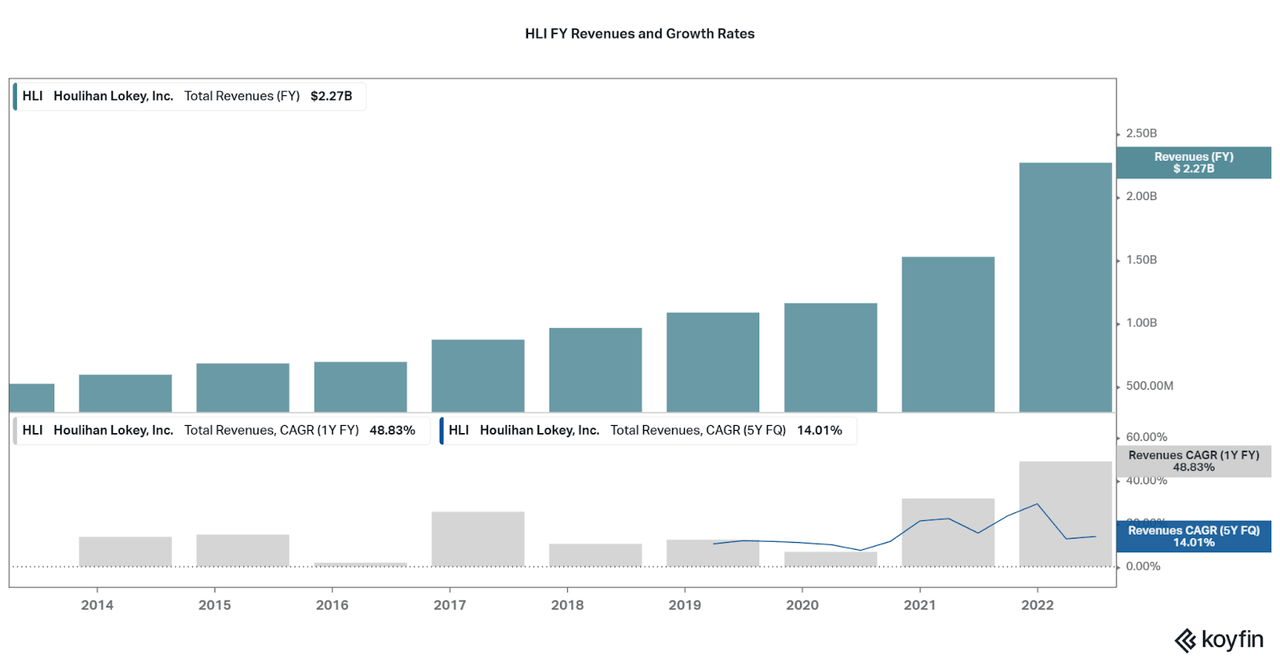

Houlihan Lokey’s recent rise to #1 market share in their business segments will support inertia that will beat current growth expectations. Just look how revenues were less than $1 billion per year after HLI was spun off from my 2nd favorite financial company, Orix (IX), back in 2015. The rise to over $2.7 billion in revenues per year has been swift, but no barriers to growth exist in my opinion. Remember that HLI does not suffer from issues with assets under management, interest rates, or economic growth, and instead rely on advisory fees that can rise as HLI expands their prowess & expertise across all capabilities.

HLI July Investor Presentation Koyfin Koyfin

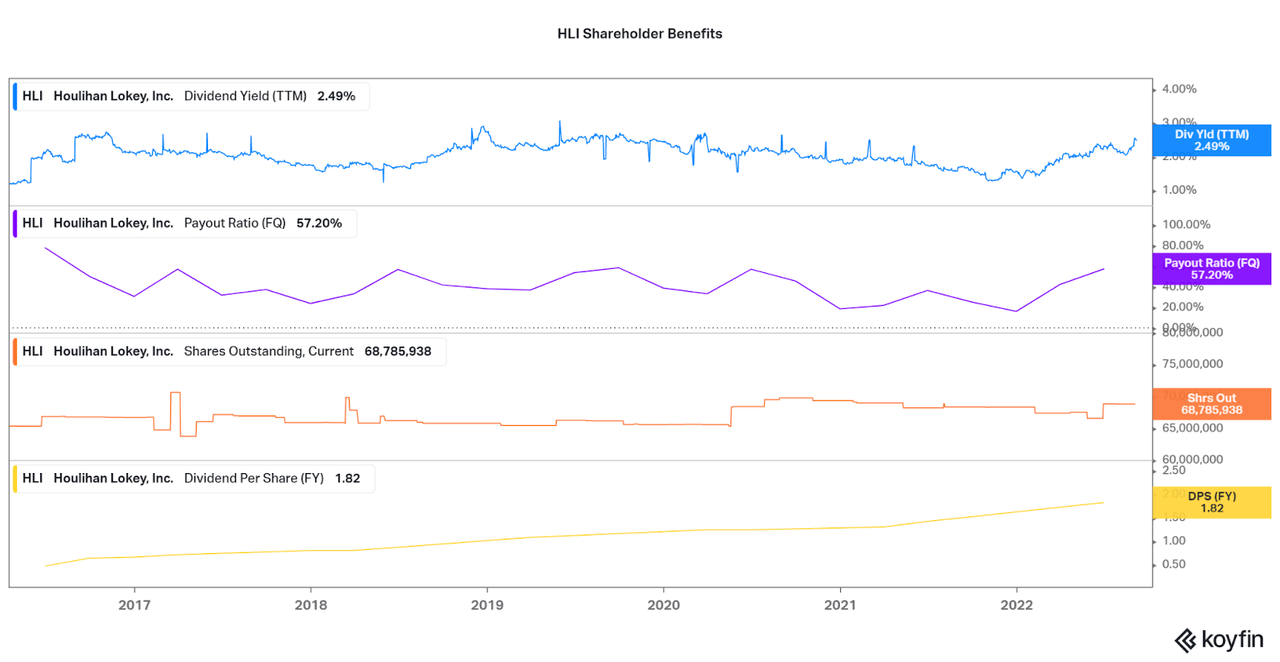

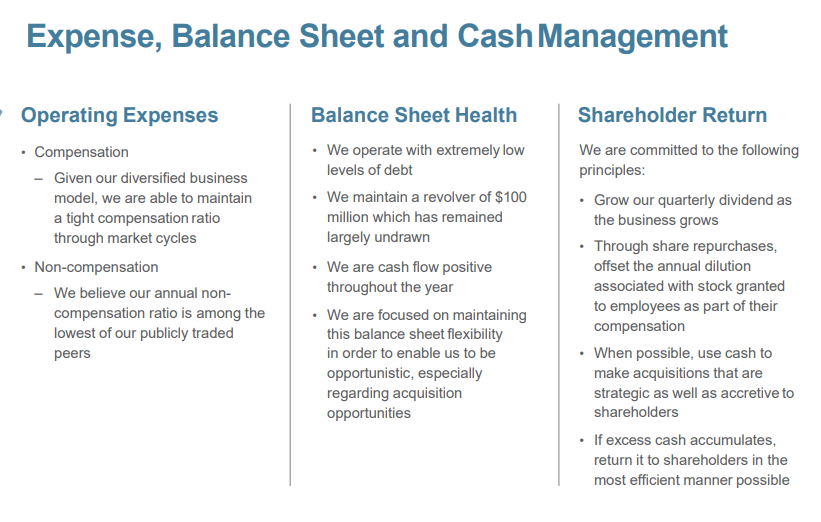

Growth often comes at a cost, but in HLI’s case, profits are unaffected and improving. Instead, we have to look elsewhere to address some potential downsides to the recent performance. First, the company has a mild dividend yield that hovers between 1% and 3%. Also, the payout ratio varies by quarter, but averages 40-50%. However, the dividend has been increasing steadily and there is no dilution to shareholders.

The reason for the lower direct shareholder returns is a result of frequent cash-based acquisitions to expand the company’s capabilities, and this is a better use of capital for long-term investors than buybacks or higher yield. As the world’s leading financial advisor, HLI knows what they are doing to prevent their own company from failing, in my opinion.

Koyfin HLI July Investor Presentation

Regardless of the exact growth rate or profit margin, I expect significant returns with a long position. While HLI already holds significant market share in their areas of expertise, the company continues to expand, especially abroad. No debt and plenty of cash allow for frequent accretive acquisitions to continue extending their lead. If necessary, they can either pull back on acquisitions or continue to expand depending on their analysis of the market. There is even room for profits to be increased with higher fee services, and this could work wonders on the company’s valuation.

HLI July Investor Presentation HLI July Investor Presentation

Even with a 300%+ run over the past ~7 years, HLI is currently seeing a low valuation. While the company has the unfortunate risk of trading in line with other financial companies, this just leads to an opportunity for shareholders to add in at a great price. However, volatility is not as extreme as other assets and recurring investments will likely perform well over the long term. As such, I will look to see HLI continue to extend the significant outperformance when compared to financials funds, such as the SPDR Financial Select Fund (XLF). Unfortunately, we can only look back to the valuation metrics of 2015, and this does not indicate where a low point in valuation may go, but I still remain confident about the company’s ability to survive an extended bear market.

Koyfin

Do you also believe that Houlihan Lokey’s financials allow for a high level of trust between investors and the business? The market seems to agree as HLI’s valuation remains one of the highest in the industry. However, I expect significant out-performance regardless of the price and will be adding on a recurring basis. In fact, I will be looking to make HLI one of the top 3 holdings in my portfolio (especially since a few of my holdings have been bought recently). I will point out that it is best to never be completely comfortable, and so I will be checking the financials on a regular basis. Stay tuned for further updates along the way.

Thanks for reading.

Be the first to comment